How far will house prices fall [volume 4]

Discussion

walm said:

Only sort-of true.

To afford to move up the ladder you need one/more of the following:

- Have paid down lots of your mortgage so you can refi back up to the original size.

- Have a larger salary. (Less and less likely these days.)

- Hope the multipliers are more generous. Hint: they aren't.

Having lots of equity with a static mortgage and a static wage means you can afford to say put.

You can't move.

And let's not forget stamp duty here...

Well to address your points.. To afford to move up the ladder you need one/more of the following:

- Have paid down lots of your mortgage so you can refi back up to the original size.

- Have a larger salary. (Less and less likely these days.)

- Hope the multipliers are more generous. Hint: they aren't.

Having lots of equity with a static mortgage and a static wage means you can afford to say put.

You can't move.

And let's not forget stamp duty here...

Firstly, anyone with a repayment mortgage will be paying it down so that's a given that'll be happening for many.

Secondly, people do still have careers don't they?? Many people don't sit at average UK salary for their whole working life like some people apparently seem to think (not refering to you as such, just a general point..)

Thirdly, lending multiples do seem more generous than they were in the past, probably because of the low interest rate landscape, 5 times income and all that.

So, I should think many have constantly rising equity and affordability due to rising house prices, diminishing mortgage as it's being paid down, and rising income as the career progresses.

Edited by XJ40 on Friday 27th November 14:46

XJ40 said:

walm said:

Only sort-of true.

To afford to move up the ladder you need one/more of the following:

- Have paid down lots of your mortgage so you can refi back up to the original size.

- Have a larger salary. (Less and less likely these days.)

- Hope the multipliers are more generous. Hint: they aren't.

Having lots of equity with a static mortgage and a static wage means you can afford to say put.

You can't move.

And let's not forget stamp duty here...

Well to address your points.. To afford to move up the ladder you need one/more of the following:

- Have paid down lots of your mortgage so you can refi back up to the original size.

- Have a larger salary. (Less and less likely these days.)

- Hope the multipliers are more generous. Hint: they aren't.

Having lots of equity with a static mortgage and a static wage means you can afford to say put.

You can't move.

And let's not forget stamp duty here...

Firstly, anyone with a repayment mortgage will be paying it down so that's a given that'll be happening for many.

Secondly, people do still have careers don't they?? Many people don't sit at average UK salary for their whole working life like some people apparently seem to think (not refering to you as such, just a general point..)

Thirdly, lending multiples do seem more generous than they were in the past, probably because of the low interest rate landscape, 5 times income and all that.

So, I should think many have constantly rising equity and affordability due to rising house prices, diminishing mortgage as it's being paid down, and rising income as the career progresses.

Edited by XJ40 on Friday 27th November 14:46

Back in the real world they are more like 3 1/2 times and then anything that you pay for (car, train ticket, day to day living expenses, child maintenance, etc etc) will be taken away from the amount you can actually borrow.

XJ40 said:

Well to address your points..

Firstly, anyone with a repayment mortgage will be paying it down so that's a given that'll be happening for many.

Secondly, people do still have careers don't they?? Many people don't sit at average UK salary for their whole working life like some people apparently seem to think (not refering to you as such, just a general point..)

Thirdly, lending multiples do seem more generous than they were in the past, probably because of the low interest rate landscape, 5 times income and all that.

So, I should think many have constantly rising equity and affordability due to rising house prices, diminishing mortgage as it's being paid down, and rising income as the career progresses.

I agree with some of that!Firstly, anyone with a repayment mortgage will be paying it down so that's a given that'll be happening for many.

Secondly, people do still have careers don't they?? Many people don't sit at average UK salary for their whole working life like some people apparently seem to think (not refering to you as such, just a general point..)

Thirdly, lending multiples do seem more generous than they were in the past, probably because of the low interest rate landscape, 5 times income and all that.

So, I should think many have constantly rising equity and affordability due to rising house prices, diminishing mortgage as it's being paid down, and rising income as the career progresses.

Perhaps I am (as so often) just biased by my own situation:

- Interest only.

- Wage stagnant.

- Lending multiples I have followed quite closely: hit all time highs in 07 (>5-6x) then dropped in the crunch to <3-4x, crept back up as confidence restored but since April and the new "affordability" regs are effectively capped back down again (slightly). Certainly when I looked to re-mortgage 5x was a pipedream - it was more like 3-4x.

The problem with your "career" point is that you have to consider the country in aggregate.

Sure individuals might be moving up their career paths but that alone can't push the nation's house prices up.

The only way for that to happen is by definition for the average wage to go up! (Which is only just starting to happen.)

The point is that the people who move house aren't just people who got a promotion.

They are average people.

We are trying to answer the question - are houses more or less affordable in the past - to the average punter.

Not just to the guy who got a raise.

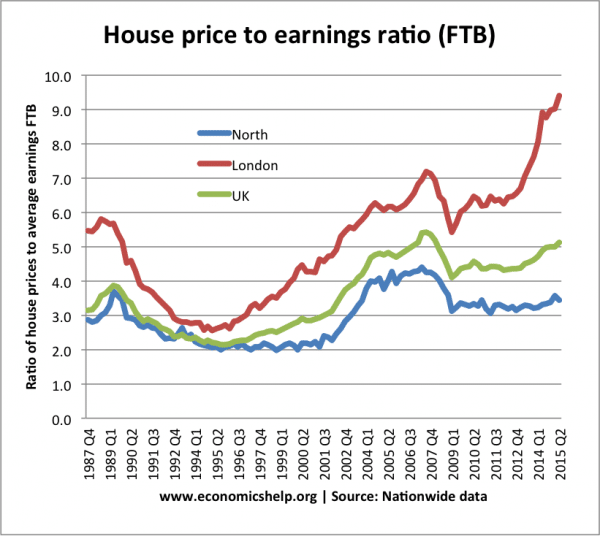

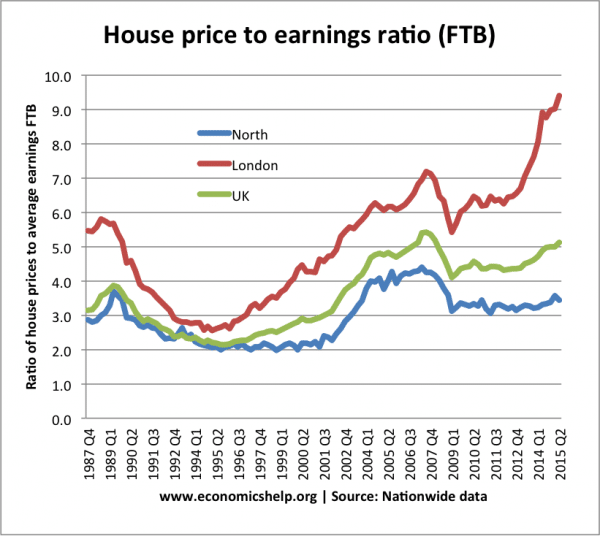

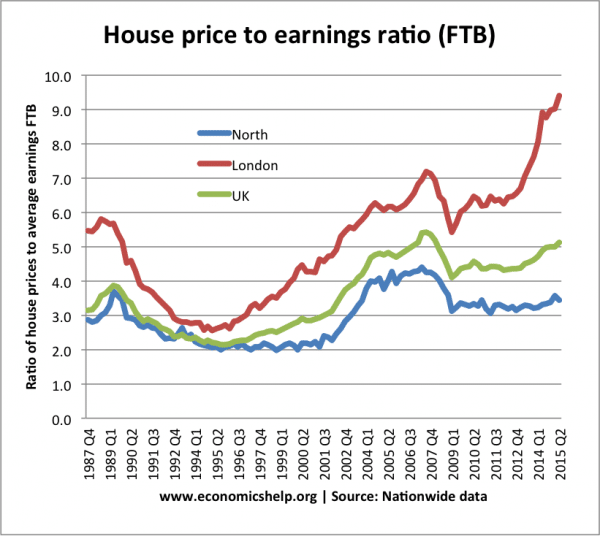

But you can forget my hypotheticals - let's just look at the data:

This is FTBs but you get the idea...

walm said:

sugerbear said:

Back in the real world they are more like 3 1/2 times and then anything that you pay for (car, train ticket, day to day living expenses, child maintenance, etc etc) will be taken away from the amount you can actually borrow.

This.walm said:

I agree with some of that!

Perhaps I am (as so often) just biased by my own situation:

- Interest only.

- Wage stagnant.

- Lending multiples I have followed quite closely: hit all time highs in 07 (>5-6x) then dropped in the crunch to <3-4x, crept back up as confidence restored but since April and the new "affordability" regs are effectively capped back down again (slightly). Certainly when I looked to re-mortgage 5x was a pipedream - it was more like 3-4x.

The problem with your "career" point is that you have to consider the country in aggregate.

Sure individuals might be moving up their career paths but that alone can't push the nation's house prices up.

The only way for that to happen is by definition for the average wage to go up! (Which is only just starting to happen.)

The point is that the people who move house aren't just people who got a promotion.

They are average people.

We are trying to answer the question - are houses more or less affordable in the past - to the average punter.

Not just to the guy who got a raise.

But you can forget my hypotheticals - let's just look at the data:

This is FTBs but you get the idea...

Some fair points and things aren't the same for everyone.Perhaps I am (as so often) just biased by my own situation:

- Interest only.

- Wage stagnant.

- Lending multiples I have followed quite closely: hit all time highs in 07 (>5-6x) then dropped in the crunch to <3-4x, crept back up as confidence restored but since April and the new "affordability" regs are effectively capped back down again (slightly). Certainly when I looked to re-mortgage 5x was a pipedream - it was more like 3-4x.

The problem with your "career" point is that you have to consider the country in aggregate.

Sure individuals might be moving up their career paths but that alone can't push the nation's house prices up.

The only way for that to happen is by definition for the average wage to go up! (Which is only just starting to happen.)

The point is that the people who move house aren't just people who got a promotion.

They are average people.

We are trying to answer the question - are houses more or less affordable in the past - to the average punter.

Not just to the guy who got a raise.

But you can forget my hypotheticals - let's just look at the data:

This is FTBs but you get the idea...

I will say though that your refering to the average person, people who are buying houses at the current prices are very likely to be better off than average and have significant equity in property, that was my point above. There lots of folks out there earning minimum wage which pulls down the UK average earning figure, these guys probably aren't the average house buyer though..

You refer to FTB's again, as I say above house prices are toughest for this group. The average age of FTB's is higher now, many will be higher than average earners, buy as a couple with two incomes, may well have help from the bank of mum and dad, inheritance, etc.

As there is no sustained downward house price correction happening and the market does support current house prices then I'd say that evidence that my points are sound. I'm not saying it's a fair situation, or not, it is what it is.

Edited by XJ40 on Friday 27th November 16:28

XJ40 said:

walm said:

sugerbear said:

Back in the real world they are more like 3 1/2 times and then anything that you pay for (car, train ticket, day to day living expenses, child maintenance, etc etc) will be taken away from the amount you can actually borrow.

This.Firstly they have to stress test whether you can afford it at 5% on repayment (in my case) not whatever the current rate is.

So on a £500k mortgage for example, if you are facing a 3% rate that’s what £2,400 a month (over 25 yrs) IIRC.

If you are on £100k that is £5,400 a net income month.

So you might have what £3k immutable outgoings (ex-mortgage)? (They ask real questions about that now.)

Thus no probs to support that 3% rate and they will lend 5x.

But NOW they stress test at a 5% rate.

The repayments jump to nearly £3k per month.

And you can’t afford it.

So they lower the offer to get you back to a £2,400 monthly repayment on a 5% rate… to £400k. 4x.

If you have just been using the rough calculators online they aren’t reflective of the true underwriting process.

Of course if your outgoings are REALLY only £2,400 a month not £3,000 then you CAN afford the £500k mortgage and they will lend 5x.

The problem is that most £100k earners tend to spend more than that as far as I can tell.

Obviously YMMV and best of luck!!

XJ40 said:

As there is no sustained downward house price correction happening and the market does support current house prices then I'd say that evidence that my points are sound. I'm not saying it's a fair situation, or not, it is what it is.

This is a great point and totally fair enough.I guess I was really thinking about where next!

But so far this year you have been absolutely correct!

Someone has touched on it already (XJ40, perhaps), but people don't realise how muh a regular credit card payment, car finance, loan reparnt etc can take off your limit they will lend you.

A year ago my Wife and I bought our first home together, income c£70k, no outgoings whatsoever paid monthly (apart from her phone bill) and we were offered c£350k. That's a staggering amount of money. And so proves that recently, 5 x salary deals are available. For what it's worth, we borrowed £120k... Lol.

That was this time 2014 and we are in North Yorkshire, BTW.

A year ago my Wife and I bought our first home together, income c£70k, no outgoings whatsoever paid monthly (apart from her phone bill) and we were offered c£350k. That's a staggering amount of money. And so proves that recently, 5 x salary deals are available. For what it's worth, we borrowed £120k... Lol.

That was this time 2014 and we are in North Yorkshire, BTW.

walm said:

This is a great point and totally fair enough.

I guess I was really thinking about where next!

But so far this year you have been absolutely correct!

I guess I'm pointing out the obvious, I don't own a crystal ball and it could all start heading south tomorrow of course! But my opinion is that it won't, until we get the next recession and sentiment/confidence takes a dive. We're probably quite some way along in the current economic cycle so who knows, we've had 7 years now since '08.. hardly what you'd call a boom but in a couple be a couple of years time??I guess I was really thinking about where next!

But so far this year you have been absolutely correct!

I've been of this opinion for years, started this thread a couple of years ago but it didn't really take off, too many doom mongers around.

http://www.pistonheads.com/gassing/topic.asp?h=20&...

TheLordJohn said:

Someone has touched on it already (XJ40, perhaps), but people don't realise how muh a regular credit card payment, car finance, loan reparnt etc can take off your limit they will lend you.

A year ago my Wife and I bought our first home together, income c£70k, no outgoings whatsoever paid monthly (apart from her phone bill) and we were offered c£350k. That's a staggering amount of money. And so proves that recently, 5 x salary deals are available. For what it's worth, we borrowed £120k... Lol.

That was this time 2014 and we are in North Yorkshire, BTW.

Offered £350k...A year ago my Wife and I bought our first home together, income c£70k, no outgoings whatsoever paid monthly (apart from her phone bill) and we were offered c£350k. That's a staggering amount of money. And so proves that recently, 5 x salary deals are available. For what it's worth, we borrowed £120k... Lol.

That was this time 2014 and we are in North Yorkshire, BTW.

Take just £120k...

North Yorkshire...

Story checks out!

(BTW makes a big difference if it was pre/post APRIL 2014...!)

XJ40 said:

I've been of this opinion for years, started this thread a couple of years ago but it didn't really take off, too many doom mongers around.

http://www.pistonheads.com/gassing/topic.asp?h=20&...

FWIW I share your opinion and in terms of the thread linked above, 20+ pages (settings vary) is hardly a dud! The reason it hasn't gone further is that this thread tends to be the repository for all things housey pricey.

http://www.pistonheads.com/gassing/topic.asp?h=20&...

I know you will all say the average person by definition lives in an average house.

However, people in say the bottom third or so of incomes often rent privately, with help from housing benefit or live in council accommodation.

I can't see houses doing anything but continue their skyward trajectory.

Why would property fall in value? The only reason I could see is if interest rates rose substantially but the government has shown they won't let this happen. Plus, not everyone is overstretched financially.

However, people in say the bottom third or so of incomes often rent privately, with help from housing benefit or live in council accommodation.

I can't see houses doing anything but continue their skyward trajectory.

Why would property fall in value? The only reason I could see is if interest rates rose substantially but the government has shown they won't let this happen. Plus, not everyone is overstretched financially.

jonah35 said:

I know you will all say the average person by definition lives in an average house.

However, people in say the bottom third or so of incomes often rent privately, with help from housing benefit or live in council accommodation.

I can't see houses doing anything but continue their skyward trajectory.

Why would property fall in value? The only reason I could see is if interest rates rose substantially but the government has shown they won't let this happen. Plus, not everyone is overstretched financially.

And then there are the international cash buyers, looking for a relatively safe haven with the prospect of healthy returns, who will see a self-fulfilling prophecy when they look for their next UK location and move on it.However, people in say the bottom third or so of incomes often rent privately, with help from housing benefit or live in council accommodation.

I can't see houses doing anything but continue their skyward trajectory.

Why would property fall in value? The only reason I could see is if interest rates rose substantially but the government has shown they won't let this happen. Plus, not everyone is overstretched financially.

Houses are a store of wealth for many. Private ownership for the masses is a relatively new paradigm, say two generations roughly, previous to that it was the landed and gentry renting to the masses, the housing market was not commoditised.

People live in their house and slowly pay it off. They then die and often leave the house to their children. Children either sell it, rent it, or live in it, and often will put some or all of the capital into their own home, and wealth store.

This effect increases the proportion of peoples wealth tied up in houses and passes it through generations.

This coupled with finite land and increasing population makes it is obvious to me that homes as a general trend will increase in value, all that happens is the funding of them has to change, shared ownership, low rates, longer terms etc etc.

We will end up with cross generational mortgages. If possible, and if one can and has a capitalist outlook it pays to be slightly long residential property, it is has for a couple of generations now.

People live in their house and slowly pay it off. They then die and often leave the house to their children. Children either sell it, rent it, or live in it, and often will put some or all of the capital into their own home, and wealth store.

This effect increases the proportion of peoples wealth tied up in houses and passes it through generations.

This coupled with finite land and increasing population makes it is obvious to me that homes as a general trend will increase in value, all that happens is the funding of them has to change, shared ownership, low rates, longer terms etc etc.

We will end up with cross generational mortgages. If possible, and if one can and has a capitalist outlook it pays to be slightly long residential property, it is has for a couple of generations now.

Gassing Station | News, Politics & Economics | Top of Page | What's New | My Stuff