Boomer life according to the economist

Discussion

NickZ24 said:

The exact issue of the following generations is that decent live and creating fortunes don't go well together.

I'm not talking about creating a fortune.I'm talking about being able to 'live'* (not just exist) in your 20s and 30s while subsequently not being a pauper in retirement / never really retiring.

* The odd meal out with partner or friends. Gigs and clubs every couple of months. A holiday maybe. s

t, a trackday if that's your thing, or a hiking trip with the lads, or a football/rugby tour...whatever. Stuff that adds flavour to what might otherwise feel like a punitive existence.

t, a trackday if that's your thing, or a hiking trip with the lads, or a football/rugby tour...whatever. Stuff that adds flavour to what might otherwise feel like a punitive existence.NickZ24 said:

I wonder if you could could give us a number of the cost of the decent living.

The exact issue of the following generations is that decent live and creating fortunes don't go well together.

You're very dismissive of the actual evidence and academics who have looked at this stuff. Don't you believe them? Or is easier to simply put your head in the sand and keep complaining about avocados and coffees? The exact issue of the following generations is that decent live and creating fortunes don't go well together.

Whatever metric you chose to use, it is harder to buy a house today than at any point since WW2. Taxes on working people are the highest in 70 years. Young people today drink less and smoke less than previous generations. Where is this £20k for a deposit supposed to come from in such an economic environment? If they want to spend some money on enjoying life while they are young that should not come at the expense of things which your generation was able to do at the same age, while drinking more, smoking more, and enjoying a lads holiday to Magaluf once a year!

Condi said:

NickZ24 said:

I wonder if you could could give us a number of the cost of the decent living.

The exact issue of the following generations is that decent live and creating fortunes don't go well together.

You're very dismissive of the actual evidence and academics who have looked at this stuff. Don't you believe them? The exact issue of the following generations is that decent live and creating fortunes don't go well together.

Belief is hardly relevant; if their data is sound, their methodology reasonable for their aims, and conclusions are in keeping with that, then their positions would have credibility.

Belief on its own without the above analysis isn't the same thing as credibility, it's for the religious types and sometimes cults.

Edited by turbobloke on Sunday 12th May 22:10

funinhounslow said:

Surely availability of credit has a role too?

When I got my first mortgage in the 90s you could borrow 3.5x salary and that was it.

The early 2000s gave us interest only mortgages, self certification mortgages (“liar loans”) and the explosion of BTL.

If credit has been as restricted as it was back in the day surely it would have kept a lid on house price inflation?

ExactlyWhen I got my first mortgage in the 90s you could borrow 3.5x salary and that was it.

The early 2000s gave us interest only mortgages, self certification mortgages (“liar loans”) and the explosion of BTL.

If credit has been as restricted as it was back in the day surely it would have kept a lid on house price inflation?

I remember getting a £120K mortgage and being asked why I wasn't getting a £300K one.

Condi said:

You're very dismissive of the actual evidence and academics who have looked at this stuff. Don't you believe them? Or is easier to simply put your head in the sand and keep complaining about avocados and coffees?

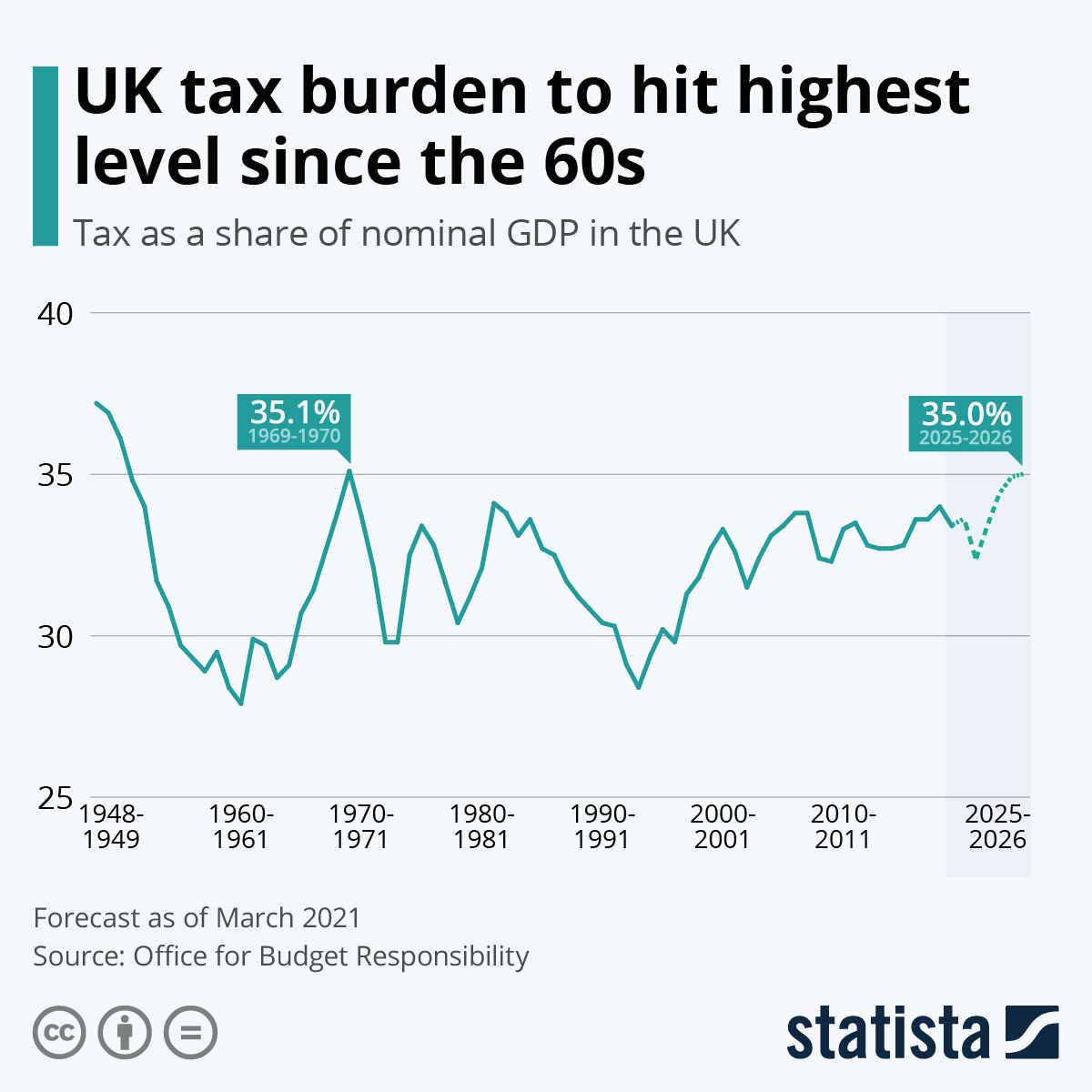

Whatever metric you chose to use, it is harder to buy a house today than at any point since WW2. Taxes on working people are the highest in 70 years. Young people today drink less and smoke less than previous generations. Where is this £20k for a deposit supposed to come from in such an economic environment? If they want to spend some money on enjoying life while they are young that should not come at the expense of things which your generation was able to do at the same age, while drinking more, smoking more, and enjoying a lads holiday to Magaluf once a year!

Taxes on working people aren’t the highest in 70 years. Income tax was astronomical for everyone just after the war and even into the 70s and 80s the basic rate was as high as the higher rate is now.Whatever metric you chose to use, it is harder to buy a house today than at any point since WW2. Taxes on working people are the highest in 70 years. Young people today drink less and smoke less than previous generations. Where is this £20k for a deposit supposed to come from in such an economic environment? If they want to spend some money on enjoying life while they are young that should not come at the expense of things which your generation was able to do at the same age, while drinking more, smoking more, and enjoying a lads holiday to Magaluf once a year!

Housing is more expensive in real terms now, particularly in some areas, but as a proportion of typical household spending food is now cheaper by a greater amount.

I posted the evidence for this (quite) a few pages ago on this thread.

Lads holidays abroad ever year were pretty much unheard of for boomers and by no means the norm for genX, eating out was far less prevalent and fags/booze were taxed a lot less so weren’t such a big factor in any of this.

Like I said earlier………..

Steve H said:

But I think the overall picture is that everyone needs to take a bit of the rough with the smooth rather than just banging on about pensions and house prices when millennials and genZ have many advantages that balance that out (longevity, technology, inside toilets, no mines to work down etc).

Pretty much no one paid those tax rates though, so it’s a bit pointless comparing a high rate that a handful of people paid versus a lot more people now. You’re deliberately misusing statistics.

Same as before when I posted people should get a free £140k handout for houses, lots jumped on it quite rightly yet we gave a lot of boomers a 50% discount on their house (roughly the equivalent of the £140k now) and that was fine/is just a tiny difference we should ignore.

Same as before when I posted people should get a free £140k handout for houses, lots jumped on it quite rightly yet we gave a lot of boomers a 50% discount on their house (roughly the equivalent of the £140k now) and that was fine/is just a tiny difference we should ignore.

NRS said:

Pretty much no one paid those tax rates though, so it’s a bit pointless comparing a high rate that a handful of people paid versus a lot more people now. You’re deliberately misusing statistics.

Not at all. I don’t know much about how the rates that applied immediately post war were used but in the 60s/70s the standard rate that everyone paid was similar to the higher rate now that only just over 1/4 pay. Gary C said:

funinhounslow said:

Surely availability of credit has a role too?

When I got my first mortgage in the 90s you could borrow 3.5x salary and that was it.

The early 2000s gave us interest only mortgages, self certification mortgages (“liar loans”) and the explosion of BTL.

If credit has been as restricted as it was back in the day surely it would have kept a lid on house price inflation?

ExactlyWhen I got my first mortgage in the 90s you could borrow 3.5x salary and that was it.

The early 2000s gave us interest only mortgages, self certification mortgages (“liar loans”) and the explosion of BTL.

If credit has been as restricted as it was back in the day surely it would have kept a lid on house price inflation?

I remember getting a £120K mortgage and being asked why I wasn't getting a £300K one.

Steve H said:

NRS said:

Pretty much no one paid those tax rates though, so it’s a bit pointless comparing a high rate that a handful of people paid versus a lot more people now. You’re deliberately misusing statistics.

Not at all. I don’t know much about how the rates that applied immediately post war were used but in the 60s/70s the standard rate that everyone paid was similar to the higher rate now that only just over 1/4 pay. Steve H said:

Taxes on working people aren’t the highest in 70 years. Income tax was astronomical for everyone just after the war and even into the 70s and 80s the basic rate was as high as the higher rate is now.

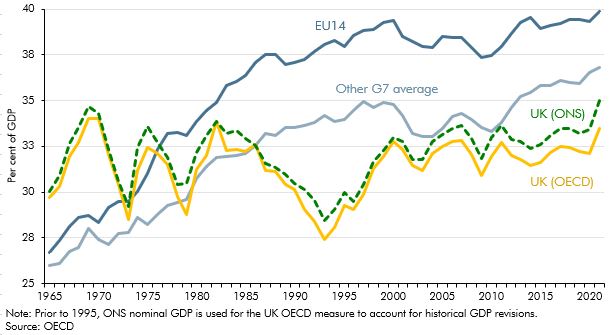

Statistics might argue with you, to a degree (see my note at the foot - the truth is somewhere between the two perspectives):-

...but it's also worth noting the top-chart comparing us to our peers in the G7 and the EU, who have substantially higher tax takes which...y'know...fund a society that actually works!

We've been a low growth country for decades now, and the only reason that's not become a big problem socially up to now is because the below-average Joe has had his share of the income tax (!) burden kept artificially low (e.g. personal allowance, introductory tax rate etc.) at the expense of

(a) higher NIC contributions which are an income tax in all but name - in the 1970s NICs were around 6%*, they're 12% now;

(b) higher income tax rates for anyone earning anything decent, and

(c) increased VAT rates which are less obvious but just as damaging.

So you're right, for the bottom half of society...or rather the bottom ~30-40% of workers, who pay less direct tax now than in the historic peaks, but pay higher VAT on most stuff they buy. For anyone above average wage in particular, the picture is worse - higher direct taxes and higher indirect taxes than at pretty much any time in history.

...and yet it's somehow not enough - our country is crumbling - roads are in an utter state and overcrowded, trains still aren't reliable or of comparable quality to much of the EU, NHS on its knees, schools underfunded, lack of GPs and dentists in many areas, lack of visible police presence in most places and a law-enforcement system that's also falling apart. And and and...

* See Column I in the Excel file here:-

https://ifs.org.uk/media/9157/download

Steve H said:

Taxes on working people aren’t the highest in 70 years. Income tax was astronomical for everyone just after the war and even into the 70s and 80s the basic rate was as high as the higher rate is now.

The UK's official statistics body disagrees with you. "based on the OECD’s measure, the UK’s tax burden is set to rise to a post-war high of 37.7 per cent of GDP in 2027-28"

https://obr.uk/box/the-uks-tax-burden-in-historica...

BBC News this morning, under 30's are increasingly taking out mortgages which they'll still be repaying beyond retirement age...

https://www.bbc.co.uk/news/articles/c4n1yjll87wo

Clearly not a good situation if young people are having to saddle themselves with an entire working lifetime's worth of debt to buy their first house.

Condi said:

BBC News this morning, under 30's are increasingly taking out mortgages which they'll still be repaying beyond retirement age...

https://www.bbc.co.uk/news/articles/c4n1yjll87wo

Clearly not a good situation if young people are having to saddle themselves with an entire working lifetime's worth of debt to buy their first house.

Except they are not are they?https://www.bbc.co.uk/news/articles/c4n1yjll87wo

Clearly not a good situation if young people are having to saddle themselves with an entire working lifetime's worth of debt to buy their first house.

45 years worth of inflation will diminish the repayments down to a fraction of what they currently would be in real terms. A 40 year mortgage may be the only way on the ladder today, but it should be comfortably repayable well within that term. .

GT03ROB said:

Except they are not are they?

45 years worth of inflation will diminish the repayments down to a fraction of what they currently would be in real terms. A 40 year mortgage may be the only way on the ladder today, but it should be comfortably repayable well within that term. .

Possibly so, but clearly they are having to consider that possibility whereas in the past it wasn't a concern. 45 years worth of inflation will diminish the repayments down to a fraction of what they currently would be in real terms. A 40 year mortgage may be the only way on the ladder today, but it should be comfortably repayable well within that term. .

havoc said:

...but it's also worth noting the top-chart comparing us to our peers in the G7 and the EU, who have substantially higher tax takes which...y'know...fund a society that actually works!

Does it work though? What's going on in France right now? They've got some pretty s tty budget choices to make, run significantly higher debt to GDP ratio and have a borrowing cost about to decouple Germany and look like Spain - heaping more cost on tax revenue.

tty budget choices to make, run significantly higher debt to GDP ratio and have a borrowing cost about to decouple Germany and look like Spain - heaping more cost on tax revenue.Its not just about tax take, borrowing and fiscal rules all play apart. Their debt balloons are funding a lot of public services with the ECB pulling the rug on crisis support - debt refinancing costs are going up. And some of those with highest debt needs are in for hundreds of billions this year.

Its very, very difficult to parallel countries with different rules, attitude to fiscal policy, debt etc. Look at the US on the other end of the spectrum (some seem to think the US performance ought to be lauded - when in fact they have broken the economy to the point of near failure).

No one sane would point to the US and suggest that works here, and in many cases the EU is as irrelevant - regardless of proximity.

The UK needs to fix what's in front of it, not look for false equivalence.

Condi said:

GT03ROB said:

Except they are not are they?

45 years worth of inflation will diminish the repayments down to a fraction of what they currently would be in real terms. A 40 year mortgage may be the only way on the ladder today, but it should be comfortably repayable well within that term. .

Possibly so, but clearly they are having to consider that possibility whereas in the past it wasn't a concern. 45 years worth of inflation will diminish the repayments down to a fraction of what they currently would be in real terms. A 40 year mortgage may be the only way on the ladder today, but it should be comfortably repayable well within that term. .

BandOfBrothers said:

From memory the longest duration mortgage I could arrange back in 2010 was up to age 65 and not a day longer?

Guess what allowing additional lending into retirement age will do to house prices?

You can easily get into the 70's now. Its a reality for many coming off low rates and fixing now. Not quite "sub-prime adjustable" shock, but the only option for many is to extend the debt to reduce the payments. Which is much better than defaulting.Guess what allowing additional lending into retirement age will do to house prices?

GT03ROB said:

In the past we were also flogged endowment mortgages as a cheap option to get on the ladder, because we couldn't afford the repayment terms over 25yrs. Effectively an interest only product, with a sometimes dodgy insurance product behind it!

Not 100% true.The endowment 'policy' (while mis-sold on numerous occasions) was a legitimate route to dealing with the capital at a future point. And I'm not entirely certain the overall payments were that much different.

Comparing it to 40 year mortgages is a little disingenuous.

havoc said:

GT03ROB said:

In the past we were also flogged endowment mortgages as a cheap option to get on the ladder, because we couldn't afford the repayment terms over 25yrs. Effectively an interest only product, with a sometimes dodgy insurance product behind it!

Not 100% true.The endowment 'policy' (while mis-sold on numerous occasions) was a legitimate route to dealing with the capital at a future point. And I'm not entirely certain the overall payments were that much different.

Comparing it to 40 year mortgages is a little disingenuous.

A 40yr mortgage is really not a problem. As I’ve said let inflation do its work & what once was expensive is not 20yrs later, never mind 40yrs.

Gassing Station | Finance | Top of Page | What's New | My Stuff