Daily Dreaming - what are you looking at?

Discussion

Bibbs said:

Colonial said:

Nope.

I don't get Australian or us cars unless they are old cruisers

Different strokes and all that.I don't get Australian or us cars unless they are old cruisers

Where the thought of owning a BMW or a Euro hatchback sh*ts me to tears.

Pommygranite said:

I think to own it would be amusing but on the buying/value side of things -

And I agree, throwing $20k at a $20k car is madness. But I've done similar before.The issue I have with the GenF is that only the GTS gets the LSA, and that's $100k.

Also, is there a series 2 round the corner? Flappy paddles and LT4?

A swan song for the Commodore?

Agreed - love the diversity.

I think I'm too tight to do it. Everyone who does it loses fortunes, some have mega issues that need permanently continuously fixing and the end result is a car worth the same/less than when you started burning $50 notes...but I do respect those who do it.

I think I'm too tight to do it. Everyone who does it loses fortunes, some have mega issues that need permanently continuously fixing and the end result is a car worth the same/less than when you started burning $50 notes...but I do respect those who do it.

Pommygranite said:

Agreed - love the diversity.

I think I'm too tight to do it. Everyone who does it loses fortunes, some have mega issues that need permanently continuously fixing and the end result is a car worth the same/less than when you started burning $50 notes...but I do respect those who do it.

Yup, I just wish people would stop getting so excited about the latest diesel Fiesta though. I think I'm too tight to do it. Everyone who does it loses fortunes, some have mega issues that need permanently continuously fixing and the end result is a car worth the same/less than when you started burning $50 notes...but I do respect those who do it.

I've stopped with the major modifying game now (I'll always tweak).

If I want a faster car, I'll just save and buy one.

There's a '88 911 turbo on carsales for $58k, what am I missing? Surely it should be $100k?

It's a uk import but has reasonable mileage and looks in decent shape?

Something seems not right though, it's been on for a few months, has a s t write up and is listed as an '86 but the wording states '88 plus buyer states it's a 3.2 whereas the detail specs correctly list it as a 3.3.

t write up and is listed as an '86 but the wording states '88 plus buyer states it's a 3.2 whereas the detail specs correctly list it as a 3.3.

If it's genuine someone should snap up a bargain - if only I had the space!

It's a uk import but has reasonable mileage and looks in decent shape?

Something seems not right though, it's been on for a few months, has a s

t write up and is listed as an '86 but the wording states '88 plus buyer states it's a 3.2 whereas the detail specs correctly list it as a 3.3.

t write up and is listed as an '86 but the wording states '88 plus buyer states it's a 3.2 whereas the detail specs correctly list it as a 3.3.If it's genuine someone should snap up a bargain - if only I had the space!

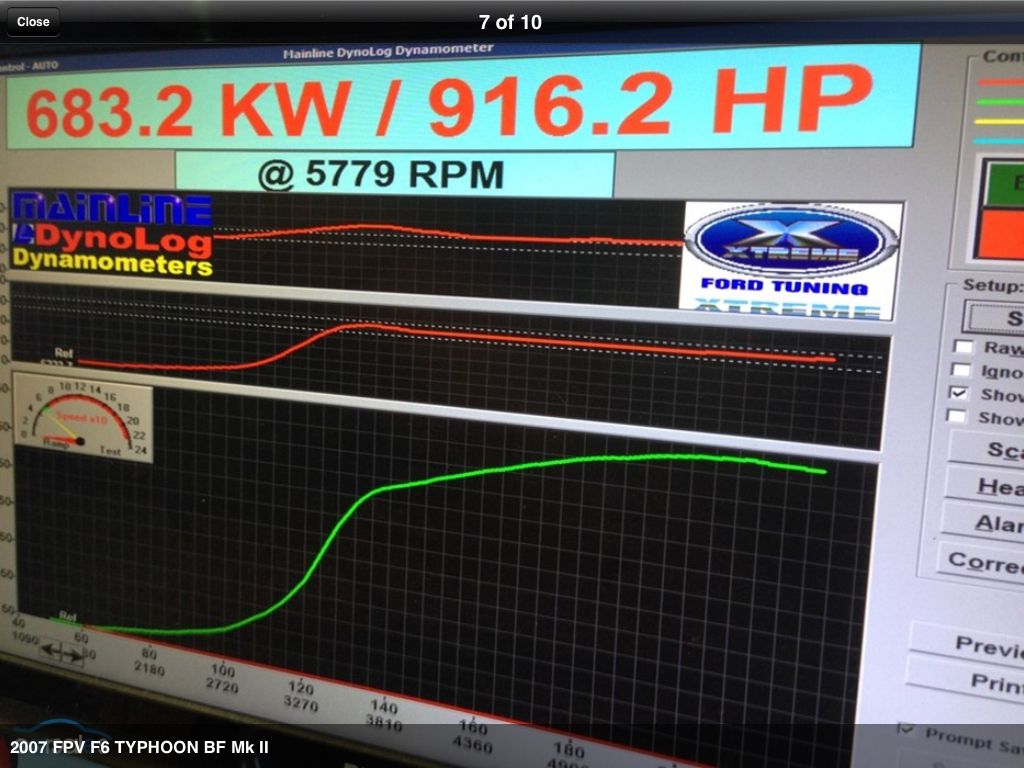

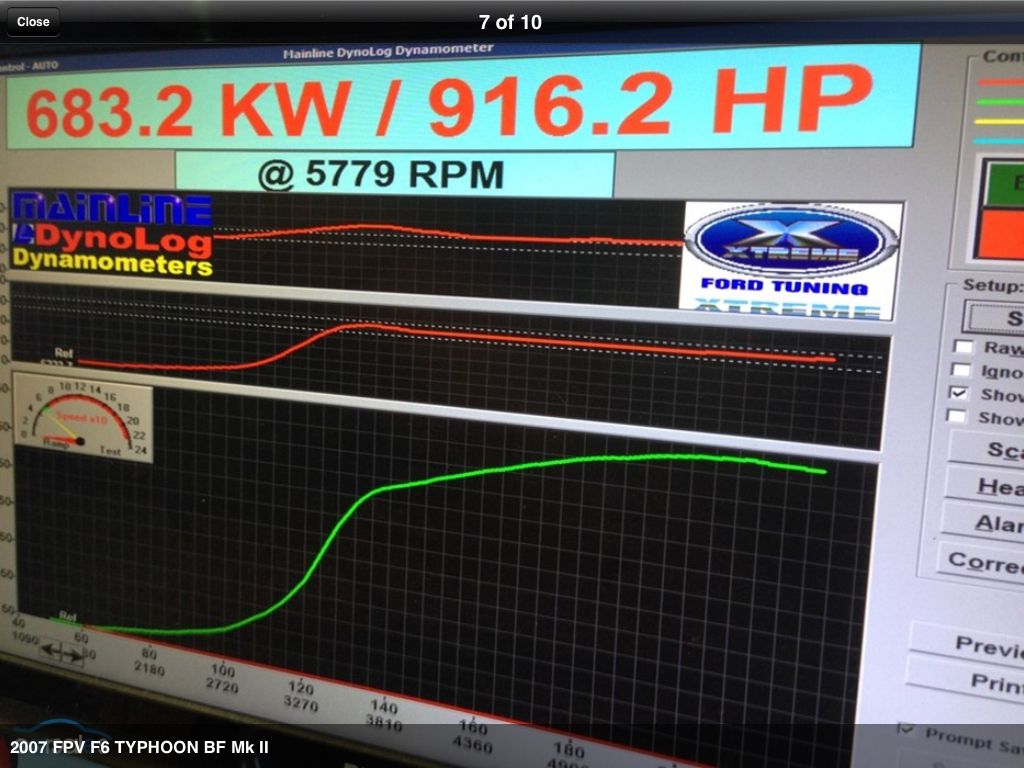

$50,000 for a 7 year old FPV?

Ad says 9 sec 1/4 mile...

Ps found a video - nippy...

http://m.youtube.com/watch?v=S6Zbh8zdf0g

Ad says 9 sec 1/4 mile...

Ps found a video - nippy...

http://m.youtube.com/watch?v=S6Zbh8zdf0g

Edited by Pommygranite on Sunday 20th July 23:46

In a country where good handling is rarely required a love of lots of power, kit and just big engine is surely justifiable?

I mean yes it's pretty much an American Hyundai with a big engine but for some unfathomable reason I have much want for this- I mean at $45k for a 2013 its exceptional value.

I mean yes it's pretty much an American Hyundai with a big engine but for some unfathomable reason I have much want for this- I mean at $45k for a 2013 its exceptional value.

Looks like a smashed Camry.

If the actual year of the car does not bother you there are some interesting / quirky options out there for under $50k.

http://www.carsales.com.au/private/details/Mercede...

http://www.carsales.com.au/private/details/Audi-RS...

For a really odd choice: http://www.carsales.com.au/private/details/Jaguar-...

If the actual year of the car does not bother you there are some interesting / quirky options out there for under $50k.

http://www.carsales.com.au/private/details/Mercede...

http://www.carsales.com.au/private/details/Audi-RS...

For a really odd choice: http://www.carsales.com.au/private/details/Jaguar-...

papahet said:

Looks like a smashed Camry.

If the actual year of the car does not bother you there are some interesting / quirky options out there for under $50k.

http://www.carsales.com.au/private/details/Mercede...

http://www.carsales.com.au/private/details/Audi-RS...

For a really odd choice: http://www.carsales.com.au/private/details/Jaguar-...

If the actual year of the car does not bother you there are some interesting / quirky options out there for under $50k.

http://www.carsales.com.au/private/details/Mercede...

http://www.carsales.com.au/private/details/Audi-RS...

For a really odd choice: http://www.carsales.com.au/private/details/Jaguar-...

couldn't disagree with you there. The age is important due to the financing/depreciation offset requirements.

couldn't disagree with you there. The age is important due to the financing/depreciation offset requirements.Still like it

papahet said:

Feels like madness to get in to finance and dealing with depreciation and offsets when there is a s t load of cars out there for under $25K...even the previous gen Hemi 300C.

t load of cars out there for under $25K...even the previous gen Hemi 300C.

Actually it works out well. t load of cars out there for under $25K...even the previous gen Hemi 300C.

t load of cars out there for under $25K...even the previous gen Hemi 300C.For instance if you buy say a car that is over 5 years old for $25k then you are looking at normal financing without balloons (generally) and perhaps a slightly higher interest rate. If you borrow over 4-5 years it wont be worth a huge amount at the end.

If you go for a near new vehicle you can get a good balloon, good rate and a monthly cost pretty much at the same cost as the old car but the real kicker is that you can claim (in my case as its for business use) the depreciation offset against your personal tax bill.

This is why my old Falcon at $700pm Gross Cost to me became an end of year Net cost of about $300pm after tax return - near enough the same cost as the older car if I just financed outright.

Now there is the matter that at the end you have some value left in the older car once the loan is fulfilled but its perhaps offset against the luxury of having a near new car.

Makes a lot of sense once the financials are dealt with.

Talking Finance Deals I see the Lotus Dealer's now have 2% on offer...

Makes me think about this:

http://www.carsales.com.au/bncis/details/Lotus-Exi...

Except I'd definitely lose my licence.

While on that matter and using 'man-logic' to the max, I could just about stretch to this:

http://www.carsales.com.au/private/details/Mclaren...

Assuming he'd take my 2014 Range Rover Vogue as a part/ex that is.

Makes me think about this:

http://www.carsales.com.au/bncis/details/Lotus-Exi...

Except I'd definitely lose my licence.

While on that matter and using 'man-logic' to the max, I could just about stretch to this:

http://www.carsales.com.au/private/details/Mclaren...

Assuming he'd take my 2014 Range Rover Vogue as a part/ex that is.

papahet said:

So how much business use do you actually need to be able to get these sorts of figures? Is it a % of total KMS travelled or something?

It's very simple.

D1 Work-related car expenses 2014

For information about what expenses you claim as car expenses (item D1) and what expenses you claim as travel expenses (item D2), and some examples of trips you can and cannot claim, see Car and travel expenses.

This question is about work-related expenses you incurred as an employee for a car you:

owned (even if it is not registered in your name)

leased (even if it is not registered in your name), or

hired under a hire-purchase agreement.

Owned or leased cars

You can claim at this item your work-related expenses for using a car that you owned, leased or hired (under a hire-purchase agreement).

You cannot claim at this item any expenses relating to a car owned or leased by someone else, including your employer or another member of your family. However, we consider you to be the owner or lessee of a car and eligible to claim expenses where a family or private arrangement made you the owner or lessee even though you were not the registered owner. For example, we would allow you to claim for a family car that was given to you as a birthday present and which, although it was not registered in your name, you used as your own and for which you paid all expenses.

If you owned or leased a car or hired one under a hire-purchase agreement, you can use one of the four methods explained in this question to claim your work-related car expenses.

Depending on the method you choose, you will need to know or estimate your business kilometres. Business kilometres are the kilometres you travelled in the car in the course of using it for work-related purposes.

Did you have any of these work-related car expenses?

No

Go to question D2 Work-related travel expenses, or

return to main menu Individual tax return instructions.

Yes

Read on.

Answering this question

You may need:

written evidence for your car expenses (receipts, invoices or diary entries)

your car logbook and odometer records.

You can choose one of four methods to work out your car expenses. If you qualify to use more than one method, you can use whichever gives you the largest deduction or is most convenient. These methods are:

cents per kilometre

12% of original value

one-third of actual expenses

logbook.

They are summarised below.

You must have the necessary evidence for the method you choose.

Each method requires you to know or estimate your business kilometres. Business kilometres are the kilometres you travelled in the car in the course of earning assessable income (includes work-related activities). For some examples of trips you can and cannot claim, see Car and travel expenses.

We also have online calculators to assist you: go to ato.gov.au/calculators

If you received assessable income from your work as an employee outside Australia that is shown on a PAYG payment summary - foreign employment, you must claim any work-related car expenses you incurred in earning that income at this item.

If you received assessable foreign employment income that is not shown on a PAYG payment summary - foreign employment you must claim your deductions against that income at item 20 Foreign source income and foreign assets or property.

Deductions for decline in value (depreciation)

You can claim a deduction for the decline in value of the car only if you owned it or hired it under a hire-purchase agreement and you must use either the 'one-third of actual expenses' or the 'logbook' method.

If you leased a luxury car, see Special circumstances and glossary for more information.

Remember:

The car starts to decline in value from the day you first use it, even if you don't begin using it for work until a later time.

You can claim a deduction only for a year in which you used the car for work.

If you used the 'logbook' method and owned your car for only part of the year, you will need to apportion your deduction accordingly.

If you are claiming a deduction for the decline in value of a car, see the Guide to depreciating assets 2014 (NAT 1996).

Was your car sold, disposed of, stolen or destroyed?

If you have been claiming deductions for your car and, during the income year, you sold or disposed of it, or it was stolen or destroyed, you might need to make a balancing adjustment. You do not need to make a balancing adjustment if you used only the 'cents per kilometre' or '12% of original value' method for calculating expenses for your car.

The publication Guide to depreciating assets 2014 explains how to work out the amount of the balancing adjustment.

If you had a loss after making the adjustment, include your deduction for it at item D5. If you had a profit after making your adjustment, include it at item 24 on your tax return.

You also make a balancing adjustment if you:

switched between the 'one-third of actual expenses' method and the 'logbook' method, or

switched between the 'one-third of actual expenses' or 'logbook' method and the 'cents per kilometre' or '12% of original value' method.

To work out the amount of the balancing adjustment in these situations, contact us or your recognised tax adviser.

Completing your tax return

If you have more than one car and you are claiming expenses under different methods, add the amounts you work out under each method and write the total at item D1 on your tax return. Print the code letter for the method that gave you the largest amount in the CLAIM TYPE box beside the amount.

Method 1: Cents per kilometre

Your claim is based on a set rate for each business kilometre.

You can claim a maximum of 5,000 business kilometres per car, per year.

You do not need written evidence, but you need to be able to show how you worked out your business kilometres. There is more information on record keeping and written evidence in Keeping your tax records.

Step 1

Multiply the total business kilometres travelled (maximum of 5,000 km per car) by the number of cents allowed for your car's engine capacity (see below).

Rates per business kilometre

Rates per business kilometre

Engine capacity

Cents per kilometre

Ordinary engine

Rotary engine

1.6 litre (1,600cc) or less

0.8 litre (800cc) or less

65 cents

1.601-2.6 litre (1,601-2,600cc)

0.801-1.3 litre (801-1,300cc)

76 cents

2.601 litre (2,601cc) and over

1.301 litre (1,301cc) and over

77 cents

Step 2

Divide your answer by 100 to work out the dollar amount you can claim.

Step 3

If you are claiming for more than one car using this method, repeat the steps above and add up all the amounts.

Step 4

Write the total at A item D1. Print the code letter S in the CLAIM TYPE box beside the amount.

Example

Joanne had a 2-litre ordinary engine car which she used to travel 300 km in performing her job during 2013-14. She claims a deduction of $228.

Method 2: 12% of original value

For you to use this method, your car must have travelled more than 5,000 business kilometres in the income year (or, if you used the car for only part of the year it would have travelled more than 5,000 business kilometres had you used it for the whole year, see step 1 below).

Your claim is based on 12% of the original cost of your car, or 12% of its market value at the time you first leased it.

The maximum deduction you can claim is 12% of the car limit for the year you first used or leased the car; see Special circumstances and glossary for car limits for the last 10 years.

You do not need written evidence, but you need to keep a record of how you worked out your kilometres.

Step 1

If you owned or leased your car for the whole year, go to step 2.

If you owned or leased the car for part of the year, you will need to work out whether you can use this method. Firstly, work out the number of business kilometres travelled and multiply that number by 365. Then divide this amount by the number of days you had the car during the year. If your answer is more than 5,000 km you can use this method.

Step 2

Multiply the cost of the car or car limit, whichever is less, by 0.12.

Step 3

Go to step 5 if you owned or leased the car for the whole year.

Step 4

If you had the car for part of the year, multiply the amount you worked out at step 2 by the number of days you had the car. Then divide by 365.

Step 5

Write the total at A item D1. Print the code letter T in the CLAIM TYPE box beside the amount.

Method 3: One-third of actual expenses

Your car must have travelled more than 5,000 business kilometres in the income year (or, if you used the car for only part of the year it would have travelled more than 5,000 business kilometres had you used it for the whole year, see step 1 below).

You claim one-third of all your car expenses, including private costs (but excluding capital costs, such as the purchase price, the principal on any money borrowed to buy your car and the cost of any improvements).

For fuel and oil costs, you can keep receipts to work out the amounts or you can estimate them based on odometer records that show readings from the start and the end of the period you had the car during the year.

You need written evidence for all the other expenses for the car as well as records that show the car's engine capacity, make, model and registration number.

You may need to show how you worked out your business kilometres and any estimates you made.

Step 1

If you owned or leased your car for the whole year, go to step 2.

If you owned or leased the car for part of the year, you will need to work out whether you can use this method. Firstly, work out the number of kilometres travelled and multiply that number by 365. Then divide this amount by the number of days you had the car during the year. If your answer is more than 5,000 km you can use this method.

Step 2

Add up your total expenses for fuel and oil, registration, insurance, loan interest, repairs and maintenance, the decline in value or lease payments and any other costs of running your car. Work out the amount to show here for decline in value.

Step 3

Divide the total expenses by 3.

Step 4

Write the amount at A item D1. Print the code letter O in the CLAIM TYPE box beside the amount.

Method 4: Logbook

Your claim is based on the business use percentage of the expenses for the car.

Expenses include running costs and decline in value but not capital costs, such as the purchase price of your car, the principal on any money borrowed to buy it and any improvement costs. If you need to work out the decline in value of your car, see Deductions for decline in value (depreciation).

To work out your business use percentage, you need a logbook and the odometer readings for the logbook period (see below).

You can claim fuel and oil costs based on either your actual receipts or you can estimate the expenses based on odometer records that show readings from the start and the end of the period you had the car during the year.

You need written evidence for all other expenses for the car.

Your business use percentage is the percentage of kilometres you travelled in the car for work during the year divided by the total kilometres travelled by the car during the year.

If the pattern of your car use changed during the year, make a reasonable estimate of your business use percentage for the whole of 2013-14, taking into account your logbook, odometer and other records, any variations in the pattern of use of your car and any changes in the number of cars you used in the course of earning your income.

Logbook period

Your logbook is valid for five years. If this is the first year you are using this method, you must have kept a logbook during 2013-14. It must cover at least 12 continuous weeks. If you started using your car for work-related purposes less than 12 weeks before the end of the year, you can extend the 12-week period into 2014-15. (If you are using the logbook method for two or more cars, the logbook for each car must cover the same period.)

If you established your business use percentage using a logbook from an earlier year, you need to keep that logbook and maintain odometer records. You also need to keep a logbook if we told you in writing to keep one.

Your logbook must show:

when the logbook period starts and ends, and the odometer readings at these times

the total number of kilometres the car travelled during the logbook period

the number of kilometres travelled for work during the logbook period based on the journeys recorded for the period

the business use percentage for the period.

Entries in the logbook for each business trip must be made at the end of the journey (or as soon as possible afterwards) and show the:

date the journey began and ended

odometer readings at the start and end of the journey

kilometres travelled on the journey

reason for the journey.

Your records must also show the make, model, engine capacity and registration number of the car.

Step 1

Work out the total kilometres travelled during the logbook period and how many of these were business kilometres. Divide the business kilometres by the total kilometres travelled. This is your business use percentage.

Step 2

Add up your total expenses. (See Deductions for decline in value (depreciation) to work out the amount to include for decline in value.)

Step 3

Multiply the amount at step 2 by your business use percentage from step 1 (or if the pattern of use of the car has changed then use the reasonable estimate you made).

Step 4

Write the amount at A item D1. Print the code letter B in the CLAIM TYPE box beside the amount.

Or...if your car does 20,000kms pa and 16,000 of that was business use then 80% of your usage is deductible.

So if your car service was $100, $80 is deductible (80%) which if your tax rate is 40% means $32 comes back as a rebate (if you've paid full tax on PAYG). Or something like that.

With regards to depreciation, I think 25% of the cars purchase value is deductible in the first year, so if your car was $40k, $10k is deductible and with a 40% tax rate means $4k comes back in your return, which if your car isn't $600 pm finance cost has really only cost $3200 in the first year. Or something like that.

Once a car is older than 3 yrs the depreciation schedule doesn't give a great return, hence many cars getting ditched at 3yrs old and explaining why a new/ish car can be a better financial deal than an older cheaper car.

So if your car service was $100, $80 is deductible (80%) which if your tax rate is 40% means $32 comes back as a rebate (if you've paid full tax on PAYG). Or something like that.

With regards to depreciation, I think 25% of the cars purchase value is deductible in the first year, so if your car was $40k, $10k is deductible and with a 40% tax rate means $4k comes back in your return, which if your car isn't $600 pm finance cost has really only cost $3200 in the first year. Or something like that.

Once a car is older than 3 yrs the depreciation schedule doesn't give a great return, hence many cars getting ditched at 3yrs old and explaining why a new/ish car can be a better financial deal than an older cheaper car.

robm3 said:

Talking Finance Deals I see the Lotus Dealer's now have 2% on offer...

Makes me think about this:

http://www.carsales.com.au/bncis/details/Lotus-Exi...

Except I'd definitely lose my licence.

While on that matter and using 'man-logic' to the max, I could just about stretch to this:

http://www.carsales.com.au/private/details/Mclaren...

Assuming he'd take my 2014 Range Rover Vogue as a part/ex that is.

Do it! Makes me think about this:

http://www.carsales.com.au/bncis/details/Lotus-Exi...

Except I'd definitely lose my licence.

While on that matter and using 'man-logic' to the max, I could just about stretch to this:

http://www.carsales.com.au/private/details/Mclaren...

Assuming he'd take my 2014 Range Rover Vogue as a part/ex that is.

Actually what's the RR like? They look fabulous.

Gassing Station | Australia | Top of Page | What's New | My Stuff