Who's have thunk it? UC recipient bank account access trail

Discussion

Murph7355 said:

skwdenyer said:

Agreed entirely. It is £6k for UC by the way; £16k is only for pensioners.

The “safety net” in the UK is laughable; you get better benefits in most of the United States. Countries such as Germany have formal unemployment insurance - based on contributions, you get a sizeable chunk of your salary for a sensible period (time to find new work at the same pay, or downsize your life), then dropping down to similar-to-the-UK levels in the long term.

It is extraordinary we’ve allowed this to get so bad. It of course incentivises the taking of *any* work and helps to keep wages lower; that may be the point.

You cannot cherry pick part of another country's system without being prepared to accept everything else that comes with it. And some parts cannot be leveraged because economies are so different. The “safety net” in the UK is laughable; you get better benefits in most of the United States. Countries such as Germany have formal unemployment insurance - based on contributions, you get a sizeable chunk of your salary for a sensible period (time to find new work at the same pay, or downsize your life), then dropping down to similar-to-the-UK levels in the long term.

It is extraordinary we’ve allowed this to get so bad. It of course incentivises the taking of *any* work and helps to keep wages lower; that may be the point.

On the face of it the German system is great. But how is it funded? What doesn't get done to cover it?

Ultimately there's only one way to benefit from the German social compromises.

Yes, those in the UK *can* take out private unemployment insurance. But as ever that’s a far more expensive proposition for an individual than it would be for a population as a whole.

We’ve allowed the myth of low taxation to persist for so long it has become ingrained. Many believe the US is lower still (it isn’t). Low taxation doesn’t promote growth, economic stability, global competitiveness, or greater self-sufficiency. We’ve abandoned all pretence of a “safety net” in favour of a bizarre worst-of-most-possible-worlds system the aims of which are incredibly hard to fathom.

skwdenyer said:

We’ve allowed the myth of low taxation to persist for so long it has become ingrained. Many believe the US is lower still (it isn’t). Low taxation doesn’t promote growth, economic stability, global competitiveness, or greater self-sufficiency. We’ve abandoned all pretence of a “safety net” in favour of a bizarre worst-of-most-possible-worlds system the aims of which are incredibly hard to fathom.

Based on what I've had to pay I'll put the suggestion out there that we most definitely do not have a system of low taxation.Biggy Stardust said:

skwdenyer said:

We’ve allowed the myth of low taxation to persist for so long it has become ingrained. Many believe the US is lower still (it isn’t). Low taxation doesn’t promote growth, economic stability, global competitiveness, or greater self-sufficiency. We’ve abandoned all pretence of a “safety net” in favour of a bizarre worst-of-most-possible-worlds system the aims of which are incredibly hard to fathom.

Based on what I've had to pay I'll put the suggestion out there that we most definitely do not have a system of low taxation.The *burden* of taxation may be wrong (far too little employers’ contributions for a start), but the overall level for a long time was far too low to be sustainable.

The problem now is how to get out of it. Low taxation has explicitly driven an asset bubble; getting out of it will inevitably lead to asset price falls, which in turn will be seen as unfair and tax-like. But we not only need proper taxation; we need to maintain proper taxation for decades in order to provide the funds to allow our country to function.

We’ve no more easy assets to fall back on (empire, oil, gas, coal, etc). We’re no longer a part of any significant reading bloc. We sell little the world can’t source elsewhere. We’ve deliberately squandered our lead in industrialisation, whilst allowing our newer tech to be sold overseas.

One of our primary assets now is a moderately educated workforce who cannot easily leave (Brexit) and have to take whatever wages are offered (neutered unions, no effective safety net), supported by a weakened currency. US companies hiring, say, programmers find the UK now to be often cheaper than India for given outputs.

We absolutely need to re-balance the economy and relative tax take. But that shouldn’t be mistaken for lowering the overall level of taxation.

Biggy Stardust said:

skwdenyer said:

We’ve allowed the myth of low taxation to persist for so long it has become ingrained. Many believe the US is lower still (it isn’t). Low taxation doesn’t promote growth, economic stability, global competitiveness, or greater self-sufficiency. We’ve abandoned all pretence of a “safety net” in favour of a bizarre worst-of-most-possible-worlds system the aims of which are incredibly hard to fathom.

Based on what I've had to pay I'll put the suggestion out there that we most definitely do not have a system of low taxation.As an additional rate PAYE taxpayer I feel robbed most of the time. Especially when the effective tax rates for the mega rich in society are low due to clever accountants and offshore companies etc.

Equality eh?

s1962a said:

Biggy Stardust said:

skwdenyer said:

We’ve allowed the myth of low taxation to persist for so long it has become ingrained. Many believe the US is lower still (it isn’t). Low taxation doesn’t promote growth, economic stability, global competitiveness, or greater self-sufficiency. We’ve abandoned all pretence of a “safety net” in favour of a bizarre worst-of-most-possible-worlds system the aims of which are incredibly hard to fathom.

Based on what I've had to pay I'll put the suggestion out there that we most definitely do not have a system of low taxation.As an additional rate PAYE taxpayer I feel robbed most of the time. Especially when the effective tax rates for the mega rich in society are low due to clever accountants and offshore companies etc.

Equality eh?

TX.

Terminator X said:

s1962a said:

Biggy Stardust said:

skwdenyer said:

We’ve allowed the myth of low taxation to persist for so long it has become ingrained. Many believe the US is lower still (it isn’t). Low taxation doesn’t promote growth, economic stability, global competitiveness, or greater self-sufficiency. We’ve abandoned all pretence of a “safety net” in favour of a bizarre worst-of-most-possible-worlds system the aims of which are incredibly hard to fathom.

Based on what I've had to pay I'll put the suggestion out there that we most definitely do not have a system of low taxation.As an additional rate PAYE taxpayer I feel robbed most of the time. Especially when the effective tax rates for the mega rich in society are low due to clever accountants and offshore companies etc.

Equality eh?

TX.

1949/50: 43.3%

1948/49: 42.9%

1950/51: 42.8%

1969/70: 41.9%

1981/82: 40.9%

1982/83: 40.6%

2023/24: 40.4% (est)

2022/23: 40.3%

1976/77: 40.2%

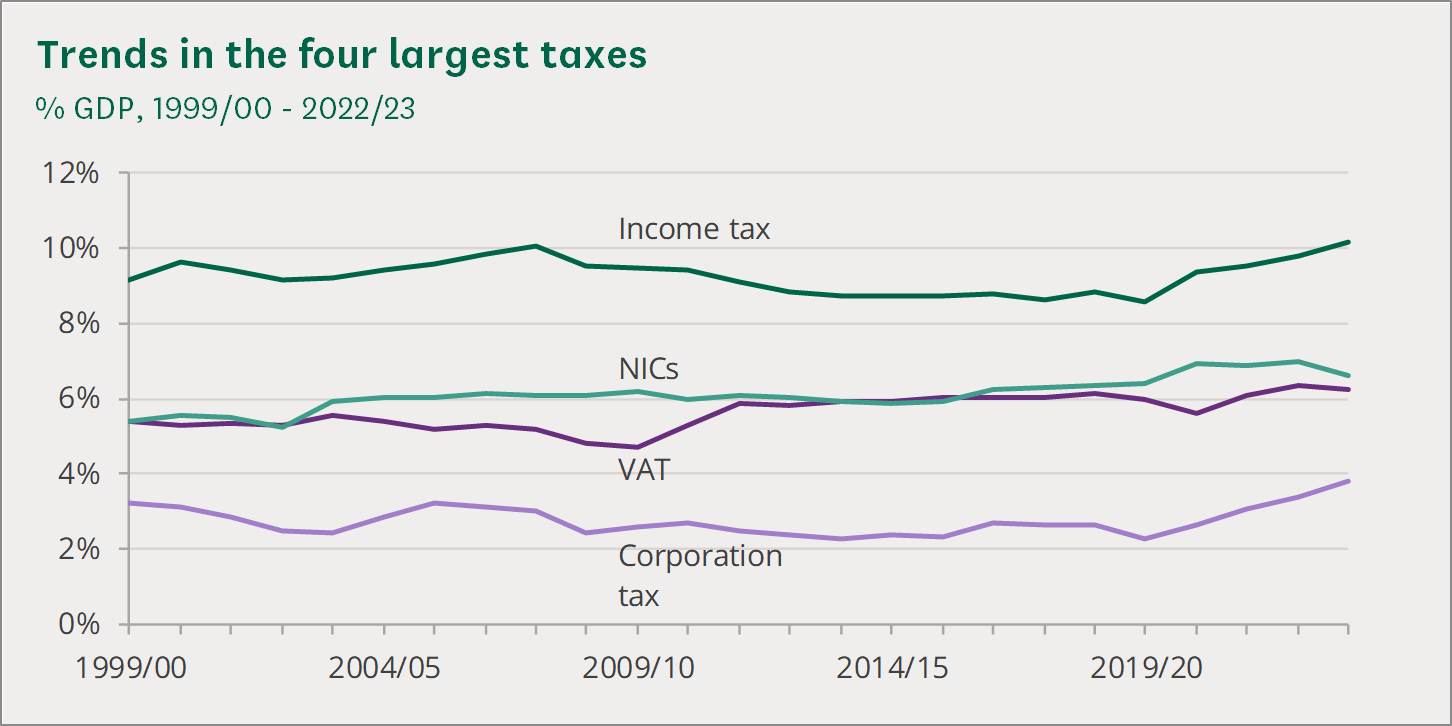

In terms of the main taxes, against as a % of GDP:

See how income tax *declined* from 2009/10 to 2019/20 quite considerably. Ridiculous. See how VAT has been used to make up for income tax - regressive.

And look at how Govt revenyues were destroyed between 1980/81 and 1993/94 - fully 25% of Govt revenues given up, corresponding to huge destruction of infrastructure, education, etc. spending.

Anyhow, overall taxation is not at its highest since WW2. But it may get there, of course - and even then, we won't be a high-tax economy.

How that tax is raised is an entirely different question.

Gassing Station | News, Politics & Economics | Top of Page | What's New | My Stuff