40p Tax band - history

Discussion

Terminator X said:

mrmr96 said:

Terminator X said:

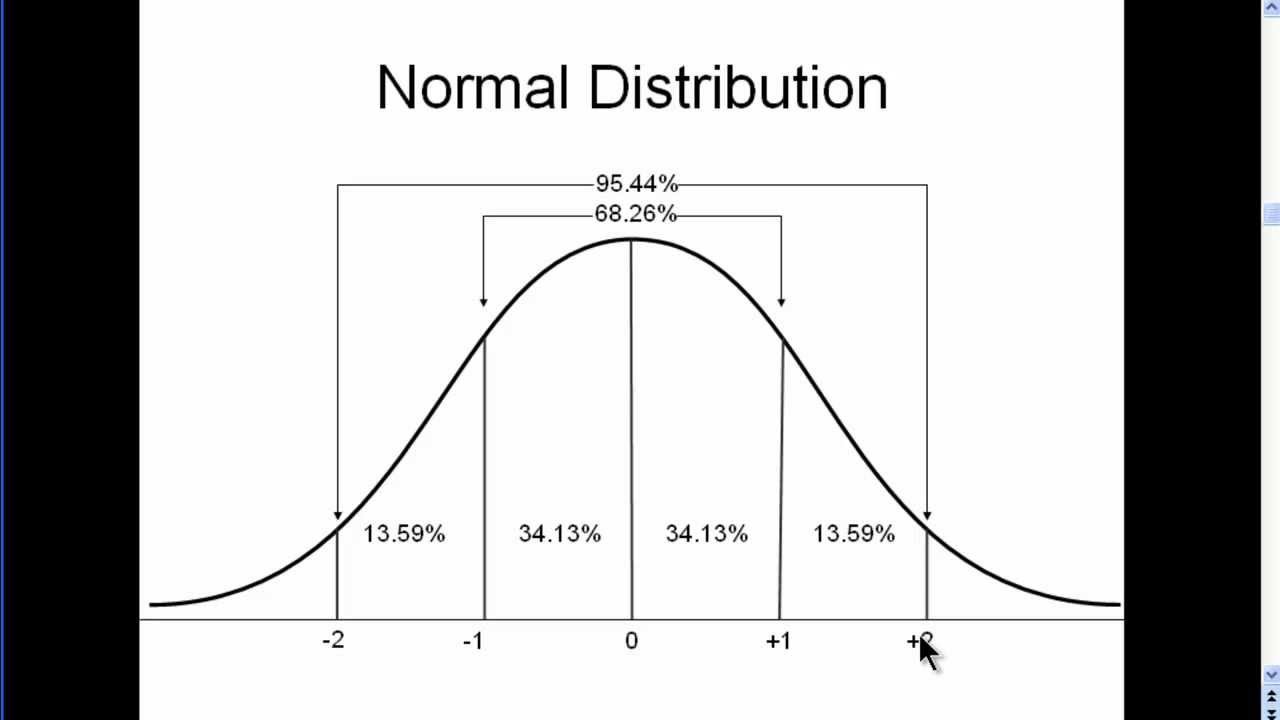

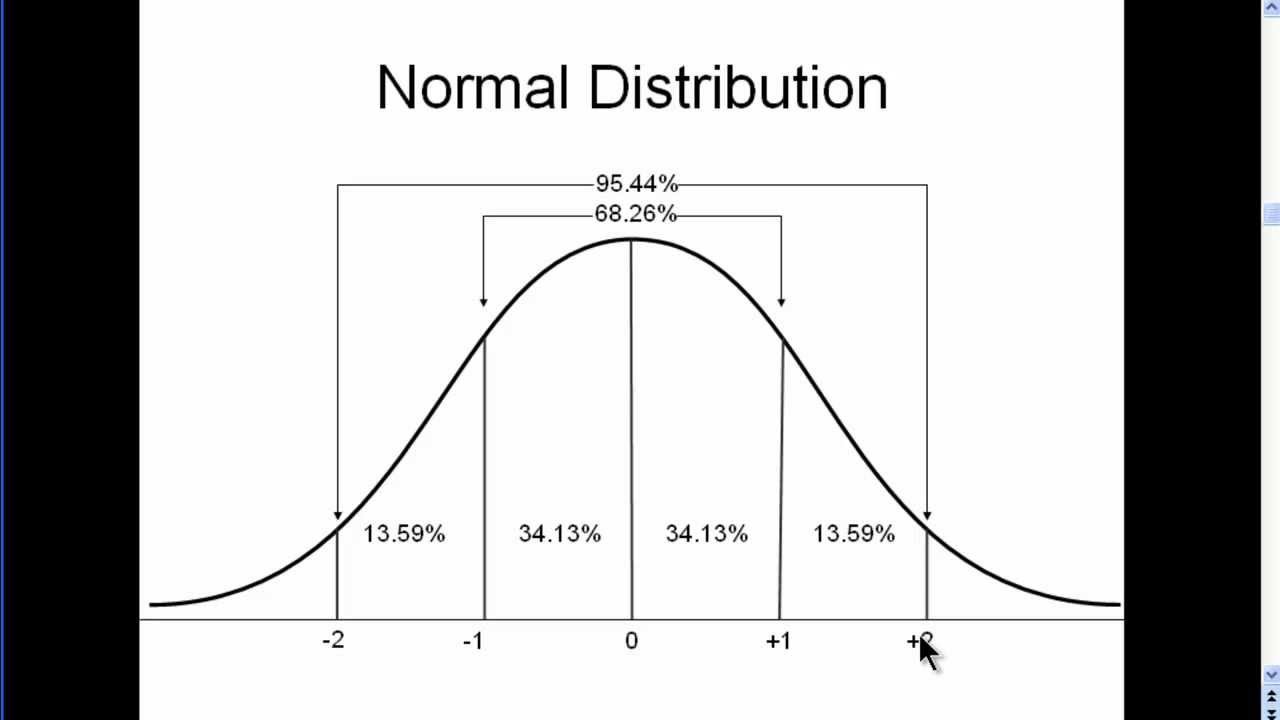

Not too surprising that the middle 95% are getting screwed, simple bell graph approach?

TX.

How do you define "middle" WRT to wages? On a cumulative basis? The distribution looks nothing like your chart.

TX.

TX.

youngsyr said:

Newc said:

A UK flat tax, with no other changes and a 10k tax free threshold, would be between 50% and 60%, and closer to 60%.

It's not just the '1% pay 30%' ratio, it's that the top 10% of taxpayers pay 60% of the tax. UK income tax take is massively distorted to the top end.

Hmm, I'm not convinced it would be closer to 60% - from memory the highest marginal rate (excluding a few people in the £100-£150k band) is 50% for income tax plus another 1% for NI (at the higher levels), so I can only ever see a flat rate being at the highest amount of that - unless you start reducing the tax taken from lower earners from the current position, which given they're paying minimal marginal rates (from 0% up to something like 12% for basic rate earners once PA is taken into account), seems unlikely.It's not just the '1% pay 30%' ratio, it's that the top 10% of taxpayers pay 60% of the tax. UK income tax take is massively distorted to the top end.

1. Total of £250bn income tax and NI for 2012/13.

2. 22m people in full time work, 8m in part time.

3. Assume the UK average salary is 30k and applies to the 22m, and they have 10k threshold, giving 440bn taxable.

So it's 250/440 = 57% for the full timers.

Say part time average hours are 66% = salary is 20k; that gives another 80bn of taxable, reducing the rate to 250/520 = 48%.

But those are high estimates for average salaries. If the full time average is actually just 2k lower at 28k and part time hours are 50% = 14k, the flat tax rate is 250 / 396+32 = 58%.

Like I said, the subsidy level of tax receipts from higher earners is absolutely huge.

Newc said:

youngsyr said:

kiethton said:

jonah35 said:

Income tax should be a flat 35% on every bit of earnings. The rich would still pay more. They should merge tax and ni.

Your first £10k should be tax free.

How simple!

This! check the 2020 groupYour first £10k should be tax free.

How simple!

It's tricky to find the exact % it would need to be, but bear in mind that the top 1% of earners currently pay 30% of the UK's total income tax bill and their marginal income tax rate alone won't be far below 50%.

A UK flat tax, with no other changes and a 10k tax free threshold, would be between 50% and 60%, and closer to 60%.

A flat tax at 22% with a £12k allowance would only have a £50B shortfall within the first couple of years. (Details from 2005)

So a flat tax of 30% and £10k allowance would be more than enough

http://www.adamsmith.org/sites/default/files/image...

Newc said:

youngsyr said:

Newc said:

A UK flat tax, with no other changes and a 10k tax free threshold, would be between 50% and 60%, and closer to 60%.

It's not just the '1% pay 30%' ratio, it's that the top 10% of taxpayers pay 60% of the tax. UK income tax take is massively distorted to the top end.

Hmm, I'm not convinced it would be closer to 60% - from memory the highest marginal rate (excluding a few people in the £100-£150k band) is 50% for income tax plus another 1% for NI (at the higher levels), so I can only ever see a flat rate being at the highest amount of that - unless you start reducing the tax taken from lower earners from the current position, which given they're paying minimal marginal rates (from 0% up to something like 12% for basic rate earners once PA is taken into account), seems unlikely.It's not just the '1% pay 30%' ratio, it's that the top 10% of taxpayers pay 60% of the tax. UK income tax take is massively distorted to the top end.

1. Total of £250bn income tax and NI for 2012/13.

2. 22m people in full time work, 8m in part time.

3. Assume the UK average salary is 30k and applies to the 22m, and they have 10k threshold, giving 440bn taxable.

So it's 250/440 = 57% for the full timers.

Say part time average hours are 66% = salary is 20k; that gives another 80bn of taxable, reducing the rate to 250/520 = 48%.

But those are high estimates for average salaries. If the full time average is actually just 2k lower at 28k and part time hours are 50% = 14k, the flat tax rate is 250 / 396+32 = 58%.

Like I said, the subsidy level of tax receipts from higher earners is absolutely huge.

So, somewhere along the lines your figures must be wrong as even a flat rate of 51% will result in a lot of people's current effective rate being increased whilst no-one's is decreased.

youngsyr said:

Newc said:

Quick and easy calcs from ONS data:

1. Total of £250bn income tax and NI for 2012/13.

2. 22m people in full time work, 8m in part time.

3. Assume the UK average salary is 30k and applies to the 22m, and they have 10k threshold, giving 440bn taxable.

So it's 250/440 = 57% for the full timers.

Say part time average hours are 66% = salary is 20k; that gives another 80bn of taxable, reducing the rate to 250/520 = 48%.

But those are high estimates for average salaries. If the full time average is actually just 2k lower at 28k and part time hours are 50% = 14k, the flat tax rate is 250 / 396+32 = 58%.

The problem is that your quick and easy calcs are contradicted by reality - no-one (excluding a few in the £100-£150k bracket) is currently paying more than 51% tax and NI combined as their highest rate, let alone their effective (= average) rate and those on the 51% rate are paying more than their fare share of the tax take.1. Total of £250bn income tax and NI for 2012/13.

2. 22m people in full time work, 8m in part time.

3. Assume the UK average salary is 30k and applies to the 22m, and they have 10k threshold, giving 440bn taxable.

So it's 250/440 = 57% for the full timers.

Say part time average hours are 66% = salary is 20k; that gives another 80bn of taxable, reducing the rate to 250/520 = 48%.

But those are high estimates for average salaries. If the full time average is actually just 2k lower at 28k and part time hours are 50% = 14k, the flat tax rate is 250 / 396+32 = 58%.

So, somewhere along the lines your figures must be wrong as even a flat rate of 51% will result in a lot of people's current effective rate being increased whilst no-one's is decreased.

1. £250bn total tax take: http://www.hmrc.gov.uk/statistics/receipts/receipt...

2. 22m FT and 8m PT workers: ONS via http://www.telegraph.co.uk/finance/jobs/10301545/T...

3. Average earnings of c28k : http://www.ons.gov.uk/ons/rel/ashe/annual-survey-o...

Even if you make no assumption about part time earnings, apply the average to everyone, and say that the total taxable pot is 30m x (28k - 10k threshold) = 540bn, the flat rate required to make £250bn is 46%.

It's a simple calculation, so feel free to identify any actual errors.

youngsyr said:

The problem is that your quick and easy calcs are contradicted by reality - no-one (excluding a few in the £100-£150k bracket) is currently paying more than 51% tax and NI combined as their highest rate, let alone their effective (= average) rate and those on the 51% rate are paying more than their fare share of the tax take.

So, somewhere along the lines your figures must be wrong as even a flat rate of 51% will result in a lot of people's current effective rate being increased whilst no-one's is decreased.

Are you including employers NI in your calculation? I think it's included in the 250bn figure.So, somewhere along the lines your figures must be wrong as even a flat rate of 51% will result in a lot of people's current effective rate being increased whilst no-one's is decreased.

When the top rate was 98%, they contributed something like 11% of tax take.

Now, at 60% or thereabouts (once NI, etc is considered), they contribute a third of the total take.

If you reduce the tax burden, it is no longer worth losing 50p to the £ on complex schemes. The only people that benefit from grossly inflated tax rates are accountants and lawyers.

Now, at 60% or thereabouts (once NI, etc is considered), they contribute a third of the total take.

If you reduce the tax burden, it is no longer worth losing 50p to the £ on complex schemes. The only people that benefit from grossly inflated tax rates are accountants and lawyers.

Newc said:

youngsyr said:

Newc said:

Quick and easy calcs from ONS data:

1. Total of £250bn income tax and NI for 2012/13.

2. 22m people in full time work, 8m in part time.

3. Assume the UK average salary is 30k and applies to the 22m, and they have 10k threshold, giving 440bn taxable.

So it's 250/440 = 57% for the full timers.

Say part time average hours are 66% = salary is 20k; that gives another 80bn of taxable, reducing the rate to 250/520 = 48%.

But those are high estimates for average salaries. If the full time average is actually just 2k lower at 28k and part time hours are 50% = 14k, the flat tax rate is 250 / 396+32 = 58%.

The problem is that your quick and easy calcs are contradicted by reality - no-one (excluding a few in the £100-£150k bracket) is currently paying more than 51% tax and NI combined as their highest rate, let alone their effective (= average) rate and those on the 51% rate are paying more than their fare share of the tax take.1. Total of £250bn income tax and NI for 2012/13.

2. 22m people in full time work, 8m in part time.

3. Assume the UK average salary is 30k and applies to the 22m, and they have 10k threshold, giving 440bn taxable.

So it's 250/440 = 57% for the full timers.

Say part time average hours are 66% = salary is 20k; that gives another 80bn of taxable, reducing the rate to 250/520 = 48%.

But those are high estimates for average salaries. If the full time average is actually just 2k lower at 28k and part time hours are 50% = 14k, the flat tax rate is 250 / 396+32 = 58%.

So, somewhere along the lines your figures must be wrong as even a flat rate of 51% will result in a lot of people's current effective rate being increased whilst no-one's is decreased.

1. £250bn total tax take: http://www.hmrc.gov.uk/statistics/receipts/receipt...

2. 22m FT and 8m PT workers: ONS via http://www.telegraph.co.uk/finance/jobs/10301545/T...

3. Average earnings of c28k : http://www.ons.gov.uk/ons/rel/ashe/annual-survey-o...

Even if you make no assumption about part time earnings, apply the average to everyone, and say that the total taxable pot is 30m x (28k - 10k threshold) = 540bn, the flat rate required to make £250bn is 46%.

It's a simple calculation, so feel free to identify any actual errors.

High earners pay for lots of people.

Your calculation boils everything down to the "average" salary and shows a significant shortfall (or a massive flat rate required).

If you take your average of £30k with a £10k threshold (so £20k taxable). A 30% flat rate give a £6k tax.

Now take our person on £1 million. They are taxed 30% on £990,000. So that's 297,000 tax...or the same as almost 50 of your "average" people.

andy_s said:

Is it an accurate representation of the situation regarding tax distribution across population or just to show what a bell graph looks like?

Originally posted to suggest that it (people that get clobbered the most) would follow a standard bell graph as indeed most things do - small tax to one side, large tax to the other with the majority of us in the middle.TX.

London424 said:

Now take our person on £1 million. They are taxed 30% on £990,000. So that's 297,000 tax...or the same as almost 50 of your "average" people.

But if they were taxed at 50% they would still be paying as much as many 'average' people. A flat rate couldn't possibly result in everyone paying more in order to produce the same revenue. I think the problem is that most of us don't include employers NI as part of our tax bill.Dr Jekyll said:

I think the problem is that most of us don't include employers NI as part of our tax bill.

It isn't part of your tax bill, it's a tax on jobs paid by the employer for the privilege of employing people. If employers NI was scrapped tomorrow there would be no effect on employee salaries. RYH64E said:

Dr Jekyll said:

I think the problem is that most of us don't include employers NI as part of our tax bill.

It isn't part of your tax bill, it's a tax on jobs paid by the employer for the privilege of employing people. If employers NI was scrapped tomorrow there would be no effect on employee salaries. And suggesting it's paid by the employer not the employee is splitting non existent hairs.

Dr Jekyll said:

But it's included in the total NI take. So if you divide the total of income tax + NI by the number of people paying, you get a higher figure than you might expect.

And suggesting it's paid by the employer not the employee is splitting non existent hairs.

Employers NI isn't part of 'our tax bill' it's part of 'their tax bill', they being the employer. It's a cost to the employer much like the cost of providing an employee's office and computer.And suggesting it's paid by the employer not the employee is splitting non existent hairs.

RYH64E said:

Dr Jekyll said:

But it's included in the total NI take. So if you divide the total of income tax + NI by the number of people paying, you get a higher figure than you might expect.

And suggesting it's paid by the employer not the employee is splitting non existent hairs.

Employers NI isn't part of 'our tax bill' it's part of 'their tax bill', they being the employer. It's a cost to the employer much like the cost of providing an employee's office and computer.And suggesting it's paid by the employer not the employee is splitting non existent hairs.

The dispute was about why dividing the total income tax take (inc NI) by the number of workers implies an average tax rate of around 50%. Much higher than the proportion we pay in OUR tax bill. My point was that if the total tax take figure included the employers NI, this would explain at least part of the difference.

Comparing total income tax + employees NI + employers NI with the employees income tax + NI bills isn't comparing like with like.

If you want to use HMRC figures to estimate what a flat tax rate would have to be. Either EXCLUDE employers NI from the HMRC figure, or INCLUDE it in the employees payments figure.

marcosgt said:

I think that's a reflection on how spoilt you (we) are.

Loads of people would LOVE to earn enough to pay 40% tax... (From the figures I can find online only 29% of taxpayers pay 40% or more - Presumably this doesn't include the super-rich who pay nothing, either).

M.

many more people earn enough to pay 40% but dodge it via. ltd company structures - according to the statistics they'll be classified as minimum wage earners. this is so common place, even in the civil service it seems, that i'd imagine it has a statistically significant effect on pay data.Loads of people would LOVE to earn enough to pay 40% tax... (From the figures I can find online only 29% of taxpayers pay 40% or more - Presumably this doesn't include the super-rich who pay nothing, either).

M.

scenario8 said:

A few years a go my then boss turned down the opportunity for a bit of extra work (about £500) on the basis that he pays "90% of that in tax - it isn't worth it". This man earns around £60-80k a year, has a dozen graduates report to him, is allowed to drive a car and even vote.

He is as much of a cretin now as he was then.

clearly he's exaggerating for effect, but i can empathise completely.He is as much of a cretin now as he was then.

my attitude to 'additional work' has also changed now that only about 33% of the additional money earned actually ends up in my bank account. obviously i don't turn down pay rises and performance bonuses etc. but doing extra work when you'll only be left with a negligible proportion of it would be crazy - my time is worth more to me than the net gain - so unless it is urgent or particularly enjoyable work i don't bother.

i wonder how much more money might be earned, and therefore taxed if the rate of taxation was flat..

Edited by BeefMaster9000 on Thursday 5th December 21:20

This issue is back in the news again.

25 years ago 1 in 20 fell into the 40p bracket - today that is now 1 in 6 and rising pretty fast. The Times recently reported that 1.1m more people would be paying the 40p tax rate over the life of this parliament since 2010 (compared to a situation where the government had continued with the policy they inherited from Labour).

Nadhim Zahawi, MP and a member of the No. 10 Policy Board suggests scrapping the 40p band altogether and lowering the threshold for the 45p rate to £62k (from 150k).

25 years ago 1 in 20 fell into the 40p bracket - today that is now 1 in 6 and rising pretty fast. The Times recently reported that 1.1m more people would be paying the 40p tax rate over the life of this parliament since 2010 (compared to a situation where the government had continued with the policy they inherited from Labour).

Nadhim Zahawi, MP and a member of the No. 10 Policy Board suggests scrapping the 40p band altogether and lowering the threshold for the 45p rate to £62k (from 150k).

Telegraph said:

The Conservatives should consider scrapping the 40p higher rate of income tax as an "iconic" pledge to help win voters, a Number 10 policy adviser has said.

Nadhim Zahawi, a member of the No. 10 Policy Board, said that the time has come for the Conservative Party to have a "serious debate" about its income tax policy.

However David Cameron on Wednesday dismissed calls to increase the threshold for paying the 40p rate in next week's Budget, saying that his priority will be giving tax breaks to low earners.

The prospect has infuriated Tory MPs, who have warned that growing numbers of middle-class workers are being dragged into the 40p rate.

They are demanding tax cuts for the 800,000 middle-class professionals who have be dragged into the higher tax rate in the last three years as their wages have risen above the threshold for the 40p tax band.

Mr Zahawi on Wednesday praised plans by Renewal, a Tory pressure group, to abolish the 40p rate entirely and deliver a tax cut worth £2,000-a-year for 2 million middle class workers.

Under the proposals, the move would be funded by lowering threshold for the 45p rate would be from £150,000 to £62,000.

In a speech at Policy Exchange, a think-tank with links to the Conservative Party, Mr Zahawi said: "It is a welcome development that Conservatives have started to seriously debate where next for income tax.

"Labour have the 50p, the Lib Dems have the mansion tax, we need our own iconic tax policy. I think Dave Skelton's [from Renewal's] contribution, and his suggestion that we abolish the 40p rate and pay for it by lowering the 45p rate was a great way of starting the conversation."

One of the Coalition's flagship policies has been raising the tax-free personal allowance, which it says has taken more than 2 million people out of the tax system.

However, the £41,450 threshold for higher rate tax will rise by a flat 1 per cent over the next two years, significantly below the level of inflation.

The below inflation rise means that more than 1 million extra middle-income workers will have been dragged into the 40p tax bracket by next year.

Twenty-five years ago, when the then Nigel Lawson, the former Tory Chancellor, first introduced the 40 per cent band, only one person in 20 paid the higher rate. Today, one in six people pays the 40 per cent rate.

Mr Cameron on Wednesday defended the government's focus on increasing the tax free threshold.

Asked if Tory back-benchers were right to call for the 40p threshold to be raised, Mr Cameron said: "I'm a tax cutting conservative. I want to see us relieve people's tax burden. We've chosen to do that through raising the personal allowance which helps everyone earning under £100,000."

Mr Zahawi said that the cuts are unlikely to be announced in the Budget next week and cautioned against a "knee jerk, panicked reaction".

He said: "I think it's a healthy debate for us to have, although I think it is right that we stick to what the Prime Minister and Chancellor have said, that if there is any money it should go to the lower end of the spectrum."

http://www.telegraph.co.uk/finance/personalfinance/consumertips/tax/10693615/Scrapping-40p-rate-could-be-iconic-Tory-pledge-No-10-policy-adviser-says.htmlNadhim Zahawi, a member of the No. 10 Policy Board, said that the time has come for the Conservative Party to have a "serious debate" about its income tax policy.

However David Cameron on Wednesday dismissed calls to increase the threshold for paying the 40p rate in next week's Budget, saying that his priority will be giving tax breaks to low earners.

The prospect has infuriated Tory MPs, who have warned that growing numbers of middle-class workers are being dragged into the 40p rate.

They are demanding tax cuts for the 800,000 middle-class professionals who have be dragged into the higher tax rate in the last three years as their wages have risen above the threshold for the 40p tax band.

Mr Zahawi on Wednesday praised plans by Renewal, a Tory pressure group, to abolish the 40p rate entirely and deliver a tax cut worth £2,000-a-year for 2 million middle class workers.

Under the proposals, the move would be funded by lowering threshold for the 45p rate would be from £150,000 to £62,000.

In a speech at Policy Exchange, a think-tank with links to the Conservative Party, Mr Zahawi said: "It is a welcome development that Conservatives have started to seriously debate where next for income tax.

"Labour have the 50p, the Lib Dems have the mansion tax, we need our own iconic tax policy. I think Dave Skelton's [from Renewal's] contribution, and his suggestion that we abolish the 40p rate and pay for it by lowering the 45p rate was a great way of starting the conversation."

One of the Coalition's flagship policies has been raising the tax-free personal allowance, which it says has taken more than 2 million people out of the tax system.

However, the £41,450 threshold for higher rate tax will rise by a flat 1 per cent over the next two years, significantly below the level of inflation.

The below inflation rise means that more than 1 million extra middle-income workers will have been dragged into the 40p tax bracket by next year.

Twenty-five years ago, when the then Nigel Lawson, the former Tory Chancellor, first introduced the 40 per cent band, only one person in 20 paid the higher rate. Today, one in six people pays the 40 per cent rate.

Mr Cameron on Wednesday defended the government's focus on increasing the tax free threshold.

Asked if Tory back-benchers were right to call for the 40p threshold to be raised, Mr Cameron said: "I'm a tax cutting conservative. I want to see us relieve people's tax burden. We've chosen to do that through raising the personal allowance which helps everyone earning under £100,000."

Mr Zahawi said that the cuts are unlikely to be announced in the Budget next week and cautioned against a "knee jerk, panicked reaction".

He said: "I think it's a healthy debate for us to have, although I think it is right that we stick to what the Prime Minister and Chancellor have said, that if there is any money it should go to the lower end of the spectrum."

c7xlg said:

Ain't democarcy great... no party seems to give a doggies danglies about the vote of people earning over 100k. Is it because there r too few of them to worry about their votes or because tories think they will vote for them anyway as the alternatives are obviously even worse? ?

Agreed, you should get an additional vote per £25,000 you pay in tax Gassing Station | News, Politics & Economics | Top of Page | What's New | My Stuff