Car finance - hidden commission payments

Discussion

sugerbear said:

OddCat said:

DonkeyApple said:

Not quite right. The issue with the scenario is that when you walk in with your own money you don't get the same offer price on the car. That's the key to the jig and the issue with captive house finance.

So you get the car cheaper if you take the dealer finance ? Is this not six of one and half a dozen of the other ? Does the price discount for taking the finance therefore not have to be offset against the discretionary commission refund ? Otherwise the buyer had the penny and the bun ? DonkeyApple said:

The key to equitable pricing, transparency and eliminating over charging is to always segregate the finance deal from the purchase deal.

This is a discretionary purchase ! There isn't any equitable element. It's like buying a washing machine. I'm sure various places sell the same machine at different prices and have different finance deals with different splits of who gets what. Caveat emptor and all that....

And that these are interchangeable pairs.

Hope that helps

Looking forward to the autumn decisions.

Prediction 1 - it’s found to need compensation and the winter car market goes bonkers as everyone follows the rules of man maths and spends the “free money” on more cars. Prices also go up immediately as dealers realise there is blood in the water again.

Prediction 1a - divorce numbers escalate as people celebrate the decision and immediately cause the smoke and mirrors of man maths to disappear and partners throw the calculator at car nuts after realising the real amount spent on cars….

Prediction 1 - it’s found to need compensation and the winter car market goes bonkers as everyone follows the rules of man maths and spends the “free money” on more cars. Prices also go up immediately as dealers realise there is blood in the water again.

Prediction 1a - divorce numbers escalate as people celebrate the decision and immediately cause the smoke and mirrors of man maths to disappear and partners throw the calculator at car nuts after realising the real amount spent on cars….

Just been discussing this at work today, seems a few of the lads have had positive claims on used vehicles bought through finance through various finance companies, none what so ever with new vehicles via VWFS.

I had my 2 new vehicles from VWFS confirmed as no commission.

Only other vehicle is an ex-demo I30N via black horse on a "used" finance agreement. They've sent me emails every month saying they're busy please wait, yet I see countless adverts everywhere saying they're liable.

As everyone is, waiting until September to see the outcome.

I had my 2 new vehicles from VWFS confirmed as no commission.

Only other vehicle is an ex-demo I30N via black horse on a "used" finance agreement. They've sent me emails every month saying they're busy please wait, yet I see countless adverts everywhere saying they're liable.

As everyone is, waiting until September to see the outcome.

Random_Person said:

I have had no answer from Toyota, theu replied to me at the stat of March saying they would give me an answer within 28 days. That was 2 months ago and they have failed to respond to my initial and subsequent chaser emails.

Yup same with Alphera. Decided not to worry or bother chasing again and will just wait for the September announcement by the FCA.

ML said the important thing was to email now and just get your name on the list and the auto reply proves that apparently.

Porsche Financial Services:-

We’re writing to let you know that based on our review of your complaint, we believe a Discretionary Commission Arrangement may have applied to your agreement and as such the pause applies to your complaint. We are therefore not in a position to issue a final response to your complaint at this time.

We’re writing to let you know that based on our review of your complaint, we believe a Discretionary Commission Arrangement may have applied to your agreement and as such the pause applies to your complaint. We are therefore not in a position to issue a final response to your complaint at this time.

Had a reply from Ford, says they cant tell if my finance had a DCA, but they need more time. Someone from work bought a car the same day as me using the same finance scheme, her APR was 0.4 higher than mine, so I reckon they were amending things, they did say I can complain to the FCA already and have given me the details, but im hoping Martin Lewis is right and am holding on for now.

Northridge/BMW have said they need more time to get the documents - which I attached a scanned copy.

Northridge/BMW have said they need more time to get the documents - which I attached a scanned copy.

OddCat said:

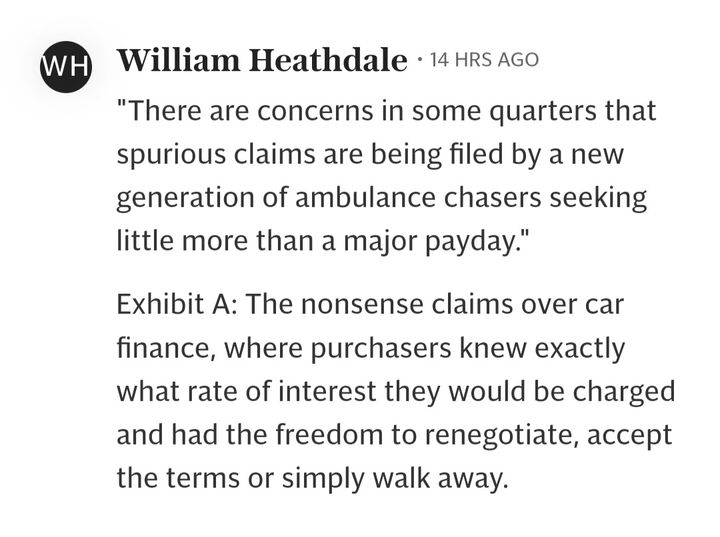

Article in today's Telegraph re the rise of 'class actions' in the UK:

And this comment:

Just sayin'.....

I was free to walk away, however I needed a car, I needed finance, I was told that was the rate take it or leave it, what I wasn't told was that rate was set by someone who got extra commission for bumping my rate up.And this comment:

Just sayin'.....

Just sayin'......

Wont someone think of the poor finance companies !!

"Volkswagen Financial Services have concluded the 2023 financial year with another good result. The operating profit of EUR 3.25 billion is the outcome of a normalization of business performance, without the special effects of the past two years"

They are drowning apparently.

"Volkswagen Financial Services have concluded the 2023 financial year with another good result. The operating profit of EUR 3.25 billion is the outcome of a normalization of business performance, without the special effects of the past two years"

They are drowning apparently.

geeks said:

I was free to walk away, however I needed a car, I needed finance, I was told that was the rate take it or leave it, what I wasn't told was that rate was set by someone who got extra commission for bumping my rate up.

Just sayin'......

And that's the nub. The premium wasn't customer risk related by any credible metric but third party salesman added based on what they could get away with. Just sayin'......

The lender quoted a fair rate for the risk they were taking and then allowed the agent sitting between them and the client to add on whatever they liked for themselves.

What you then always end up with is some being honest and fair and others gauging mugs, the latter being quite easy with cars as many customers walk in thinking 24% credit card funding is a sane figure to work back from as opposed to others who work forward from 2% mortgage rates or 3% unsecured loan rates.

It's exactly why people who sell cars should sell cars and people who sell debt should sell debt and never the Twain should ever be allowed to meet.

DonkeyApple said:

The lender quoted a fair rate for the risk they were taking and then allowed the agent sitting between them and the client to add on whatever they liked for themselves

Disgusting. A retailer setting their own margin.To be fair, I do think that making people signing these agreements while having a gun held to their heads was out of order.

Gassing Station | Finance | Top of Page | What's New | My Stuff