40p Tax band - history

Discussion

I wish I could find the link....but anyway (excuse my inaccurate figures, you'll get the gist);

Someone far wiser than I pointed out on here a while back, that whilst a £1mil a year earner is earning FORTY times more than someone on 25k (the rough 'household' average), they are paying (again excuse the lack of accuracy - I've used random online takehome pay calculators) EIGHTYEIGHT times more tax and NI.

Now, how can anyone claim that is 'fair'?

The high earners are already paying MORE.

Someone far wiser than I pointed out on here a while back, that whilst a £1mil a year earner is earning FORTY times more than someone on 25k (the rough 'household' average), they are paying (again excuse the lack of accuracy - I've used random online takehome pay calculators) EIGHTYEIGHT times more tax and NI.

Now, how can anyone claim that is 'fair'?

The high earners are already paying MORE.

tomw2000 said:

I wish I could find the link....but anyway (excuse my inaccurate figures, you'll get the gist);

Someone far wiser than I pointed out on here a while back, that whilst a £1mil a year earner is earning FORTY times more than someone on 25k (the rough 'household' average), they are paying (again excuse the lack of accuracy - I've used random online takehome pay calculators) EIGHTYEIGHT times more tax and NI.

Now, how can anyone claim that is 'fair'?

The high earners are already paying MORE.

How about leaving out the personal allowance and then redoing the calculations? Someone far wiser than I pointed out on here a while back, that whilst a £1mil a year earner is earning FORTY times more than someone on 25k (the rough 'household' average), they are paying (again excuse the lack of accuracy - I've used random online takehome pay calculators) EIGHTYEIGHT times more tax and NI.

Now, how can anyone claim that is 'fair'?

The high earners are already paying MORE.

It's a bit like saying somebody on £1m pays 389000 times as much tax as somebody on £9,445 (or a bilion billion billion billion times as much tax as somebody earning £9k)

Countdown said:

How about leaving out the personal allowance and then redoing the calculations?

It's a bit like saying somebody on £1m pays 389000 times as much tax as somebody on £9,445 (or a bilion billion billion billion times as much tax as somebody earning £9k)

Told you my maffs was a bit poor, thanks for pointing out

It's a bit like saying somebody on £1m pays 389000 times as much tax as somebody on £9,445 (or a bilion billion billion billion times as much tax as somebody earning £9k)

kiethton said:

jonah35 said:

Income tax should be a flat 35% on every bit of earnings. The rich would still pay more. They should merge tax and ni.

Your first £10k should be tax free.

How simple!

This! check the 2020 groupYour first £10k should be tax free.

How simple!

It's tricky to find the exact % it would need to be, but bear in mind that the top 1% of earners currently pay 30% of the UK's total income tax bill and their marginal income tax rate alone won't be far below 50%.

I wouldn't be surprised if the people paying the majority of the income tax take aren't well into the 40% numbers when you take their income tax and NI into account.

turbobloke said:

Eric Mc said:

Really?

What do you propose as an alternative?

I propose a reduction in State spending, starting with the enormous amount of waste, then going on to fraud.What do you propose as an alternative?

Smaller government and smaller spending require lower taxes.

I am all for tackling fraud - especially that of the mega corporations, banks etc.

Eric Mc said:

turbobloke said:

Eric Mc said:

Really?

What do you propose as an alternative?

I propose a reduction in State spending, starting with the enormous amount of waste, then going on to fraud.What do you propose as an alternative?

Smaller government and smaller spending require lower taxes.

I am all for tackling fraud - especially that of the mega corporations, banks etc.

Cheap shots aside (sorry about the above), I could save the govt £80bn a year for the next 36 years tomorrow if they'd let me. I could save many thousands of elderly people from dying through heating poverty too if they'd let me. I could also save £billions wasted on EU membership if they let me. HS2 - how much is that going to cost? Let's scrap that. I could go on, but I've got to earn more money so the scumbags can relieve me of most of it in order to piss it up the wall etc etc.

Government = wasteful, plundering, thieving f

ktards. And tax, which is theft, is their oxygen.

ktards. And tax, which is theft, is their oxygen. Diderot said:

Eric Mc said:

turbobloke said:

Eric Mc said:

Really?

What do you propose as an alternative?

I propose a reduction in State spending, starting with the enormous amount of waste, then going on to fraud.What do you propose as an alternative?

Smaller government and smaller spending require lower taxes.

I am all for tackling fraud - especially that of the mega corporations, banks etc.

Cheap shots aside (sorry about the above), I could save the govt £80bn a year for the next 36 years tomorrow if they'd let me. I could save many thousands of elderly people from dying through heating poverty too if they'd let me. I could also save £billions wasted on EU membership if they let me. HS2 - how much is that going to cost? Let's scrap that. I could go on, but I've got to earn more money so the scumbags can relieve me of most of it in order to piss it up the wall etc etc.

Government = wasteful, plundering, thieving f

ktards. And tax, which is theft, is their oxygen.

ktards. And tax, which is theft, is their oxygen.  espeically on bean counters

espeically on bean counters

tomw2000 said:

Countdown said:

How about leaving out the personal allowance and then redoing the calculations?

It's a bit like saying somebody on £1m pays 389000 times as much tax as somebody on £9,445 (or a bilion billion billion billion times as much tax as somebody earning £9k)

Told you my maffs was a bit poor, thanks for pointing out

It's a bit like saying somebody on £1m pays 389000 times as much tax as somebody on £9,445 (or a bilion billion billion billion times as much tax as somebody earning £9k)

Edited by anonymous-user on Wednesday 4th December 17:05

youngsyr said:

kiethton said:

jonah35 said:

Income tax should be a flat 35% on every bit of earnings. The rich would still pay more. They should merge tax and ni.

Your first £10k should be tax free.

How simple!

This! check the 2020 groupYour first £10k should be tax free.

How simple!

It's tricky to find the exact % it would need to be, but bear in mind that the top 1% of earners currently pay 30% of the UK's total income tax bill and their marginal income tax rate alone won't be far below 50%.

A UK flat tax, with no other changes and a 10k tax free threshold, would be between 50% and 60%, and closer to 60%.

It's not just the '1% pay 30%' ratio, it's that the top 10% of taxpayers pay 60% of the tax. UK income tax take is massively distorted to the top end.

And as we know it's not a taxation problem, it's a spending problem.

Eric Mc said:

I am all for tackling fraud - especially that of the mega corporations, banks etc.

Nice populist sound-bytes .. but please detail this 'fraud' which is taking place?

I'm sure HRMC would like to know. Or did you mean legal ways to avoid tax?

Meanwhile, we'll carry on throwing 250+ billion a year on Edukashun (because that's working really well), the NHS and Welfare.

Edited by fido on Wednesday 4th December 16:48

There is a fine line between what constitutes avoidance and evasion.

Just because an entity engages in an activity they THINK is legal avoidance doesn't mean it is.

That is one of the reasons why the tax code has become so complex - as legislation often becomes complex as it tries to clarify what is intended.

And then complexity breeds further complexity. It's a vicious circle.

I should know.

Just because an entity engages in an activity they THINK is legal avoidance doesn't mean it is.

That is one of the reasons why the tax code has become so complex - as legislation often becomes complex as it tries to clarify what is intended.

And then complexity breeds further complexity. It's a vicious circle.

I should know.

fido said:

Eric Mc said:

I am all for tackling fraud - especially that of the mega corporations, banks etc.

Nice populist sound-bytes .. but please detail this 'fraud' which is taking place?

I'm sure HRMC would like to know. Or did you mean legal ways to avoid tax?

Because government control of spending is poor, large "favoured" suppliers often abuse this poor control.

The problem is with both parties - the government departments who often don't really know what they are doing - and the private contractors who make hay while the sun is shining.

The problem is with both parties - the government departments who often don't really know what they are doing - and the private contractors who make hay while the sun is shining.

"Taking low earners out of income tax" is a good political sound-bite and also avoids lots of administration for minimal tax take. (However, that will always be an issue at the bottom end of tax - because it's not like stamp Duty which operates on a sudden death basis)

The low paid are quite heavily taxed through VAT, fuel duty, alcohol duty, council tax and other indirect taxes.

It's increasingly attractive to run your own company rather then getting a job. There are many tax breaks. Avoidance of National Insurance, compounding returns at 20% tax rate and paying CGT instead of IT (where practicable) are all good news.

Rapid lowering of the "real" 40% threshold is screwing the middle class on salaries. The government targets them because the tax raised is mahoosive. These people have very few opportunities to avoid tax and are sitting ducks for the PAYE system.

Government loves PAYE and VAT. They are HUGE taxes and cost very little to administer - the whole burden is placed on business.

The low paid are quite heavily taxed through VAT, fuel duty, alcohol duty, council tax and other indirect taxes.

It's increasingly attractive to run your own company rather then getting a job. There are many tax breaks. Avoidance of National Insurance, compounding returns at 20% tax rate and paying CGT instead of IT (where practicable) are all good news.

Rapid lowering of the "real" 40% threshold is screwing the middle class on salaries. The government targets them because the tax raised is mahoosive. These people have very few opportunities to avoid tax and are sitting ducks for the PAYE system.

Government loves PAYE and VAT. They are HUGE taxes and cost very little to administer - the whole burden is placed on business.

Newc said:

youngsyr said:

kiethton said:

jonah35 said:

Income tax should be a flat 35% on every bit of earnings. The rich would still pay more. They should merge tax and ni.

Your first £10k should be tax free.

How simple!

This! check the 2020 groupYour first £10k should be tax free.

How simple!

It's tricky to find the exact % it would need to be, but bear in mind that the top 1% of earners currently pay 30% of the UK's total income tax bill and their marginal income tax rate alone won't be far below 50%.

A UK flat tax, with no other changes and a 10k tax free threshold, would be between 50% and 60%, and closer to 60%.

It's not just the '1% pay 30%' ratio, it's that the top 10% of taxpayers pay 60% of the tax. UK income tax take is massively distorted to the top end.

And as we know it's not a taxation problem, it's a spending problem.

mrmr96 said:

Terminator X said:

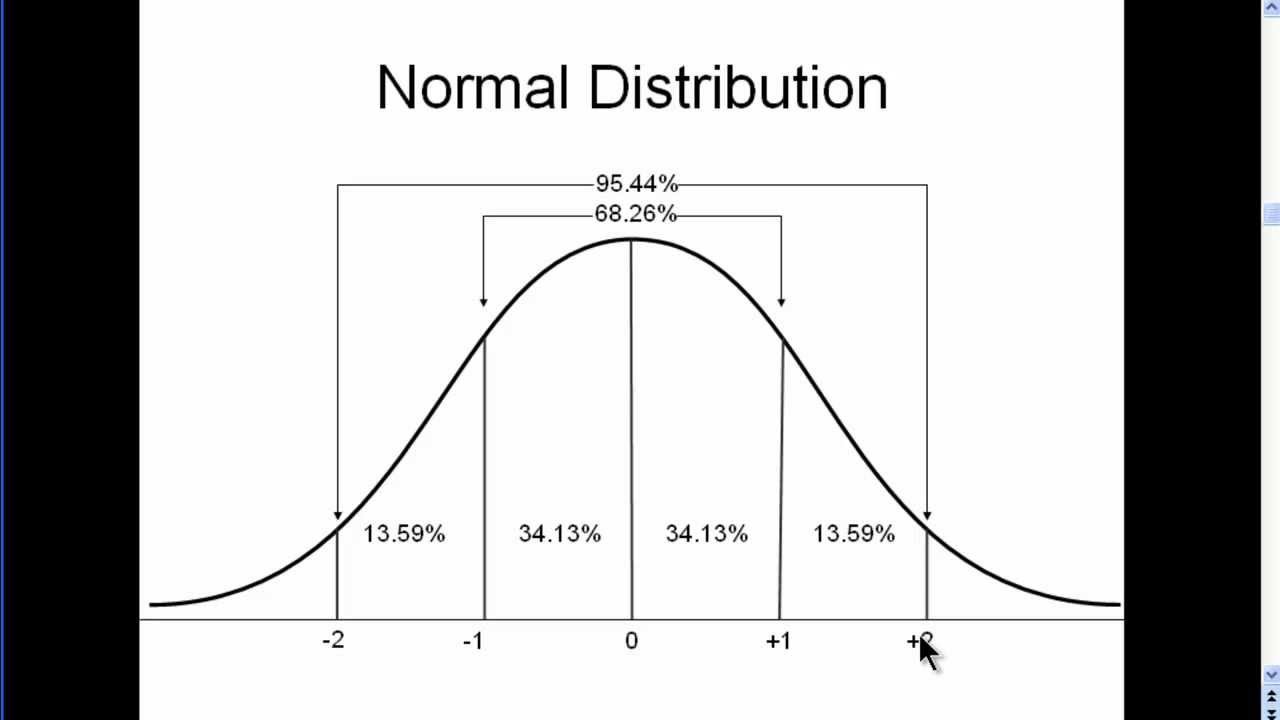

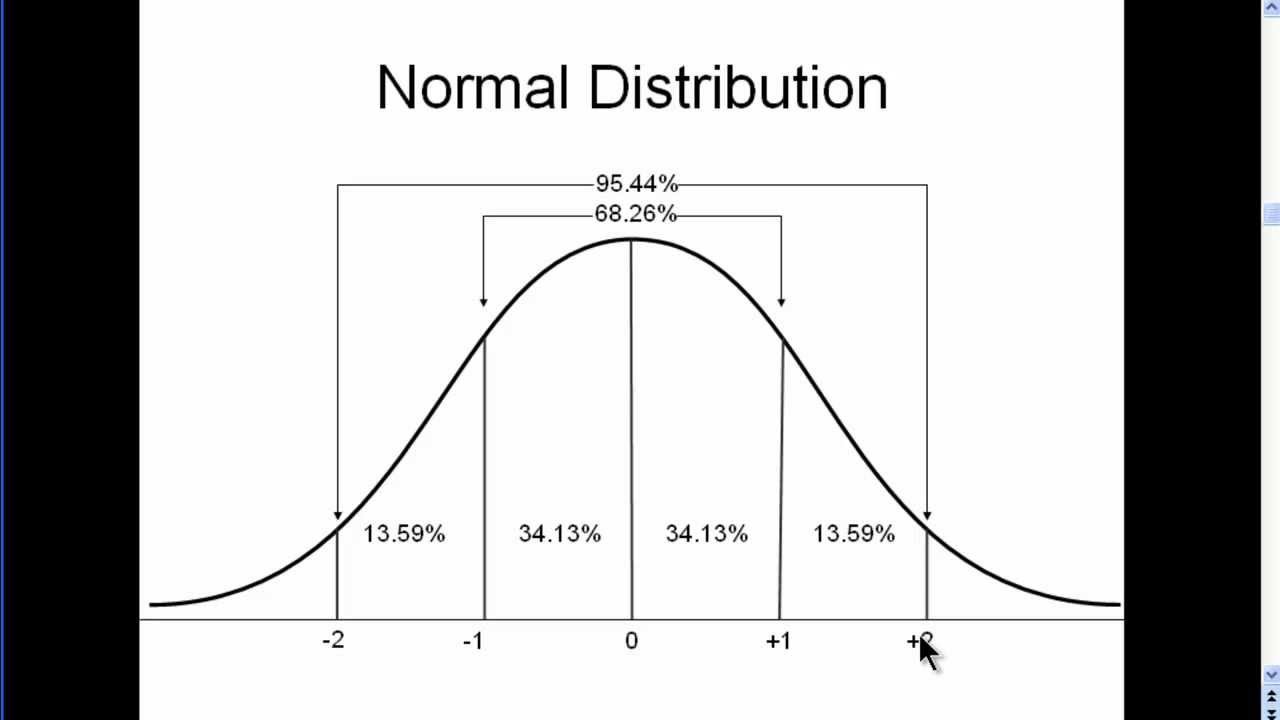

Not too surprising that the middle 95% are getting screwed, simple bell graph approach?

TX.

How do you define "middle" WRT to wages? On a cumulative basis? The distribution looks nothing like your chart.

TX.

TX.

Gassing Station | News, Politics & Economics | Top of Page | What's New | My Stuff