Is the end nigh for the Euro? [vol. 3]

Discussion

fblm said:

Driller said:

Good god man, lighten up, I was being facetious

Oh right. Obviously.

http://youtu.be/Ij1pZvv9m0g

Or it might not and you can continue to be a miserable git

Steffan said:

I do appreciate your very kind moments. In the early days f this thread i received a LOT of very kind support and encouragement from a significant number of posters on PH. Well recieved by me because the abuse was considerable. At the time i was trying to rebut all these nonsense comments, which eventually made me start referring to the whole m,EU shebang as the "Nonsense", which rightly I think. It seems to have stuck!

I have also read the comments of TheDonOfCroy and I am delighted to see from the comments on here that a number of contributors, recognise the reality of the wholly unsustainable position that so many failing states witn the EU are heading into. Sadly financial collapse is the only way I can see reality returning to the EU. When Greece, France, Spain, Portugal, and Italy are already visibly failing and even Germany with the Deutsche Bank affair are looking at a very expensive under the table bail out or deeply serious consequences to their Banking strengths, hopefully, (but very improbably) hidden from view then something is obviously totally wrong.

j

This nonsense has been teetering on the edge of discovery for some years and the EU blithely continuing to bail out Greece, when by any assessement Greece is totally insolvent is madness. Greece never will recover, because Greece never could afford to survive unaided within EU.

The British decision to leave the EU has seriously reduced the remaining strength of the EU. Brexit may well prove to be an expensive exercise with the EU looking for naximimum penalties and obstructive efforts to dissuade any other countries from following the same path. But the die is cast IMO and the EU ad Euro are both living on borrowed time. Change is coming to Europe and no amount of shenanigans and QE printing is going to put this nonsense back together again. Matter of time.

Thank you SteffanI have also read the comments of TheDonOfCroy and I am delighted to see from the comments on here that a number of contributors, recognise the reality of the wholly unsustainable position that so many failing states witn the EU are heading into. Sadly financial collapse is the only way I can see reality returning to the EU. When Greece, France, Spain, Portugal, and Italy are already visibly failing and even Germany with the Deutsche Bank affair are looking at a very expensive under the table bail out or deeply serious consequences to their Banking strengths, hopefully, (but very improbably) hidden from view then something is obviously totally wrong.

j

This nonsense has been teetering on the edge of discovery for some years and the EU blithely continuing to bail out Greece, when by any assessement Greece is totally insolvent is madness. Greece never will recover, because Greece never could afford to survive unaided within EU.

The British decision to leave the EU has seriously reduced the remaining strength of the EU. Brexit may well prove to be an expensive exercise with the EU looking for naximimum penalties and obstructive efforts to dissuade any other countries from following the same path. But the die is cast IMO and the EU ad Euro are both living on borrowed time. Change is coming to Europe and no amount of shenanigans and QE printing is going to put this nonsense back together again. Matter of time.

Edited by Steffan on Friday 14th October 18:14

Digga said:

911gary said:

Having just returned from Spain the few I discussed Brexit with were of the opinion that we rushed into it and are now realising our mistake and wont leave.

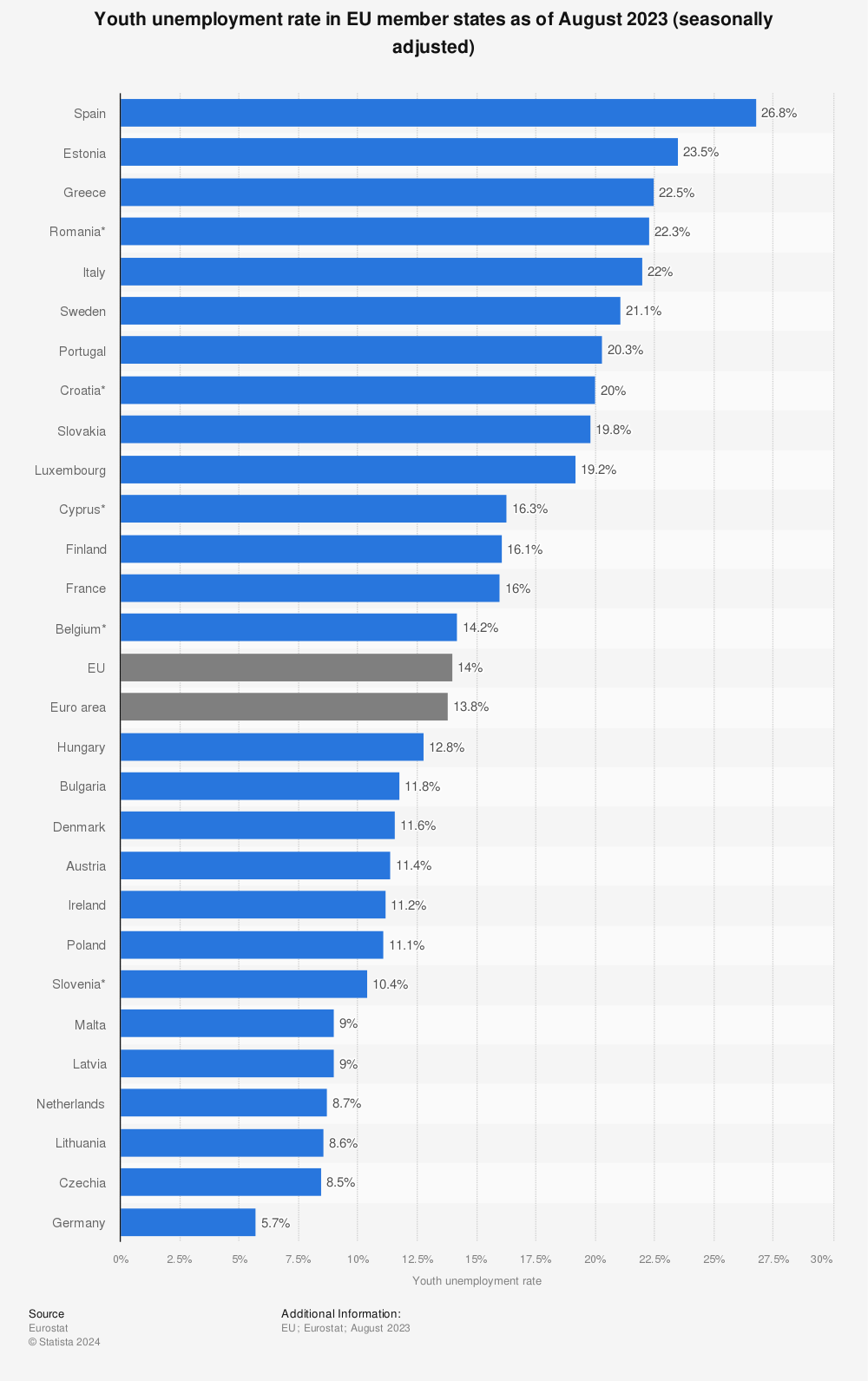

40+% youth unemployment, and still they drink the Kool Aid?B'stard Child said:

Digga said:

911gary said:

Having just returned from Spain the few I discussed Brexit with were of the opinion that we rushed into it and are now realising our mistake and wont leave.

40+% youth unemployment, and still they drink the Kool Aid?

paulrockliffe said:

When you convert that into numbers, that's a huge number of youths that can't get a job.

And when you consider most youths will have parents then that's a huge number of voting people that don't seem to be bothered about changing the national; government that is apparently the cause of the problem.... In rather a lot of countries??? - I find that a bit weird!!B'stard Child said:

paulrockliffe said:

When you convert that into numbers, that's a huge number of youths that can't get a job.

And when you consider most youths will have parents then that's a huge number of voting people that don't seem to be bothered about changing the national; government that is apparently the cause of the problem.... In rather a lot of countries??? - I find that a bit weird!!Hi all, been a while since I posted so thought I’d drop in and say hello.

It appears that the euro is still here and the imbalance of economies within the euro area are still here. The same arguments from Vol 1 are still going round and round. What is less obvious is whether discussions regarding the euro break the laws of thermodynamics, the theory being that anything which goes round and round in circles adds to the general disorder of the universe. Ponder that as you will.

Please don’t discuss calories per word lest some feker works out how to tax it.

Regardless, I’m stuck in a bit of a ‘remoaner’ echo chamber at the moment so wanted to talk to you good folks about where the euro’s headed. Italy’s up the creek and the ECB’s role of ‘lender of last resort’ appears to be tied by the precedent set by previous Greek (and Cypriot bail in) interventions, however one feels that the core banks upon whose alter the Greeks were sacrificed may be given a touch of leeway. ‘Do whatever it takes’ if you will.

A separate question (though also a translation of the previous question in to ‘real politic’)… Will the Eurozone money folks be smart enough to soothe (misrepresent?) the situation sufficiently to hide the fact that France will be the last and biggest domino to fall, and therefore prevent a Le Pen win?

Perhaps a more pertinent interpretation of that question… given that France are the make or break of the ‘nigh’ upon which the euro may (or may not) end – Are the mainstream parties of France capable of continuing the charade until such a point that the Germans are willing to admit that their surplus is not so much ‘earned’ as ‘slightly earned and then multiplied through the maths of being in a blatantly ridiculous currency union’. It’s a subtle distinction that’s probably over the head of your average German (or Brit/other European), yet an important distinction.

If the above doesn’t make sense then apologies for trying to put too many thoughts in too few words. Happy to expand brackets, engage in discussion or otherwise parley.

As a note, despite the bruising I'm still in favour of the European experiment. I can think of few things that are more beneficial to the UK than a peaceful and contented eastern Europe... People who know history are doomed to watch others repeat it.

It appears that the euro is still here and the imbalance of economies within the euro area are still here. The same arguments from Vol 1 are still going round and round. What is less obvious is whether discussions regarding the euro break the laws of thermodynamics, the theory being that anything which goes round and round in circles adds to the general disorder of the universe. Ponder that as you will.

Please don’t discuss calories per word lest some feker works out how to tax it.

Regardless, I’m stuck in a bit of a ‘remoaner’ echo chamber at the moment so wanted to talk to you good folks about where the euro’s headed. Italy’s up the creek and the ECB’s role of ‘lender of last resort’ appears to be tied by the precedent set by previous Greek (and Cypriot bail in) interventions, however one feels that the core banks upon whose alter the Greeks were sacrificed may be given a touch of leeway. ‘Do whatever it takes’ if you will.

A separate question (though also a translation of the previous question in to ‘real politic’)… Will the Eurozone money folks be smart enough to soothe (misrepresent?) the situation sufficiently to hide the fact that France will be the last and biggest domino to fall, and therefore prevent a Le Pen win?

Perhaps a more pertinent interpretation of that question… given that France are the make or break of the ‘nigh’ upon which the euro may (or may not) end – Are the mainstream parties of France capable of continuing the charade until such a point that the Germans are willing to admit that their surplus is not so much ‘earned’ as ‘slightly earned and then multiplied through the maths of being in a blatantly ridiculous currency union’. It’s a subtle distinction that’s probably over the head of your average German (or Brit/other European), yet an important distinction.

If the above doesn’t make sense then apologies for trying to put too many thoughts in too few words. Happy to expand brackets, engage in discussion or otherwise parley.

As a note, despite the bruising I'm still in favour of the European experiment. I can think of few things that are more beneficial to the UK than a peaceful and contented eastern Europe... People who know history are doomed to watch others repeat it.

Driller said:

What happened in Spain for example around '86 and '94 then Digga because it was almost 45% in both cases?

TBH I am not too clued-up on the Spanish economy but you pose a very interesting question and that graph is rather alarming. I daresay though - and the legacies of pre-Euro currency devaluations (Lira, Peseta, Drachma etc. etc.) attest to this - that a lot of the PIIGS economies has rocky histories.

It would be good to know, if anyone has answers.

Tartan Pixie said:

Hi all, been a while since I posted so thought I’d drop in and say hello.

It appears that the euro is still here and the imbalance of economies within the euro area are still here. The same arguments from Vol 1 are still going round and round. What is less obvious is whether discussions regarding the euro break the laws of thermodynamics, the theory being that anything which goes round and round in circles adds to the general disorder of the universe. Ponder that as you will.

Please don’t discuss calories per word lest some feker works out how to tax it.

Regardless, I’m stuck in a bit of a ‘remoaner’ echo chamber at the moment so wanted to talk to you good folks about where the euro’s headed. Italy’s up the creek and the ECB’s role of ‘lender of last resort’ appears to be tied by the precedent set by previous Greek (and Cypriot bail in) interventions, however one feels that the core banks upon whose alter the Greeks were sacrificed may be given a touch of leeway. ‘Do whatever it takes’ if you will.

A separate question (though also a translation of the previous question in to ‘real politic’)… Will the Eurozone money folks be smart enough to soothe (misrepresent?) the situation sufficiently to hide the fact that France will be the last and biggest domino to fall, and therefore prevent a Le Pen win?

Perhaps a more pertinent interpretation of that question… given that France are the make or break of the ‘nigh’ upon which the euro may (or may not) end – Are the mainstream parties of France capable of continuing the charade until such a point that the Germans are willing to admit that their surplus is not so much ‘earned’ as ‘slightly earned and then multiplied through the maths of being in a blatantly ridiculous currency union’. It’s a subtle distinction that’s probably over the head of your average German (or Brit/other European), yet an important distinction.

If the above doesn’t make sense then apologies for trying to put too many thoughts in too few words. Happy to expand brackets, engage in discussion or otherwise parley.

As a note, despite the bruising I'm still in favour of the European experiment. I can think of few things that are more beneficial to the UK than a peaceful and contented eastern Europe... People who know history are doomed to watch others repeat it.

Welcome back, I have occasionally wondered where you went, are you still writing ? It appears that the euro is still here and the imbalance of economies within the euro area are still here. The same arguments from Vol 1 are still going round and round. What is less obvious is whether discussions regarding the euro break the laws of thermodynamics, the theory being that anything which goes round and round in circles adds to the general disorder of the universe. Ponder that as you will.

Please don’t discuss calories per word lest some feker works out how to tax it.

Regardless, I’m stuck in a bit of a ‘remoaner’ echo chamber at the moment so wanted to talk to you good folks about where the euro’s headed. Italy’s up the creek and the ECB’s role of ‘lender of last resort’ appears to be tied by the precedent set by previous Greek (and Cypriot bail in) interventions, however one feels that the core banks upon whose alter the Greeks were sacrificed may be given a touch of leeway. ‘Do whatever it takes’ if you will.

A separate question (though also a translation of the previous question in to ‘real politic’)… Will the Eurozone money folks be smart enough to soothe (misrepresent?) the situation sufficiently to hide the fact that France will be the last and biggest domino to fall, and therefore prevent a Le Pen win?

Perhaps a more pertinent interpretation of that question… given that France are the make or break of the ‘nigh’ upon which the euro may (or may not) end – Are the mainstream parties of France capable of continuing the charade until such a point that the Germans are willing to admit that their surplus is not so much ‘earned’ as ‘slightly earned and then multiplied through the maths of being in a blatantly ridiculous currency union’. It’s a subtle distinction that’s probably over the head of your average German (or Brit/other European), yet an important distinction.

If the above doesn’t make sense then apologies for trying to put too many thoughts in too few words. Happy to expand brackets, engage in discussion or otherwise parley.

As a note, despite the bruising I'm still in favour of the European experiment. I can think of few things that are more beneficial to the UK than a peaceful and contented eastern Europe... People who know history are doomed to watch others repeat it.

Yes its true we do seem to be stuck with the fact that whilst the theory that a single currency union across different economies can't work, they do seem to be willing to throw fresh money at it, or financial ruin states in order to keep it on the road.

But I think the complete failure to enforce the Financial Stability pact must have consequences at some point, there seems to only be expedient answers, no will to take a harder road to bring about "convergence" (you don't hear anyone talk about economic convergence anymore)

I do think Marie Le Pen is the single biggest threat to the EU and by implication the Euro as a currency. Brexit is a sideshow, perfidious Albion was long discounted from the discussion. Though the economic impact will be substantial on the European economy if the EU get it wrong.

Interesting that there has been no comment on the ECB gently suggesting no further QE. Ok the £ fell a little on the news, but does the ECB really think the EU economy is ready to come of QE, or is it out of cash ?

But I believe what he said, in effect, is that there will be more QE after December. Hence the small rise in £:€ yesterday,

http://www.bbc.com/news/business-37712526

http://www.bbc.com/news/business-37712526

Digga said:

So we can conclude that some eurozone economies are doing well and some aren't, coincidentally, the same ez countries that are doing well today have always done well, and the same countries that are doing badly have always done so. Or in the case of Italy and Greece, haven't done very well since the fall of the Roman empire and the death of Alexander the Great. And the UK, with our Great British Pound are doing better than some and worse than others. If we'd adopted the euro would we be doing as well as Germany, Holland and Denmark, or as badly as Greece, Spain and Italy? Who knows, but my guess is that we'd be in about the same position in that table either way, maybe better as the euro tends to assist stronger economies.

Gassing Station | News, Politics & Economics | Top of Page | What's New | My Stuff