Tesla unlikely to Survive (Vol. 3)

Discussion

Gone fishing said:

h0b0 said:

I out this on another thread but seems it should be here.

Elon was forced to open up his supercharger network to all in the US. As a result, any investment I the network nets him zero competitive advantage. In fact, his biggest asset in over coming people’s fear was the super charger network. Now it is open, any investment is helping his competition.

No surprise he pulled out. Elon isn’t in this for his customers. He is in it for the money as a CEO.

They started opening them in Europe a long time ago and seemingly without pressure to do so. If Musk thinks the world stops at the US border and kills the worldwide supercharging team then that’s a bit stupid.Elon was forced to open up his supercharger network to all in the US. As a result, any investment I the network nets him zero competitive advantage. In fact, his biggest asset in over coming people’s fear was the super charger network. Now it is open, any investment is helping his competition.

No surprise he pulled out. Elon isn’t in this for his customers. He is in it for the money as a CEO.

Superchargers have always been a sales point, in the US, through the app, you have a captive audience of people you can promote to, that’s quote valuable. In the U.K. the majority of the early ones to be opened up were collocated at sales centres, brilliant idea, you turn up in the etron, you’re at a lose end for 30 mins, you go and look in the showroom.

My read on the situation, FWIW, is that the financials are really hurting big-time. At the end of Q1 2024, Tesla had something like $29bn in cash on hand, which sounds a lot. However, IIRC, there are debt repayments coming up, plus a chunk of that money is deposits against future orders (CT etc.).

The factors really hurting Tesla right now include:

- interest rates (competitive finance is an important selling point, and Tesla is presumably having to underwrite the finance deals) - many forecasters assumed rates would have started falling by now;

- interest rates (dampening demand because of cost ups in daily living, alongside inflation) - again, the forecasts were for an easing of that problem by now;

- a major price war with Chinese manufacturers, some of whom appear to be essentially dumping product in order to buy market share;

- the continued high costs of utilities (which are likely to be hurting the Supercharger business);

- a very cash-hungry roadmap (new factories, new models, new tech).

At times like this, Tesla gets stung by its reliance on in-house tech (as opposed to just buying-in and licensing from suppliers such as MobilEye - whose own financial performance has taken a major hit).

Tesla won't want to go back to raising finance using convertible bonds, or selling equity. And there is - of course - the conflict of interest issue (we believe Musk's debt is secured against Tesla stock; if the stock price continues to fall, he's going to be in trouble posting collateral to keep his loans afloat). I suspect he can't leverage SpaceX stock for this purpose and, besides, SpaceX is itself in a continuing cash-burn situation.

As I've said before, there's no doubt in my mind that his purchase of Twitter was a major mis-step. Not only did it distract him at an important time; it also created a really poor (for Tesla) feedback loop in which the stock price became even more of a driver of short-term decision-making than in other firms.

It would seem Musk is responding to all of these things by slashing costs hither and yon (presumably in an attempt to beat analysts' forecasts on P&L for Q2), whilst trying to maintain progress on what he sees as core tech (whether that's core to Tesla's future or core to the stock price is up for discussion). Hence his comments on the earnings call (anyone who sees as as just a car company shouldn't be invested in Tesla stock), continued updates on robotics (which do, to be fair, look promising), the accelerating cadence of FSD beta releases (which, judging by the videos, are now very impressive), the announced China FSD deal, the continued pressure on European regulators over FSD, and so on.

Musk isn't short of imagination. I'm sure, were I in his shoes, I'd be looking at the world quite similarly. He can see the prospect for ill economic winds to blow away the fantastic gains he's made so far. Right now he's probably looking to batten down the hatches, try to maximise revenues from the existing investments, and weather the next 2-3 quarters in the hope of an economic rebound.

As far as Superchargers go, now the standardisation issue has been resolved in Tesla's favour in North America, the smart money would be on a strategic partnership, JV or spin-out of that business. There's a ready-made pool of employees (who could usefully be taken off of Tesla's payroll), and bringing in a partner (say a financial institution) to underpin the capital required for the next phase of expansion could be a smart move. Whilst it would be a hit to P&L (assuming Superchargers are profitable), it would generate very useful cash right now, and it would reassure investors that one of Tesla's key competitive advantages is safely underpinned by fresh capital.

If only he'd left Twitter alone...

The factors really hurting Tesla right now include:

- interest rates (competitive finance is an important selling point, and Tesla is presumably having to underwrite the finance deals) - many forecasters assumed rates would have started falling by now;

- interest rates (dampening demand because of cost ups in daily living, alongside inflation) - again, the forecasts were for an easing of that problem by now;

- a major price war with Chinese manufacturers, some of whom appear to be essentially dumping product in order to buy market share;

- the continued high costs of utilities (which are likely to be hurting the Supercharger business);

- a very cash-hungry roadmap (new factories, new models, new tech).

At times like this, Tesla gets stung by its reliance on in-house tech (as opposed to just buying-in and licensing from suppliers such as MobilEye - whose own financial performance has taken a major hit).

Tesla won't want to go back to raising finance using convertible bonds, or selling equity. And there is - of course - the conflict of interest issue (we believe Musk's debt is secured against Tesla stock; if the stock price continues to fall, he's going to be in trouble posting collateral to keep his loans afloat). I suspect he can't leverage SpaceX stock for this purpose and, besides, SpaceX is itself in a continuing cash-burn situation.

As I've said before, there's no doubt in my mind that his purchase of Twitter was a major mis-step. Not only did it distract him at an important time; it also created a really poor (for Tesla) feedback loop in which the stock price became even more of a driver of short-term decision-making than in other firms.

It would seem Musk is responding to all of these things by slashing costs hither and yon (presumably in an attempt to beat analysts' forecasts on P&L for Q2), whilst trying to maintain progress on what he sees as core tech (whether that's core to Tesla's future or core to the stock price is up for discussion). Hence his comments on the earnings call (anyone who sees as as just a car company shouldn't be invested in Tesla stock), continued updates on robotics (which do, to be fair, look promising), the accelerating cadence of FSD beta releases (which, judging by the videos, are now very impressive), the announced China FSD deal, the continued pressure on European regulators over FSD, and so on.

Musk isn't short of imagination. I'm sure, were I in his shoes, I'd be looking at the world quite similarly. He can see the prospect for ill economic winds to blow away the fantastic gains he's made so far. Right now he's probably looking to batten down the hatches, try to maximise revenues from the existing investments, and weather the next 2-3 quarters in the hope of an economic rebound.

As far as Superchargers go, now the standardisation issue has been resolved in Tesla's favour in North America, the smart money would be on a strategic partnership, JV or spin-out of that business. There's a ready-made pool of employees (who could usefully be taken off of Tesla's payroll), and bringing in a partner (say a financial institution) to underpin the capital required for the next phase of expansion could be a smart move. Whilst it would be a hit to P&L (assuming Superchargers are profitable), it would generate very useful cash right now, and it would reassure investors that one of Tesla's key competitive advantages is safely underpinned by fresh capital.

If only he'd left Twitter alone...

Puzzles said:

I didn’t think Tesla had substantial debt, I might be wrong but last time I checked it was a tiny amount.

Also I think they had 2m 1k deposits for the cybertruck?

If they do have $2bn in deposits for CT, that's $2bn of sales that generate no new cash. And nearly 10% of their total estimated cash on hand. But how many of those deposit-holders either cancel, given the new pricing and/or economic realities?Also I think they had 2m 1k deposits for the cybertruck?

In terms of net debt, it *was* almost zero towards the end of last year; since then it has been jumping up very rapidly, which is what I suspect has prompted Musk's actions.

If they can turn the handle on CT deliveries, that will help. I'd assume the $2bn deposits is included in that $10bn total at the end of Q1. If they all cancel, that's 20% of total debt that suddenly has to be repaid...

U.K. sales data from SMMt for April:

Overall BEV market YTD is +10%

Tesla sales YTD are -13%

Tesla market share -20%

There’s a few potential explanations, Tesla have normally peaked at quarter ends and they’re trying to change that, the shipping from China is taking longer, new updated version of the Model 3, some of those things you could argue would help, some hi see the numbers. But hard sales numbers are the e d of a sales pipeline that only Tesla will know, how many people are visiting the website, how many test drives are happening, how many orders are being configured to check finance costs, how many part ex valuations, that will be telling them if the world is falling out of love with the brand, because despite the argument “bank rates are high, money is tight”, the market has grown 10% and Tesla have lost 1/5 of their market share

Overall BEV market YTD is +10%

Tesla sales YTD are -13%

Tesla market share -20%

There’s a few potential explanations, Tesla have normally peaked at quarter ends and they’re trying to change that, the shipping from China is taking longer, new updated version of the Model 3, some of those things you could argue would help, some hi see the numbers. But hard sales numbers are the e d of a sales pipeline that only Tesla will know, how many people are visiting the website, how many test drives are happening, how many orders are being configured to check finance costs, how many part ex valuations, that will be telling them if the world is falling out of love with the brand, because despite the argument “bank rates are high, money is tight”, the market has grown 10% and Tesla have lost 1/5 of their market share

Gone fishing said:

U.K. sales data from SMMt for April:

Overall BEV market YTD is +10%

Tesla sales YTD are -13%

Tesla market share -20%

There’s a few potential explanations, Tesla have normally peaked at quarter ends and they’re trying to change that, the shipping from China is taking longer, new updated version of the Model 3, some of those things you could argue would help, some hi see the numbers. But hard sales numbers are the e d of a sales pipeline that only Tesla will know, how many people are visiting the website, how many test drives are happening, how many orders are being configured to check finance costs, how many part ex valuations, that will be telling them if the world is falling out of love with the brand, because despite the argument “bank rates are high, money is tight”, the market has grown 10% and Tesla have lost 1/5 of their market share

I'd expect that to happen as a result of new competitors entering the markets where Tesla sells.Overall BEV market YTD is +10%

Tesla sales YTD are -13%

Tesla market share -20%

There’s a few potential explanations, Tesla have normally peaked at quarter ends and they’re trying to change that, the shipping from China is taking longer, new updated version of the Model 3, some of those things you could argue would help, some hi see the numbers. But hard sales numbers are the e d of a sales pipeline that only Tesla will know, how many people are visiting the website, how many test drives are happening, how many orders are being configured to check finance costs, how many part ex valuations, that will be telling them if the world is falling out of love with the brand, because despite the argument “bank rates are high, money is tight”, the market has grown 10% and Tesla have lost 1/5 of their market share

If a company starts with relatively little competition and takes a run on the market, all that can happen is their market share will reduce as others enter the same market and start I compete.

That's not so much a problem, it's just a reality. It's also a reality firmly predicted a decade ago, as it's the only thing that could happen.

TheDeuce said:

I'd expect that to happen as a result of new competitors entering the markets where Tesla sells.

If a company starts with relatively little competition and takes a run on the market, all that can happen is their market share will reduce as others enter the same market and start I compete.

That's not so much a problem, it's just a reality. It's also a reality firmly predicted a decade ago, as it's the only thing that could happen.

I agree up to a point, but Tesla are blaming everything but the competition If a company starts with relatively little competition and takes a run on the market, all that can happen is their market share will reduce as others enter the same market and start I compete.

That's not so much a problem, it's just a reality. It's also a reality firmly predicted a decade ago, as it's the only thing that could happen.

Gone fishing said:

TheDeuce said:

I'd expect that to happen as a result of new competitors entering the markets where Tesla sells.

If a company starts with relatively little competition and takes a run on the market, all that can happen is their market share will reduce as others enter the same market and start I compete.

That's not so much a problem, it's just a reality. It's also a reality firmly predicted a decade ago, as it's the only thing that could happen.

I agree up to a point, but Tesla are blaming everything but the competition If a company starts with relatively little competition and takes a run on the market, all that can happen is their market share will reduce as others enter the same market and start I compete.

That's not so much a problem, it's just a reality. It's also a reality firmly predicted a decade ago, as it's the only thing that could happen.

Most of all they'll blame anything they can convince people can be fixed somehow to protect the share price. They can't really 'fix' growing competition because as the world is well aware, Tesla started out as the only serious EV maker and now there are 30+ with more on their way each year. It's only been a little over a decade since Tesla began, that's quite a transformation of the market they trade in! Tesla have to sell less, it's the only thing that can realistically happen. The only exception would be if they come out with a killer new car that takes the market by storm, or diversify in some way to sidestep the competition. They talk about both things fairly regularly - despite thus far nothing concrete emerging.

Gone fishing said:

TheDeuce said:

I'd expect that to happen as a result of new competitors entering the markets where Tesla sells.

If a company starts with relatively little competition and takes a run on the market, all that can happen is their market share will reduce as others enter the same market and start I compete.

That's not so much a problem, it's just a reality. It's also a reality firmly predicted a decade ago, as it's the only thing that could happen.

I agree up to a point, but Tesla are blaming everything but the competition If a company starts with relatively little competition and takes a run on the market, all that can happen is their market share will reduce as others enter the same market and start I compete.

That's not so much a problem, it's just a reality. It's also a reality firmly predicted a decade ago, as it's the only thing that could happen.

A "problem" I predict with EV's is just how long they last. From what I've seen, they have the capability of outlasting ICE vehicles by a factor of two. A lot of people will still swap cars every 2-5 years, but I can imagine the second hand market will just be saturated to the extend it will really hurt resale value.

Watch the autoalex video where they buy a cheap Model S with over 700 000 km on the odo. Of course it lost a significant amount of range, but other than that the drivetrain was mechanically sound. Where they usually were afraid to go anywhere in a barge like that in fear of breaking down, all they had was "range anxiety", which is completely manufactured as you know exactly when it's going to happen.

ZesPak said:

Gone fishing said:

TheDeuce said:

I'd expect that to happen as a result of new competitors entering the markets where Tesla sells.

If a company starts with relatively little competition and takes a run on the market, all that can happen is their market share will reduce as others enter the same market and start I compete.

That's not so much a problem, it's just a reality. It's also a reality firmly predicted a decade ago, as it's the only thing that could happen.

I agree up to a point, but Tesla are blaming everything but the competition If a company starts with relatively little competition and takes a run on the market, all that can happen is their market share will reduce as others enter the same market and start I compete.

That's not so much a problem, it's just a reality. It's also a reality firmly predicted a decade ago, as it's the only thing that could happen.

A "problem" I predict with EV's is just how long they last. From what I've seen, they have the capability of outlasting ICE vehicles by a factor of two. A lot of people will still swap cars every 2-5 years, but I can imagine the second hand market will just be saturated to the extend it will really hurt resale value.

Watch the autoalex video where they buy a cheap Model S with over 700 000 km on the odo. Of course it lost a significant amount of range, but other than that the drivetrain was mechanically sound. Where they usually were afraid to go anywhere in a barge like that in fear of breaking down, all they had was "range anxiety", which is completely manufactured as you know exactly when it's going to happen.

It is interesting to consider the potential long lives of EV's. I think they will generally outlast ICE due to their mechanical simplicity. Range degredation is a none issue for ageing, cheap EV's because at least half the cars on the road never go anywhere like as far as even half a modem EV's range. I doubt they'll last significantly longer in practice though, because the tech will become outdated. I bet they last a good few years longer on average ahead of scrapping though.

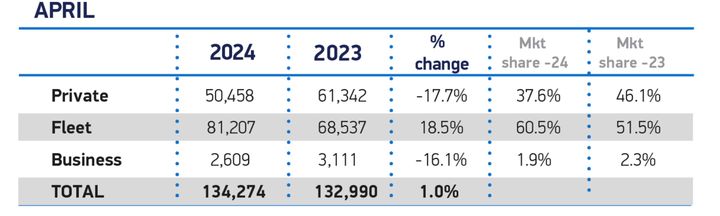

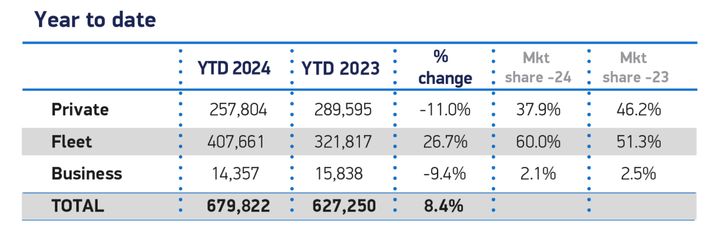

I think you’re all missing the key data from the SMMT release:

The overall market may seem healthyish, but the markets that matter for profitability are on their arse. -17.7% is an enormous drop-off; even YTD private sales are down 11%.

Tesla market mainly to private buyers and user-choosers. Private sales seem to have collapsed. We don’t have user-chooser fleet data, but business buyers (a much smaller slice of the pie, but again important to Tesla) has also tanked.

The SMMT doesn’t publish the cross tabs, so we can’t see where the different purchaser groups are spending.

The problem with data is we tend to see headlines and then construct a narrative around it. For all we know, Tesla is doing better in terms of market share of the private market than before, but that market has shrunk.

It is very likely, however, that price is a major factor, and Tesla needs to keep moving volume. It is indeed a shame that Model 2 hasn’t turned up. As we know, substantially cheaper product is at least 12 months away.

So, if I tend to believe likely, Tesla has a problem there, it must lean itself rapidly (which it is doing) and do the best it can. It is unlikely to want to meet the sort of fleet discounts many other manufacturers routinely offer, for instance. But in the UK, right now, fleets are 60% of the market.

This trend has been there for a while. Tesla units YTD April 23 vs 22 were down 2.5% as large fleet sales picked up again.

The overall market may seem healthyish, but the markets that matter for profitability are on their arse. -17.7% is an enormous drop-off; even YTD private sales are down 11%.

Tesla market mainly to private buyers and user-choosers. Private sales seem to have collapsed. We don’t have user-chooser fleet data, but business buyers (a much smaller slice of the pie, but again important to Tesla) has also tanked.

The SMMT doesn’t publish the cross tabs, so we can’t see where the different purchaser groups are spending.

The problem with data is we tend to see headlines and then construct a narrative around it. For all we know, Tesla is doing better in terms of market share of the private market than before, but that market has shrunk.

It is very likely, however, that price is a major factor, and Tesla needs to keep moving volume. It is indeed a shame that Model 2 hasn’t turned up. As we know, substantially cheaper product is at least 12 months away.

So, if I tend to believe likely, Tesla has a problem there, it must lean itself rapidly (which it is doing) and do the best it can. It is unlikely to want to meet the sort of fleet discounts many other manufacturers routinely offer, for instance. But in the UK, right now, fleets are 60% of the market.

This trend has been there for a while. Tesla units YTD April 23 vs 22 were down 2.5% as large fleet sales picked up again.

We can also try and create a narrative where it might not be as bad.. I quoted YTD figures and Tesla are down, share falling and in a growing segment.

The mix of business v private sellers is somewhat academic to Tesla as that’s unlikely to be a reflection of Tesla leasing to companies directly, but as rules change going forward it only appears to be more trouble ahead.

There’s very little potential good news looking forward in European markets for Tesla, FSD is a maybe, maybe not, cybertruck isn’t coming, no sign of updated Model Y, robotaxi is nothing put a long term pipe dream.. UK is stuck with the Ford Mondeo of the electric car market, every company car driver has one, and has lost any sense of an aspirational choice

The mix of business v private sellers is somewhat academic to Tesla as that’s unlikely to be a reflection of Tesla leasing to companies directly, but as rules change going forward it only appears to be more trouble ahead.

There’s very little potential good news looking forward in European markets for Tesla, FSD is a maybe, maybe not, cybertruck isn’t coming, no sign of updated Model Y, robotaxi is nothing put a long term pipe dream.. UK is stuck with the Ford Mondeo of the electric car market, every company car driver has one, and has lost any sense of an aspirational choice

Gone fishing said:

We can also try and create a narrative where it might not be as bad.. I quoted YTD figures and Tesla are down, share falling and in a growing segment.

The mix of business v private sellers is somewhat academic to Tesla as that’s unlikely to be a reflection of Tesla leasing to companies directly, but as rules change going forward it only appears to be more trouble ahead.

There’s very little potential good news looking forward in European markets for Tesla, FSD is a maybe, maybe not, cybertruck isn’t coming, no sign of updated Model Y, robotaxi is nothing put a long term pipe dream.. UK is stuck with the Ford Mondeo of the electric car market, every company car driver has one, and has lost any sense of an aspirational choice

Selling to lease companies heavily reduces margin - more than ever up against the competition from China.The mix of business v private sellers is somewhat academic to Tesla as that’s unlikely to be a reflection of Tesla leasing to companies directly, but as rules change going forward it only appears to be more trouble ahead.

There’s very little potential good news looking forward in European markets for Tesla, FSD is a maybe, maybe not, cybertruck isn’t coming, no sign of updated Model Y, robotaxi is nothing put a long term pipe dream.. UK is stuck with the Ford Mondeo of the electric car market, every company car driver has one, and has lost any sense of an aspirational choice

I agree that the Tesla lineup has stagnated somewhat and a smaller/more basic, M2 car is needed - especially if it's to appeal to private buyers.

I think there's no doubt Tesla have and we're always destined to lose market share over time, that's a given when si many competitors jump into the same market. But whilst that forgives Tesla to an extent, I do feel they could be doing better in terms of product lineup and development. It's as if they lost momentum..

TheDeuce said:

I doubt they'll last significantly longer in practice though, because the tech will become outdated.

You'd think that, but the leaf is over 14 years old and while the plug has become obsolete, the car hasn't.I think we will see some technological changes and changes in battery tech, but if the first gen cars are still relevant I don't see how next gens will change that? It's not like they stop working altogether.

ZesPak said:

TheDeuce said:

I doubt they'll last significantly longer in practice though, because the tech will become outdated.

You'd think that, but the leaf is over 14 years old and while the plug has become obsolete, the car hasn't.I think we will see some technological changes and changes in battery tech, but if the first gen cars are still relevant I don't see how next gens will change that? It's not like they stop working altogether.

I agree that technological advances don't make current cars any less suitable - people sometimes act as if their current EV would be next to worthless if one with better batteries was introduced... In reality it'd just take a small value hit and become a bargain for a future owner that simply doesn't need more range than it offers. Which is most drivers.

I’d also hope an aftermarket develops. For instance, I’d love an old BMW i3 to run around in, but for my use the tiny batteries don’t offer good enough range, and the REX option seems mired in failure and cost.

If/when affordable battery upgrades turn up for the i3, I suspect their value will rise again - they’re otherwise a very impressive vehicle for their chosen design criteria.

If/when affordable battery upgrades turn up for the i3, I suspect their value will rise again - they’re otherwise a very impressive vehicle for their chosen design criteria.

[quote=TheDeuce]

I think there's no doubt Tesla have and we're always destined to lose market share over time/quote]

The thing is, it's not just market share they have lost; it's volume.

2023 YTD 15168 units

2024 YTD 13120 units

People say it is because of supply issues; however, you can get any Tesla delivered in May/ June.

I think there's no doubt Tesla have and we're always destined to lose market share over time/quote]

The thing is, it's not just market share they have lost; it's volume.

2023 YTD 15168 units

2024 YTD 13120 units

People say it is because of supply issues; however, you can get any Tesla delivered in May/ June.

TheRainMaker]heDeuce said:

I think there's no doubt Tesla have and we're always destined to lose market share over time/quote]

The thing is, it's not just market share they have lost; it's volume.

2023 YTD 15168 units

2024 YTD 13120 units

People say it is because of supply issues; however, you can get any Tesla delivered in May/ June.

For the same reason, the sheer number of competitors entering the market which vastly outweighs the rate of sales increase, I would expect the volume to drop too.The thing is, it's not just market share they have lost; it's volume.

2023 YTD 15168 units

2024 YTD 13120 units

People say it is because of supply issues; however, you can get any Tesla delivered in May/ June.

Also not helped by the ageing lineup. Buying a Tesla doesn't set you apart anymore, they need a new car. Not a refresh and not a truck.

Gassing Station | Tesla | Top of Page | What's New | My Stuff