The ins and outs of a Pensioner Life??

Discussion

Gordon Hill said:

2 people doing 40 hours a week at 11.44 an hour is £457.60 a week or £1982.93 a month x2 is £3965.86 a month. This is before stoppages.

Aldi starting minimum pay is £12.40/hr.When I was at school, I would spend summer holidays working in a take-away, 10 hours a day, six days a week. At that rate, I'd be on £744 per week wages.

leef44 said:

Gordon Hill said:

2 people doing 40 hours a week at 11.44 an hour is £457.60 a week or £1982.93 a month x2 is £3965.86 a month. This is before stoppages.

Aldi starting minimum pay is £12.40/hr.When I was at school, I would spend summer holidays working in a take-away, 10 hours a day, six days a week. At that rate, I'd be on £744 per week wages.

Douglas Quaid said:

Essel said:

68 here.

1) I'd have thought you'd need more state pension in a depraved area, what with all the extra coke and hookers - mind you, I haven't been round many stockbroker areas

.

At your age coke is probably not a good idea as it could stop your heart. Saying that at least it’s an instant death. When did you last indulge?1) I'd have thought you'd need more state pension in a depraved area, what with all the extra coke and hookers - mind you, I haven't been round many stockbroker areas

.

But hopefully not for a few more years.

VanDriver99 said:

So pensioners are expected to survive with a quarter or thereabouts of that???

No, it's nigh on impossible with the cost of living as it is now but you won't get anybody in Whitehall on either side of the house who gives a sh#t about any of that. Their answer will be that you should have worked harder or got a better job OR keep working until you're 80 (and paying tax as well). That will also be the glib remarks of some on here too. As I said before, I go through this with clients every day, it's like groundhog day, with some of them it's their own fault as they've had the opportunity to be a bit more frugal and save for their later years while others have been pretty much living from hand to mouth all their lives.

By that's why we have occupational pensions so that you're not relying solely on the state pension as your sole source of income.

Edited by Gordon Hill on Saturday 27th April 17:49

Edited by Gordon Hill on Saturday 27th April 17:51

Fwiw.

The State Pension is the same in the Stockbroker Belt as it is in some depraved areas...is that a little odd?

I retired in Dec 21 and thus far still feels like I’m on holiday.

The State Pension is the same in the Stockbroker Belt as it is in some depraved areas...is that a little odd?

- No.

- Fully owned and have done for 14 years.

- Depends on what your other overheads are.

- I retired “ early “ at 60 having worked since I was 17 so think I had earned the right to. Looked at doing so 5 years prior but the numbers didn’t work for us. Then Covid came along when I was 58 and decided to carry on working ( from home ) which persuaded my wife that I was a joy to have around.

- I always said that I wanted the same lifestyle when I stop working.

I retired in Dec 21 and thus far still feels like I’m on holiday.

keo said:

I think it’s a load of b ks because how many people have £4k a month coming in even when they are working!

ks because how many people have £4k a month coming in even when they are working!

Lots.  ks because how many people have £4k a month coming in even when they are working!

ks because how many people have £4k a month coming in even when they are working!I could, but I pay extra into my pension so I end up with £3260, which is the take home on PAYE if you choose to salary sacrifice into pension, so you don't pay tax at 40%

Lots of couples are taking home £4 to 6000 per month.

Even a couple both doing 40 hours a week at minium wage, would take home £3350 a month.

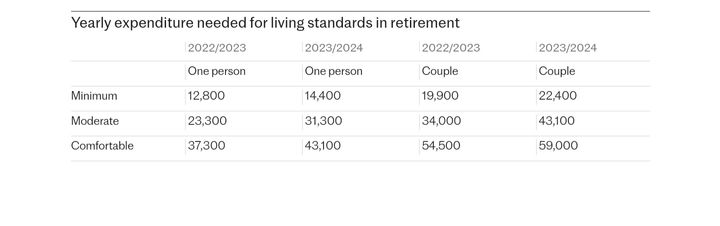

Just to add to that earlier question I posed, managed to find the article which comes from Pensions and Lifetime Savings Association so very biased towards getting people to save for retirement.

PLSA reckon that 76pc of people are on track to meet the Minimum retirement, including all couples on the full state pension. One in five workers should reach the Moderate level, and only 8pc will achieve the Comfortable level.

PLSA said:

A comfortable lifestyle – which allows for an annual three-week foreign holiday, £1,500 for clothing and footwear and a kitchen and bathroom replacement every 10-15 years – now requires a post-tax income of £43,000 a year for a single retiree, up from £37,300 last year.

A retired couple would need £59,000 between them, up from £54,500 in 2023.

The amount is lower for a moderate or minimum income, which both come with lifestyle changes.

A retired couple would need £59,000 between them, up from £54,500 in 2023.

The amount is lower for a moderate or minimum income, which both come with lifestyle changes.

PLSA reckon that 76pc of people are on track to meet the Minimum retirement, including all couples on the full state pension. One in five workers should reach the Moderate level, and only 8pc will achieve the Comfortable level.

1) Not really - NI is paid as tax and you get a flat rate benefit back: I'd hope no future government dares to means-test the state pension, given that those failing the means test will have likely put the most in.

2) Own my house - mortgage minimised two years ago, when rates went up, officially cancelled this year.

3) Everyone's needs are different, so it's difficult to say whether £1250 / month is enough for you. The 'comfortable' lifestyles above seem a bit much - I run silly cars for a lot less than that. The state pension (at 67 for me) is factored into my future earnings.

4) The most important part for me when deciding to retire - what to do with my time? A mixture of house projects and voluntary work means I don't have time to watch TV, and barely any time to read PH!

5) Having a safety net is valuable - say six months' expenses if you can allows a degree of flexibility for life's unexpected turns. Appreciate that this isn't possible for many.

Me? Retired in 2022 at 49. Couldn't be happier.

2) Own my house - mortgage minimised two years ago, when rates went up, officially cancelled this year.

3) Everyone's needs are different, so it's difficult to say whether £1250 / month is enough for you. The 'comfortable' lifestyles above seem a bit much - I run silly cars for a lot less than that. The state pension (at 67 for me) is factored into my future earnings.

4) The most important part for me when deciding to retire - what to do with my time? A mixture of house projects and voluntary work means I don't have time to watch TV, and barely any time to read PH!

5) Having a safety net is valuable - say six months' expenses if you can allows a degree of flexibility for life's unexpected turns. Appreciate that this isn't possible for many.

Me? Retired in 2022 at 49. Couldn't be happier.

Chris Type R said:

Judging by some of the comments on here, it might be than on average more people are retiring early than retiring late.

Some of those working beyond retirement age might also be business owners, so liquidating a business due to retirement could result in fewer job opportunities.

Personally, at the ripe old age of 54 I'm planning my exit strategy, but still need more capital in SIPPs. Hopefully I will be able to semi-retire and leave the business as a ticking over affair.

No idea what I'd do with the time to be honest.

& that last bit was the point I was trying to make above.Some of those working beyond retirement age might also be business owners, so liquidating a business due to retirement could result in fewer job opportunities.

Personally, at the ripe old age of 54 I'm planning my exit strategy, but still need more capital in SIPPs. Hopefully I will be able to semi-retire and leave the business as a ticking over affair.

No idea what I'd do with the time to be honest.

People spend an inordinate chunk of time figuring out their work lives…..they need to spend it on their playtime!

Sort out the things OUTSIDE of work *whilst* you’re working.

Maybe it’s golf, swimming, some sports club. A good pal of mine joined his bowls club after stopping and now spends probably 4-5 evenings on that (in summer). Figure out how to head to sunnier climes for winter, or indeed ski slopes. Join a bridge club. Make a point of having a film night. Read books, do pub quizzes. Help out: drive a minibus for old people to have a day out (one day you might be that old person

)

)As V12GT put it: “The most important part for me when deciding to retire - what to do with my time? A mixture of house projects and voluntary work means I don't have time to watch TV, and barely any time to read PH!”

For my part, online forums forms part of my day…but to some extent, did when I was working.

Ken_Code said:

VanDriver99 said:

So pensioners are expected to survive with a quarter or thereabouts of that???

Not at all. They are expected to supplement their state pension with a work or private pension.keo said:

Wires crossed, hold my hands up I thought £4k a month was one persons earnings.

Google says the average UK wage is £34900. Take home this is £2313 a month. I would guess that wages are different down south compared to the midlands where I live though.

Google says the average UK wage is £34900. Take home this is £2313 a month. I would guess that wages are different down south compared to the midlands where I live though.

Even 1 person earning 4k a month isn't anything out of the ordinary now, above average maybe but not in any way exceptional, I'm earning roughly the same now as I was in 1989! It just doesn't go anywhere near as far as it did then.

The Leaper said:

Here's my responses to the OP's questions. Note wife and are 81/80 and been retired for almost 20 years, so my responses are experienced based.

1)The State Pension is the same in the Stockbroker Belt as it is in some depraved areas...is that a little odd?

No. Everyone pays the same so should get the same.

How does everyone pay the same? A bloke who worked from 16 to SP age, v his wife who went to uni, started work at 21, had 3 kids so didn't work and claimed child benefit from 25 -50, then went back to work part time until SP age. 1)The State Pension is the same in the Stockbroker Belt as it is in some depraved areas...is that a little odd?

No. Everyone pays the same so should get the same.

okgo said:

keo said:

I think it’s a load of b ks because how many people have £4k a month coming in even when they are working!

ks because how many people have £4k a month coming in even when they are working!

Given it’s about what you get for 2 people working full time in minimum wage, I’d guess lots on this forum have significantly more than £4k coming in per month! ks because how many people have £4k a month coming in even when they are working!

ks because how many people have £4k a month coming in even when they are working!Which, to be honest, would be way more than we'd need - but then we're not paying a mortgage, don't have young kids, run sheds etc.

It's a lot more than we spend now.

Gassing Station | Finance | Top of Page | What's New | My Stuff