The damage of taxation

Discussion

Ozzie Osmond said:

How on earth does a 20% tax on profits stifle anything?!

Because businesses - once they reach a certain size - have to generate more than 20% to keep anything back for growth and investment. Does this simple explanation help you or shall I elucidate further?VAT, which you subsequntly mention is largely neutral for B2B although increasing it (as our idiot chancellor did, right in the midst of the credit crunch) does have short-term chas-flow implications.

youngsyr said:

Sounds ideal, until you realise that with no CT, and no NI, the flat rate of tax would need to be vastly higher than 25% to cover the shortfall, even with a substantial pick up in employment.

Even with CT and NI, I suspect the flat rate would need to be in the high 30%/low 40% range, as don't forget, the vast majority of income tax is paid by the tiny minority with the highest incomes, who will largely be paying over 30% effective rate.

But you forget that:Even with CT and NI, I suspect the flat rate would need to be in the high 30%/low 40% range, as don't forget, the vast majority of income tax is paid by the tiny minority with the highest incomes, who will largely be paying over 30% effective rate.

- Under this scheme you would rule out a lot of tax avoidance / evasion hence increasing total tax income

- Under this scheme there would be more jobs and hence lower benefits (so lower tax income would be required)

etc

sidicks said:

youngsyr said:

Sounds ideal, until you realise that with no CT, and no NI, the flat rate of tax would need to be vastly higher than 25% to cover the shortfall, even with a substantial pick up in employment.

Even with CT and NI, I suspect the flat rate would need to be in the high 30%/low 40% range, as don't forget, the vast majority of income tax is paid by the tiny minority with the highest incomes, who will largely be paying over 30% effective rate.

But you forget that:Even with CT and NI, I suspect the flat rate would need to be in the high 30%/low 40% range, as don't forget, the vast majority of income tax is paid by the tiny minority with the highest incomes, who will largely be paying over 30% effective rate.

- Under this scheme you would rule out a lot of tax avoidance / evasion hence increasing total tax income

- Under this scheme there would be more jobs and hence lower benefits (so lower tax income would be required)

etc

As the off-topic poster^^ reminded us, revenue is a function of desired expenditure, and that's a separate discussion.

sidicks said:

But you forget that:

- Under this scheme you would rule out a lot of tax avoidance / evasion hence increasing total tax income

- Under this scheme there would be more jobs and hence lower benefits (so lower tax income would be required)

etc

It doesn't even come close. Spending is so out of whack with receipts, and income taxes are so skewed to the highest earners, that you would need close to 50% flat rates to match current expenditures. That's why there have to be spending cuts, not tax rises, to fix the deficit.- Under this scheme you would rule out a lot of tax avoidance / evasion hence increasing total tax income

- Under this scheme there would be more jobs and hence lower benefits (so lower tax income would be required)

etc

To answer the OP - lower income taxes. "Ought we to deprive the people of capital, which would fructify in their hands much more than in those of government" (The Chancellor in 1819 - it's not a new debate). Oh, and scrap the nonsense that 'NI' is not income tax.

Digga said:

Because businesses - once they reach a certain size - have to generate more than 20% to keep anything back for growth and investment. Does this simple explanation help you or shall I elucidate further?

You don't seem to understand the basics.Corporation tax is on PROFITS.

Make £100 profit and that's £20 for the taxman with £80 for "growth and investment" as you put it.

Newc said:

To answer the OP - lower income taxes. "Ought we to deprive the people of capital, which would fructify in their hands much more than in those of government" (The Chancellor in 1819 - it's not a new debate).

That quote, due to its date, lacks the context of Corporation Tax though. One could suggest that both taxes 'deprive the people of capital'.V8mate said:

Newc said:

To answer the OP - lower income taxes. "Ought we to deprive the people of capital, which would fructify in their hands much more than in those of government" (The Chancellor in 1819 - it's not a new debate).

That quote, due to its date, lacks the context of Corporation Tax though. One could suggest that both taxes 'deprive the people of capital'.Newc said:

There will be Internet Points awarded though for anyone who can work 'fructify' into their business correspondence this afternoon.

I thought that was rather special too!

Reminds me of a sales presentation where a particularly flamboyant fellow said he would "bend over backwards to expose his credentials".

sidicks said:

youngsyr said:

Sounds ideal, until you realise that with no CT, and no NI, the flat rate of tax would need to be vastly higher than 25% to cover the shortfall, even with a substantial pick up in employment.

Even with CT and NI, I suspect the flat rate would need to be in the high 30%/low 40% range, as don't forget, the vast majority of income tax is paid by the tiny minority with the highest incomes, who will largely be paying over 30% effective rate.

But you forget that:Even with CT and NI, I suspect the flat rate would need to be in the high 30%/low 40% range, as don't forget, the vast majority of income tax is paid by the tiny minority with the highest incomes, who will largely be paying over 30% effective rate.

- Under this scheme you would rule out a lot of tax avoidance / evasion hence increasing total tax income

- Under this scheme there would be more jobs and hence lower benefits (so lower tax income would be required)

etc

There was a thread on here recently that discussed some of the numbers. IIRC the conclusion was that a flat rate tax of 25% was a pipe dream.

It's a common misconception that most of the income tax take is generated by those paying a marginal rate of 20%. It isn't, not by a long shot. I wouldn't be suprised if the majority of it wasn't even from those paying (a marginal) 40%, but was from the 50% band. So, that's your starting point, then you need to make up the difference from getting rid of CT and NI.

Edited by youngsyr on Wednesday 11th July 14:40

youngsyr said:

RacerMDR said:

andymadmak said:

Corporation tax should be set at zero. Then watch the companies flock here, watch business bloom, watch unemployment vanish, watch our pension funds recover massively. Set personal tax at 25% across the board. No NI. No avoidance schemes tolerated. Keep it simple and let people keep more of their money.

I agree with this. If you got rid of the stupidly retarded HMRC......you'd save the well published massive amount.Everybody pays a fair 25% regardless.

I doubt there would be the need for avoidance schemes

Even with CT and NI, I suspect the flat rate would need to be in the high 30%/low 40% range, as don't forget, the vast majority of income tax is paid by the tiny minority with the highest incomes, who will largely be paying over 30% effective rate.

If I ran my business like the government run UK PLC - i'd be bankrupt and would have probably jumped in front of a train.

If we stopped wasting money then 25% from everyone would be just fine.

Driller said:

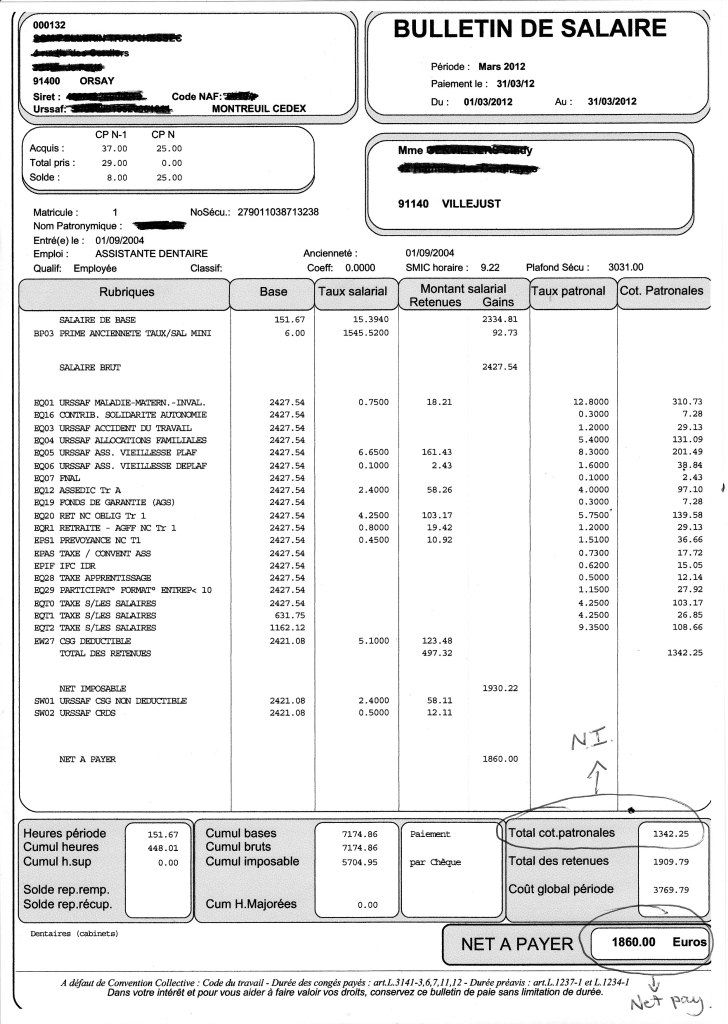

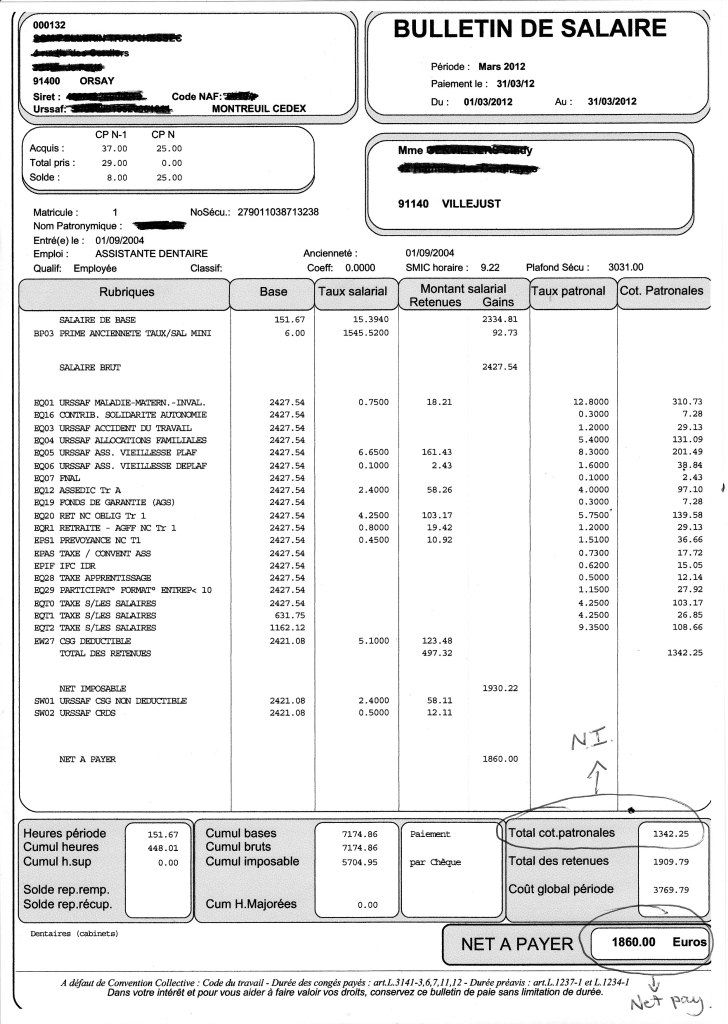

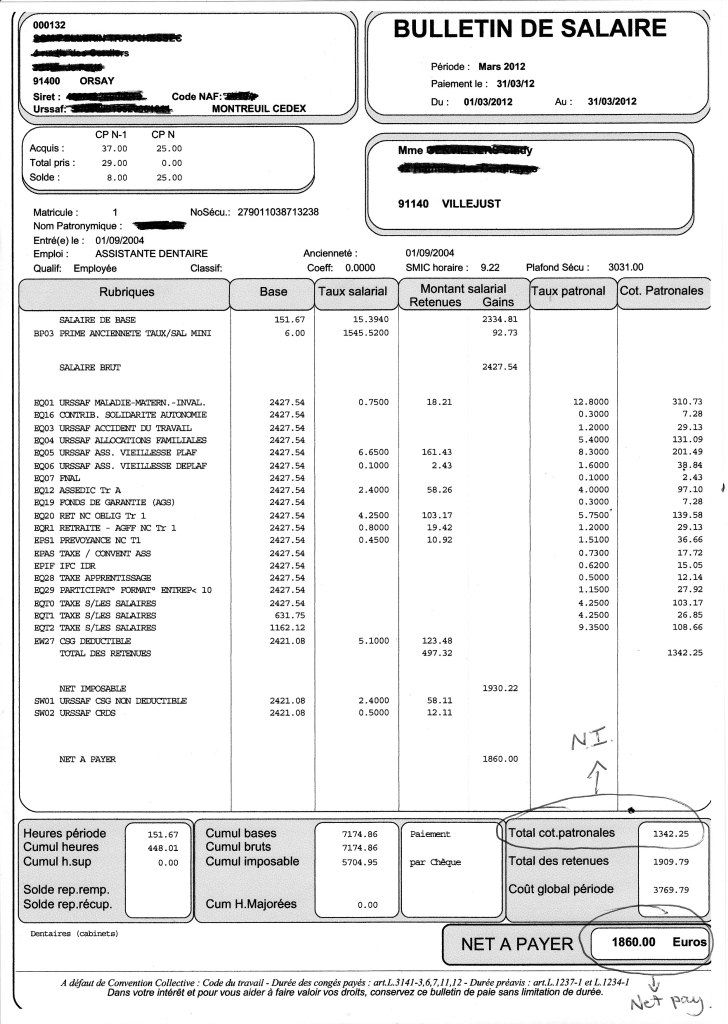

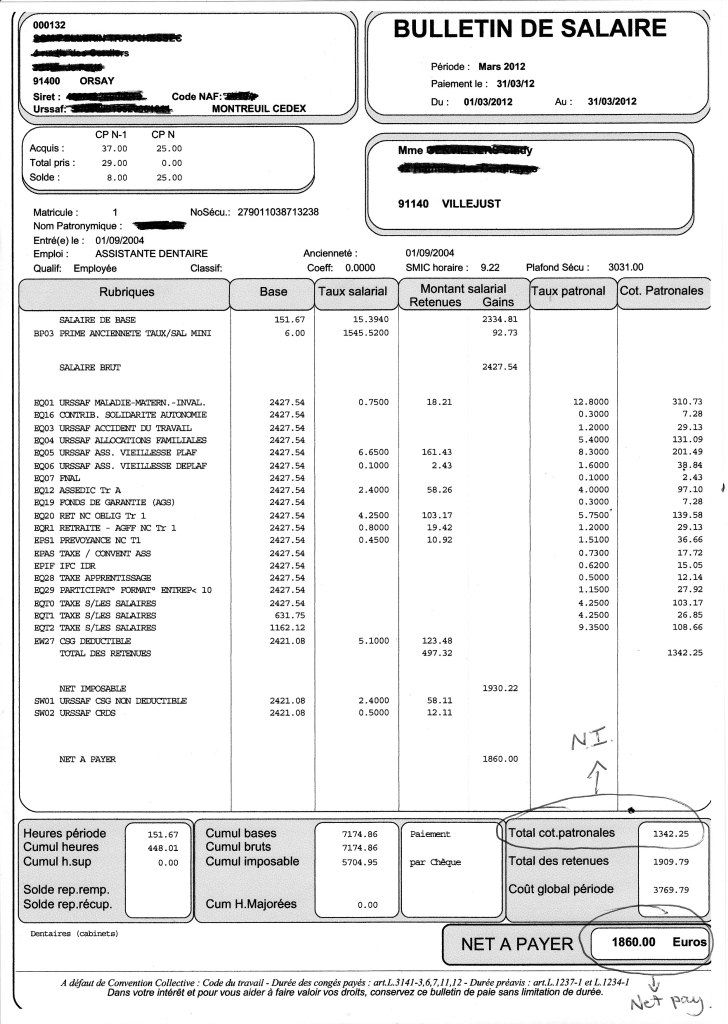

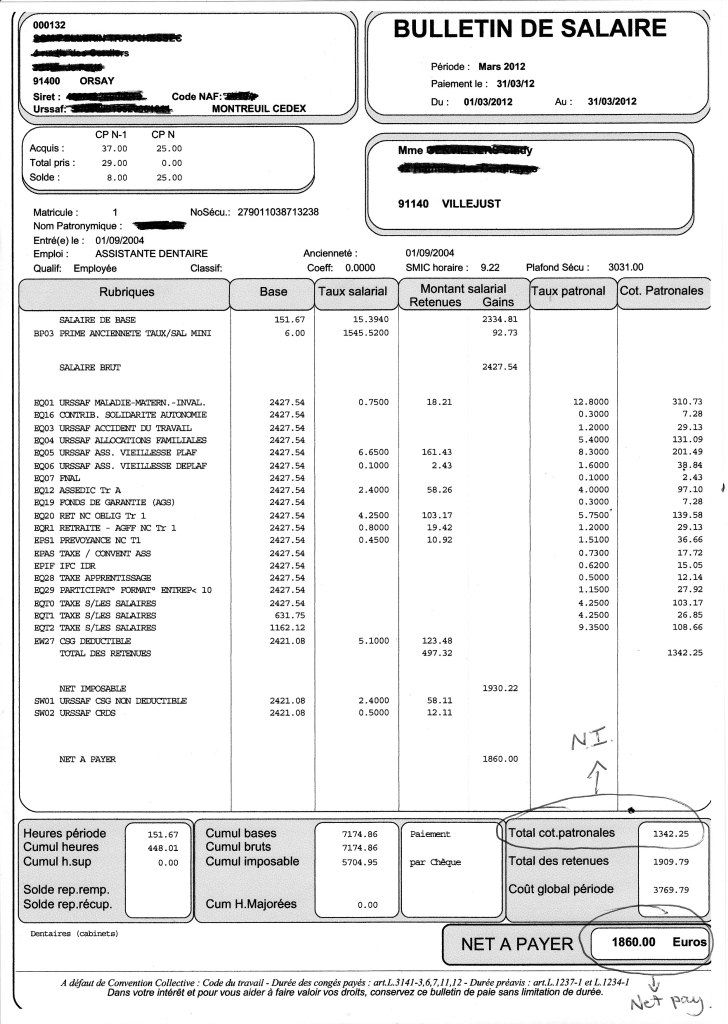

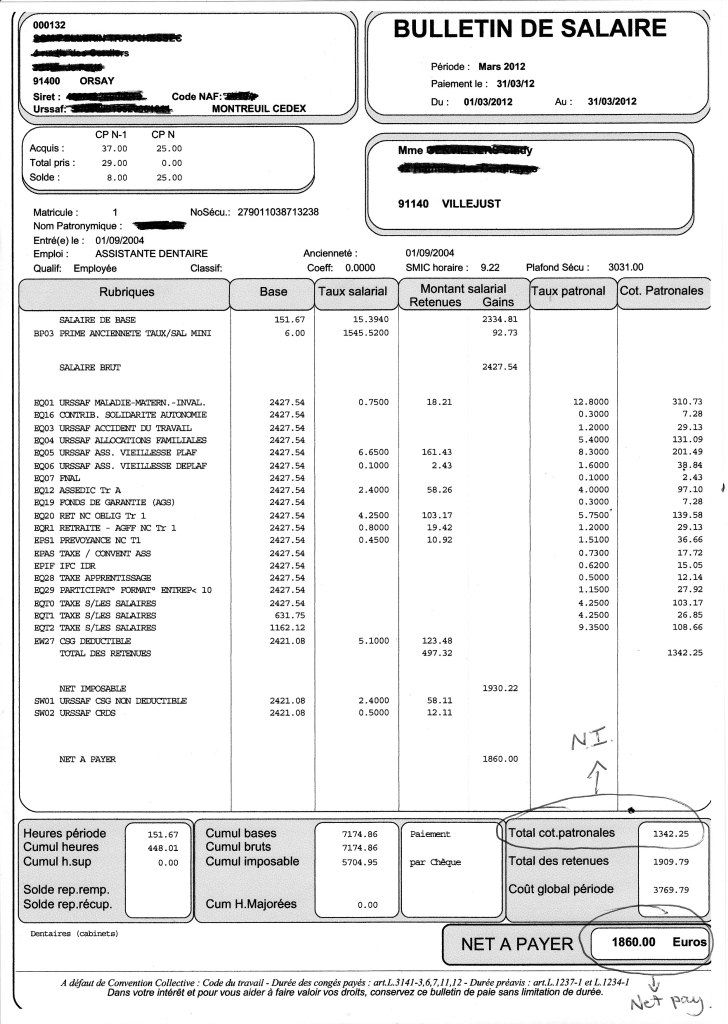

All you guys complaining about taxes etc, you think you've got it bad!

Here's a copy of a pay slip of a dental assistant here in France (names removed to protect the guilty).

Have a look at the net pay compared to the NI. Misery!

I think you're looking at NI 'To Date'.Here's a copy of a pay slip of a dental assistant here in France (names removed to protect the guilty).

Have a look at the net pay compared to the NI. Misery!

1 months figures (looks like 7hrs a day too):

Gross 2427.54

less 497.32

less 58.11

less 12.11

Net 1860.00

Comparable to here, non?

Edited by richardxjr on Wednesday 11th July 15:32

Ozzie Osmond said:

RacerMDR said:

Corporation Tax - I hate it! It should be certainly dropped on anything below 1million - as it stifles small business!

How on earth does a 20% tax on profits stifle anything?!They either invest retained earnings or borrow money to do this investing.

If they had more retained earnings to play with, they would invest more, as retained earnings are cheaper than borrowed capital.

johnfm said:

Businesses grow (and employ more people, pay more NI, rent, rates, consume more 3rd party products and services) by investing money in product or service deveoplment, design, manufacture, distribution etc.

They either invest retained earnings or borrow money to do this investing.

If they had more retained earnings to play with, they would invest more, as retained earnings are cheaper than borrowed capital.

Do they always do that though?They either invest retained earnings or borrow money to do this investing.

If they had more retained earnings to play with, they would invest more, as retained earnings are cheaper than borrowed capital.

Sometimes businesses just sit on cash, because:

a. Consumers have no money

b. There's no more growth in their product (just the consistent income)

c. The ROI of R&D, or even just D, is forecast as worse than sticking their cash in a savings account

d. They're a family business and they've 'always just stuffed spare cash under the mattress'

I'll take a completely unsubstantiable punt here, but I'd suggest that giving an individual a notional 'extra pound' will more likely result in that pound being spent than giving it to a company, who will consider more carefully the benefit of spending that pound.

richardxjr said:

Driller said:

All you guys complaining about taxes etc, you think you've got it bad!

Here's a copy of a pay slip of a dental assistant here in France (names removed to protect the guilty).

Have a look at the net pay compared to the NI. Misery!

I think you're looking at NI 'To Date'.Here's a copy of a pay slip of a dental assistant here in France (names removed to protect the guilty).

Have a look at the net pay compared to the NI. Misery!

1 months figures (looks like 7hrs a day too):

Gross 2427.54

less 497.32

less 58.11

less 12.11

Net 1860.00

Comparable to here, non?

Would you like the telephone number of my accountant?

V8mate said:

johnfm said:

Businesses grow (and employ more people, pay more NI, rent, rates, consume more 3rd party products and services) by investing money in product or service deveoplment, design, manufacture, distribution etc.

They either invest retained earnings or borrow money to do this investing.

If they had more retained earnings to play with, they would invest more, as retained earnings are cheaper than borrowed capital.

Do they always do that though?They either invest retained earnings or borrow money to do this investing.

If they had more retained earnings to play with, they would invest more, as retained earnings are cheaper than borrowed capital.

Sometimes businesses just sit on cash, because:

a. Consumers have no money

b. There's no more growth in their product (just the consistent income)

c. The ROI of R&D, or even just D, is forecast as worse than sticking their cash in a savings account

d. They're a family business and they've 'always just stuffed spare cash under the mattress'

I'll take a completely unsubstantiable punt here, but I'd suggest that giving an individual a notional 'extra pound' will more likely result in that pound being spent than giving it to a company, who will consider more carefully the benefit of spending that pound.

touché

1 months figures (looks like 7hrs a day too):

Gross 2427.54

less 497.32

less 58.11

less 12.11

Net 1860.00

Comparable to here, non?I think I own a dental practice here and that NI is between 80% and 100% of an employees salary rather than the 11% of the UK.

Would you like the telephone number of my accountant?

Driller said:

richardxjr said:

Driller said:

All you guys complaining about taxes etc, you think you've got it bad!

Here's a copy of a pay slip of a dental assistant here in France (names removed to protect the guilty).

Have a look at the net pay compared to the NI. Misery!

I think you're looking at NI 'To Date'.Here's a copy of a pay slip of a dental assistant here in France (names removed to protect the guilty).

Have a look at the net pay compared to the NI. Misery!

1 months figures (looks like 7hrs a day too):

Gross 2427.54

less 497.32

less 58.11

less 12.11

Net 1860.00

Comparable to here, non?

Would you like the telephone number of my accountant?

Gassing Station | News, Politics & Economics | Top of Page | What's New | My Stuff