Mortgage.... does it make sense to switch now?

Discussion

Current situation is:

Santander Mortgage, 130k, 35 years, 3.39% fixed for 5 years.

That was 2.5 years ago. Currently £125k outstanding.

HSBC (who we do all our banking with except the mortgage) are doing 1.69% for 5 years.

Does it make sense to switch considering a) £6.3k repayment fee on Santander and b) £750 booking fee for HSBC.

I've used an online calculator and it seems that, with the HSBC offer, total loan would be about 133k so borrowing more. But we could drop to 25 year term keeping the same monthlies, taking 10 years off the term. At the end of Santander's 5 years we'd owe 119k, 2.5 years into HSBC we'd owe 120k (I think) but of course have another 2.5 years at 1.69% before going to variable at 3.69% (which could change of course).

We were also planning to make overpayments anyway so could bring the term down further.

If those rates stayed the same for the terms its a big difference; 222k vs 177k total repayable.

Or does it make more sense to stay put with santander @ 3.39%, make overpayments for the remaining 2.5 years and then switch (hoping the deals are as good as they are now?).

Santander Mortgage, 130k, 35 years, 3.39% fixed for 5 years.

That was 2.5 years ago. Currently £125k outstanding.

HSBC (who we do all our banking with except the mortgage) are doing 1.69% for 5 years.

Does it make sense to switch considering a) £6.3k repayment fee on Santander and b) £750 booking fee for HSBC.

I've used an online calculator and it seems that, with the HSBC offer, total loan would be about 133k so borrowing more. But we could drop to 25 year term keeping the same monthlies, taking 10 years off the term. At the end of Santander's 5 years we'd owe 119k, 2.5 years into HSBC we'd owe 120k (I think) but of course have another 2.5 years at 1.69% before going to variable at 3.69% (which could change of course).

We were also planning to make overpayments anyway so could bring the term down further.

If those rates stayed the same for the terms its a big difference; 222k vs 177k total repayable.

Or does it make more sense to stay put with santander @ 3.39%, make overpayments for the remaining 2.5 years and then switch (hoping the deals are as good as they are now?).

cossy400 said:

Im not clever enough but interested to see what the collective say, as the total repayment figure is a very big eye opener when its a 45 grand saving.

That would be me sold.

It isn't a 45k saving. The OP should only be comparing the difference of the fixed term period ie the next 5 years as after then the rates will be the same under either option.That would be me sold.

paolow said:

if you move now it will cost £6300 but youll save 3250 odd in interest so overall it will cost you nigh on £3k to make this move.

I'd run it till the end of the term and evaluate then - but thats just me

Interesting. I am going to have a go on excel to see if I can work this out. FWIW Santander's VR is about 1% higher than HSBCs at the moment. Again, that is all subject to change, its only the rate today, not in 5 years. I'd run it till the end of the term and evaluate then - but thats just me

Whilst on the subject, I was amazed at how much difference even a modest regular overpayment makes.

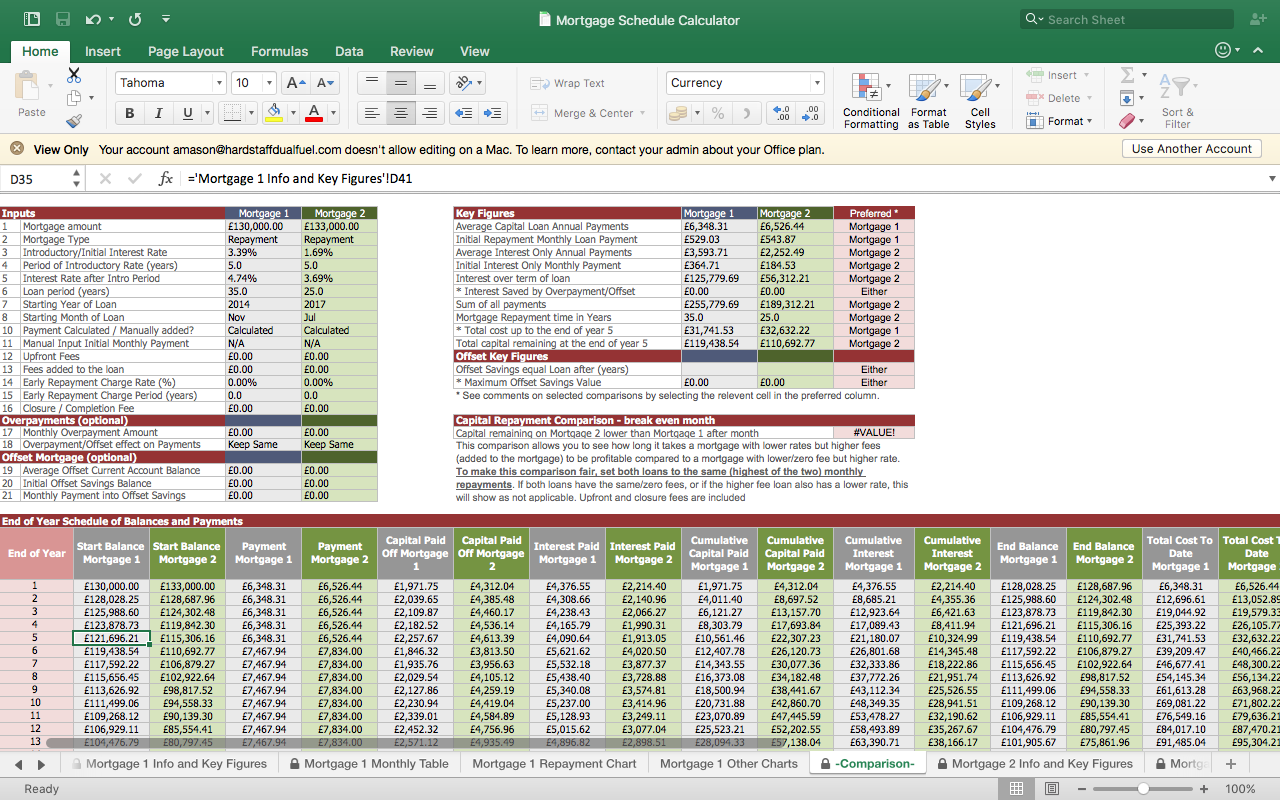

EDIT: I have found a useful spreadsheet on the MSE forums, allows you to compare two mortgages as well.

I assume its actually best to compare where we are now with the other mortgage... i.e. not inputting the original mortgage terms but rather putting in our current position (125k owed, 2.5 years left of the fix) and comparing that to taking out a new mortgage for 133k with HSBC?

Although that discounts all the money spent so far.

EDIT2: Hmmm if I compare both as if doing them from the start, by year 5 total cost of the original santander mortgage is less. But there is less capital outstanding with HSBC. It is hard to try see past the massive difference in total interest spent though (125 k vs 56 k)....but again, assumes variable rates stay the same. Which they wont.

Edited by Otispunkmeyer on Saturday 6th May 15:29

Screen Shot 2017-05-06 at 15.28.30 by Alex Mason, on Flickr

Screen Shot 2017-05-06 at 15.28.30 by Alex Mason, on FlickrOk lets have a look

so did it from the start of both. 130k originally borrowed, 5 year fix @ 3.39, 35 year term and then switch to santander variable at 4.74. Currently 2.5 years in. 2.5 years to go. 125.7k outstanding.

If I changed today. Its 6.3k to jump ship, plus £750 fee. Lets say 133k to mortgage @ 1.69%, 5 year fix, 25 year term, switch to HSBC variable at 3.69 after 5.

So total cost to 5 years is in favour of mortgage 1. But we are out of step here by 2 years, I should be looking at 7 years figures on the original mortgage where Mortgage 1 total cost still wins @ 7 years (assuming variable rates as they are now).

However.... whilst total cost is lower for 1, amount of outstanding capital for 2 is 10k less at that point, term is 20 years vs 28, Cumulative interest paid looks good for 2, until you count interest already paid on 1 and its not much different.

I dunno, its all a bit wood for the trees.

my own meandering mathematics (and non checked spreadsheet!) tells me

£130k 35yrs 3.39%= ~£529.03/mo

after 30 months balance is

after 60 mo balance would be £119,438.54

new mortgage taken now (using your figures it looks like a 5% balance exit fee of £6250 and £750 arrgt)

starting balance £124,942.59 +£6250.00+£750.00

=£131,942.59 25 yrs @1.69% = ~539.55/mo so a £10/mo increase.

after 30 months balance is £121,111.20 comparing this with where you would be by staying = £2k worse off.

after 60 mo balance would be £109,812.71 but this would be 2.5yrs beyond your current end date; who knows what rates will be? but compares favourably if we extrapolate the current mortgage to 90 months (assuming existing rate as a guess - no default to variable as why would you do that?) £113,448.39 you are £3.5k better off.... may be more may be less depending on rates.

if you stuck the £10/mo overpayment in you would have £112,425.27 remaining so £2.5k difference in real terms but still better dependent on rates.

I can see why it’s a tough call. The gamble is what rates will do in 30months as noted above.

Personally I look at balance at the end not term (fixed) or anything else as I would be changing products at this time and term can be set to suit needs (within reason & age)

I am not a financial advisor nor should this be taken as financial advice I enjoy the puzzle and maths which might well be wrong.

Speak to a professional.

Good luck

G

£130k 35yrs 3.39%= ~£529.03/mo

after 30 months balance is

after 60 mo balance would be £119,438.54

=

new mortgage taken now (using your figures it looks like a 5% balance exit fee of £6250 and £750 arrgt)

starting balance £124,942.59 +£6250.00+£750.00

=£131,942.59 25 yrs @1.69% = ~539.55/mo so a £10/mo increase.

after 30 months balance is £121,111.20 comparing this with where you would be by staying = £2k worse off.

after 60 mo balance would be £109,812.71 but this would be 2.5yrs beyond your current end date; who knows what rates will be? but compares favourably if we extrapolate the current mortgage to 90 months (assuming existing rate as a guess - no default to variable as why would you do that?) £113,448.39 you are £3.5k better off.... may be more may be less depending on rates.

if you stuck the £10/mo overpayment in you would have £112,425.27 remaining so £2.5k difference in real terms but still better dependent on rates.

I can see why it’s a tough call. The gamble is what rates will do in 30months as noted above.

Personally I look at balance at the end not term (fixed) or anything else as I would be changing products at this time and term can be set to suit needs (within reason & age)

I am not a financial advisor nor should this be taken as financial advice I enjoy the puzzle and maths which might well be wrong.

Speak to a professional.

Good luck

G

CaptainSlow said:

cossy400 said:

Im not clever enough but interested to see what the collective say, as the total repayment figure is a very big eye opener when its a 45 grand saving.

That would be me sold.

It isn't a 45k saving. The OP should only be comparing the difference of the fixed term period ie the next 5 years as after then the rates will be the same under either option.That would be me sold.

Big ask I know.

CaptainSlow said:

No, you should be putting your current balance for mortgage one with a two year into term as this is what is remaining. then compare after five years. this obviously assumes you don;t move straight off onto another fix if you were to remain with your current lender.

In that case, 1 has remaining captial of 117k, 2 is 115k. 1 has cost 34k, 2 has cost 32k. So 2 is still best, assuming of course we got to the end of our current 5 year fix and just left it going onto variable. Which may well be higher. Not a lot in it.

I think we'll stick and just make some over payments. No idea what rates will do in 2 years, but I suppose if they start creeping upward (as of now they seem to be creeping down or being flat very low), then jumping ship early might be a more clear decision.

Edited by Otispunkmeyer on Sunday 7th May 14:22

Gassing Station | Finance | Top of Page | What's New | My Stuff