How far will house prices fall [volume 4]

Discussion

rufusgti said:

I know people who have bought the noise next door, just so they have a bit of control over who lives there. Makes a bit of sense I suppose. I agree with the above comments though, ignorance is bliss.

Thank you for the comments.The post above is relevant, the house in question is my only close neighbour and I have always had a good relationship with them. Would be nice to have some input into who moves in next. I'm trying to rule the world, one house at a time!

So how do we get first time buyer on the market ? cause if we dont then the pack ogf cards will collapse we need need FTB to keep the prices high.

So the pundits/government /housing amrket peole come along and say we will doa 75% mortgage and 25% loan interest free from developer this will kick start housing market/get FTB buying houses

So what happens when the FTB jump on these government backed/developer backed schemes to get em on the housing ladder.

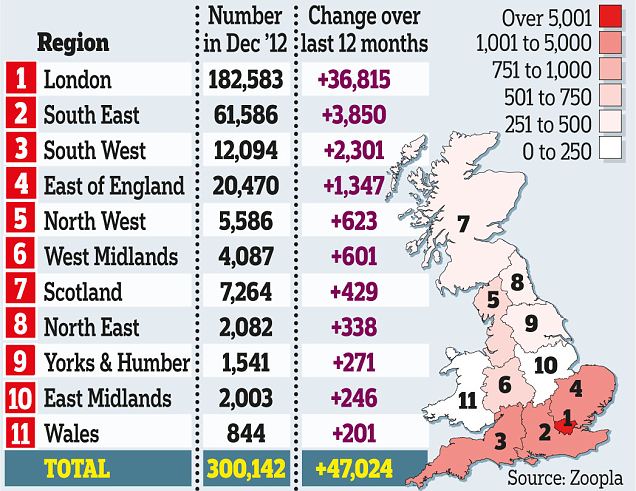

http://www.dailymail.co.uk/money/mortgageshome/art...

So the pundits/government /housing amrket peole come along and say we will doa 75% mortgage and 25% loan interest free from developer this will kick start housing market/get FTB buying houses

So what happens when the FTB jump on these government backed/developer backed schemes to get em on the housing ladder.

http://www.dailymail.co.uk/money/mortgageshome/art...

br d said:

Not sure if this belongs here but I know there are some landlords floating about on this thread, need a bit of advice.

I have a property rented out a couple of streets from where I live and haven't had any issues. My immediate neighbours have now put their house up for sale and need to move it quickly, I think I could get a very good deal. How do people stand with renting a property next door? Do you think tenants would be put off by having the landlord so close?

Apologies if this isn't the most appropriate place for this post.

I lived across the hall from one of my past BTL's. Was no issue at all and the tenants seemed to quite like it as I was near by if there were any issues. Although, I was lucky that they were nice enough tenants.I have a property rented out a couple of streets from where I live and haven't had any issues. My immediate neighbours have now put their house up for sale and need to move it quickly, I think I could get a very good deal. How do people stand with renting a property next door? Do you think tenants would be put off by having the landlord so close?

Apologies if this isn't the most appropriate place for this post.

Is there anyone out there who still thinks prices are going to crash?

People on low incomes may no longer be able to afford to buy and own a home like they used to but there's plenty of money out there in the hands of the wealth, more than ever. With this gradual but seemingly steady redistribution of wealth to the rich I see the owner occupier numbers continuing their decline and more on low incomes simply renting.

There may be a reasonable number of people out there struggling but I don't see this having a large adverse affect on property prices.

People on low incomes may no longer be able to afford to buy and own a home like they used to but there's plenty of money out there in the hands of the wealth, more than ever. With this gradual but seemingly steady redistribution of wealth to the rich I see the owner occupier numbers continuing their decline and more on low incomes simply renting.

There may be a reasonable number of people out there struggling but I don't see this having a large adverse affect on property prices.

Pulled the trigger and bought a house (Wilmslow, North West)

After four years we decided we had a enough of renting, it is nice to have a home (that you can maintain, decorate and know you won't need to move out of at the whim of someone else)

It had been on the mkt for just over a year and in that time it had two price drops, in the end we paid about 18% below the original asking price (circa 6% less than the latest asking price)

As a guide the price I paid is pretty much equal to the price the seller paid when they bought it in 2007 (as a bit of wreck) plus the likely costs to carry out the refurb.

I'd post a link to the details but I suspect the ph massive will rip into it

After four years we decided we had a enough of renting, it is nice to have a home (that you can maintain, decorate and know you won't need to move out of at the whim of someone else)

It had been on the mkt for just over a year and in that time it had two price drops, in the end we paid about 18% below the original asking price (circa 6% less than the latest asking price)

As a guide the price I paid is pretty much equal to the price the seller paid when they bought it in 2007 (as a bit of wreck) plus the likely costs to carry out the refurb.

I'd post a link to the details but I suspect the ph massive will rip into it

MycroftWard said:

Is there anyone out there who still thinks prices are going to crash? .

I still think they are ridiculously overpriced, if that counts?Wil they crash? Probably not, but for the wrong reasons. People still, wrongly, believe that high house prices are a good thing. It helps big business, no one else. Until that changes, the government will stop at nothing to see the crazy level of house prices are maintained.

MycroftWard said:

Is there anyone out there who still thinks prices are going to crash?

People on low incomes may no longer be able to afford to buy and own a home like they used to but there's plenty of money out there in the hands of the wealth, more than ever. With this gradual but seemingly steady redistribution of wealth to the rich I see the owner occupier numbers continuing their decline and more on low incomes simply renting.

There may be a reasonable number of people out there struggling but I don't see this having a large adverse affect on property prices.

Rents do seem to be ever increasing and with interest rates so low it seems you could buy almost anything and at least break even - and I know people who are happy to do that as they regard property as a safe store, or they're looking to have houses available for their kids when needed.People on low incomes may no longer be able to afford to buy and own a home like they used to but there's plenty of money out there in the hands of the wealth, more than ever. With this gradual but seemingly steady redistribution of wealth to the rich I see the owner occupier numbers continuing their decline and more on low incomes simply renting.

There may be a reasonable number of people out there struggling but I don't see this having a large adverse affect on property prices.

The only things that could mess that up are big increases in interest rates (always possible) or massive public sector housing build programmes (pretty unlikley). I can't imagine circumstances (other than below) in which rents would fall.

BTL in student areas looks increasingly dodgy though, as many universities are building accommodation and student numbers fall.

Pork said:

I still think they are ridiculously overpriced, if that counts?

Wil they crash? Probably not, but for the wrong reasons. People still, wrongly, believe that high house prices are a good thing. It helps big business, no one else. Until that changes, the government will stop at nothing to see the crazy level of house prices are maintained.

markets always correct themselves eventually , I would put it down to low interest rates and massive government intervention in the banks , neither will last long term , long term interest rates wont stay this low and long term the government will withdraw funding from the banks.Wil they crash? Probably not, but for the wrong reasons. People still, wrongly, believe that high house prices are a good thing. It helps big business, no one else. Until that changes, the government will stop at nothing to see the crazy level of house prices are maintained.

Deva Link said:

Rents do seem to be ever increasing and with interest rates so low it seems you could buy almost anything and at least break even - and I know people who are happy to do that as they regard property as a safe store, or they're looking to have houses available for their kids when needed.

Thats normally the tip of the peak , before it crash(historically) when everyone does it cause you will make money or at least break even.jonny70 said:

Pork said:

I still think they are ridiculously overpriced, if that counts?

Wil they crash? Probably not, but for the wrong reasons. People still, wrongly, believe that high house prices are a good thing. It helps big business, no one else. Until that changes, the government will stop at nothing to see the crazy level of house prices are maintained.

markets always correct themselves eventually , I would put it down to low interest rates and massive government intervention in the banks , neither will last long term , long term interest rates wont stay this low and long term the government will withdraw funding from the banks.Wil they crash? Probably not, but for the wrong reasons. People still, wrongly, believe that high house prices are a good thing. It helps big business, no one else. Until that changes, the government will stop at nothing to see the crazy level of house prices are maintained.

As you say ZIRP has removed compulsion from the market. Volumes are shocking.

I agree with those saying that the current zero interest rate environment is preventing some downward correction in prices. It's in the governments interest to maintain this situation and I feel that as long as they do house prices won't fall significantly if at all.

Perhaps a more interesting question now is: When will interest rates rise? Not for at least several more years I shouldn't think, not until the economy shows some signs of life. Probably not before the next election.

Perhaps a more interesting question now is: When will interest rates rise? Not for at least several more years I shouldn't think, not until the economy shows some signs of life. Probably not before the next election.

Gassing Station | News, Politics & Economics | Top of Page | What's New | My Stuff