Liz Truss Prime Minister

Discussion

Wombat3 said:

skwdenyer said:

Carl_VivaEspana said:

(almost) three pages of ranting about Liz and no alternative ideas that are better other than tax , spend and mass immigration.

This is why the UK economy is on the trajectory it is. Bring on the election so I can have a good laugh at all the additional regulation Team Red are going to apply.

Because the low tax experiment has failed. Our enormous backlog of spending requires high taxes to remain, and then continue so we can have the standard of services and government that we want.This is why the UK economy is on the trajectory it is. Bring on the election so I can have a good laugh at all the additional regulation Team Red are going to apply.

Even the USA has been more expensive to operate in than the UK!

Its also not the right conversation. The real conversation should be about evaluating the gap between the level of services we think we are entitled to and that which we can afford/are prepared to pay for; and how we can close it.

The reason the gap exists is on the one hand the workforce is unproductive and on the other it doesn't like paying tax because it doesn't think it can see the benefits of it.

Whats also missing from the "just raise tax" argument is any acknowledgment that there might be a huge issue with what's done with the money that's allready being raised. That goes back to accountability of / from the public sector and their blatant disregard and dislike for it.

More tax is not the answer and never has been, ever, anywhere. Just throwing more money at an already inefficient and wasteful public sector that is subject to minimall (if any) jeopardy and benefits from gold plated, diamond encusted final salary pension shemes, the likes of which are completely unaffordable elsewhere will not solve anything.

We know what it costs to run a first world country with proper services and benefits. We've got lots of exemplars against which to compare ourselves. For far too long, we cut taxes well below the sustainable level. We slashed public expenditure. We put a spanner in the works of economic recovery, the educational attainment of our children, the health of our population (and, especially, of our workforce - don't forget the NHS was primarily set up to keep working-age people able to work). We've transferred untold £billions into the private sector for scant return to the public purse.

Take Thames Water as singular example. Flogged off on the cheap by the Government. Was the capital receipt re-invested? No, of course not; it was used to lower taxes - gone in the (relative) blink of an eye. Vast land assets were given to TW, with the stated intention of allowing them to borrow against them for investment. Did they? Of course not; they borrowed against them to pay dividends, relying upon the toothless regulatory regime to allow them to keep upping prices for customers.

That's just one example of the ludicrous, dogma-laden approach to managing public assets. You simply can't keep flogging off assets and using that money to lower taxes. Eventually you run out of things to sell, and everyone is poorer forever.

Think about the former public assets we're now renting from overseas investors. Madness. If somebody had proposed it in those terms (we're going to flog off our assets to foreign, sometimes state-owned, businesses, and then allow them to suck money out of the country), would anyone have supported it? If those assets had been ring-fenced so as to be buyable only by, say, UK pension funds, there might have been a modicum of logic to it. But that's not what we've got, is it?

The amount of money available to local Government has been reduced by well over a third in nominal terms since 2010. A third. Why? Because our tax base has stalled. Rather than having proper tax rates, and proper public expenditure, we had "austerity." The problem? Public investment has an overall positive ROI at the national level. Remove it, and the economy - and the overall tax take - goes down.

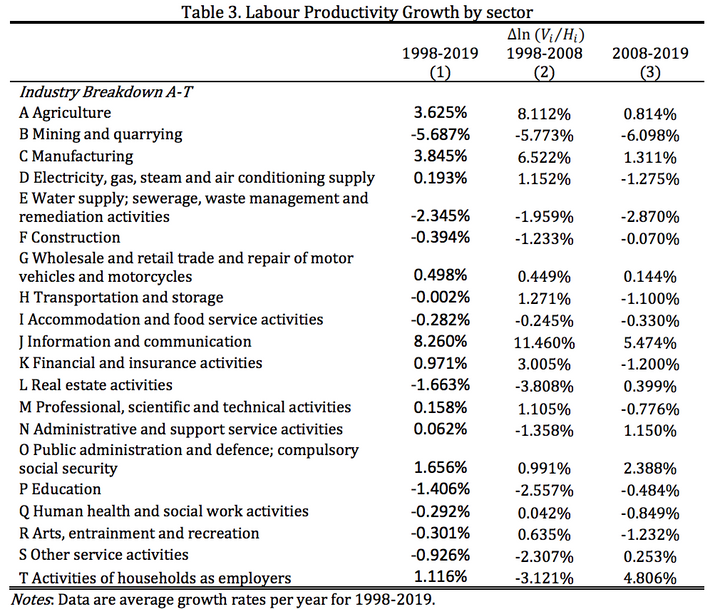

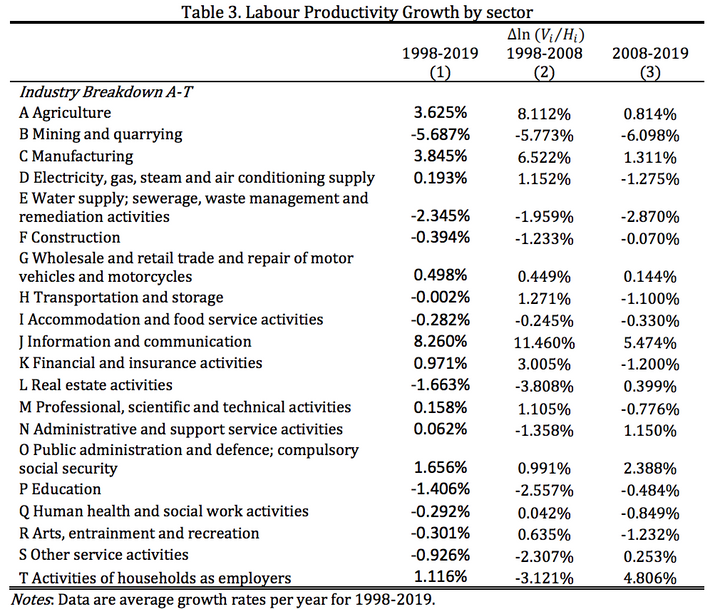

People love to talk about the unproductive Britons. What is less talked-about is that 2008 was an inflection point. The productivity growth story can be divided at that date. This table paints a picture:

Agriculture (-7.296%), information and communication (-5.986%), manufacturing (-5.211%), financial and insurance activities (-4.205%), and electricity, gas, steam and air conditioning supply (-2.427%) were the five industries with the largest productivity downturn between the two periods.

Further analysis shows worrying drops in things like pharmaceuticals, transport equipment, telecommunications and software. That's a worry, because those are "high tech" sectors, the sort of things we need for a prosperous economy. A nation of shopkeepers is terribly unproductive.

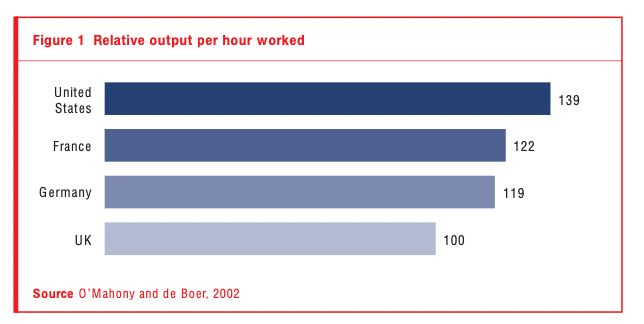

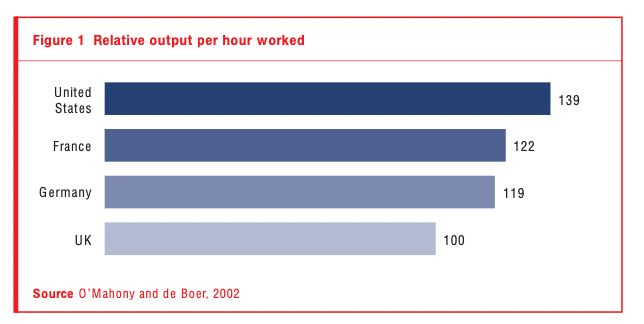

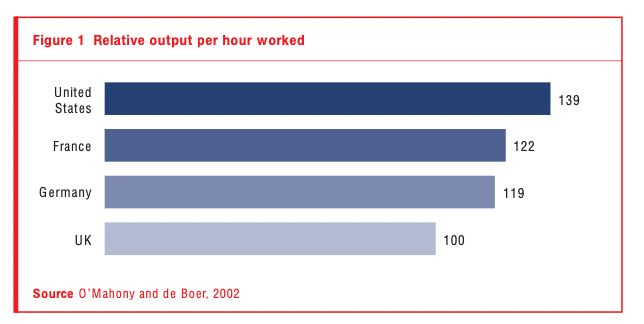

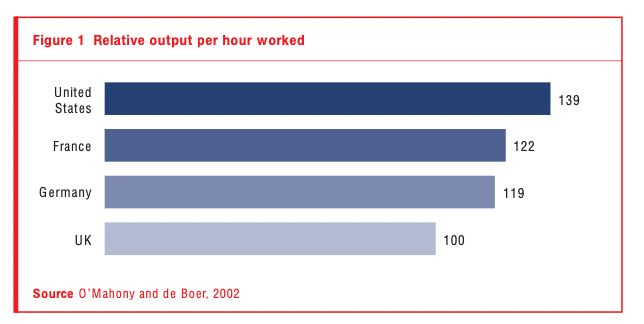

Looking at the big picture vs our near peers:

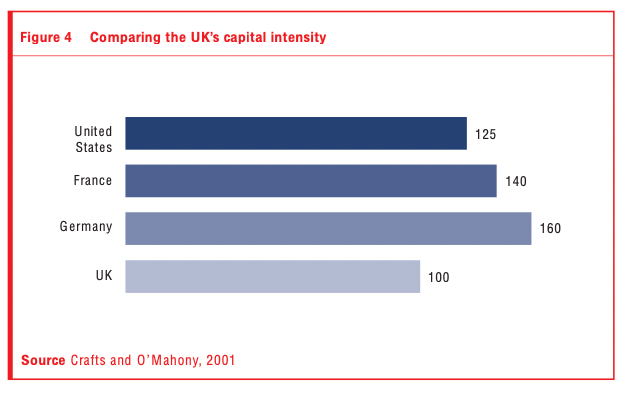

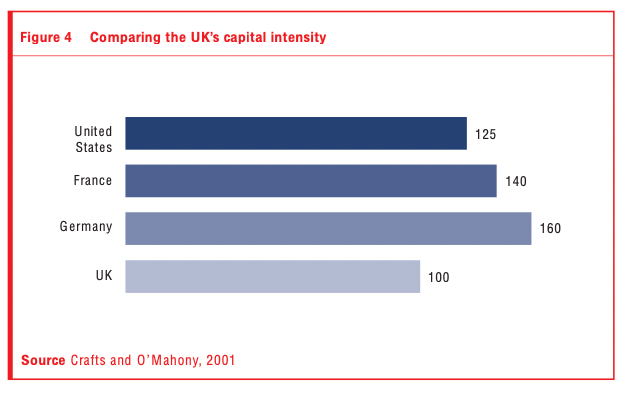

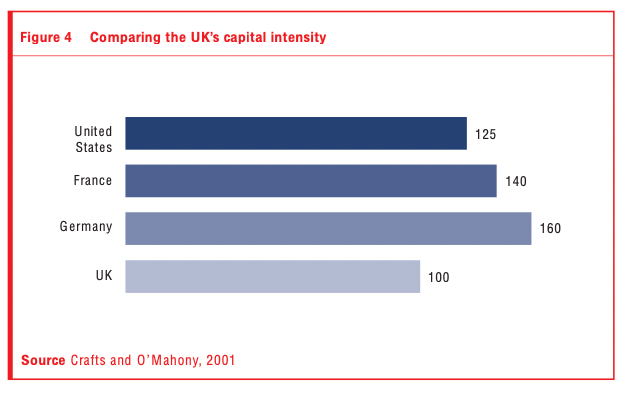

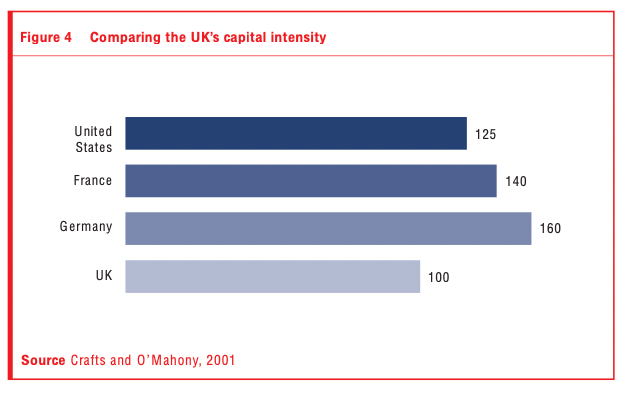

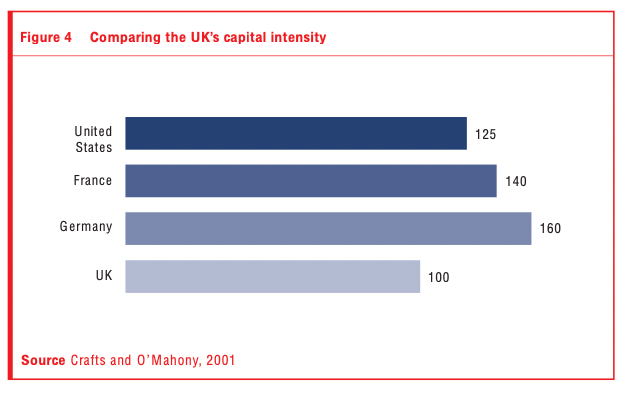

Why such a huge gap to our EU peers? One answer is simple: more capital invested per worker, and their workers are more skilled. We don't invest in plant, equipment, or staff. Our tax and corporate governance regimes don't reward such investment. What's the difference in capital?

That effect is slightly less when comparing us to the USA; instead the drivers are different ways of working and - very especially - a far lower and less effective use of (and investment in) technology here.

In all cases, our investment in R&D is woeful compared to our peers. We have high quality science and engineering, but we simply don't back it up with the requisite funding - allowing it to bleed overseas.

Our skills base is poor. Again, there's simply no investment in up-skilling. Management training and education is scant (which is also a driver of poorer productivity here).

Frankly, they're simply not our peers any longer. Our productivity is on a par with Spain, not Germany.

It is laughable to say that the impetus for improvement cannot come from Government. Those far more productive countries have higher taxation than ours, far greater regulation than ours, and far greater Government investment in everything from education and training to infrastructure and strategic science and technology.

This discussion goes on and on, and I ought to get some sleep! But the continual refrain that our productivity problems are the fault of the lazy, feckless British workers simply doesn't stand up to scrutiny. There are very real, very measurable, structural reasons why our economy is under-performing. Fixing those requires a lot of investment, including from the public sector - which means proper tax rates (and proper taxation of everybody) to fund the sort of work that's going to be needed.

It reads like an extract from a Paul Mason book.

The point regarding water utilities has been conceded, it was a mistake and it's time to move on but it doesn't debunk capitalist theory in favour of a democratic (sic) socialist one.

It doesn't answer the core questions of a) mass immigration by people that can't produce over the 45k thresh-hold b) every increasing amounts of tax and spend on successful people and companies c) ever increasing amounts of regulation.

A Labour government, cheered on by the likes of Mason and his pseudo experts of his ilk will exacerbate these issues and not sort them.

If you tax the people that do succeed to a point where it's not worth working as much and rewarding people that do not succeed with greater sums by taxing those that do succeed by ever greater amounts, what type of economy do you end up with?

If your only route to growth is mass immigration by those that can't hit the 45k level, what type of society do we end up with?

If we strangle the City with ever increasing amounts of regulation, what type of a stock market do we end up with?

Masons theories don't address these problems they waffle around them.

The point regarding water utilities has been conceded, it was a mistake and it's time to move on but it doesn't debunk capitalist theory in favour of a democratic (sic) socialist one.

It doesn't answer the core questions of a) mass immigration by people that can't produce over the 45k thresh-hold b) every increasing amounts of tax and spend on successful people and companies c) ever increasing amounts of regulation.

A Labour government, cheered on by the likes of Mason and his pseudo experts of his ilk will exacerbate these issues and not sort them.

If you tax the people that do succeed to a point where it's not worth working as much and rewarding people that do not succeed with greater sums by taxing those that do succeed by ever greater amounts, what type of economy do you end up with?

If your only route to growth is mass immigration by those that can't hit the 45k level, what type of society do we end up with?

If we strangle the City with ever increasing amounts of regulation, what type of a stock market do we end up with?

Masons theories don't address these problems they waffle around them.

The Times are going to town on her.

Times Radio video called "We read it so you don't have to"

Times article describes it as "as readable as a crisp packet" (the whole article goes on in the same vein) https://www.thetimes.co.uk/article/liz-truss-book-...

Times Radio video called "We read it so you don't have to"

Times article describes it as "as readable as a crisp packet" (the whole article goes on in the same vein) https://www.thetimes.co.uk/article/liz-truss-book-...

Carl_VivaEspana said:

It reads like an extract from a Paul Mason book.

The point regarding water utilities has been conceded, it was a mistake and it's time to move on but it doesn't debunk capitalist theory in favour of a democratic (sic) socialist one.

It doesn't answer the core questions of a) mass immigration by people that can't produce over the 45k thresh-hold b) every increasing amounts of tax and spend on successful people and companies c) ever increasing amounts of regulation.

A Labour government, cheered on by the likes of Mason and his pseudo experts of his ilk will exacerbate these issues and not sort them.

If you tax the people that do succeed to a point where it's not worth working as much and rewarding people that do not succeed with greater sums by taxing those that do succeed by ever greater amounts, what type of economy do you end up with?

If your only route to growth is mass immigration by those that can't hit the 45k level, what type of society do we end up with?

If we strangle the City with ever increasing amounts of regulation, what type of a stock market do we end up with?

Masons theories don't address these problems they waffle around them.

And your solution is what?The point regarding water utilities has been conceded, it was a mistake and it's time to move on but it doesn't debunk capitalist theory in favour of a democratic (sic) socialist one.

It doesn't answer the core questions of a) mass immigration by people that can't produce over the 45k thresh-hold b) every increasing amounts of tax and spend on successful people and companies c) ever increasing amounts of regulation.

A Labour government, cheered on by the likes of Mason and his pseudo experts of his ilk will exacerbate these issues and not sort them.

If you tax the people that do succeed to a point where it's not worth working as much and rewarding people that do not succeed with greater sums by taxing those that do succeed by ever greater amounts, what type of economy do you end up with?

If your only route to growth is mass immigration by those that can't hit the 45k level, what type of society do we end up with?

If we strangle the City with ever increasing amounts of regulation, what type of a stock market do we end up with?

Masons theories don't address these problems they waffle around them.

Carl_VivaEspana said:

It reads like an extract from a Paul Mason book.

The point regarding water utilities has been conceded, it was a mistake and it's time to move on but it doesn't debunk capitalist theory in favour of a democratic (sic) socialist one.

It doesn't answer the core questions of a) mass immigration by people that can't produce over the 45k thresh-hold b) every increasing amounts of tax and spend on successful people and companies c) ever increasing amounts of regulation.

A Labour government, cheered on by the likes of Mason and his pseudo experts of his ilk will exacerbate these issues and not sort them.

If you tax the people that do succeed to a point where it's not worth working as much and rewarding people that do not succeed with greater sums by taxing those that do succeed by ever greater amounts, what type of economy do you end up with?

If your only route to growth is mass immigration by those that can't hit the 45k level, what type of society do we end up with?

If we strangle the City with ever increasing amounts of regulation, what type of a stock market do we end up with?

Masons theories don't address these problems they waffle around them.

The City is not strangled by regulation. Look at the regulatory framework in which US banks operate, then compare that to the UK. A much more significant determinant of the City's future is the effect of Brexit and the ability that gave the EU to move financial business on shore.The point regarding water utilities has been conceded, it was a mistake and it's time to move on but it doesn't debunk capitalist theory in favour of a democratic (sic) socialist one.

It doesn't answer the core questions of a) mass immigration by people that can't produce over the 45k thresh-hold b) every increasing amounts of tax and spend on successful people and companies c) ever increasing amounts of regulation.

A Labour government, cheered on by the likes of Mason and his pseudo experts of his ilk will exacerbate these issues and not sort them.

If you tax the people that do succeed to a point where it's not worth working as much and rewarding people that do not succeed with greater sums by taxing those that do succeed by ever greater amounts, what type of economy do you end up with?

If your only route to growth is mass immigration by those that can't hit the 45k level, what type of society do we end up with?

If we strangle the City with ever increasing amounts of regulation, what type of a stock market do we end up with?

Masons theories don't address these problems they waffle around them.

You ask what type of economy you end up with if you tax "successful" (define?) people to the point that they become demotivated. This is the usual "Laffer curve" panic. The question that matters is "are current tax levels demotivating a significant number of people whose economic activity is material to the economy?" Answer, no evidence to suggest that it is. Look at other G7 economies. In that context, why would anyone think the absolute levels of tax in the UK are a big problem? We'd all like to pay less tax, but we shouldn't allow our wishes to stop us from honest, rational thinking. (And lots of small business owners, typically describing themselves as entrepreneurs, massively overestimate their importance to the economy and like to think they're being held back by everyone else.) The tax and benefits systems do unnecessarily demotivate people by the abrupt withdrawal of benefits and tax breaks over relatively small changes in earnings. If we want to boost productivity without torpedoing public finances, these are the things that the government should be trying to tackle. For example, the tax breaks for small businesses are supposed to help them get established. What they actually do is create a ceiling that many traders desperately try to avoid breaching. That is nuts. If nothing else it creates intense unfair competition for the small firms that have just broken through the ceiling. Rather than thinking "I'm free-loading on a bunch of tax breaks unavailable to Joe Average", which is their actual position, people entirely understandably think "it's not fair that I'll be hit with a load more tax if I grow my business a tiny bit". So change the bleeding framework. Either remove the tax breaks entirely, or withdraw them more gradually even if that makes the calculation more complicated.

Edited by ATG on Wednesday 17th April 09:19

Carl_VivaEspana said:

It reads like an extract from a Paul Mason book.

The point regarding water utilities has been conceded, it was a mistake and it's time to move on but it doesn't debunk capitalist theory in favour of a democratic (sic) socialist one.

It doesn't answer the core questions of a) mass immigration by people that can't produce over the 45k thresh-hold b) every increasing amounts of tax and spend on successful people and companies c) ever increasing amounts of regulation.

If I may, as a response to skwdenyer's post, this comes across a bit like sticking your fingers in your ears and going "lalalala, not listening!". Or the very 'proof by assumption' that is mentioned in their very first sentence. The point regarding water utilities has been conceded, it was a mistake and it's time to move on but it doesn't debunk capitalist theory in favour of a democratic (sic) socialist one.

It doesn't answer the core questions of a) mass immigration by people that can't produce over the 45k thresh-hold b) every increasing amounts of tax and spend on successful people and companies c) ever increasing amounts of regulation.

I don't know, or care, who Paul Mason is. I don't hold a candle for Labour in any upcoming election, and there is no party in the UK landscape offering "democratic (sic) socialism" ('sic' applies here as well - none of the countries skwdenyer draws contrasts with are democratic socialist systems and there isn't a single democratic socialist country in Europe. Lots of social democracies, though...)

Carl_VivaEspana said:

If you tax the people that do succeed to a point where it's not worth working as much and rewarding people that do not succeed with greater sums by taxing those that do succeed by ever greater amounts, what type of economy do you end up with?

if you get the targets and the amounts right, maybe an economy where wealth and capital circulate around rather than being sucked up and retained by the (increasingly small) rentier/owner class at the top? One without massive demographic and geographic imbalances? One where GDP growth is actually felt by ordinary people and the GDP/capita figure actually bears some relation to reality? Are we anywhere near the point of "tax the people that do succeed to a point where it's not worth working" overall? Yes, we all hear the complaints about the Highest Tax Burden in 70 Years but that generally applies to personal income (and to a very specific upper-middle band of income) and particular tipping points in tax that affect SMEs. Both these points are ones over-represented on PH, as it happens. Those are flaws, but also a deliberate choice of the political and economic system we've had for the past 40-odd years.

But the overall tax burden in the UK economy is not high, either historically for ourselves or - critically - when compared to our peers and competitors. It's about 10% lower than our European neighbours whose services and infrastructure we envy so much. They target the burden differently (broadly they tend to share it out more widely rather than piling it on those in the middle). If you're a person, or if you run a business, that has been targeted for squeezing it may be uncomfortable to hear, but it's the truth: The UK is not a high-tax country.

Carl_VivaEspana said:

If your only route to growth is mass immigration by those that can't hit the 45k level, what type of society do we end up with?

This is related to the other points - "<£45k immigration" is a requirement of the current socio-economic system, not a more social-democratic one. With government and capital essentially refusing to invest in either people or technology to generate growth and increase productivity, the only remaining option when demand for (relatively low-skill, low-wage) labour grows is to import it. Despite being a beloved target of criticism and humour for being work-shy, strike-prone, protectionist and bolshy, the French workforce is more productive than the go-getting, liberalised, un-unionised UK one. By nearly a quarter, going by skwdenyer's figures above. And that has been the case for decades. Why? Because the high degree of worker protection, rights and wages in France incentivise investment in skills, technology and automation to take on the fewest number of humans and get the most output from the ones you do have. That sounds like a recipe for mass unemployment (and I suspect than in UK hands it would be) but in fact what it means is that instead of one factory with 100 people making 100 widgets by hand, France has two factories each with 50 people watching machinery make 100 widgets. France also has good services and infrastructure, which generates higher productivity. And less geographic inequality, which also boosts productivity.

Of course, France has its own low-wage/low-skill immigration, mostly to serve as an underclass of labour that does not enjoy the rights and protections of citizens. But their economy is less dependent on it structurally than ours.

The trope of the "£45k tipping point" is narrow, being an individual pay in/spend out account based on personal income tax on one side and personal state spending on the other. It makes no account of added value or multiplier effects. Maybe a nurse or teacher or lorry driver or food packer or construction worker never personally pays in more than they receive, but how much economic activity and value do they enable? Is it 'not worth it' to the economy having nurses and teachers? What would happen if everyone on less than £45k/year was suddenly removed from the economy? All those 'negative contributors' suddenly gone - it should be a paradise! But of course it wouldn't be. Economic activity would slam to a halt.

The statistics about how much tax is paid by a small percentage of (high-earning) the population, often thrown about with simultaneous pride and victimhood, is actually a damning indictment of the UK's inequality in both income and contribution. Wages should be higher, so more people pay more tax, and more people should be paying at least some tax. That is how you get the tax base to actually afford the things we desire and deserve.

Carl_VivaEspana said:

If we strangle the City with ever increasing amounts of regulation, what type of a stock market do we end up with?

Why default straight to 'strangulation by regulation'? This weird 'fait accompli' attitude where if the City isn't given free rein (which it has proven several times that it will end up abusing) then it will collapse? But, running with your point, maybe we'd end up with stock market that, as it did for the 100-odd years before the Big Bang of deregulation, actually served to support and lubricate the British economy rather than being an international counting house? This is another factor in our neighbours' outcomes - because their financial sectors aren't so overwhelmingly geared to being a processing plant for international capital, they actually work more as capitalist theory suggests a financial system should, of being a support system for productive business within the local economy. Is the American financial system/Wall Street 'strangled by regulation'? Because they operate under much more stringent and specific regs than the City does.

There is the big Damoclean problem that the UK economy is so overwhelmingly reliant on the City being what it is that change is incredibly/impossibly risky. But that doesn't invalidate the point that it's a massive failure of long-term policy (and dogma) to have driven things into that situation. There is no lever to pull that will magically reverse that, but it can be done incrementally.

More broadly to your point c), I really don't think anyone can survey the British economy over the last 15 years (or even 20 or 30) and say "ah yes, the problem here is too much regulation!". A lot of our issues, from our excrement-laden rivers to ludicrous PFI burdens to our terrible housing stock to our dire bus services to our low wages, come from regulators not even having the means (or the desire) to enforce what regulations they have at their disposal, let alone the cases when the penalties and consequences of those regulations being enforced are trivial.

Edited by 2xChevrons on Wednesday 17th April 09:22

Edited by 2xChevrons on Wednesday 17th April 09:23

skwdenyer said:

There is an undercurrent of proof by assumption. The same old lines get trotted out: "diamond encrusted final salary pension schemes" (long since a thing of the past), "already inefficient and wasteful public sector" and so on.

We know what it costs to run a first world country with proper services and benefits. We've got lots of exemplars against which to compare ourselves. For far too long, we cut taxes well below the sustainable level. We slashed public expenditure. We put a spanner in the works of economic recovery, the educational attainment of our children, the health of our population (and, especially, of our workforce - don't forget the NHS was primarily set up to keep working-age people able to work). We've transferred untold £billions into the private sector for scant return to the public purse.

Take Thames Water as singular example. Flogged off on the cheap by the Government. Was the capital receipt re-invested? No, of course not; it was used to lower taxes - gone in the (relative) blink of an eye. Vast land assets were given to TW, with the stated intention of allowing them to borrow against them for investment. Did they? Of course not; they borrowed against them to pay dividends, relying upon the toothless regulatory regime to allow them to keep upping prices for customers.

That's just one example of the ludicrous, dogma-laden approach to managing public assets. You simply can't keep flogging off assets and using that money to lower taxes. Eventually you run out of things to sell, and everyone is poorer forever.

Think about the former public assets we're now renting from overseas investors. Madness. If somebody had proposed it in those terms (we're going to flog off our assets to foreign, sometimes state-owned, businesses, and then allow them to suck money out of the country), would anyone have supported it? If those assets had been ring-fenced so as to be buyable only by, say, UK pension funds, there might have been a modicum of logic to it. But that's not what we've got, is it?

The amount of money available to local Government has been reduced by well over a third in nominal terms since 2010. A third. Why? Because our tax base has stalled. Rather than having proper tax rates, and proper public expenditure, we had "austerity." The problem? Public investment has an overall positive ROI at the national level. Remove it, and the economy - and the overall tax take - goes down.

People love to talk about the unproductive Britons. What is less talked-about is that 2008 was an inflection point. The productivity growth story can be divided at that date. This table paints a picture:

Agriculture (-7.296%), information and communication (-5.986%), manufacturing (-5.211%), financial and insurance activities (-4.205%), and electricity, gas, steam and air conditioning supply (-2.427%) were the five industries with the largest productivity downturn between the two periods.

Further analysis shows worrying drops in things like pharmaceuticals, transport equipment, telecommunications and software. That's a worry, because those are "high tech" sectors, the sort of things we need for a prosperous economy. A nation of shopkeepers is terribly unproductive.

Looking at the big picture vs our near peers:

Why such a huge gap to our EU peers? One answer is simple: more capital invested per worker, and their workers are more skilled. We don't invest in plant, equipment, or staff. Our tax and corporate governance regimes don't reward such investment. What's the difference in capital?

That effect is slightly less when comparing us to the USA; instead the drivers are different ways of working and - very especially - a far lower and less effective use of (and investment in) technology here.

In all cases, our investment in R&D is woeful compared to our peers. We have high quality science and engineering, but we simply don't back it up with the requisite funding - allowing it to bleed overseas.

Our skills base is poor. Again, there's simply no investment in up-skilling. Management training and education is scant (which is also a driver of poorer productivity here).

Frankly, they're simply not our peers any longer. Our productivity is on a par with Spain, not Germany.

It is laughable to say that the impetus for improvement cannot come from Government. Those far more productive countries have higher taxation than ours, far greater regulation than ours, and far greater Government investment in everything from education and training to infrastructure and strategic science and technology.

This discussion goes on and on, and I ought to get some sleep! But the continual refrain that our productivity problems are the fault of the lazy, feckless British workers simply doesn't stand up to scrutiny. There are very real, very measurable, structural reasons why our economy is under-performing. Fixing those requires a lot of investment, including from the public sector - which means proper tax rates (and proper taxation of everybody) to fund the sort of work that's going to be needed.

There's a lot in the above to digest and comment on and I doubt anyone would argue about the Thames Water issue. However, I'd like to touch on the bits I've bolded. Simple question, what are the "proper tax rates" - what/who should be taxed and at what rates?We know what it costs to run a first world country with proper services and benefits. We've got lots of exemplars against which to compare ourselves. For far too long, we cut taxes well below the sustainable level. We slashed public expenditure. We put a spanner in the works of economic recovery, the educational attainment of our children, the health of our population (and, especially, of our workforce - don't forget the NHS was primarily set up to keep working-age people able to work). We've transferred untold £billions into the private sector for scant return to the public purse.

Take Thames Water as singular example. Flogged off on the cheap by the Government. Was the capital receipt re-invested? No, of course not; it was used to lower taxes - gone in the (relative) blink of an eye. Vast land assets were given to TW, with the stated intention of allowing them to borrow against them for investment. Did they? Of course not; they borrowed against them to pay dividends, relying upon the toothless regulatory regime to allow them to keep upping prices for customers.

That's just one example of the ludicrous, dogma-laden approach to managing public assets. You simply can't keep flogging off assets and using that money to lower taxes. Eventually you run out of things to sell, and everyone is poorer forever.

Think about the former public assets we're now renting from overseas investors. Madness. If somebody had proposed it in those terms (we're going to flog off our assets to foreign, sometimes state-owned, businesses, and then allow them to suck money out of the country), would anyone have supported it? If those assets had been ring-fenced so as to be buyable only by, say, UK pension funds, there might have been a modicum of logic to it. But that's not what we've got, is it?

The amount of money available to local Government has been reduced by well over a third in nominal terms since 2010. A third. Why? Because our tax base has stalled. Rather than having proper tax rates, and proper public expenditure, we had "austerity." The problem? Public investment has an overall positive ROI at the national level. Remove it, and the economy - and the overall tax take - goes down.

People love to talk about the unproductive Britons. What is less talked-about is that 2008 was an inflection point. The productivity growth story can be divided at that date. This table paints a picture:

Agriculture (-7.296%), information and communication (-5.986%), manufacturing (-5.211%), financial and insurance activities (-4.205%), and electricity, gas, steam and air conditioning supply (-2.427%) were the five industries with the largest productivity downturn between the two periods.

Further analysis shows worrying drops in things like pharmaceuticals, transport equipment, telecommunications and software. That's a worry, because those are "high tech" sectors, the sort of things we need for a prosperous economy. A nation of shopkeepers is terribly unproductive.

Looking at the big picture vs our near peers:

Why such a huge gap to our EU peers? One answer is simple: more capital invested per worker, and their workers are more skilled. We don't invest in plant, equipment, or staff. Our tax and corporate governance regimes don't reward such investment. What's the difference in capital?

That effect is slightly less when comparing us to the USA; instead the drivers are different ways of working and - very especially - a far lower and less effective use of (and investment in) technology here.

In all cases, our investment in R&D is woeful compared to our peers. We have high quality science and engineering, but we simply don't back it up with the requisite funding - allowing it to bleed overseas.

Our skills base is poor. Again, there's simply no investment in up-skilling. Management training and education is scant (which is also a driver of poorer productivity here).

Frankly, they're simply not our peers any longer. Our productivity is on a par with Spain, not Germany.

It is laughable to say that the impetus for improvement cannot come from Government. Those far more productive countries have higher taxation than ours, far greater regulation than ours, and far greater Government investment in everything from education and training to infrastructure and strategic science and technology.

This discussion goes on and on, and I ought to get some sleep! But the continual refrain that our productivity problems are the fault of the lazy, feckless British workers simply doesn't stand up to scrutiny. There are very real, very measurable, structural reasons why our economy is under-performing. Fixing those requires a lot of investment, including from the public sector - which means proper tax rates (and proper taxation of everybody) to fund the sort of work that's going to be needed.

Carl_VivaEspana said:

It reads like an extract from a Paul Mason book.

The point regarding water utilities has been conceded, it was a mistake and it's time to move on but it doesn't debunk capitalist theory in favour of a democratic (sic) socialist one.

It doesn't answer the core questions of a) mass immigration by people that can't produce over the 45k thresh-hold b) every increasing amounts of tax and spend on successful people and companies c) ever increasing amounts of regulation.

A Labour government, cheered on by the likes of Mason and his pseudo experts of his ilk will exacerbate these issues and not sort them.

If you tax the people that do succeed to a point where it's not worth working as much and rewarding people that do not succeed with greater sums by taxing those that do succeed by ever greater amounts, what type of economy do you end up with?

If your only route to growth is mass immigration by those that can't hit the 45k level, what type of society do we end up with?

If we strangle the City with ever increasing amounts of regulation, what type of a stock market do we end up with?

Masons theories don't address these problems they waffle around them.

Strawman, assertion and some waffle about mass immigration? Did you even read his post?The point regarding water utilities has been conceded, it was a mistake and it's time to move on but it doesn't debunk capitalist theory in favour of a democratic (sic) socialist one.

It doesn't answer the core questions of a) mass immigration by people that can't produce over the 45k thresh-hold b) every increasing amounts of tax and spend on successful people and companies c) ever increasing amounts of regulation.

A Labour government, cheered on by the likes of Mason and his pseudo experts of his ilk will exacerbate these issues and not sort them.

If you tax the people that do succeed to a point where it's not worth working as much and rewarding people that do not succeed with greater sums by taxing those that do succeed by ever greater amounts, what type of economy do you end up with?

If your only route to growth is mass immigration by those that can't hit the 45k level, what type of society do we end up with?

If we strangle the City with ever increasing amounts of regulation, what type of a stock market do we end up with?

Masons theories don't address these problems they waffle around them.

skwdenyer said:

People love to talk about the unproductive Britons. What is less talked-about is that 2008 was an inflection point. The productivity growth story can be divided at that date. This table paints a picture:

Agriculture (-7.296%), information and communication (-5.986%), manufacturing (-5.211%), financial and insurance activities (-4.205%), and electricity, gas, steam and air conditioning supply (-2.427%) were the five industries with the largest productivity downturn between the two periods.

Further analysis shows worrying drops in things like pharmaceuticals, transport equipment, telecommunications and software. That's a worry, because those are "high tech" sectors, the sort of things we need for a prosperous economy. A nation of shopkeepers is terribly unproductive.

Looking at the big picture vs our near peers:

Why such a huge gap to our EU peers? One answer is simple: more capital invested per worker, and their workers are more skilled. We don't invest in plant, equipment, or staff. Our tax and corporate governance regimes don't reward such investment. What's the difference in capital?

That effect is slightly less when comparing us to the USA; instead the drivers are different ways of working and - very especially - a far lower and less effective use of (and investment in) technology here.

Very good cherry picking in that table above. One has to note however that the next 2 charts are dated 2002 and 2001 and long before the 'bad' austerity program that was implemented post 2010. I have to say though, if the UK started to move towards a more US-style economy (and society) in order to achieve that higher productivity, you probably won't be quite as happy for that to happen as well.Agriculture (-7.296%), information and communication (-5.986%), manufacturing (-5.211%), financial and insurance activities (-4.205%), and electricity, gas, steam and air conditioning supply (-2.427%) were the five industries with the largest productivity downturn between the two periods.

Further analysis shows worrying drops in things like pharmaceuticals, transport equipment, telecommunications and software. That's a worry, because those are "high tech" sectors, the sort of things we need for a prosperous economy. A nation of shopkeepers is terribly unproductive.

Looking at the big picture vs our near peers:

Why such a huge gap to our EU peers? One answer is simple: more capital invested per worker, and their workers are more skilled. We don't invest in plant, equipment, or staff. Our tax and corporate governance regimes don't reward such investment. What's the difference in capital?

That effect is slightly less when comparing us to the USA; instead the drivers are different ways of working and - very especially - a far lower and less effective use of (and investment in) technology here.

2xChevrons said:

...<snipped for brevity>

But the overall tax burden in the UK economy is not high, either historically for ourselves or - critically - when compared to our peers and competitors. It's about 10% lower than our European neighbours whose services and infrastructure we envy so much. They target the burden differently (broadly they tend to share it out more widely rather than piling it on those in the middle). If you're a person, or if you run a business, that has been targeted for squeezing it may be uncomfortable to hear, but it's the truth: The UK is not a high-tax country.

....

The statistics about how much tax is paid by a small percentage of (high-earning) the population, often thrown about with simultaneous pride and victimhood, is actually a damning indictment of the UK's inequality in both income and contribution. Wages should be higher, so more people pay more tax, and more people should be paying at least some tax. That is how you get the tax base to actually afford the things we desire and deserve.

I'm not sure how you can say the overall tax burden in the UK is not historically high given thisBut the overall tax burden in the UK economy is not high, either historically for ourselves or - critically - when compared to our peers and competitors. It's about 10% lower than our European neighbours whose services and infrastructure we envy so much. They target the burden differently (broadly they tend to share it out more widely rather than piling it on those in the middle). If you're a person, or if you run a business, that has been targeted for squeezing it may be uncomfortable to hear, but it's the truth: The UK is not a high-tax country.

....

The statistics about how much tax is paid by a small percentage of (high-earning) the population, often thrown about with simultaneous pride and victimhood, is actually a damning indictment of the UK's inequality in both income and contribution. Wages should be higher, so more people pay more tax, and more people should be paying at least some tax. That is how you get the tax base to actually afford the things we desire and deserve.

https://ifs.org.uk/taxlab/taxlab-key-questions/how...

It's forecast to be the highest since the immediate post ww2 years.

And on the second point, perhaps it just means that the most tax payers in the lower bands aren't taxed enough with nothing to do with averages wages being high or low. Employer tax contributions for the 'mid-level' tax bracket are what lags (and substantially lags at that) most other european countries and that makes up a good chunk of the differential of overall tax take. The trade-off then is a question of employment and whether you'd be fine to have european levels of unemployment with corresponding benefits being paid out.....

isaldiri said:

I'm not sure how you can say the overall tax burden in the UK is not historically high given this

https://ifs.org.uk/taxlab/taxlab-key-questions/how...

It's forecast to be the highest since the immediate post ww2 years.

And on the second point, perhaps it just means that the most tax payers in the lower bands aren't taxed enough with nothing to do with averages wages being high or low. Employer tax contributions for the 'mid-level' tax bracket are what lags (and substantially lags at that) most other european countries and that makes up a good chunk of the differential of overall tax take. The trade-off then is a question of employment and whether you'd be fine to have european levels of unemployment with corresponding benefits being paid out.....

Is revenue the same as burden? (Genuine question - I am neither an economist nor a tax advisor). Either way, that graph showing revenue as %GDP still lags approximately 10-12% behind the countries that we like to think ourselves peers to and usually hold as a standard of how things should be. There's a fundamental reason the French railways or the Spanish roads or the German city centres or the Dutch cycle paths are so much nicer than their UK equivalents - they spend more money on them than we do. https://ifs.org.uk/taxlab/taxlab-key-questions/how...

It's forecast to be the highest since the immediate post ww2 years.

And on the second point, perhaps it just means that the most tax payers in the lower bands aren't taxed enough with nothing to do with averages wages being high or low. Employer tax contributions for the 'mid-level' tax bracket are what lags (and substantially lags at that) most other european countries and that makes up a good chunk of the differential of overall tax take. The trade-off then is a question of employment and whether you'd be fine to have european levels of unemployment with corresponding benefits being paid out.....

2xChevrons said:

Are we anywhere near the point of "tax the people that do succeed to a point where it's not worth working" overall? Yes, we all hear the complaints about the Highest Tax Burden in 70 Years but that generally applies to personal income (and to a very specific upper-middle band of income) and particular tipping points in tax that affect SMEs. Both these points are ones over-represented on PH, as it happens. Those are flaws, but also a deliberate choice of the political and economic system we've had for the past 40-odd years.

But the overall tax burden in the UK economy is not high, either historically for ourselves or - critically - when compared to our peers and competitors. It's about 10% lower than our European neighbours whose services and infrastructure we envy so much. They target the burden differently (broadly they tend to share it out more widely rather than piling it on those in the middle). If you're a person, or if you run a business, that has been targeted for squeezing it may be uncomfortable to hear, but it's the truth: The UK is not a high-tax country.

In terms of tax it is not a straightforward comparison with our European neighbours as they have far more generous state pension paid through tax, whereas we have to supplement the state pension with private pensions. Add on the average private pension contribution rate, both employee and employer to UK tax and NI rates to compare. But the overall tax burden in the UK economy is not high, either historically for ourselves or - critically - when compared to our peers and competitors. It's about 10% lower than our European neighbours whose services and infrastructure we envy so much. They target the burden differently (broadly they tend to share it out more widely rather than piling it on those in the middle). If you're a person, or if you run a business, that has been targeted for squeezing it may be uncomfortable to hear, but it's the truth: The UK is not a high-tax country.

In terms of historical comparisons the tax burden is at its highest since the immediate post war period, this may be only by a few percent, but it is historically high.

Finally the average European country does indeed pile it on those in the middle, as tax rates tend to be higher for those on middle incomes, while being similar, or less, for those on high incomes when all allowances and reliefs are taken into account.

Likely we have some of the highest marginal rates of any country in the developed world at certain trigger points, such as the withdrawal of the personal allowance.

For a long period of a time we did have stable personal taxation and one at a fairly reasonable level, roughly a third of income with tax and NI, and then 40% thereafter. This changed to a system of sudden cliff edges and with higher rate tax going ever further down the earnings scale. This seems to have occurred alongside economic stagnation, but of course correlation is not causation.

2xChevrons said:

Is revenue the same as burden? (Genuine question - I am neither an economist nor a tax advisor). Either way, that graph showing revenue as %GDP still lags approximately 10-12% behind the countries that we like to think ourselves peers to and usually hold as a standard of how things should be. There's a fundamental reason the French railways or the Spanish roads or the German city centres or the Dutch cycle paths are so much nicer than their UK equivalents - they spend more money on them than we do.

Well tax revenue can only be raised by 'someone' having to eat that burden of taxes so it's one and the same I'd have thought (I'm neither an economist nor a tax advisor too). Who are these countries that the UK are 10-12% behind countries that we think ourselves are peers to?

https://ifs.org.uk/taxlab/taxlab-key-questions/how...

as of now the UK tax % of gdp is over 35%. only france and Denmark are over 45% with germany and the netherlands at around 40%. Japan is at 33% and the US is in the high 20s.

Carl_VivaEspana said:

It reads like an extract from a

It doesn't answer the core questions of a) mass immigration by people that can't produce over the 45k thresh-hold ......

If your only route to growth is mass immigration by those that can't hit the 45k level, what type of society do we end up with?

It's been explained many time why the £45k, I think the actual figure is lower, is complete and utter rubbish. But you keep using it. It doesn't answer the core questions of a) mass immigration by people that can't produce over the 45k thresh-hold ......

If your only route to growth is mass immigration by those that can't hit the 45k level, what type of society do we end up with?

vaud said:

isaldiri said:

... the US is in the high 20s.

And if you think UK infrastructure is bad, the US is incredibly bad.isaldiri said:

It might well be. so? I was merely pointing out that the UK's share of tax as a % of gdp was not quite as far off 'our peers' as portrayed in the earlier post.

Sorry it was a side point. I agree with your comments.I wonder what the picture looks like if we factor in realistic healthcare costs (very high in the US but mostly not paid out of tax and some European countries have an insurance model)

Gassing Station | News, Politics & Economics | Top of Page | What's New | My Stuff