The damage of taxation

Discussion

Re: abolishing / lowering taxes - as I mentioned elsewhere, if that was the panacea for our economic ills there would be plenty of countries in Africa/Asia/Latin America that would be economic powerhouses because of all the "re-investment" and "growth".

The fact that most developed economies have broadly similar tax levels suggests to me that this is the right balance.

The fact that most developed economies have broadly similar tax levels suggests to me that this is the right balance.

sidicks said:

Countdown said:

How can NI be as much as 80% of salary ?

Not just 80%, but "between 80% and 100%" apparently....

If true, of course.....

Sidicks

Speak to any boss here: when you pay someone a salary, you pay the same again in NI. I'm not an accountant and I don't stick my nose into the numbers but I'll get back to you with a detailed explanation of that payslip.

Like I said, you think you've got it bad?

Driller said:

It's hard to believe isn't it? This is what a country, which is socialist from every pore from the ground up, is like.

Speak to any boss here: when you pay someone a salary, you pay the same again in NI. I'm not an accountant and I don't stick my nose into the numbers but I'll get back to you with a detailed explanation of that payslip.

Like I said, you think you've got it bad?

So you actually mean 40% - 50% employee NI ?Speak to any boss here: when you pay someone a salary, you pay the same again in NI. I'm not an accountant and I don't stick my nose into the numbers but I'll get back to you with a detailed explanation of that payslip.

Like I said, you think you've got it bad?

(or are you talking about employer's NI?

I'm saying that as an employer I have to pay social taxes for someone when I pay them a salary. This is the French equivalent of NI, a sort of Super NI.

This is made up of all sorts of things as listed on that payslip.

These taxes are up to 100% of the salary paid (can't remember if it's gross or net-I will find out).

ETA I'm talking about what the employer pays, the employee pays a tiny amount in comparison.

This is made up of all sorts of things as listed on that payslip.

These taxes are up to 100% of the salary paid (can't remember if it's gross or net-I will find out).

ETA I'm talking about what the employer pays, the employee pays a tiny amount in comparison.

Since this is a motoring forum, how about doing something about the BIK on company cars.

You shouldn't be taxed on the list price new of a car if you buy one a few years old. The tax should be based on the price that you paid for it.

At a time when banks have supposedly signed up with the Government to make borrowing easier for small businesses, how about easing the tax burden on these companies to encourage expansion and employment.

You shouldn't be taxed on the list price new of a car if you buy one a few years old. The tax should be based on the price that you paid for it.

At a time when banks have supposedly signed up with the Government to make borrowing easier for small businesses, how about easing the tax burden on these companies to encourage expansion and employment.

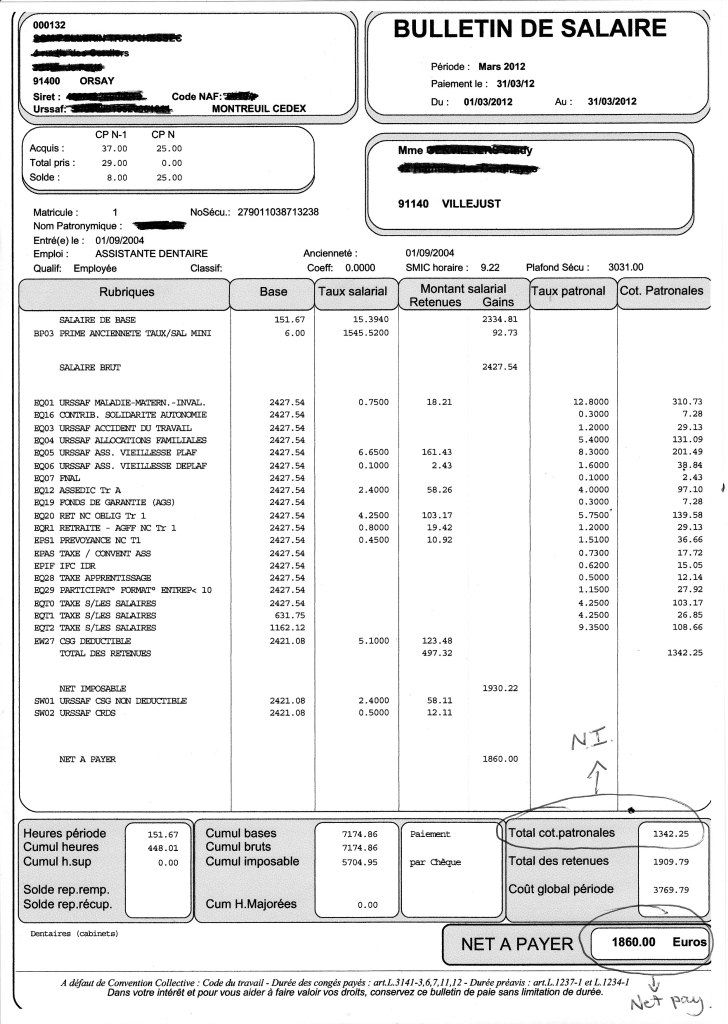

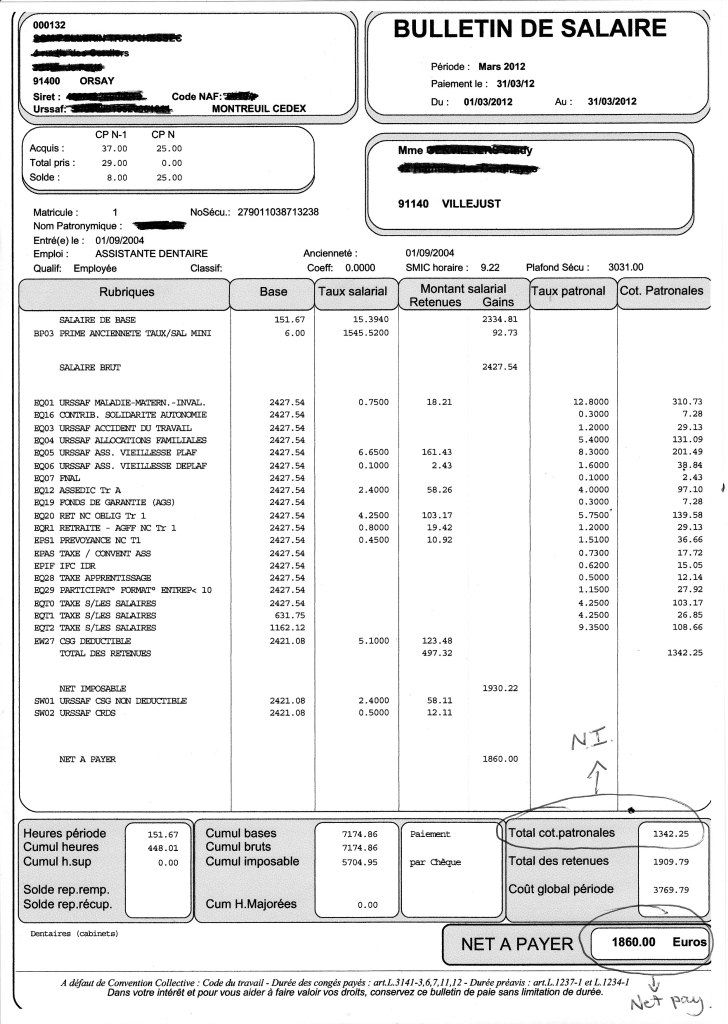

Just for RichardXJR and Sidicks (and sorry to divert attention from the Uk situation):

I don't get involved in this side of things because it makes me vomit but...

Have a look at the top right and you will see that this is for the period from 1.3.12 to 31.3.12.

If you look in the left column "Rubriques" you will see "salaire brut" this means gross pay. Follow across to the right and you will see in the column "montant salarial" the figure of €2427.54.

This is the gross pay.

If you look further down in the Rubriques column you will see all the taxes that the NI makes up and it's showing that for most the tax is imposed on the full amount of €2427.54.

Follow each one across and you will see the columns "taux patronal" that's employer's rate, the % he must pay of the gross and cot(short for cotisations) patronal which means employers cost which is how much this translates to.

Add these all up and at the bottom they come to €1342.25 and at the bottom this is shown as Total Cot Patronal (total employer's costs).

The employees net is shown as €1860.00.

€1342.25 is actually 72.2% ( still bloody loads!) because this is a special case due to the age of the employee (young) or something and there is a bit of NI "relief" (!). In most cases it is 80%+.

You will be asking yourself how a business can function under such conditions, lots of business owners here ask the same.

I don't get involved in this side of things because it makes me vomit but...

Have a look at the top right and you will see that this is for the period from 1.3.12 to 31.3.12.

If you look in the left column "Rubriques" you will see "salaire brut" this means gross pay. Follow across to the right and you will see in the column "montant salarial" the figure of €2427.54.

This is the gross pay.

If you look further down in the Rubriques column you will see all the taxes that the NI makes up and it's showing that for most the tax is imposed on the full amount of €2427.54.

Follow each one across and you will see the columns "taux patronal" that's employer's rate, the % he must pay of the gross and cot(short for cotisations) patronal which means employers cost which is how much this translates to.

Add these all up and at the bottom they come to €1342.25 and at the bottom this is shown as Total Cot Patronal (total employer's costs).

The employees net is shown as €1860.00.

€1342.25 is actually 72.2% ( still bloody loads!) because this is a special case due to the age of the employee (young) or something and there is a bit of NI "relief" (!). In most cases it is 80%+.

You will be asking yourself how a business can function under such conditions, lots of business owners here ask the same.

Edited by Driller on Wednesday 11th July 20:21

Edited by Driller on Wednesday 11th July 20:22

Countdown said:

Driller

Your employers on cost is 55% (the amount you pay on top of the gross salary) admittedly fairly shocking compared to 23% in the UK but not 80% -100%. Your employees personal tax rate seems fairly comparable to UK.

Diagram below shows comparative rates between countries

When you put it like that it doesn't sound so bad and it's true that this is not my department. I'll clarify what this 80%-100% thing is that is bandied about.Your employers on cost is 55% (the amount you pay on top of the gross salary) admittedly fairly shocking compared to 23% in the UK but not 80% -100%. Your employees personal tax rate seems fairly comparable to UK.

Diagram below shows comparative rates between countries

I thought it was 11% in the UK?

Income tax is indeed not so different-thank God.

Driller said:

When you put it like that it doesn't sound so bad and it's true that this is not my department. I'll clarify what this 80%-100% thing is that is bandied about.

You're quoting it as a percentage of the net salary not the gross salary which is how it would normally be quoted?I would remove VAT from goods made 100% in the UK, and increase VAT to 40% for anything made outside of Europe.

So if you built a car in Oxford, with parts manufactured in Japan, India and South America, you'd have 40% vat on the whole thing.

If you built a car in Halewood with bits from all over Europe, you'd have to charge 20% Vat

If you built a car in Derby, using engines from Deeside, brakes from Pontypool, Electrics from Burnley, Turbo's from Skem, Glass from St Helens, Trim from Liecester, you'd have no Vat to charge your customers.

Then I'd get rid of NI, totally, and add 4% to the tax rate. I'd then get rid of tax credits and just have a married couple with children tax coding.

So if you built a car in Oxford, with parts manufactured in Japan, India and South America, you'd have 40% vat on the whole thing.

If you built a car in Halewood with bits from all over Europe, you'd have to charge 20% Vat

If you built a car in Derby, using engines from Deeside, brakes from Pontypool, Electrics from Burnley, Turbo's from Skem, Glass from St Helens, Trim from Liecester, you'd have no Vat to charge your customers.

Then I'd get rid of NI, totally, and add 4% to the tax rate. I'd then get rid of tax credits and just have a married couple with children tax coding.

RacerMDR said:

yeah I agree - its 20% tax on success - especially in small business.

Agree 100%Retaining profit in the company to help it's cashflow and to assist growth wouldnt be penalised.

I co-run a small business, we've been growing slowly for 10 years now with no credit facility from the bank other than short term overdrafts personally guaranteed by directors. We could probably get one now but because we've been careful dont need to borrow big gobs of money.

If we weren't stung for 20% on everything left in the company at the end of the year we'd have twice as many employees now.

even no corp' tax up to 500k would be a massive boost to us as a business, 100k a year to employ 3 more people for a start!! They make profit, employ more people, it's so f'ing simple it utterly boils my wee that the gubbermint dont see it...

Christ, even no corp tax up to 100k would almost pay for an extra member of staff, and I'm sure that's not going to dent to coffers too much.

New POD said:

I would remove VAT from goods made 100% in the UK, and increase VAT to 40% for anything made outside of Europe.

So if you built a car in Oxford, with parts manufactured in Japan, India and South America, you'd have 40% vat on the whole thing.

If you built a car in Halewood with bits from all over Europe, you'd have to charge 20% Vat

If you built a car in Derby, using engines from Deeside, brakes from Pontypool, Electrics from Burnley, Turbo's from Skem, Glass from St Helens, Trim from Liecester, you'd have no Vat to charge your customers.

Then I'd get rid of NI, totally, and add 4% to the tax rate. I'd then get rid of tax credits and just have a married couple with children tax coding.

Some good ideas there, I often wonder why we dont have VAT breaks for products manufactured in the UK. Even if it's a 10% reduction, it would make the increased cost of manufacturing in the UK tollerable to local and international firms.So if you built a car in Oxford, with parts manufactured in Japan, India and South America, you'd have 40% vat on the whole thing.

If you built a car in Halewood with bits from all over Europe, you'd have to charge 20% Vat

If you built a car in Derby, using engines from Deeside, brakes from Pontypool, Electrics from Burnley, Turbo's from Skem, Glass from St Helens, Trim from Liecester, you'd have no Vat to charge your customers.

Then I'd get rid of NI, totally, and add 4% to the tax rate. I'd then get rid of tax credits and just have a married couple with children tax coding.

I think the component thing may be an issue though, some part we just cannot build here, because we just dont have the skills and factories... maybe a sliding scale assembled here, 10% duty, 75% of component parts made here too, 5% duty, 100% british, 0% duty.

Not sure about the married allowances though, who the hell gets married these days, it really is an out-dated tradition for a lot of people and unfair to require they get hitched before starting a family to avoid tax-raping.

Davel said:

Since this is a motoring forum, how about doing something about the BIK on company cars.

You shouldn't be taxed on the list price new of a car if you buy one a few years old. The tax should be based on the price that you paid for it

I still cannot believe that this is the case. It is one of the stupidest rules in a tax system full of really stupid rules.You shouldn't be taxed on the list price new of a car if you buy one a few years old. The tax should be based on the price that you paid for it

I understand that in 2015 employers will be forced to contribute 3% of the e/ee wages to a pension for them but cant take into account this extra cost or benefit to the e/ee when reviewing their wages.

So in 2015 its a 3% pay rise from my pocket to my e/ee when I dont have a pension myself. Great. Plus I cant say to them in 2015 sorry no pay rise as you have had it via your new pension.

So in 2015 its a 3% pay rise from my pocket to my e/ee when I dont have a pension myself. Great. Plus I cant say to them in 2015 sorry no pay rise as you have had it via your new pension.

superlightr said:

I understand that in 2015 employers will be forced to contribute 3% of the e/ee wages to a pension for them but cant take into account this extra cost or benefit to the e/ee when reviewing their wages.

So in 2015 its a 3% pay rise from my pocket to my e/ee when I dont have a pension myself. Great. Plus I cant say to them in 2015 sorry no pay rise as you have had it via your new pension.

Pay rise isn't compulsory. If your profits haven't increased and your costs have, then be truthful with them.So in 2015 its a 3% pay rise from my pocket to my e/ee when I dont have a pension myself. Great. Plus I cant say to them in 2015 sorry no pay rise as you have had it via your new pension.

Gassing Station | News, Politics & Economics | Top of Page | What's New | My Stuff

Just add a command economy and a 5-year plan...

Just add a command economy and a 5-year plan...