Is my pension a bit rubbish?

Discussion

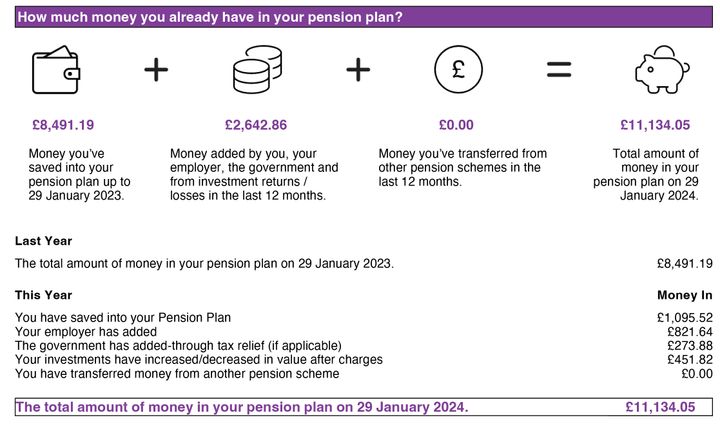

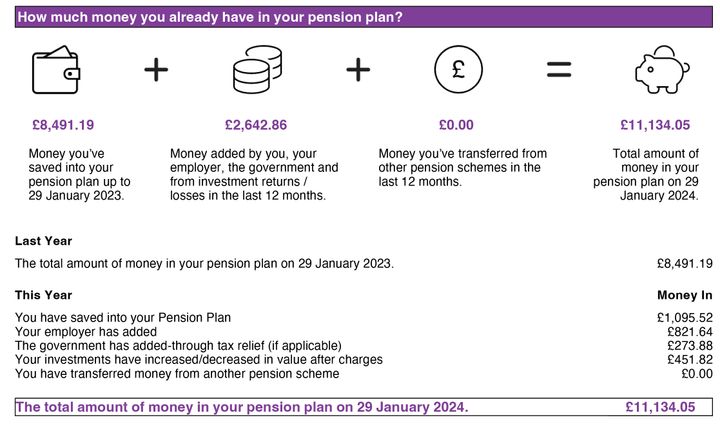

Annual statement from my Workplace Pension

Isn't that a bit of a rubbish return? My financial maths isn't that great, but it looks like a roughly 4% return (not sure if that is before or after fees), which doesn't sound great, especially as the 2022 return was a loss.

Is it worth transferring elsewhere (assuming i can) or are all workplace pension schemes likely to be more-or-less the same?

Isn't that a bit of a rubbish return? My financial maths isn't that great, but it looks like a roughly 4% return (not sure if that is before or after fees), which doesn't sound great, especially as the 2022 return was a loss.

Is it worth transferring elsewhere (assuming i can) or are all workplace pension schemes likely to be more-or-less the same?

What fund(s) is it actually in and what are the fees for being in those funds?

On the face of it, oit does look a bit pants, but that depends on what you think you were supposed to be invested in.

For example, I had a NEST pension and the fund choices were terrible. The best of a bad bunch was to be in their Sharia fund while I was still contributing. I've since moved it all to Vanguard and into ETFs where it performs much better, and at a much lower cost.

On the face of it, oit does look a bit pants, but that depends on what you think you were supposed to be invested in.

For example, I had a NEST pension and the fund choices were terrible. The best of a bad bunch was to be in their Sharia fund while I was still contributing. I've since moved it all to Vanguard and into ETFs where it performs much better, and at a much lower cost.

boyse7en said:

Annual statement from my Workplace Pension

Isn't that a bit of a rubbish return? My financial maths isn't that great, but it looks like a roughly 4% return (not sure if that is before or after fees), which doesn't sound great, especially as the 2022 return was a loss.

Is it worth transferring elsewhere (assuming i can) or are all workplace pension schemes likely to be more-or-less the same?

Depends on your age a bit too - 4% however is pretty low considering cash can get 4.8% just now. I would check whether you can change the fund its investing in or whether they would contribute to a provider of your choice.Isn't that a bit of a rubbish return? My financial maths isn't that great, but it looks like a roughly 4% return (not sure if that is before or after fees), which doesn't sound great, especially as the 2022 return was a loss.

Is it worth transferring elsewhere (assuming i can) or are all workplace pension schemes likely to be more-or-less the same?

Jonathan27 said:

If you are 19 years old and have only been working for a year then its pretty good. If you are 62 and this is your only pension pot then its a bit issue. The in year growth seems okay, but the missing context is age and any other pensions out there.

You could certainly ask about his age and whether he's invested in appropriate assets, but he is initially just asking about the return that was earned, not whether his investments are adequate and suitable for his age, so the missing info is what his pension is invested in and what fees are being charged.ATG said:

Jonathan27 said:

If you are 19 years old and have only been working for a year then its pretty good. If you are 62 and this is your only pension pot then its a bit issue. The in year growth seems okay, but the missing context is age and any other pensions out there.

You could certainly ask about his age and whether he's invested in appropriate assets, but he is initially just asking about the return that was earned, not whether his investments are adequate and suitable for his age, so the missing info is what his pension is invested in and what fees are being charged.Fund fee is 0.76%, platform fee is 0.4%

It is invested in a selection of funds that the provider packages up as its "Growth Portfolio"

In turn, the dozen or so funds my money is in, are invested into:

US Stocks 39.35%

European Stocks ex UK 11.78%

UK Stocks 8.72%

Japanese Stocks 6.68%

Emerging Market Stocks 6.27%

Global Sovereign Bonds 4.89%

Global High Yield Bonds 3.59%

Alternatives 3.58%

Global Corporate Bonds 2.64%

Emerging Market Bonds 2.12%

boyse7en said:

Fund fee is 0.76%, platform fee is 0.4%

A 'name brand' global tracker is about 0.12% and even Fidelity (which isn't the cheapest) is 0.35% platform.You are about 0.7% over paying on that basis but doesn't make loads of difference with the size of your holding.

I would think about going global tracker though as the performance of what you've got isn't great.

I don't think this reflects a 4% return if you are paying in monthly - some of the money will have had nearly 12 months to grow, while some has had only a month.

The pension you have here will be in funds that are bought every time you pay money into your plan. Royal London are simply the company that administrates the scheme. It is the funds (X investment fund) chosen rather than the pension company (Royal London) that drive returns. All pension companies will provide access to a range of funds. Some of these funds will have done very well / very badly.

Your company pension scheme will have a 'Default Investment option' that defines what fund / funds you are invested in if you don't choose your own.

This Default option is often an 'Investment profile', where your investments go into more adventurous funds when you are a long way from retirement, and are gradually moved into safer funds the close you get to your retirement age. This should protect your fund as you get closer to retirement, but is generally designed around keeping money safe to take an annuity (a fixed amount for life) when you reach your retirement date, rather than using the new Pensions Freedoms (either take it as a lump sum which could be taxed, or leave money invested and gradually 'Draw Down' from your Pot).

There will normally be other funds available to invest in.

The available funds you can invest in will depend on the pension company (Royal London), and if your employer has any arrangement to restrict / enhance the choice of funds you can invest in. You can usually change funds within your pension very easily - just a matter of selling one fund and buying a different one. This 'fund switch' is usually free, or very cheap.

As others have said above, you probably need to check what funds you are invested in, and what other options are available. You will then have to decide if your current investments are suitable, or if you want to change.

A change to another company may be worthwhile if Royal London have high charges, or an unsuitable fund choice, but it doesn't sound from your questions that you are someone who needs thousands of investment options at this point.

The pension you have here will be in funds that are bought every time you pay money into your plan. Royal London are simply the company that administrates the scheme. It is the funds (X investment fund) chosen rather than the pension company (Royal London) that drive returns. All pension companies will provide access to a range of funds. Some of these funds will have done very well / very badly.

Your company pension scheme will have a 'Default Investment option' that defines what fund / funds you are invested in if you don't choose your own.

This Default option is often an 'Investment profile', where your investments go into more adventurous funds when you are a long way from retirement, and are gradually moved into safer funds the close you get to your retirement age. This should protect your fund as you get closer to retirement, but is generally designed around keeping money safe to take an annuity (a fixed amount for life) when you reach your retirement date, rather than using the new Pensions Freedoms (either take it as a lump sum which could be taxed, or leave money invested and gradually 'Draw Down' from your Pot).

There will normally be other funds available to invest in.

The available funds you can invest in will depend on the pension company (Royal London), and if your employer has any arrangement to restrict / enhance the choice of funds you can invest in. You can usually change funds within your pension very easily - just a matter of selling one fund and buying a different one. This 'fund switch' is usually free, or very cheap.

As others have said above, you probably need to check what funds you are invested in, and what other options are available. You will then have to decide if your current investments are suitable, or if you want to change.

A change to another company may be worthwhile if Royal London have high charges, or an unsuitable fund choice, but it doesn't sound from your questions that you are someone who needs thousands of investment options at this point.

Looking at 1 year is a bit of a drop in the ocean without comparison to the performance of others. Especially with how the world has been in turmoil the past few years.

If you are looking for a benchmark, the performance of my DC pensions for 23-24 were:

Pension 1 (Fidelity) = 21.71%

Pension 2 (Fidelity) = 21.48%

Current workplace DC (L&G) = 3.3%

Big difference there, my L&G and yours are comparable sh*te, I suggest we both look at how they are being invested.

If you are looking for a benchmark, the performance of my DC pensions for 23-24 were:

Pension 1 (Fidelity) = 21.71%

Pension 2 (Fidelity) = 21.48%

Current workplace DC (L&G) = 3.3%

Big difference there, my L&G and yours are comparable sh*te, I suggest we both look at how they are being invested.

boyse7en said:

It is invested in a selection of funds that the provider packages up as its "Growth Portfolio"

In turn, the dozen or so funds my money is in, are invested into:

US Stocks 39.35%

European Stocks ex UK 11.78%

UK Stocks 8.72%

Japanese Stocks 6.68%

Emerging Market Stocks 6.27%

Global Sovereign Bonds 4.89%

Global High Yield Bonds 3.59%

Alternatives 3.58%

Global Corporate Bonds 2.64%

Emerging Market Bonds 2.12%

Can you pick funds within the pension scheme, and do you understand things like why you might or might not want to vary the equity:bond ratio over your working career?In turn, the dozen or so funds my money is in, are invested into:

US Stocks 39.35%

European Stocks ex UK 11.78%

UK Stocks 8.72%

Japanese Stocks 6.68%

Emerging Market Stocks 6.27%

Global Sovereign Bonds 4.89%

Global High Yield Bonds 3.59%

Alternatives 3.58%

Global Corporate Bonds 2.64%

Emerging Market Bonds 2.12%

The fees on the pension aren't great, but on this small a holding that isn't the end of the world, bigger issue is the asset allocation is somewhat idiosyncratic to my eyes at least.

If there are no reasonable / good value fund options (I.e a global tracker and govt bond fund) I would transfer out to your own SIPP once per year.

Most schemes will let you do this as long as you keep a notional balance/ keep the account live.

3% employer contribution is miserly but still part of your comp so worth taking, imo.

Most schemes will let you do this as long as you keep a notional balance/ keep the account live.

3% employer contribution is miserly but still part of your comp so worth taking, imo.

Looks a bit rubbish to me!

As another comparison in my SIPP the four funds I dumped a load into at the start of the financial year ‘23 have done 27%, 24%, 19% and 26%. This was the first time I’d moved away from the two standard funds that my workplace pension selects, but even they’ve done 16% and 12% over the last 12 months.

As another comparison in my SIPP the four funds I dumped a load into at the start of the financial year ‘23 have done 27%, 24%, 19% and 26%. This was the first time I’d moved away from the two standard funds that my workplace pension selects, but even they’ve done 16% and 12% over the last 12 months.

0.76% fund fee is on the higher side (esp if that's meant to be the default fund option) however most employer schemes have a fee discount that is applied so worth checking the small print on your scheme guide.

My work pension fund options aren't great but there were a couple of global trackers with reasonable fees and a HSBC Sharia fund which has performed well recently (but is quite concentrated/narrow in terms of investment focus) so I've opted for those instead and even if we do see a correction or significant drop in the US Equities markets am not fussed as have at least 15 years to go till retirement and hopefully can take advantage of those drops.

My work pension fund options aren't great but there were a couple of global trackers with reasonable fees and a HSBC Sharia fund which has performed well recently (but is quite concentrated/narrow in terms of investment focus) so I've opted for those instead and even if we do see a correction or significant drop in the US Equities markets am not fussed as have at least 15 years to go till retirement and hopefully can take advantage of those drops.

VR99 said:

0.76% fund fee is on the higher side (esp if that's meant to be the default fund option) however most employer schemes have a fee discount that is applied so worth checking the small print on your scheme guide.

My work pension fund options aren't great but there were a couple of global trackers with reasonable fees and a HSBC Sharia fund which has performed well recently (but is quite concentrated/narrow in terms of investment focus) so I've opted for those instead and even if we do see a correction or significant drop in the US Equities markets am not fussed as have at least 15 years to go till retirement and hopefully can take advantage of those drops.

Just transfer it out periodically to a SIPP would make sense - no restrictions or high charge then. My work pension fund options aren't great but there were a couple of global trackers with reasonable fees and a HSBC Sharia fund which has performed well recently (but is quite concentrated/narrow in terms of investment focus) so I've opted for those instead and even if we do see a correction or significant drop in the US Equities markets am not fussed as have at least 15 years to go till retirement and hopefully can take advantage of those drops.

Simpo Two said:

Mankers said:

You wouldn’t have had to try too hard to get c.30% over the past 12 months….

If it was all in US/Tech, indeed. But pensions usually aren'tThat said, what's making the FTSE100 go bonkers? I sold some when it got to nearly 8,000 but kept some too...

UK market (FTSE100) has been a poor place to invest, and has regularly underperformed other markets for a long time now.

Gassing Station | Finance | Top of Page | What's New | My Stuff