I predict a massive financial case next 5 years

Discussion

Ken_Code said:

soupdragon1 said:

Yes it is. Unless of course you are being the arbiter of the English language, in which case, who put you there?

In twenty-odd years in trading I’ve never heard it being used.For the problem is the debt has moved from corporate to state. There isn't the room to print money and there isn't the prosperity to wipe out the debt through taxes. The US government sits there

Building $3tn a year on top of the $34tn debt hoping for what?

Considering it's not planning to use inflation to kill it, and prosperity's unlikely to dent it, you have to be worried about what the 'what is'.

There's a reason governments both sides of the Atlantic are dropping hints about us being in a pre-war environment. Ukraine and Taiwan are totems not reasons.

Building $3tn a year on top of the $34tn debt hoping for what?

Considering it's not planning to use inflation to kill it, and prosperity's unlikely to dent it, you have to be worried about what the 'what is'.

There's a reason governments both sides of the Atlantic are dropping hints about us being in a pre-war environment. Ukraine and Taiwan are totems not reasons.

Melting things generally enter a liquid state and as such will be subject to gravity pulling it down.

Thus melt-down.

Or a melt-down being a terrible event of a nuclear reactor, and being used as a terrible event generally like a rapid stock price fall.

I’m not sure how something would melt up unless it’s something lighter than air in it’s liquid state like hydrogen but then if exposed to air it’d just “evaporate-up”

Hmmm

Thus melt-down.

Or a melt-down being a terrible event of a nuclear reactor, and being used as a terrible event generally like a rapid stock price fall.

I’m not sure how something would melt up unless it’s something lighter than air in it’s liquid state like hydrogen but then if exposed to air it’d just “evaporate-up”

Hmmm

There are voices calling that stock market melt town is upon us.

https://archive.ph/wkcH6

How far who knows.

A lot of companies went to enlist in the US stock market, Server companies.

That many shares are over valued is quite clear.

Hoster goes belly up and many sites drop off.

https://archive.ph/wkcH6

How far who knows.

A lot of companies went to enlist in the US stock market, Server companies.

That many shares are over valued is quite clear.

Hoster goes belly up and many sites drop off.

NowWatchThisDrive said:

Crikey, give the guy a break. It's rather CNBC-esque and not the best analogy, but not exactly an uncommon turn of phrase in financial press in recent years.

Melt down is a fairly common phrase. Melt up , until now I have never in my life heard it used by anyone for anything.

It just doesn’t make sense.

alscar said:

NowWatchThisDrive said:

Crikey, give the guy a break. It's rather CNBC-esque and not the best analogy, but not exactly an uncommon turn of phrase in financial press in recent years.

Melt down is a fairly common phrase. Melt up , until now I have never in my life heard it used by anyone for anything.

It just doesn’t make sense.

Mr Whippy said:

Melting things generally enter a liquid state and as such will be subject to gravity pulling it down.

Thus melt-down.

Or a melt-down being a terrible event of a nuclear reactor, and being used as a terrible event generally like a rapid stock price fall.

I’m not sure how something would melt up unless it’s something lighter than air in it’s liquid state like hydrogen but then if exposed to air it’d just “evaporate-up”

Hmmm

Sublimation ? : I.e. heat causing material to change phase from solid to gas with no interim liquid phase.Thus melt-down.

Or a melt-down being a terrible event of a nuclear reactor, and being used as a terrible event generally like a rapid stock price fall.

I’m not sure how something would melt up unless it’s something lighter than air in it’s liquid state like hydrogen but then if exposed to air it’d just “evaporate-up”

Hmmm

Of course none of this explains the stupid use of "melt-up"

I’m actually going to back-peddle here - I’ve googled it and it DOES actually mean something in financial circles.

https://www.investopedia.com/terms/m/melt-up.asp#:...

https://www.investopedia.com/terms/m/melt-up.asp#:...

okgo said:

I’m actually going to back-peddle here - I’ve googled it and it DOES actually mean something in financial circles.

https://www.investopedia.com/terms/m/melt-up.asp#:...

How about that! Apologies to the poster from me.https://www.investopedia.com/terms/m/melt-up.asp#:...

NickZ24 said:

There are voices calling that stock market melt town is upon us.

https://archive.ph/wkcH6

How far who knows.

A lot of companies went to enlist in the US stock market, Server companies.

That many shares are over valued is quite clear.

Hoster goes belly up and many sites drop off.

Hussman also runs funds.https://archive.ph/wkcH6

How far who knows.

A lot of companies went to enlist in the US stock market, Server companies.

That many shares are over valued is quite clear.

Hoster goes belly up and many sites drop off.

If you look at the returns trust me you wouldn't want to have been anywhere near them the past ten or so years.

He's a stopped clock.

b hstewie said:

hstewie said:

hstewie said:

hstewie said: Hussman also runs funds.

If you look at the returns trust me you wouldn't want to have been anywhere near them the past ten or so years.

He's a stopped clock.

In all fairness businessinsider mentioned already the critical component on the narrative: If you look at the returns trust me you wouldn't want to have been anywhere near them the past ten or so years.

He's a stopped clock.

businessinsider.com said:

If Hussman's measure of market conditions is to be believed, he's absolutely right.

In his May 6 market comment, Hussman — the president of the Hussman Investment Trust who called the 2000 and 2008 stock market crashes — said that current market conditions are more ripe for a "major" peak than virtually any time over the last 100 years. His proprietary measure, the "cluster proximity score," considers inputs like investor sentiment, stock valuations, and fundamental, technical, and cyclical indicators.

Some stocks in the most popular stock-exchanges are quite high. In his May 6 market comment, Hussman — the president of the Hussman Investment Trust who called the 2000 and 2008 stock market crashes — said that current market conditions are more ripe for a "major" peak than virtually any time over the last 100 years. His proprietary measure, the "cluster proximity score," considers inputs like investor sentiment, stock valuations, and fundamental, technical, and cyclical indicators.

I wonder when capital turns to emerging markets to park their money there.

Most important factor is not being too connected to the world stream of Money.

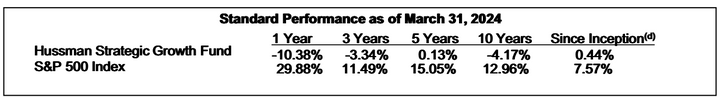

This is what listening to Hussman would have done for your wealth.

There will always be permabears and people warning of an impending crash.

That guy has spent ten years telling anyone who would listen that the sky is falling in and if you listened and invested in his fund it would have lost you 4% a year whilst the S&P would have returned nearly 13% a year.

Be careful who you listen to.

Reality is nobody knows what will happen and when.

There will always be permabears and people warning of an impending crash.

That guy has spent ten years telling anyone who would listen that the sky is falling in and if you listened and invested in his fund it would have lost you 4% a year whilst the S&P would have returned nearly 13% a year.

Be careful who you listen to.

Reality is nobody knows what will happen and when.

Gassing Station | Finance | Top of Page | What's New | My Stuff