It's looking grim again. Is gold the would-be saviour?

Discussion

I've got some investment in physical gold, so been watching proceedings over the last few months with more than passing interest.

Gold (and my investment therefore!) has taken a beating in the last few weeks, after pulling strongly to 1800 from a similar low in September.

I wish I had the sort of in-depth knowledge of the economy and related behaviours that would explain what we can expect from gold going forward.

I guess, my layman’s view is reflected in this article. Then again, my hoping it’s right doesn’t make it so!

http://www.goldmadesimplenews.com/gold/gold-price-...

[i]You are here: Gold News // Analysis // Gold price breaks down through the 200 daily moving average

Wednesday, December 14th, 2011 | Posted by Thomas PatersonGold price breaks down through the 200 daily moving average

Yesterday when gold was trading $1665 we warned:

This $1617 level is really the last line in the sand before we might see lower prices. We will have a much clearer idea where gold is heading in the next few hours and days, but right now gold is right at some crucial levels and should be watched very keenly.

About two hours after we wrote that the gold price quickly broke down and headed towards the 200 daily moving average at around $1617.

Gold has now broken through this level and is now trading around $1605.

As you can see from the chart we have to go back all the way to the start of 2009 for the last time gold broke through its 200 DMA.

So what is happening? Well, it’s just the small matter of the dawning realization that all those gimmicks we pulled globally back in 2008 simply postponed the pain and papered over the fact that the entire global banking system is insolvent.

But this time its much worse, in a bid to ‘bail out’ the banks all sovereign countries have done is pile on huge debts on the backs of an already over indebted taxpayer – so now we are also faced with the insolvency of pretty much all western nations too. Not a nice thought.

So now we have banks not willing to lend to one another (again) and insolvent banks desperately trying to find ‘liquidity’ to roll the great ponzi experiment over for another month. One way to grab some liquidity is the forced sale of gold – this is what is pushing down the gold price.

The action in gold is very reminiscent. of 2008 when gold was chopped by a 1/3 going from $1000 to $700 as the scramble for liquidity was well and truly ‘on’.

With hindsight it was clear that buying gold back then was one of the smartest things you could have done in the face of the ‘great liquidation’. The fundamentals haven’t changed a bit and in fact a stronger now than ever for gold – will this prove to be another ‘smartest things you could have done’ moment a year from now?[/i]

p.s. why can't I format the text above? I'm using the right tags?

Gold (and my investment therefore!) has taken a beating in the last few weeks, after pulling strongly to 1800 from a similar low in September.

I wish I had the sort of in-depth knowledge of the economy and related behaviours that would explain what we can expect from gold going forward.

I guess, my layman’s view is reflected in this article. Then again, my hoping it’s right doesn’t make it so!

http://www.goldmadesimplenews.com/gold/gold-price-...

[i]You are here: Gold News // Analysis // Gold price breaks down through the 200 daily moving average

Wednesday, December 14th, 2011 | Posted by Thomas PatersonGold price breaks down through the 200 daily moving average

Yesterday when gold was trading $1665 we warned:

This $1617 level is really the last line in the sand before we might see lower prices. We will have a much clearer idea where gold is heading in the next few hours and days, but right now gold is right at some crucial levels and should be watched very keenly.

About two hours after we wrote that the gold price quickly broke down and headed towards the 200 daily moving average at around $1617.

Gold has now broken through this level and is now trading around $1605.

As you can see from the chart we have to go back all the way to the start of 2009 for the last time gold broke through its 200 DMA.

So what is happening? Well, it’s just the small matter of the dawning realization that all those gimmicks we pulled globally back in 2008 simply postponed the pain and papered over the fact that the entire global banking system is insolvent.

But this time its much worse, in a bid to ‘bail out’ the banks all sovereign countries have done is pile on huge debts on the backs of an already over indebted taxpayer – so now we are also faced with the insolvency of pretty much all western nations too. Not a nice thought.

So now we have banks not willing to lend to one another (again) and insolvent banks desperately trying to find ‘liquidity’ to roll the great ponzi experiment over for another month. One way to grab some liquidity is the forced sale of gold – this is what is pushing down the gold price.

The action in gold is very reminiscent. of 2008 when gold was chopped by a 1/3 going from $1000 to $700 as the scramble for liquidity was well and truly ‘on’.

With hindsight it was clear that buying gold back then was one of the smartest things you could have done in the face of the ‘great liquidation’. The fundamentals haven’t changed a bit and in fact a stronger now than ever for gold – will this prove to be another ‘smartest things you could have done’ moment a year from now?[/i]

p.s. why can't I format the text above? I'm using the right tags?

AdvocatusD said:

Heard on the grape vine that Bank Calyon (a french bank) is closing their derivatives and commodities desk, and the slump is the impact of the closure.

Lord knows what's real anymore!

Really? One french bank stops dealing in it and Gold drops 10%? Lord knows what's real anymore!

And you think that might be a safe investment.............................

REALIST123 said:

AdvocatusD said:

Heard on the grape vine that Bank Calyon (a french bank) is closing their derivatives and commodities desk, and the slump is the impact of the closure.

Lord knows what's real anymore!

Really? One french bank stops dealing in it and Gold drops 10%? Lord knows what's real anymore!

And you think that might be a safe investment.............................

frosted said:

Is it to do with the fact people are not buying jewelry and big electronic items as much ?

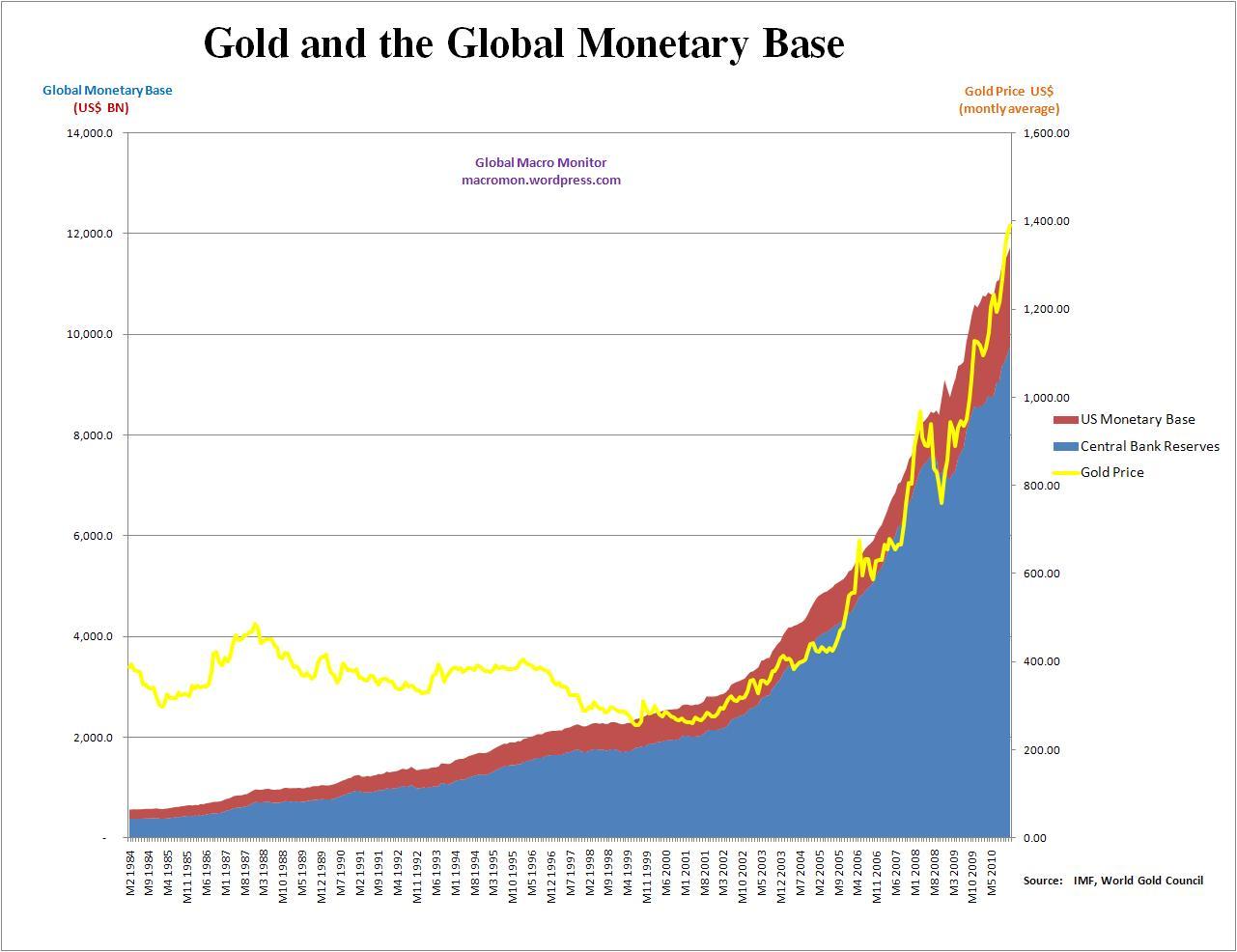

Jewelry. coins and industrial volumes are nowadays completely dwarfed by derivative and OTC volumes. It is these two that really move the market.Gold has also been converted to equity which now means that pensions and other investment vehicles that would preclude futures etc can take direct exposure.

The absolutely massive growth in synthetic financial products based on gold funnily shows a remarkable correlation to the price of the raw material.

What this means is that the forced flight out of gold would be infinitely greater than any flight into gold. I.e as funds, investors etc hit margin call issues in a declining market they will be forced sellers of holdings such as gold.

It is likely that China's pegging to the USD announced yesterday has kind of confirmed the growing belief that China is hedging itself from a Euro collapse. If the Euro does collapse a lot of gold and synthetic gold is likely to be hitting the market as trouble investors have to cash in.

This guy may well have a gold position to sell or may not.....

http://www.telegraph.co.uk/finance/financevideo/yo...

http://www.telegraph.co.uk/finance/financevideo/yo...

Ozzie Osmond said:

And people wonder why the City turns out to be nothing but a load of hot air!!

Although one has to wonder what the guy running the unregulated ponzu scheme from a large house in Luton, or the blokes in the Midlands writing doom and gloom advertorial research for coin vendors, or any number of comment and thieves have to do with the City. The trouble is that where you have wealth you have the little parasites who claim to be part of it while pedalling lies and faeces to mugs who want to get involved in it.

There was a married couple up north who banked over £23m in 2010 selling this worthless drivel to idiots.

Will watch the linky when I get a moment (or 1.30hours anyway!).

Interesting article this: http://moneymorning.com/2011/12/15/dont-be-fooled-...

It was interesting reading, well poised, etc until the writer had to go and spoil it by saying USD 5000 expected "after that (2012)"!

I really doubt that will happen.

Interesting article this: http://moneymorning.com/2011/12/15/dont-be-fooled-...

It was interesting reading, well poised, etc until the writer had to go and spoil it by saying USD 5000 expected "after that (2012)"!

I really doubt that will happen.

98elise said:

When the s t hits the fan a pile of gold will be useless.

t hits the fan a pile of gold will be useless.

What you need is guns and food......and maybe a black car with a supercharger

Nope, what you need is a tank. Then anyone in a black car with a supercharger is just easy meat. t hits the fan a pile of gold will be useless.

t hits the fan a pile of gold will be useless.What you need is guns and food......and maybe a black car with a supercharger

As for Gold. Yes I think ultimately its better than a Euro or even a dollar but when it comes down to it it just looks good. It has no intrinsic value so perhaps investing in something practical would make sense if you really thinks its going to get very bad.

Gassing Station | News, Politics & Economics | Top of Page | What's New | My Stuff