Budget 2013: A PHer's Guide

Fuel duty rise and SORN renewals scrapped; road tax exemption extended

The biggest news of all was that the 3p per litre fuel duty rise, which has been postponed for several years and was due to kick in this autumn, will now be cancelled altogether. To put that into context, 10,000 miles of average fuel consumption in a manual Porsche 911 Carrera S will cost £46 less than it would have done, assuming today’s average fuel prices. The Treasury also adds that prices today are 13p per litre cheaper than they would have been under previously-announced plans.

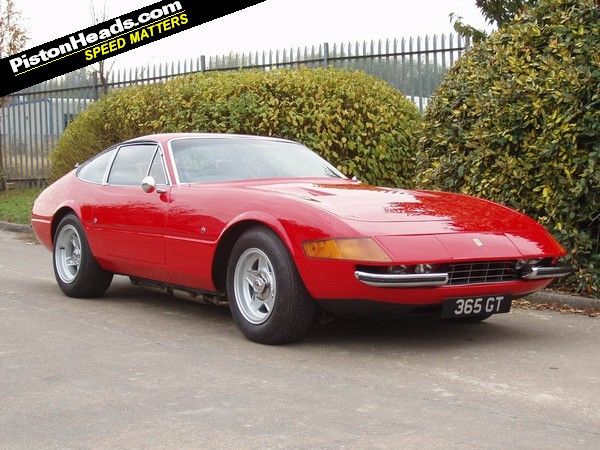

There was more good news for enthusiast motorists, too, with the announcement that the Government’s cut-off date for classic cars’ VED exemption will now be extended by one year, meaning cars produced in 1973, like the gorgeous Ferrari 365 GTB above, will now be tax exempt. There’s no word yet on whether this extension will continue to roll forward in future years, though.

One other significant change for motorists is that SORN declarations will no longer have to be renewed each year. From now on, all SORN applications will be open-ended, and as such will apply until the car’s tax is renewed. What’s more the grace period for failing to display a tax disc once purchased has been extended to 14 days.

"Other transport taxes

2.146 VED rates and bands

– From 1 April 2013 VED rates will increase in line with RPI, apart

from VED rates for heavy goods vehicles (HGVs) which will be frozen in 2013-14. (Finance Bill

2013). The Government has no plans to make significant reforms to the structure of VED for

cars and vans in this Parliament. (58)"

I think this is about £5 per vehicle

http://www.honestjohn.co.uk/news/tax-insurance-and...

I suppose we should be grateful considering what they have done with the fuel duty. However, I suspect its still going to go up anyway and £1.50+ will be the norm in 12 months time.

Gassing Station | General Gassing | Top of Page | What's New | My Stuff