Pulled over for tints-Getting 6 points for invalid insurance

Discussion

cay said:

Like anyone has insurance that doesn't cover a normal commute - because people have cars they use to not drive to work?

Seriously?

I have such an insurance and so does my other half.Seriously?

Very unfortunate for the OP to get pulled on the only day he has used his car for commuting though.

Ok - apologies, latest scam - I've never come across it - but seems some policies now have '+commuting' as an option.

I always thought Business use was different, like sales, visiting clients during day etc.

No idea how driving to a normal place of work is some different risk to social use, but I guess they will milk the cow until it runs out.

I always thought Business use was different, like sales, visiting clients during day etc.

No idea how driving to a normal place of work is some different risk to social use, but I guess they will milk the cow until it runs out.

autoshop213 said:

I had told the shop to put ones that were legal but they didn't have that option so I used the least darkest option.

The correct response in this scenario would have been to tell them to forget it, not to put on the least dark tints when they've already said they didn't have the option of "legal" ones.Also, on the insurance...

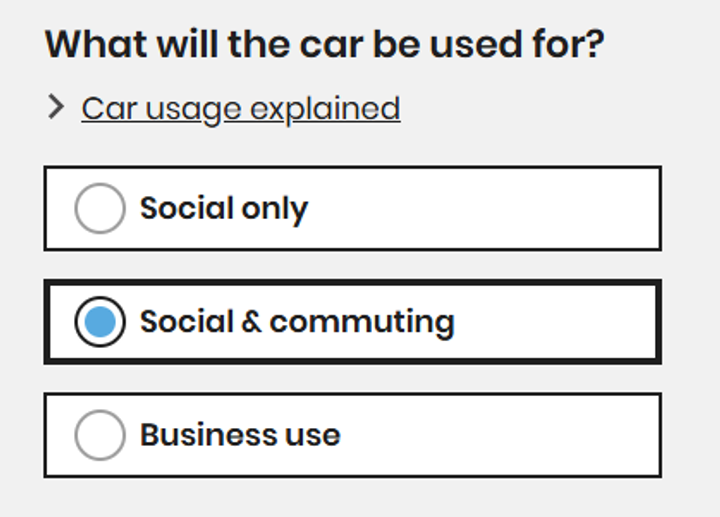

I've just been running quotes for a couple of cars I'm interested in. There are three distinct options...

1: Social, domestic & pleasure.

2: Social, domestic, pleasure & commuting.

3: Social, domestic, pleasure, commuting & business.

If you choose #1 you won't be covered for commuting.

Anyway, don't take my word for it, here it is straight from the Meerkat's mouth...

Edited by MitchT on Sunday 19th May 21:55

Super Sonic said:

Op I'm pretty sure that if you can show your insurance had been updated you should be able to appeal.

If you Google 'How to appeal a no insurance...' the top article is police advice telling you what to do.

I'm hoping I can use that and the fact that I already have a car for work that I've insured correctly. Also whats the chances If I get a solicitor and appeal this in court that I get an even bigger fine and/or points?If you Google 'How to appeal a no insurance...' the top article is police advice telling you what to do.

cay said:

Ok - apologies, latest scam - I've never come across it - but seems some policies now have '+commuting' as an option.

I always thought Business use was different, like sales, visiting clients during day etc.

No idea how driving to a normal place of work is some different risk to social use, but I guess they will milk the cow until it runs out.

It's because the odds are you are driving at the busiest times of the day. This would increase risk. If you don't have to drive to work you would probably go out when the roads were quieter. It could also mean you were driving while tired, which again would increase risk.I always thought Business use was different, like sales, visiting clients during day etc.

No idea how driving to a normal place of work is some different risk to social use, but I guess they will milk the cow until it runs out.

cay said:

Uh, no...

Insurance will cover normal social, domestic, pleasure and commuting to 'normal place of work'

Business use is different.

What did I miss?

"Social, domestic, and pleasure (SD&P) refers to an insurance policy that permits personal trips in your car. It includes cover for everyday activities such as driving to the shops, visiting family, or commuting between home and work."

While I shy away from claiming this as definitive proof, it's a popular car insurance aggregating website and it asks if the enquirer wants SDP, SDP&C or business use cover. In my experience this is normal, it's a long time since they included commuting as standard, going back to when I first started driving last century(yes grandad, whatevs).Insurance will cover normal social, domestic, pleasure and commuting to 'normal place of work'

Business use is different.

What did I miss?

"Social, domestic, and pleasure (SD&P) refers to an insurance policy that permits personal trips in your car. It includes cover for everyday activities such as driving to the shops, visiting family, or commuting between home and work."

autoshop213 said:

Super Sonic said:

Op I'm pretty sure that if you can show your insurance had been updated you should be able to appeal.

If you Google 'How to appeal a no insurance...' the top article is police advice telling you what to do.

I'm hoping I can use that and the fact that I already have a car for work that I've insured correctly. Also whats the chances If I get a solicitor and appeal this in court that I get an even bigger fine and/or points?If you Google 'How to appeal a no insurance...' the top article is police advice telling you what to do.

cay said:

Ok - apologies, latest scam - I've never come across it - but seems some policies now have '+commuting' as an option.

I always thought Business use was different, like sales, visiting clients during day etc.

No idea how driving to a normal place of work is some different risk to social use, but I guess they will milk the cow until it runs out.

What makes it a scam? I always thought Business use was different, like sales, visiting clients during day etc.

No idea how driving to a normal place of work is some different risk to social use, but I guess they will milk the cow until it runs out.

autoshop213 said:

Super Sonic said:

Op I'm pretty sure that if you can show your insurance had been updated you should be able to appeal.

If you Google 'How to appeal a no insurance...' the top article is police advice telling you what to do.

I'm hoping I can use that and the fact that I already have a car for work that I've insured correctly. Also whats the chances If I get a solicitor and appeal this in court that I get an even bigger fine and/or points?If you Google 'How to appeal a no insurance...' the top article is police advice telling you what to do.

cay said:

You don't have to include 'commuting' in insurance...

https://www.lv.com/car-insurance/for-car-insurance...

That’s LVs policy. It isn’t universally applicable. 10 seconds with Google doesn’t make an expert…https://www.lv.com/car-insurance/for-car-insurance...

cay said:

Ok - apologies, latest scam - I've never come across it - but seems some policies now have '+commuting' as an option.

I always thought Business use was different, like sales, visiting clients during day etc.

No idea how driving to a normal place of work is some different risk to social use, but I guess they will milk the cow until it runs out.

Ahh scam, the usual excuse for idiocy!I always thought Business use was different, like sales, visiting clients during day etc.

No idea how driving to a normal place of work is some different risk to social use, but I guess they will milk the cow until it runs out.

cay said:

Mr E said:

Nope

Ok... nope, but you ARE WRONGHowever, it’s possible a SDP only policy would provide sufficient 3rd party indemnity that the law might consider the OP insured.

I’ll defer to any of our learned friends who are better informed.

Edited by Mr E on Sunday 19th May 22:32

hidetheelephants said:

While I shy away from claiming this as definitive proof, it's a popular car insurance aggregating website and it asks if the enquirer wants SDP, SDP&C or business use cover. In my experience this is normal, it's a long time since they included commuting as standard, going back to when I first started driving last century(yes grandad, whatevs).

Absolutely! The commuting thing has been around since before I can remember (I passed my test in 1985). It can make a big difference to the premiums - I know this because this year I’ve removed commuting from all but one of our cars and bikes - we both WFH now and have always had commuting cover. We’ve kept it on Mrs DSs car as she goes in to her office in Harrogate literally 3 or 4 times a year - but even one occurrence is “commuting”. On my R1 the commuting extension was one third of the total policy! Even back pre Covid that was a few times a year - I had no idea it was so expensive! I get the train on the rare dates I go in.

Super Sonic said:

autoshop213 said:

Super Sonic said:

Op I'm pretty sure that if you can show your insurance had been updated you should be able to appeal.

If you Google 'How to appeal a no insurance...' the top article is police advice telling you what to do.

I'm hoping I can use that and the fact that I already have a car for work that I've insured correctly. Also whats the chances If I get a solicitor and appeal this in court that I get an even bigger fine and/or points?If you Google 'How to appeal a no insurance...' the top article is police advice telling you what to do.

https://www.ah-solicitors.co.uk/road-traffic/drivi...

Take it to court & there’s a chance you’ll get 8 points and a higher fine.

Super Sonic said:

Don't think 'having correct insurance on another car' cuts any ice. Either you updated your insurance to cover the car you drove to work or you didn't. If you did, you will be able to prove it and appeal.

I updated my insurance within the hour and I have paperwork to prove it. Is this a good case for appeal then? It was a genuine mistake as I didn't even remember that the insurance didn't cover commuting.autoshop213 said:

Super Sonic said:

Don't think 'having correct insurance on another car' cuts any ice. Either you updated your insurance to cover the car you drove to work or you didn't. If you did, you will be able to prove it and appeal.

I updated my insurance within the hour and I have paperwork to prove it. Is this a good case for appeal then? It was a genuine mistake as I didn't even remember that the insurance didn't cover commuting.And for the next few years your premiums may be eye watering.

Gassing Station | Speed, Plod & the Law | Top of Page | What's New | My Stuff