Brexit and savers interest rates

Discussion

fblm said:

Seriously? You are suffering from a terminal case of confirmation bias!

"The figures... exclude mortgages."

"The average amount owed by households is now £11,800, the highest level yet.

However, debt was proportionately greater in 2008, when it reached more than 30% of household income."

It may have been proportionally higher in 2008 but in absolute terms it is at the highest ever point."The figures... exclude mortgages."

"The average amount owed by households is now £11,800, the highest level yet.

However, debt was proportionately greater in 2008, when it reached more than 30% of household income."

Besides what are we talking about in terms of "proportion of household incomes" median earnings growth has been poor since 2008 and the average may be being bumped up by the relatively few households at the top.

2008 is hardly a yardstick of sensible credit levels in any case as it was just before one of the worst recessions we have had.

Anyway let us see what 2016 brings as the last data I can find online is the 3rd quarter of 2015.

And some more on the theoretical basis of why sustained ultra low interest rates are not a good thing.

http://steadystate.org/what-is-wrong-with-a-zero-i...

There was also an article in the Wall Street Journal (only available to subscribers unfortunately) by two economists who claim that ultra-low interest rates have actually led to lower business investment.

Economists who do not have a vested interest in the current policy are starting to question the whole logic behind this policy.

One thing I am fairly confident of is that if we have a repeat of the current financial crises in 50 or so years time, one of the policy responses wont be zero (or close to it) base rates for a decade afterwards.

http://steadystate.org/what-is-wrong-with-a-zero-i...

There was also an article in the Wall Street Journal (only available to subscribers unfortunately) by two economists who claim that ultra-low interest rates have actually led to lower business investment.

Economists who do not have a vested interest in the current policy are starting to question the whole logic behind this policy.

One thing I am fairly confident of is that if we have a repeat of the current financial crises in 50 or so years time, one of the policy responses wont be zero (or close to it) base rates for a decade afterwards.

fblm said:

crankedup said:

I really do need to start posting links regarding some of the stuff that I regurgitate in here, but then it's just who can find what suits the argument quickest to the draw. Thanks again.

Seriously? You are suffering from a terminal case of confirmation bias!"The figures... exclude mortgages."

"The average amount owed by households is now £11,800, the highest level yet.

However, debt was proportionately greater in 2008, when it reached more than 30% of household income."

I give up. If you only want replys to your posts that agree with your own assertions I'll leave you to Jaglover, you guys are going to make millions betting on what should have happened!

Maybe I am the luckiest guy in the world as my personal investments have done me ok, apart from the early eighties when my business almost went bust!

I actually appreciate receiving replies to my posts that are Factually correct and interesting, I guess most posters would what I dislike is replies that exaggerate (your ridiculous comment regarding rates hitting 3 or 4% as if to prove your point).

JagLover said:

And some more on the theoretical basis of why sustained ultra low interest rates are not a good thing.

http://steadystate.org/what-is-wrong-with-a-zero-i...

There was also an article in the Wall Street Journal (only available to subscribers unfortunately) by two economists who claim that ultra-low interest rates have actually led to lower business investment.

Economists who do not have a vested interest in the current policy are starting to question the whole logic behind this policy.

One thing I am fairly confident of is that if we have a repeat of the current financial crises in 50 or so years time, one of the policy responses wont be zero (or close to it) base rates for a decade afterwards.

Seriously? You're confident of the global macro economic response to the next major crisis based on an article by a guy who actually cites positivemoney and an article you read in the wsj despite the fact that the policies enacted around the world post GFC actually worked? Ooookay. Best of luck with that.http://steadystate.org/what-is-wrong-with-a-zero-i...

There was also an article in the Wall Street Journal (only available to subscribers unfortunately) by two economists who claim that ultra-low interest rates have actually led to lower business investment.

Economists who do not have a vested interest in the current policy are starting to question the whole logic behind this policy.

One thing I am fairly confident of is that if we have a repeat of the current financial crises in 50 or so years time, one of the policy responses wont be zero (or close to it) base rates for a decade afterwards.

Edited by anonymous-user on Thursday 26th May 15:30

fblm said:

JagLover said:

And some more on the theoretical basis of why sustained ultra low interest rates are not a good thing.

http://steadystate.org/what-is-wrong-with-a-zero-i...

There was also an article in the Wall Street Journal (only available to subscribers unfortunately) by two economists who claim that ultra-low interest rates have actually led to lower business investment.

Economists who do not have a vested interest in the current policy are starting to question the whole logic behind this policy.

One thing I am fairly confident of is that if we have a repeat of the current financial crises in 50 or so years time, one of the policy responses wont be zero (or close to it) base rates for a decade afterwards.

Seriously? You're confident of the global macro economic response to the next major crisis based on an article by a guy who actually cites positivemoney and an article you read in the wsj despite the fact that the policies enacted around the world post GFC actually worked? Ooookay. Best of luck with that.http://steadystate.org/what-is-wrong-with-a-zero-i...

There was also an article in the Wall Street Journal (only available to subscribers unfortunately) by two economists who claim that ultra-low interest rates have actually led to lower business investment.

Economists who do not have a vested interest in the current policy are starting to question the whole logic behind this policy.

One thing I am fairly confident of is that if we have a repeat of the current financial crises in 50 or so years time, one of the policy responses wont be zero (or close to it) base rates for a decade afterwards.

Edited by fblm on Thursday 26th May 15:30

crankedup said:

...what I dislike is replies that exaggerate (your ridiculous comment regarding rates hitting 3 or 4% as if to prove your point).

Why don't you re read what I actually wrote? You seem hung up on this 3-4%. For the 3rd time I chose 3-4% as a level that would have been worthwhile to savers; any less yielding less than inflation over the period. I said that's what I was doing; I wasn't exaggerating, attributing any of that to you or implying anything. I can't be any clearer. In fact only yesterday I had an NSandI RPI index bond mature that worked out around £2500 or 3% give or take for the same period. You asked a question which I endevoured to answer honestly earlier in the thread. I'm sorry you didn't like the answer. Perhaps if you just want to read nonsense that you agree with, you should try the comments section of zerohedge or read positivemoney and moneyweek.fblm said:

Seriously? You're confident of the global macro economic response to the next major crisis based on an article by a guy who actually cites positivemoney and an article you read in the wsj despite the fact that the policies enacted around the world post GFC actually worked? Ooookay. Best of luck with that.

Worked in what sense?We had the largest peak to trough fall in output in post war history, greater even than the fall in the early eighties.

In terms of recovery it is now 6 years old and yet we still have anaemic growth in productivity and GDP per head, in fact the worst recovery to a recession post war as well.

Add in the rampant asset price bubble, and unbalanced recovery, and it all leads me to suspect that when future economic historians write the history of this period they wont be hailing near zero interest rates for a decade as an act of economic genius.

Just as we learned from the great depression we will learn from the policy responses this time as well.

Edited by JagLover on Thursday 26th May 16:30

JagLover said:

We had the largest peak to trough fall in output in post war history, greater even than the fall in the early eighties.

Exactly! Thats what the policy response had to deal with and why it had to be so extreme! Policies take time to move the dial. (Even a massive QE funded infrastructure works program would take years to feed through to GDP). Pre-GFC the BoE reconed it took 18m for an interest rate move to work its way through the economy (remember the old cpi fan graphs?). You can't say a plastercast doesn't work because you still broke your leg, you wern't wearing it when you fell down that manhole...You had the largest drop in GDP in memory yet unemployment peaked at 8%, compared to 10 and 12% in the previous comparatively very mild recessions. Europe fannied around and check out their 'recovery'. Reposessions peaked at 45k in 2009, half the number of the '91 recession. Just about every metric you look at the effects of that massive blow to GDP were hugely more desirable, for most, than in previous, much more mild recessions. I'd call that a result.

JagLover said:

In terms of recovery it is now 6 years old and yet we still have anaemic growth in productivity and GDP per head, in fact the worst recovery to a recession post war as well.

Agreed but you are comparing to different recessions that were either not as severe or you didn't enter with so much debt. You're crawling out of a balance sheet recession, if anything you should be comparing your recovery to that of Japans ongoing 25 year 'recovery'. You're doing stormingly well compared! (The Holy Grail of Macro Economics;Lessons from Japans Great Recession by Koo is well worth a read) JagLover said:

Add in the rampant asset price bubble and unbalanced recovery and it all leads me to suspect that when future economic historians write the history of this period they wont be hailing near zero interest rates for a decade as an act of economic genius.

I agree the asset price bubble is an accident waiting to happen, in the UK's case the most serious is obviously housing but it's not like everyone is abusing cheap credit to buy up houses and leave them empty; your population growth is massively outstripping house build rates; its not just about cheap credit. (The government could smack it on the head by mandating 3 times salary maximum and no BTL borrowings if they really wished)JagLover said:

Just as we learned from the great depression we will learn from the policy responses this time as well.

A great example! One of the most highly respected academic experts on the great depression is... Ben Bernanke. The US policy responce to the GFC, mostly copied by you, was designed specifically to avoid another great depression. And it did. So far

http://www.wsj.com/articles/SB113392265577715881

Edited by anonymous-user on Thursday 26th May 17:14

fblm said:

I agree the asset price bubble is an accident waiting to happen, in the UK's case the most serious is obviously housing but it's not like everyone is abusing cheap credit to buy up houses and leave them empty; your population growth is massively outstripping house build rates; its not just about cheap credit. (The government could smack it on the head by mandating 3 times salary maximum and no BTL borrowings if they really wished)

Well we do agree on some thingsI also think that today's near zero interest rates may well have been the correct response back at the time of the financial crises, which I fully agree with you was potentially more severe than many previous recessions.

The issue I have is the continuation of near zero interest rates to today's date. At a time when unemployment is 5% here and in the US.

The spectre of deflation has been raised by many to justify this, including yourself earlier in the thread, but we haven't had deflation or anything close to it, as the chart you posted showed.

It is not just "fringe" economists who believe this either. I remember reading an article by a former member of the BOE monetary policy committee, who said he had voted to cut interest rates to 0.5% at the time of the financial crises and if he were still a member he would have been voting to raise them a couple of years ago.

To raise rates however would, as I have said, have required a coordinated response.

fblm said:

crankedup said:

...what I dislike is replies that exaggerate (your ridiculous comment regarding rates hitting 3 or 4% as if to prove your point).

Why don't you re read what I actually wrote? You seem hung up on this 3-4%. For the 3rd time I chose 3-4% as a level that would have been worthwhile to savers; any less yielding less than inflation over the period. I said that's what I was doing; I wasn't exaggerating, attributing any of that to you or implying anything. I can't be any clearer. In fact only yesterday I had an NSandI RPI index bond mature that worked out around £2500 or 3% give or take for the same period. You asked a question which I endevoured to answer honestly earlier in the thread. I'm sorry you didn't like the answer. Perhaps if you just want to read nonsense that you agree with, you should try the comments section of zerohedge or read positivemoney and moneyweek.

JagLover said:

Well we do agree on some things

I think we just agreed on quite a number of things.JagLover said:

The issue I have is the continuation of near zero interest rates to today's date. At a time when unemployment is 5% here and in the US.

To be fair to the BoE their mandate is a CPI target and they are well under target at the moment making a hike difficult to justify, especially when you consider the head winds currently facing the UK and global economy. Ah but they were way over target for so much of the last 8 years why didn't they hike then? Because there is an implicit understanding that the CPI target is not to be met at the expense of all else. After all the CPI target is just an arbitrary number set by the government. You could be right, god knows the BoE have got it wrong plenty of times before, and 18 months from now you're running 5% cpi and everyone is saying; wtf, why didn't you hike when jaglover fvcking told you to?JagLover said:

The spectre of deflation has been raised by many to justify this, including yourself earlier in the thread, but we haven't had deflation or anything close to it, as the chart you posted showed.

Indeed. I'll wager had you not done half a trillion $ of QE and dropped GBPUSD from 2.10 to 1.40 you would have seen this mystical deflation. You didn't see it as a direct result of the policy response. Instead you got inflation a percent or two over target. Hardly the end of the world. JagLover said:

It is not just "fringe" economists who believe this either. I remember reading an article by a former member of the BOE monetary policy committee, who said he had voted to cut interest rates to 0.5% at the time of the financial crises and if he were still a member he would have been voting to raise them a couple of years ago.

No doubt there are many more eminent economists who would agree with you too. Most of them are probably sulking at the ECB! Sadly economics isn't a real science like climate science so no one can ever claim that the science is settled

REALIST123 said:

don4l said:

crankedup said:

ClaphamGT3 said:

As someone with no mortgage and a reasonable amount stashed under the mattress, so to speak, I get really, really tired of 'savers' (usually pensioners) moaning about interest rates.

Yes, rates are currently at historic lows - get over it. It's a policy that's unlikely to change any time soon and one that is pathetically easy to do something about; there are plenty of investment options that will see your money making far more than your savings account, so stop moaning and start actively managing your money rather than bewailing that the magic money tree isn't making it grow faster than inflation at the moment

Why the angst?' You come across as a first rate tYes, rates are currently at historic lows - get over it. It's a policy that's unlikely to change any time soon and one that is pathetically easy to do something about; there are plenty of investment options that will see your money making far more than your savings account, so stop moaning and start actively managing your money rather than bewailing that the magic money tree isn't making it grow faster than inflation at the moment

t.

t.It's a perfectly civil question to ask isn't it and one that forum members may like to discuss.

Clapham is giving perfectly good advice.

The interest available on savings accounts has always been less than inflation. Inflation is very low at the moment and so are interest rates.

I got into the stock market in 2008, and have been very pleasantly surprised.

Managed funds in this country seem to be a complete rip-off. On this, I think that we agree.

The solution is to do some research and manage your own funds.

Do you mind telling us, in rough terms, how much you are self investing and how much time it takes you?

I'm not going say how much I have invested, but I will try to give information that I think is useful.

I started out with a standard Barclays stocks and shares trading account. This was just an experiment with a small amount of money that I was happy to lose. It went much better than expected, so I now have tax liabilities.

I have been investing my full ISA allowance into a stocks and shares ISA account since 2009. My wife had been investing into a cash ISA. Last year she finally agreed that she would open a stocks and shares ISA and allow me to manage it. This was because my ISA value was about twice what hers was. We had bot put in the same amount.

I have also been investing in a stocks and shares SIPP.

Up until last year the four accounts grew at an average rate of 17% p/a.

However, this rate of return has varied wildly.

If I set aside 2-3 hours every Saturday morning, then I make good gains. As well as the Saturday session, I also need to spend an hour every trading day keeping an eye on things.

Now comes the interesting stuff.

I have a system. I look at the dividend "Yield". If the yield is too high, then the market is worried. If the yield is too low, then the shares are overpriced. When I am being active, I check all my shares every Saturday. This is what takes three hours.

I also look at the company's balance sheet. I am mainly interested in the state of their current assets.

Before I actually bought any shares I spent 6 months running a fake account. Every Saturday I went through the FT, and I either bought or sold some shares, or simply held my position. These "trades" were all written down in ink. It would be so easy to say after an event "Well, I would have sold them".

don4l said:

Very good question.

I'm not going say how much I have invested, but I will try to give information that I think is useful.

I started out with a standard Barclays stocks and shares trading account. This was just an experiment with a small amount of money that I was happy to lose. It went much better than expected, so I now have tax liabilities.

I have been investing my full ISA allowance into a stocks and shares ISA account since 2009. My wife had been investing into a cash ISA. Last year she finally agreed that she would open a stocks and shares ISA and allow me to manage it. This was because my ISA value was about twice what hers was. We had bot put in the same amount.

I have also been investing in a stocks and shares SIPP.

Up until last year the four accounts grew at an average rate of 17% p/a.

However, this rate of return has varied wildly.

If I set aside 2-3 hours every Saturday morning, then I make good gains. As well as the Saturday session, I also need to spend an hour every trading day keeping an eye on things.

Now comes the interesting stuff.

I have a system. I look at the dividend "Yield". If the yield is too high, then the market is worried. If the yield is too low, then the shares are overpriced. When I am being active, I check all my shares every Saturday. This is what takes three hours.

I also look at the company's balance sheet. I am mainly interested in the state of their current assets.

Before I actually bought any shares I spent 6 months running a fake account. Every Saturday I went through the FT, and I either bought or sold some shares, or simply held my position. These "trades" were all written down in ink. It would be so easy to say after an event "Well, I would have sold them".

Imagine how much you could be making if you worked Sunday mornings as well!I'm not going say how much I have invested, but I will try to give information that I think is useful.

I started out with a standard Barclays stocks and shares trading account. This was just an experiment with a small amount of money that I was happy to lose. It went much better than expected, so I now have tax liabilities.

I have been investing my full ISA allowance into a stocks and shares ISA account since 2009. My wife had been investing into a cash ISA. Last year she finally agreed that she would open a stocks and shares ISA and allow me to manage it. This was because my ISA value was about twice what hers was. We had bot put in the same amount.

I have also been investing in a stocks and shares SIPP.

Up until last year the four accounts grew at an average rate of 17% p/a.

However, this rate of return has varied wildly.

If I set aside 2-3 hours every Saturday morning, then I make good gains. As well as the Saturday session, I also need to spend an hour every trading day keeping an eye on things.

Now comes the interesting stuff.

I have a system. I look at the dividend "Yield". If the yield is too high, then the market is worried. If the yield is too low, then the shares are overpriced. When I am being active, I check all my shares every Saturday. This is what takes three hours.

I also look at the company's balance sheet. I am mainly interested in the state of their current assets.

Before I actually bought any shares I spent 6 months running a fake account. Every Saturday I went through the FT, and I either bought or sold some shares, or simply held my position. These "trades" were all written down in ink. It would be so easy to say after an event "Well, I would have sold them".

fblm said:

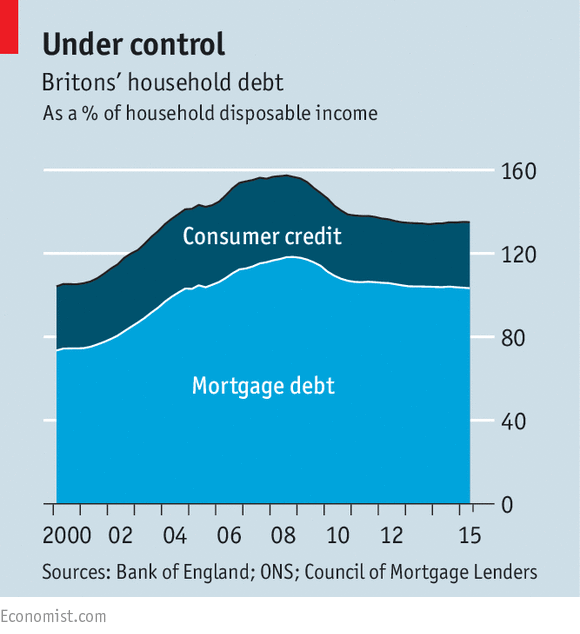

If I'm reading that chart correctly, it's quite worrying but not surprising, especially the mortgage debt. Explains why house prices are so high. For simplicity assume the Mortgage debt line is flat at 100%, in 2008 this represented average lender rates of ~5%, now this is closer to 2%...meaning any rate shocks are going to hit far people harder. RYH64E said:

don4l said:

Up until last year the four accounts grew at an average rate of 17% p/a.

17% per annum? Really? You can achieve rates of return way beyond the wildest dreams of professional investors, in a few hours on a Saturday morning at that, yet waste your time working for a living?

crankedup said:

RYH64E said:

don4l said:

Up until last year the four accounts grew at an average rate of 17% p/a.

17% per annum? Really? You can achieve rates of return way beyond the wildest dreams of professional investors, in a few hours on a Saturday morning at that, yet waste your time working for a living?

You need to find an area that's underperforming at the moment and go with it - Oil? Emerging Markets? - or stick to a market you know, like Dignity

Gassing Station | News, Politics & Economics | Top of Page | What's New | My Stuff