Your questions answered Vol 2 - IM Private Clients

Discussion

AdamIM said:

....I was staggered to read recently that 'gas stations' are charging 60p/kw which makes it as costly as Diesel. ....

Try 79p per kW at a rapid charger in the 120kW+ per hour range, with the 60p per kW for the lower 50Kw per hour chargers. Which makes range anxiety worse when thrifty folk have access to an EV tariff at 9p per kW.thepeoplespal said:

Try 79p per kW at a rapid charger in the 120kW+ per hour range, with the 60p per kW for the lower 50Kw per hour chargers. Which makes range anxiety worse when thrifty folk have access to an EV tariff at 9p per kW.

For me our company is opening up a salary sacrifice scheme. Apparently on used EV's too. Im still waiting for this to materialise but we have free chargers at work and ive also seen this EV tariff offered at British Gas. So my thoughts were trade in our family car for around 7-8k, look at Polestars/I-pace around 3/4 years old for around 21k. obtain the sacrifice discount and trade in and its a no brainer (sorry probably more for the EV thread).

But it seems from the outside in, that the EV market is very much propped up by the Salary Sacrifice/Schemes on offer. As no way would it make mathematically sense to buy new and take the huge residual hits in the first 3/4 years of an EV's life.

But in saying that, im not a "new car on the knock every 3 years" kind of person.

ferret50 said:

AdamIM said:

Portfolio changes. PHT and other portfolio's that currently hold Global Payments which see a change. Selling GPN and Buying a new name. To be announced when the rebalance is complete. Global Payments overall generated 9.88% gains within PHT. A good business but I suspect carrying too much debt which is a drag on earnings, coupled with the highly competitive nature of transaction acquirers-very thin margins.

Regards

Adam

Wonder what will replace Global Playmates?Regards

Adam

- answers on a postcard, please*

Kingdom35 said:

trade in our family car for around 7-8k, look at Polestars/I-pace around 3/4 years old for around 21k. obtain the sacrifice discount and trade in and its a no brainer

I am confused by how you think you will be able to buy a 3-4 year old EV and get the discount. The salary sacrifice will be on a new EV. Its just a leasing scheme that comes out pre-tax to save you tax and NI.KTF said:

I am confused by how you think you will be able to buy a 3-4 year old EV and get the discount. The salary sacrifice will be on a new EV. Its just a leasing scheme that comes out pre-tax to save you tax and NI.

Here is the problem, ive been lead to believe it will be on used cars ie end of the 3 year initial lease. Im thinking more and more it will be only to the people that initially leased and have taken the brunt of the initial cost/depreciation.But we shall see, im yet to see the finer details of the company policy. Proof is in the pudding but sounds too good to be true.

Kingdom35 said:

Here is the problem, ive been lead to believe it will be on used cars ie end of the 3 year initial lease.

At the end of the lease you generally get the option to buy the car or you just give them the keys back and start again.Am not aware of any company schemes that let you lease a used car as there are too many unknowns involved - residuals, maintenance, etc. - which would make it hard to price.

Here is the scheme that my company uses: https://tuskercars.com/salary-sacrifice/employees/ You pick the car, the payment is taken pre-tax and you save tax and NI as a result (although you do pay a bit of BIK on the car).

ferret50 said:

ferret50 said:

AdamIM said:

Portfolio changes. PHT and other portfolio's that currently hold Global Payments which see a change. Selling GPN and Buying a new name. To be announced when the rebalance is complete. Global Payments overall generated 9.88% gains within PHT. A good business but I suspect carrying too much debt which is a drag on earnings, coupled with the highly competitive nature of transaction acquirers-very thin margins.

Regards

Adam

Wonder what will replace Global Playmates?Regards

Adam

- answers on a postcard, please*

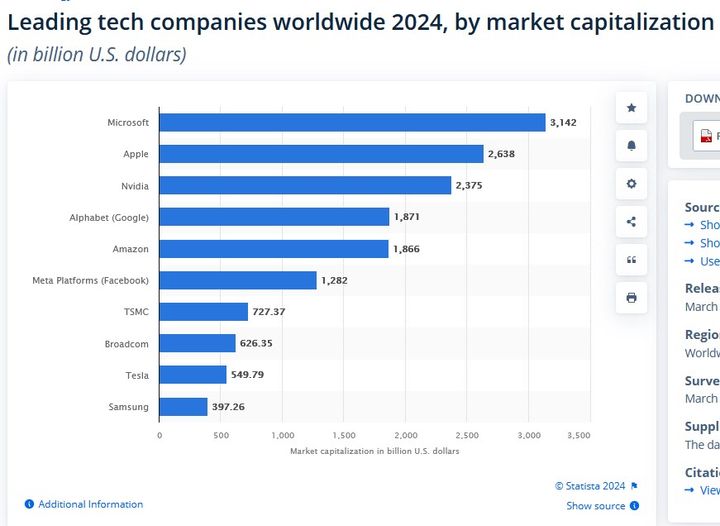

We have to pen an email to all account holders but I can tell you the company is one of the largest information technology companies in the world with a wide range of products, with a least one of their products touching just about every western person over the age of 10. Very profitable and growing. Trading at a modest PE.

I'm going to guess Meta, considering the top five already feature in the portfolio somewhere.

https://www.statista.com/statistics/1350976/leadin...

https://www.statista.com/statistics/1350976/leadin...

AdamIM said:

Hi,

We have to pen an email to all account holders but I can tell you the company is one of the largest information technology companies in the world with a wide range of products, with a least one of their products touching just about every western person over the age of 10. Very profitable and growing. Trading at a modest PE.

Thanks Adam, I'll await the news with bated breath!We have to pen an email to all account holders but I can tell you the company is one of the largest information technology companies in the world with a wide range of products, with a least one of their products touching just about every western person over the age of 10. Very profitable and growing. Trading at a modest PE.

Is the age ten part physical or mental, though? As 'er indoors tells me I often act like a three YO!

KTF said:

Kingdom35 said:

Here is the problem, ive been lead to believe it will be on used cars ie end of the 3 year initial lease.

At the end of the lease you generally get the option to buy the car or you just give them the keys back and start again.Am not aware of any company schemes that let you lease a used car as there are too many unknowns involved - residuals, maintenance, etc. - which would make it hard to price.

Here is the scheme that my company uses: https://tuskercars.com/salary-sacrifice/employees/ You pick the car, the payment is taken pre-tax and you save tax and NI as a result (although you do pay a bit of BIK on the car).

AdamIM said:

Morning All,

We are conducting some maintenance and the dashboard update will be delayed until 10am.

Regards

Adam

Looks like it's not updated yet, Adam?We are conducting some maintenance and the dashboard update will be delayed until 10am.

Regards

Adam

I guess there's work going on to extend the charts' y-axes upwards, given recent gains?

(Apologies to all for the drop that's now all but guaranteed

)

)PorkInsider said:

AdamIM said:

Morning All,

We are conducting some maintenance and the dashboard update will be delayed until 10am.

Regards

Adam

Looks like it's not updated yet, Adam?We are conducting some maintenance and the dashboard update will be delayed until 10am.

Regards

Adam

I guess there's work going on to extend the charts' y-axes upwards, given recent gains?

(Apologies to all for the drop that's now all but guaranteed

)

)Steve H said:

So, not that I am complaining, but what caused Smci to jump 15% in one day?

A few things apparently:https://247wallst.com/technology-3/2024/05/15/3-re...

SunsetZed said:

Steve H said:

So, not that I am complaining, but what caused Smci to jump 15% in one day?

A few things apparently:https://247wallst.com/technology-3/2024/05/15/3-re...

It's a good example of an article with no real information. The investors in SMCI know all of this already. Why did the stock go up 16%. It's had daily moves much bigger before. Yes, the feel good factor plus short covering(probably) These analysts 'checks' have been commonplace for a very long time and it can't be clearer to those that look. Incidentally Dell is some way behind SMCI. Dell is a big producer of servers but NOT AI servers. They produce a lot of traditional machines which are now being usurped by HPC machines. SMCI overall is 1/5th the size of Dell but bigger in AI/HPC thats because Dell sells or did sell millions of traditional low margin traditional machines.

The MS article talks about 60k servers and $10B. We talk about racks or rack scale. A rack contains multiple Rack Servers, a 'server' traditionally is a blade server. Two very different animals.

Anyway, we believe SMCI has much more AI market share than Dell and that Dell are behind for a few reasons and will remain behind for the forseable future. SMCI are focussing on Rack scale super clusters (many racks to create a super computer/super-POD) these racks are anywhere from $1.5-$3.5M each

Here is a SuperPod (multiple Racks)

Here is a Super Cluster

SMCI are the Nr1 vendor for Supercluster deployment. This is not simple/generic machinery. It is very complex and a particular expertise is required. So industry 'experts' suggesting any vendor can do this is talking nonsense. SMCI have patented DLC (direct liquid cooling) and will taylor the custom solution specifically to the customers spec. Almost every system is unique. SMCI also have their very own Data centre testing facility such that every deployment is optimised before it is shipped. Literally the customer just plugs it in and they are live on day 2 compared to every other vendor needs 2 weeks to go-live. Time is money!

SMCI have priority access to GPU's, Dell does not. SMCI has its own DC management software solution in fact they would describe their business as an IT total solution with lowest TOC (Total Operating Cost). Their machines are the greenest available (use the lowest power).

Currently SMCI can build 2,000 full AI/DLC racks per MONTH or 6k per quarter plus 3,000 'other' racks (traditional) per month. This is growing as they expand aggressively. So if an AI rack costs 1.5-3.5M and they can produce 6k per quarter, what is the potential. It's not 10B per year is it? It's 10B+ per quarter.

The take away is, they have the capacity and growing quickly, they will need more capital and more GPU's. It will all come in time. Very very rapid growth will follow. None of this 'news' is recent. You can lead a horse to water.

And one other fact-if AI disappeared faded away, SMCI solutions would still be in very high demand due to their compute power and low operating costs. So don't conflate HPC with AI and that is the very reason so many don't get it!

Edited by AdamIM on Thursday 16th May 10:23

Edited by AdamIM on Thursday 16th May 10:26

Gassing Station | Finance | Top of Page | What's New | My Stuff