How far will house prices fall [volume 4]

Discussion

98elise said:

Derek Chevalier said:

walm said:

Derek Chevalier said:

Surely they should follow earnings as they did for the ~200 years before this bubble?

Well... ignoring all the other bubbles before this one, yes.In the peak I had friends (a couple) that had bought in the peak using 2 normal incomes + did weekend jobs to get on the ladder.

Felt like a bubble to me.

crankedup said:

98elise said:

Derek Chevalier said:

walm said:

Derek Chevalier said:

Surely they should follow earnings as they did for the ~200 years before this bubble?

Well... ignoring all the other bubbles before this one, yes.In the peak I had friends (a couple) that had bought in the peak using 2 normal incomes + did weekend jobs to get on the ladder.

Felt like a bubble to me.

Or more a fact that prices were going up, so people felt inclined to buy them before they went up, which drove massive demand?

Another reason why we always need more supply than demand if we're ever to get a natural price discovery point.

It just takes away that scarcity element that lets these demand/price rise/bubble feedback loops begin.

I suppose human nature plays a big part in that. Another reason why price growth has probably stopped in many areas, because FTB people can't afford to buy even if they wanted to, so the feedback loop is stopped.

No doubt why we're seeing mortgage lending restrictions being relaxed again

Will we ever learn!

London is crashing in volume terms, and prices will follow thereafter.

The ripples will certainly be felt from the departure of speculators from the market, less so as the local markets feeling the ripples are more and more domestic and owner occupier led as you move out of town.

Outside the south east, given continued low interest rates for the foreseeable future I see little chance of a material crash in prices.

Mr Whippy said:

crankedup said:

98elise said:

Derek Chevalier said:

walm said:

Derek Chevalier said:

Surely they should follow earnings as they did for the ~200 years before this bubble?

Well... ignoring all the other bubbles before this one, yes.In the peak I had friends (a couple) that had bought in the peak using 2 normal incomes + did weekend jobs to get on the ladder.

Felt like a bubble to me.

Or more a fact that prices were going up, so people felt inclined to buy them before they went up, which drove massive demand?

Another reason why we always need more supply than demand if we're ever to get a natural price discovery point.

It just takes away that scarcity element that lets these demand/price rise/bubble feedback loops begin.

I suppose human nature plays a big part in that. Another reason why price growth has probably stopped in many areas, because FTB people can't afford to buy even if they wanted to, so the feedback loop is stopped.

No doubt why we're seeing mortgage lending restrictions being relaxed again

Will we ever learn!

I'm really not sure if the bubble was driven by speculators or simply couples like us r,acing to buy, others may know?

I remember buying in June 2004 and it was the time of gazumping.

We were looking at one house in particular that went up from £90,000 asking to £108,000 asking within about 3 months, and it still moved despite demand throughout the selling period.

Given what I'm seeing out there right now, and past history of governments propping the markets up no matter what, now might be a good time to buy around here with a long term view in mind.

That said maybe this time will be different

We were looking at one house in particular that went up from £90,000 asking to £108,000 asking within about 3 months, and it still moved despite demand throughout the selling period.

Given what I'm seeing out there right now, and past history of governments propping the markets up no matter what, now might be a good time to buy around here with a long term view in mind.

That said maybe this time will be different

crankedup said:

First Housing bubble early 1970's we were about to buy our first home. Prices rising faster than a rocket to the moon, any home that came to market in our budget would sell almost instantly, certainly within 24 hours. Went to look at a bungalow in Southend on sea, we arrived on the Saturday morning to view and joined a Q of about 60 other people!! Mental times. We looked at anything within budget within a thirty miles radius of work in a dencely populated area and had a stroke of luck to achieve our dreams.

We first bought in 1979 and demand was bonkers but I don't recall the same applying to prices. We got a new build released off-plan a year before it was built and only got it as someone dropped out - my missus to be had to leave work and rush over there with the deposit.I suppose the fact that money was hard to come by may have limited prices but yet demand was still very high. Seems hard to imagine now but lenders released money in tranches and it was very uncertain whether you'd get your loan or have to wait for the next round.

Mr Whippy said:

While all they can do is help to buy and making property slightly less appealing to BTL'ers, then it's less than ideal.

All it's really doing is forcing values higher, making people want to hop on the ladder with even more desperation, making a correction even less desirable due to all those who will be caught swimming naked!

Free markets are what are needed, because the more government meddles the more they distort things.

Imo goverment should look at real local demand for houses, build quality houses where they're needed (solar, GSHP, community hot water, super duper modern stuff, integration with new transport links and all that jazz), keep ownership of them and rent them out at a rate that makes UK gov some money for 25 years, after which start selling them off.

25 years to manage demand/prices in areas where it's needed, while getting an ROI, and investing in local jobs/infrastructure, seems logical to me.

Set trends for expectations of property (ie, decent heating systems, not s tting single thermostat s

tting single thermostat s tty gas boiler crap), set trends for expectations that new developments need investment in local infrastructure too, rather than just straddling existing stuff with no investment at all.

tty gas boiler crap), set trends for expectations that new developments need investment in local infrastructure too, rather than just straddling existing stuff with no investment at all.

Get the housing market representing something half decent in this country, rather than just a race to make some money.

I'd rather not be integrated with the government, if you don't mind.All it's really doing is forcing values higher, making people want to hop on the ladder with even more desperation, making a correction even less desirable due to all those who will be caught swimming naked!

Free markets are what are needed, because the more government meddles the more they distort things.

Imo goverment should look at real local demand for houses, build quality houses where they're needed (solar, GSHP, community hot water, super duper modern stuff, integration with new transport links and all that jazz), keep ownership of them and rent them out at a rate that makes UK gov some money for 25 years, after which start selling them off.

25 years to manage demand/prices in areas where it's needed, while getting an ROI, and investing in local jobs/infrastructure, seems logical to me.

Set trends for expectations of property (ie, decent heating systems, not s

tting single thermostat s

tting single thermostat s tty gas boiler crap), set trends for expectations that new developments need investment in local infrastructure too, rather than just straddling existing stuff with no investment at all.

tty gas boiler crap), set trends for expectations that new developments need investment in local infrastructure too, rather than just straddling existing stuff with no investment at all.Get the housing market representing something half decent in this country, rather than just a race to make some money.

One consideration though. There's a huge difference in the immigration count according to the people standing at airports with clipboards ( about 800,00 immigrants over the past 3 years ) and registrations for NI numbers ( about 2 million over the past 3 years ). Given that there is a prediction that by 2030 another 3m immigrants will have joined us ( so should that be more like 6-8m in reality ), unless there's a huge surge in house building demand will be sustained because these people will need to be housed somewhere.

All that jazz said:

Mr Whippy said:

While all they can do is help to buy and making property slightly less appealing to BTL'ers, then it's less than ideal.

All it's really doing is forcing values higher, making people want to hop on the ladder with even more desperation, making a correction even less desirable due to all those who will be caught swimming naked!

Free markets are what are needed, because the more government meddles the more they distort things.

Imo goverment should look at real local demand for houses, build quality houses where they're needed (solar, GSHP, community hot water, super duper modern stuff, integration with new transport links and all that jazz), keep ownership of them and rent them out at a rate that makes UK gov some money for 25 years, after which start selling them off.

25 years to manage demand/prices in areas where it's needed, while getting an ROI, and investing in local jobs/infrastructure, seems logical to me.

Set trends for expectations of property (ie, decent heating systems, not s tting single thermostat s

tting single thermostat s tty gas boiler crap), set trends for expectations that new developments need investment in local infrastructure too, rather than just straddling existing stuff with no investment at all.

tty gas boiler crap), set trends for expectations that new developments need investment in local infrastructure too, rather than just straddling existing stuff with no investment at all.

Get the housing market representing something half decent in this country, rather than just a race to make some money.

I'd rather not be integrated with the government, if you don't mind.All it's really doing is forcing values higher, making people want to hop on the ladder with even more desperation, making a correction even less desirable due to all those who will be caught swimming naked!

Free markets are what are needed, because the more government meddles the more they distort things.

Imo goverment should look at real local demand for houses, build quality houses where they're needed (solar, GSHP, community hot water, super duper modern stuff, integration with new transport links and all that jazz), keep ownership of them and rent them out at a rate that makes UK gov some money for 25 years, after which start selling them off.

25 years to manage demand/prices in areas where it's needed, while getting an ROI, and investing in local jobs/infrastructure, seems logical to me.

Set trends for expectations of property (ie, decent heating systems, not s

tting single thermostat s

tting single thermostat s tty gas boiler crap), set trends for expectations that new developments need investment in local infrastructure too, rather than just straddling existing stuff with no investment at all.

tty gas boiler crap), set trends for expectations that new developments need investment in local infrastructure too, rather than just straddling existing stuff with no investment at all.Get the housing market representing something half decent in this country, rather than just a race to make some money.

Unless you already are, then how would you be with government built new housing?

Derek Chevalier said:

What inflation are you referring to? The one that affects people most (house prices), or instead some Gunment produced rubbish?

You will need to clarify your definition of "afford". Unless everyone is on a fixed mortgage for life of mortgage I'm not sure you can make this statement

Surely they should follow earnings as they did for the ~200 years before this bubble?

I'm referring to CPI/RPI inflation, and yes it's doesn't account for the inflation of asset values.You will need to clarify your definition of "afford". Unless everyone is on a fixed mortgage for life of mortgage I'm not sure you can make this statement

Surely they should follow earnings as they did for the ~200 years before this bubble?

By afford I mean buy a given house for a given price, not subsequent loan repayments that don't retrospectively change what you paid for a house. Generally as wages and prices inflate, the debt will be erroded over the term of the mortgage and repayments will become less and hence more affordable in real terms. Let's see what happens with interest rates...

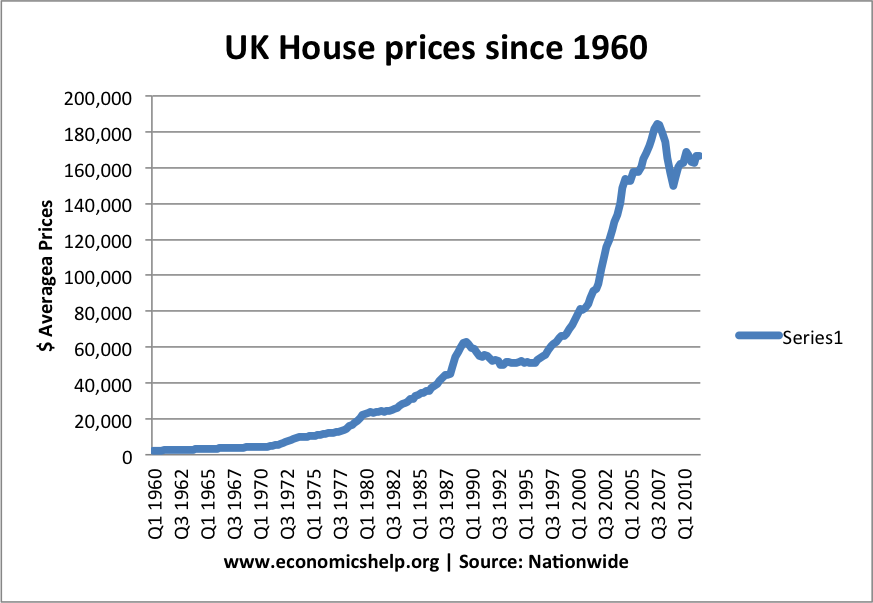

I think house price inflation has more to do with monetary inflation than earnings, the same with other asset classes. The trend pretty much looks like this...

If house prices are a bubble, then so is money, gold, capitalism, etc...

XJ40 said:

Generally as wages and prices inflate, the debt will be erroded over the term of the mortgage and repayments will become less and hence more affordable in real terms. Let's see what happens with interest rates...

Unfortunately the debt erosion due to wage inflation is unlikely to happen this time around unless the link between rates and earnings is removed. Unlikely.Mr Whippy said:

All that jazz said:

Mr Whippy said:

While all they can do is help to buy and making property slightly less appealing to BTL'ers, then it's less than ideal.

All it's really doing is forcing values higher, making people want to hop on the ladder with even more desperation, making a correction even less desirable due to all those who will be caught swimming naked!

Free markets are what are needed, because the more government meddles the more they distort things.

Imo goverment should look at real local demand for houses, build quality houses where they're needed (solar, GSHP, community hot water, super duper modern stuff, integration with new transport links and all that jazz), keep ownership of them and rent them out at a rate that makes UK gov some money for 25 years, after which start selling them off.

25 years to manage demand/prices in areas where it's needed, while getting an ROI, and investing in local jobs/infrastructure, seems logical to me.

Set trends for expectations of property (ie, decent heating systems, not s tting single thermostat s

tting single thermostat s tty gas boiler crap), set trends for expectations that new developments need investment in local infrastructure too, rather than just straddling existing stuff with no investment at all.

tty gas boiler crap), set trends for expectations that new developments need investment in local infrastructure too, rather than just straddling existing stuff with no investment at all.

Get the housing market representing something half decent in this country, rather than just a race to make some money.

I'd rather not be integrated with the government, if you don't mind.All it's really doing is forcing values higher, making people want to hop on the ladder with even more desperation, making a correction even less desirable due to all those who will be caught swimming naked!

Free markets are what are needed, because the more government meddles the more they distort things.

Imo goverment should look at real local demand for houses, build quality houses where they're needed (solar, GSHP, community hot water, super duper modern stuff, integration with new transport links and all that jazz), keep ownership of them and rent them out at a rate that makes UK gov some money for 25 years, after which start selling them off.

25 years to manage demand/prices in areas where it's needed, while getting an ROI, and investing in local jobs/infrastructure, seems logical to me.

Set trends for expectations of property (ie, decent heating systems, not s

tting single thermostat s

tting single thermostat s tty gas boiler crap), set trends for expectations that new developments need investment in local infrastructure too, rather than just straddling existing stuff with no investment at all.

tty gas boiler crap), set trends for expectations that new developments need investment in local infrastructure too, rather than just straddling existing stuff with no investment at all.Get the housing market representing something half decent in this country, rather than just a race to make some money.

Unless you already are, then how would you be with government built new housing?

All that jazz said:

Mr Whippy said:

All that jazz said:

Mr Whippy said:

While all they can do is help to buy and making property slightly less appealing to BTL'ers, then it's less than ideal.

All it's really doing is forcing values higher, making people want to hop on the ladder with even more desperation, making a correction even less desirable due to all those who will be caught swimming naked!

Free markets are what are needed, because the more government meddles the more they distort things.

Imo goverment should look at real local demand for houses, build quality houses where they're needed (solar, GSHP, community hot water, super duper modern stuff, integration with new transport links and all that jazz), keep ownership of them and rent them out at a rate that makes UK gov some money for 25 years, after which start selling them off.

25 years to manage demand/prices in areas where it's needed, while getting an ROI, and investing in local jobs/infrastructure, seems logical to me.

Set trends for expectations of property (ie, decent heating systems, not s tting single thermostat s

tting single thermostat s tty gas boiler crap), set trends for expectations that new developments need investment in local infrastructure too, rather than just straddling existing stuff with no investment at all.

tty gas boiler crap), set trends for expectations that new developments need investment in local infrastructure too, rather than just straddling existing stuff with no investment at all.

Get the housing market representing something half decent in this country, rather than just a race to make some money.

I'd rather not be integrated with the government, if you don't mind.All it's really doing is forcing values higher, making people want to hop on the ladder with even more desperation, making a correction even less desirable due to all those who will be caught swimming naked!

Free markets are what are needed, because the more government meddles the more they distort things.

Imo goverment should look at real local demand for houses, build quality houses where they're needed (solar, GSHP, community hot water, super duper modern stuff, integration with new transport links and all that jazz), keep ownership of them and rent them out at a rate that makes UK gov some money for 25 years, after which start selling them off.

25 years to manage demand/prices in areas where it's needed, while getting an ROI, and investing in local jobs/infrastructure, seems logical to me.

Set trends for expectations of property (ie, decent heating systems, not s

tting single thermostat s

tting single thermostat s tty gas boiler crap), set trends for expectations that new developments need investment in local infrastructure too, rather than just straddling existing stuff with no investment at all.

tty gas boiler crap), set trends for expectations that new developments need investment in local infrastructure too, rather than just straddling existing stuff with no investment at all.Get the housing market representing something half decent in this country, rather than just a race to make some money.

Unless you already are, then how would you be with government built new housing?

Never mind

Derek Chevalier said:

XJ40 said:

Generally as wages and prices inflate, the debt will be erroded over the term of the mortgage and repayments will become less and hence more affordable in real terms. Let's see what happens with interest rates...

Unfortunately the debt erosion due to wage inflation is unlikely to happen this time around unless the link between rates and earnings is removed. Unlikely.Debt erosion will always occur as it's pretty much fundermental to capitalism. The money supply has to rise exponentially, otherwise the system will run out of money to pay interest owed on debt... This increase will always be reflected in asset prices which will inflate accordingly.

And it'll find it's way into peoples pockets as wage inflation. The so called working/unskilled class have seen limited wage growth over the last decade or so due to various factors, currently wage growth is around the 2% mark, so higher than measures of inflation...

XJ40 said:

Derek Chevalier said:

XJ40 said:

Generally as wages and prices inflate, the debt will be erroded over the term of the mortgage and repayments will become less and hence more affordable in real terms. Let's see what happens with interest rates...

Unfortunately the debt erosion due to wage inflation is unlikely to happen this time around unless the link between rates and earnings is removed. Unlikely.Debt erosion will always occur as it's pretty much fundermental to capitalism. The money supply has to rise exponentially, otherwise the system will run out of money to pay interest owed on debt... This increase will always be reflected in asset prices which will inflate accordingly.

And it'll find it's way into peoples pockets as wage inflation. The so called working/unskilled class have seen limited wage growth over the last decade or so due to various factors, currently wage growth is around the 2% mark, so higher than measures of inflation...

Best load up with lots of cheap debt now

XJ40 said:

Mr Whippy said:

Yay wage inflation!

Best load up with lots of cheap debt now

I already have thanks! Best load up with lots of cheap debt now

But some plonkers have their house on the market that we viewed and liked, and they want to sell, but maybe not now, maybe later in the year, despite having an advert left up in the EAs with "no chain" as a highlight selling point.

Fecking muppets.

I'm thinking this is some new selling tactic to make us rush in and offer asking price since this change of heart happened about 2hrs after we asked for a second viewing...

Gassing Station | News, Politics & Economics | Top of Page | What's New | My Stuff