Sold bike, new owner crashes it, old owners responsible??

Discussion

desolate said:

Breadvan72 said:

Here's the possible wrinkle: If a judgment is obtained against the rider of the bike, then section 151 RTA 1988 may compel the insurer to satisfy that judgment. The contract between insured and insured might require the insured to indemnify the insurer against that liability.

Out of interest would the insurer need to prove negligence or is the liability "strict"?(let's not have the row about what strict liability is again!)

otolith said:

It's my understanding that your insurance will pay out to third parties if they suffer damage from your car at the hands of a joyrider.

This link claims, however, that this is at the discretion of the insurer.

http://www.thompsons.law.co.uk/road-traffic-accide...

Where does it say that? I can see that they are saying payments TO you by uninsured drivers are "discretionary" (this is debatable) but I can't see where it says that if an insured car is stolen then the payment is discretionary.This link claims, however, that this is at the discretion of the insurer.

http://www.thompsons.law.co.uk/road-traffic-accide...

desolate said:

otolith said:

It's my understanding that your insurance will pay out to third parties if they suffer damage from your car at the hands of a joyrider.

This link claims, however, that this is at the discretion of the insurer.

http://www.thompsons.law.co.uk/road-traffic-accide...

Where does it say that? I can see that they are saying payments TO you by uninsured drivers are "discretionary" (this is debatable) but I can't see where it says that if an insured car is stolen then the payment is discretionary.This link claims, however, that this is at the discretion of the insurer.

http://www.thompsons.law.co.uk/road-traffic-accide...

So as the owner of the stolen (or in this case, if the same principle holds, sold but still insured) vehicle, your insurer may pay out to a third party if the thief/buyer causes them a loss.

Breadvan72 said:

Negligence would not enter into this. The insurer would be claiming on a contractual indemnity. The original judgment against the rider would have been based on negligence, but that is for present purposes not relevant.

OK. I suppose this would be different if the accident was moments after collection.They could be arguing that the policyholder allowed the rider to ride the bike under the policy.

Breadvan72 said:

That argument would still be rubbish, seconds or months after the sale, as once the bike was sold the vendor could no longer give or refuse permission for the buyer to ride it.

Yes - your honour, you are of course correct.So which bit of the "contract" are they relying on?

BTW anyone else think he MAY have just had a letter from his insurers saying they are dealing with the claim and MAY wish to pursue the matter with him once settled?

The focus of RTA insurance legislation seems to be more about ensuring that someone is on the hook for harm to third parties than who is actually responsible - in the sense that it's difficult for insurers to wriggle out of a third party claim even if the policyholder has been somewhat dishonest. If there is a policy in force on a car, and a third party is injured, I wonder if the insurer's choice comes down to either paying the claim or rejecting the policy from inception?

otolith said:

The focus of RTA insurance legislation seems to be more about ensuring that someone is on the hook for harm to third parties than who is actually responsible - in the sense that it's difficult for insurers to wriggle out of a third party claim even if the policyholder has been somewhat dishonest. If there is a policy in force on a car, and a third party is injured, I wonder if the insurer's choice comes down to either paying the claim or rejecting the policy from inception?

Even if they make the policy void from inception they will still have to pay the claim (in almost all circumstances) and then decide whether to pursue the original policyholder.I cant see the link as it wont open at work but I think I had something similar happen to me.

Sold a car privately, filled out the V5, took the money via bank xfer and off he drove. Sent the V5 on the Monday.

A week later my insurance company calls me about an accident I had, cant remember the exact details but I forgot to cancel my insurance and he was covered by a trade policy which wasn’t linked to specific cars or some such. The 3rd party’s insurance co had done a MID check and my insurance was showing as the only insurance so my company was contracted and claim was logged.

My insurance company said that basically as i hadn’t cancelled my insurance, if he wasn’t insured the claim would/may be logged against me, id loose no claims and have a claim on my record, despite it not being my car anymore or me that was involved.

Luckily the buyer wasn’t trying to pull a fast one and sent my insurance company a copy of his trade policy which was valid, i also provided proof the car was sold when i said it was and it was dropped and went through his insurance (rear ended someone and wrote both off), but could have easily screwed me royally.

Wont be doing that again.

Sold a car privately, filled out the V5, took the money via bank xfer and off he drove. Sent the V5 on the Monday.

A week later my insurance company calls me about an accident I had, cant remember the exact details but I forgot to cancel my insurance and he was covered by a trade policy which wasn’t linked to specific cars or some such. The 3rd party’s insurance co had done a MID check and my insurance was showing as the only insurance so my company was contracted and claim was logged.

My insurance company said that basically as i hadn’t cancelled my insurance, if he wasn’t insured the claim would/may be logged against me, id loose no claims and have a claim on my record, despite it not being my car anymore or me that was involved.

Luckily the buyer wasn’t trying to pull a fast one and sent my insurance company a copy of his trade policy which was valid, i also provided proof the car was sold when i said it was and it was dropped and went through his insurance (rear ended someone and wrote both off), but could have easily screwed me royally.

Wont be doing that again.

Well this has gone off on several tangents.

In a nutshell if a vehicle has insurance then that insurer is liable for all damage whether it's their insured driving or not. That's part of the RTA rules, of which there are hundreds of weird ones.

There is no chance of the insurer being able to recover their outlay from the actual insured unless they follow a defined process which makes it much more expensive than just settling. Even then there is no guarantee of recovery, even if the underwriter chooses to proceed.

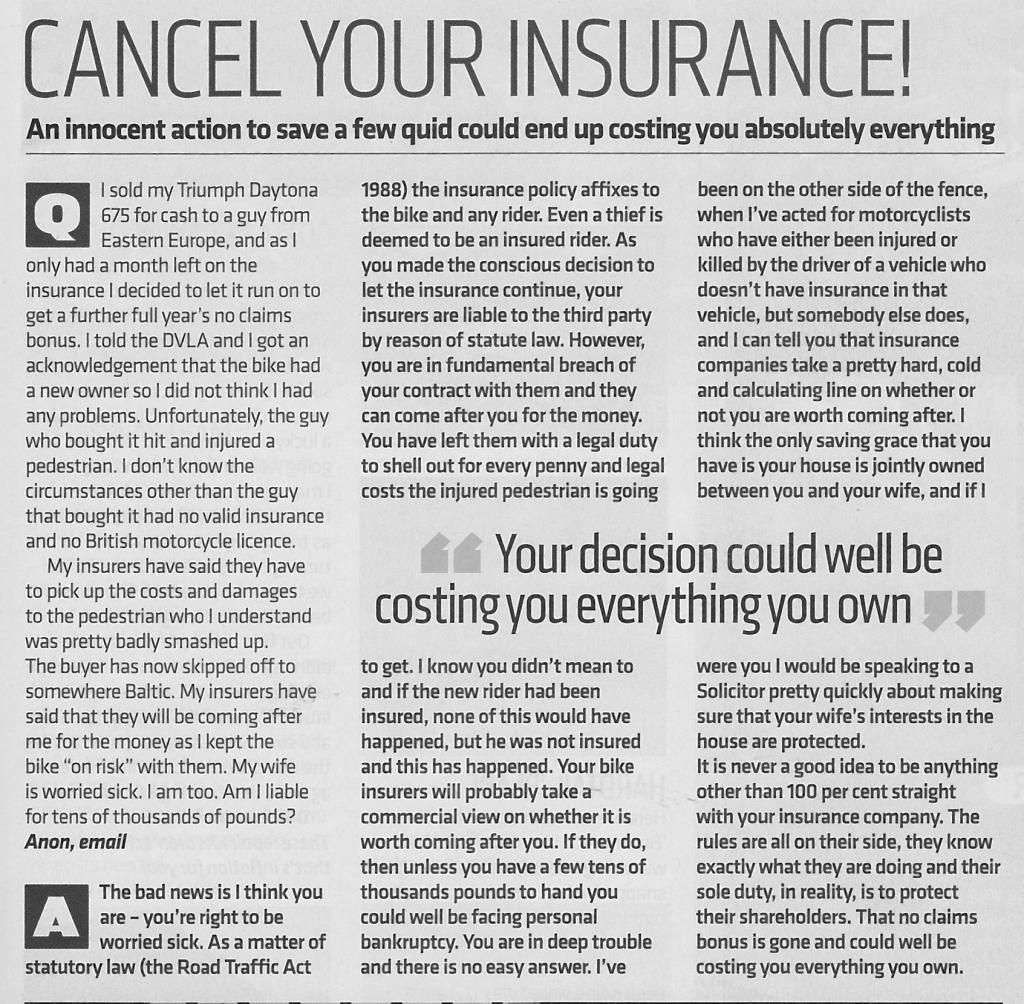

This is lazy journalism allied to a "bike specialist" solicitor looking for some free publicity.

In a nutshell if a vehicle has insurance then that insurer is liable for all damage whether it's their insured driving or not. That's part of the RTA rules, of which there are hundreds of weird ones.

There is no chance of the insurer being able to recover their outlay from the actual insured unless they follow a defined process which makes it much more expensive than just settling. Even then there is no guarantee of recovery, even if the underwriter chooses to proceed.

This is lazy journalism allied to a "bike specialist" solicitor looking for some free publicity.

The good news on this, from the vendor's point of view, is that the claim probably isn't as big as it might appear.

I don't think anyone is suggesting that there is any liability of the insured to either the rider or his dependents.

The claim for damage to the Yaris and any injuries to the driver or passengers may stand and may be substantial, as may any bills from police and ambulance, but by and large the costs here should be almost as low as it is possible for the costs of any fatal RTA to be.

There is also a question as to whether the vendor actually caused or permitted the use by that person for s.151 (8) (b). I think 'permitted' is out because he had no power to restrict, given that he had sold the bike, but 'caused' (by not refusing to sell the bike) may be a stronger argument, subject to case law of course.

In fact the meaning of cause or permit is discussed at Wilkinson's 1.159 - 1.192 according to CPS - could someone confirm? There is case law (Lloyd-Wolper v Moore) which says that the same definition for cause or permit should be used in interpreting s.151 (8) as would apply for the offence under s.143 (1) (b) so the question is whether, for the purposes of s.143 (1) (b) an offence was committed (ignoring any public interest test).

I don't think anyone is suggesting that there is any liability of the insured to either the rider or his dependents.

The claim for damage to the Yaris and any injuries to the driver or passengers may stand and may be substantial, as may any bills from police and ambulance, but by and large the costs here should be almost as low as it is possible for the costs of any fatal RTA to be.

There is also a question as to whether the vendor actually caused or permitted the use by that person for s.151 (8) (b). I think 'permitted' is out because he had no power to restrict, given that he had sold the bike, but 'caused' (by not refusing to sell the bike) may be a stronger argument, subject to case law of course.

In fact the meaning of cause or permit is discussed at Wilkinson's 1.159 - 1.192 according to CPS - could someone confirm? There is case law (Lloyd-Wolper v Moore) which says that the same definition for cause or permit should be used in interpreting s.151 (8) as would apply for the offence under s.143 (1) (b) so the question is whether, for the purposes of s.143 (1) (b) an offence was committed (ignoring any public interest test).

LoonR1 said:

That requirement is now waived within the RTA although many insurers still ask for the cert to be returned. Obviously that causes a bit of confusion when it was provided in soft copy via email.

Best one of those was them agreeing that replying to the original mail that had the PDF attached counted as returning the certificate

MikeO996 said:

"He was released from jail last month and went on holiday to Bulgaria with his girlfriend."

Hardly a crime I'd have thought.....

Yeah i couldn't quite figure out what this had to do with the story, looks to me from the picture like the accident happened in UK Hardly a crime I'd have thought.....

so he went on holiday to Bulgaria, with his girlfriend, returned to UK safe and sound, i wonder what other unrelated stuff they could fit in, maybe he had readybrek for breakfast, and subway for lunch 3 days before the accident

Gassing Station | Speed, Plod & the Law | Top of Page | What's New | My Stuff