Is the end nigh for the Euro? [vol. 3]

Discussion

gruffalo said:

Greece calls for a time out till tomorrow.

http://www.bbc.co.uk/news/world-europe-31580138

Any guess at the problem?

Which one?!http://www.bbc.co.uk/news/world-europe-31580138

Any guess at the problem?

"Minister of state Nikos Pappas says the list will include measures to fight tax evasion and trim the civil service."

Didn't the commies win on a ticket of mass public sector re-employment? And an end to austerity?

And the rest.

It looks like Greece's toughest critic is going to be Spain and its Finance Minister De Guindos.

http://www.ekathimerini.com/4dcgi/_w_articles_wsit...

http://www.ekathimerini.com/4dcgi/_w_articles_wsit...

Syriza are between a rock and a hard place, their election manifesto promised an end to austerity, but that isn't within their gift and the rest of the EU are unlikely to fund it. Without ongoing support, austerity (aka living within your means) is going to become a permanent way of life. The only independent alternative available to them is default and exit from the EZ, but Syriza are committed to both staying in the EU and keeping the euro, and even if they do default the future with a new Drachma is very uncertain.

Syriza should have learnt from the Lib Dem experience, making promises when in opposition is far easier than delivering on those promises when in government.

Syriza should have learnt from the Lib Dem experience, making promises when in opposition is far easier than delivering on those promises when in government.

turbobloke said:

gruffalo said:

Greece calls for a time out till tomorrow.

http://www.bbc.co.uk/news/world-europe-31580138

Any guess at the problem?

Which one?!http://www.bbc.co.uk/news/world-europe-31580138

Any guess at the problem?

"Minister of state Nikos Pappas says the list will include measures to fight tax evasion and trim the civil service."

Didn't the commies win on a ticket of mass public sector re-employment? And an end to austerity?

And the rest.

turbobloke said:

gruffalo said:

Greece calls for a time out till tomorrow.

http://www.bbc.co.uk/news/world-europe-31580138

Any guess at the problem?

Which one?!http://www.bbc.co.uk/news/world-europe-31580138

Any guess at the problem?

"Minister of state Nikos Pappas says the list will include measures to fight tax evasion and trim the civil service."

Didn't the commies win on a ticket of mass public sector re-employment? And an end to austerity?

And the rest.

As RYH64E confirms promising the impossible is a damned sight easer to achieve than actually delivering the impossible. Common problem for lunatic left wing politicians. They can win power but cannot deliver their promises. This was never going to work. Syriza cannot deliver on their promises and Greece must default to recover.

Remaining within the EU is still way beyond the economic capability of Greece and always was. Default is coming. Billions more will be wasted by the EU trying to push this forward but the "Solution" cannot work. This is a political dream turning into a political nightmare. Greece will inevitability default. What then is the real question for EU because the EU has lost this fight. A great deal of political shame, heartache and explanation will be required from the EU leaders. Who will not be able to justify their actions.

Where then? I think a radical rethink of where the EU is actually heading will be inevitably required when disgraces like this nonsense can go on for years and remain hidden with underhand subsidies. The losses and the consequences to the solvent states and their electorate will require serious alterations in the operation of the EU. That is why the EU are so desperate to keep this nonsense afloat at any cost using other peoples money. This is going to cause mayhem within the EU. Rightly so IMO.

Gargamel said:

Still some big number problems

50% of all people under 24 don't have an income

Country has debt to GDP of 175%

population is circa 10,000,000

Debt is around 330,000,000,000

I just don't think any of the list of policies can change the really big numbers.

I entirely agree. My concern here now is the extent of the EU fraud on the unsuspecting solvent EU nations that are actually going to pick up the tab in the end. There is no one else. I can see radical reappraisals atross the EU once the extent and consequences of this disgrace become widely known. I fear that France and Germany may find that right wing factions suddenly achieve far better election results. There will be huge consequences to the EU which will take some time to be worked through.50% of all people under 24 don't have an income

Country has debt to GDP of 175%

population is circa 10,000,000

Debt is around 330,000,000,000

I just don't think any of the list of policies can change the really big numbers.

Once the fraud becomes really visible and the effects become very apparent and these nations realise that they are just patsies being milked by the EU politics who knows where this will end? I can see really serious concerns being expressed about the lack of effective control over this matter excercsed by the EU as year after year after year of mismanagement has gone on. This is the fault of the EU. Changes will be inevitable.

Greece will be desperately struggling but I doubt many of those responsible in the EU will fare much better. Time for a radical rethink to permanently prevent such disgraces ever again because all of this has happened entirely as a result of the corruption, weak maagemen and incompetence of the EU. The EU made up all the rules . The EU were responsible for all the checking requirements. The EU have monitored all of this from day one. The EU have totally failed to recognise the problem for what it really has become, or to admit there a oroblem or even to recignise the utttter hoplessness of the Greek Insolveny. Self evident facts I fear. Even Angela Merkel will be grilled by her voters in Germany.

Very difficult times coming up for the EU. Not exactly looking like the success that was paraded by the EU on this a while ago is it? Rightly So. This was never going to work and is never going to work. Greece will inevitably default. because they are hoplessly insolvent and totally unable to servce their debts. There is no other "Solition",

Gargamel said:

Still some big number problems

50% of all people under 24 don't have an income

Country has debt to GDP of 175%

population is circa 10,000,000

Debt is around 330,000,000,000

I just don't think any of the list of policies can change the really big numbers.

A gallon out of a pint pot50% of all people under 24 don't have an income

Country has debt to GDP of 175%

population is circa 10,000,000

Debt is around 330,000,000,000

I just don't think any of the list of policies can change the really big numbers.

Steffan said:

They did indeed and you are absolutely correct Syriza won by promising the impossible........Common problem for lunatic left wing politicians.

I think you're being a tad hard on them. Even if they are "extreme" lefties they have at least been lucid and honest enough to state the obvious regarding the sustainability of Greek finances, something that the right did not do when in power. They were too busy suckling on the euro-teat and pretending to the people that the Troika's plans would somehow solve their problems.It was not Syriza that got Greece into its current predicament, and their stated aims of weeding out corruption and forcing the hitherto tax shy rich to pay their dues are laudable, even if it will be too little too late to save the day. OK, some of their other lefty plans such as high minimum wage and early retirement are not great ideas at the moment, from their point of view Greece is living a humanitarian crisis at the moment.

I have a sneaking admiration for their integrity thus far, and they have made the media much more fun to read!

Gargamel said:

Still some big number problems

50% of all people under 24 don't have an income

Country has debt to GDP of 175%

population is circa 10,000,000

Debt is around 330,000,000,000

I just don't think any of the list of policies can change the really big numbers.

Given its just in surplus now the debt is no different to 1.75x income for a mortgage multiplier. Given we've had 3x for decades and now up to 6x and can easily afford a 25yr then 1.75x is perfectly fine for what 8-10year mortgage. 50% of all people under 24 don't have an income

Country has debt to GDP of 175%

population is circa 10,000,000

Debt is around 330,000,000,000

I just don't think any of the list of policies can change the really big numbers.

Dead simple.

Too many get drawn into the while ohh its too big nonsense. Compare it to an individual and frankly if you'd say anyone with a 1.75x mortgage in the UK was insolvent is boneless.

Welshbeef said:

Too many get drawn into the while ohh its too big nonsense. Compare it to an individual and frankly if you'd say anyone with a 1.75x mortgage in the UK was insolvent is boneless.

Assuming the individual had enough income, the house isn't in negative equity, and the will to pay the mortgage. Then yes, it works. In theory.Welshbeef said:

Given its just in surplus now the debt is no different to 1.75x income for a mortgage multiplier. Given we've had 3x for decades and now up to 6x and can easily afford a 25yr then 1.75x is perfectly fine for what 8-10year mortgage.

Dead simple.

Too many get drawn into the while ohh its too big nonsense. Compare it to an individual and frankly if you'd say anyone with a 1.75x mortgage in the UK was insolvent is boneless.

No I don't think so.Dead simple.

Too many get drawn into the while ohh its too big nonsense. Compare it to an individual and frankly if you'd say anyone with a 1.75x mortgage in the UK was insolvent is boneless.

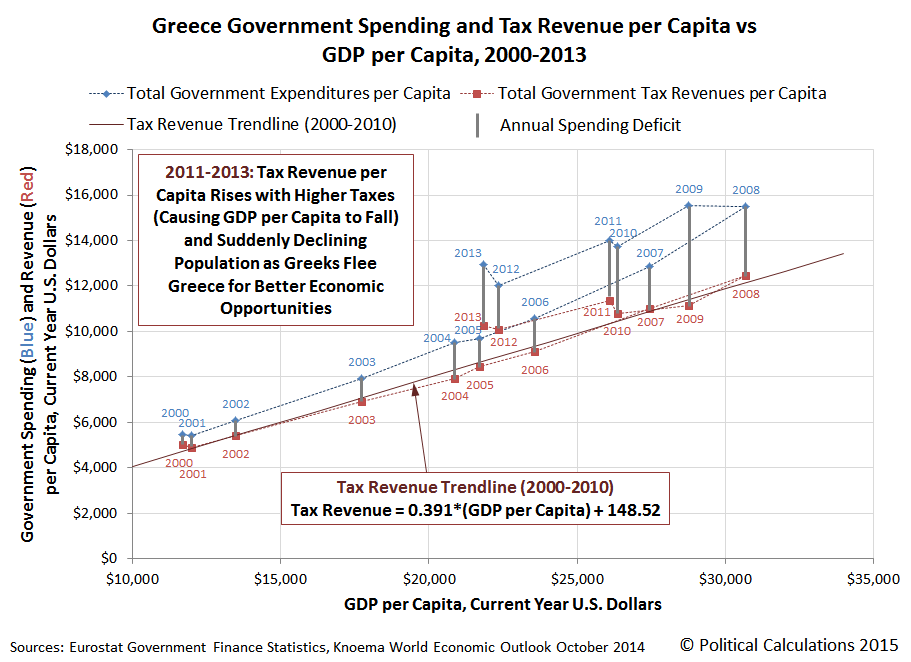

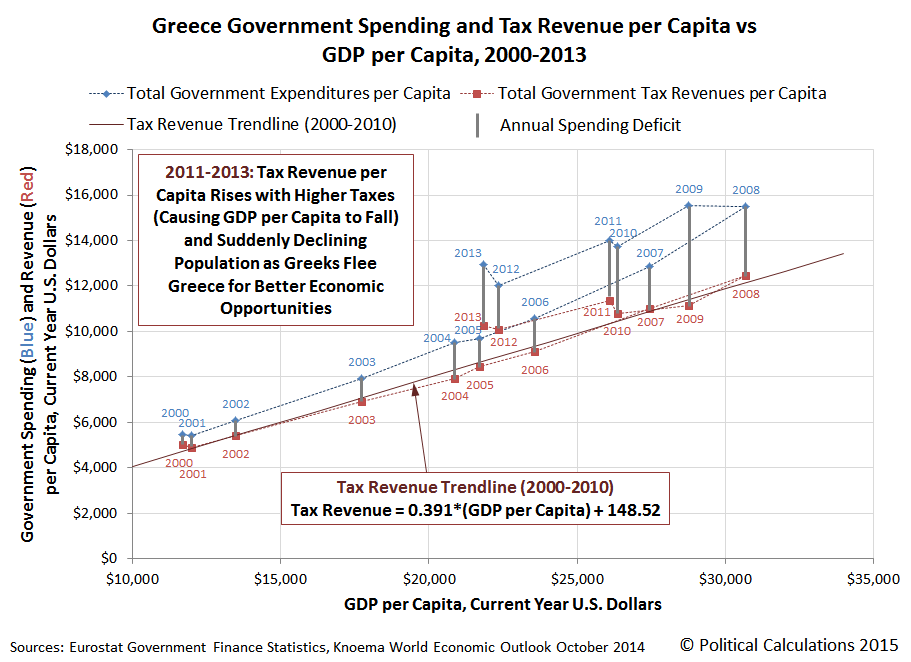

You are conflating government revenue with GDP. GDP is what the country earns, not the government tax take or income on it.

I don't have a figure to hand for the Greek governments income, but it is far far far less than GDP

Gargamel said:

No I don't think so.

You are conflating government revenue with GDP. GDP is what the country earns, not the government tax take or income on it.

I don't have a figure to hand for the Greek governments income, but it is far far far less than GDP

not the government tax take after paying wages, pensions, and running public services, like heath care, law and order ect then it can service deptYou are conflating government revenue with GDP. GDP is what the country earns, not the government tax take or income on it.

I don't have a figure to hand for the Greek governments income, but it is far far far less than GDP

Welshbeef said:

Given its just in surplus now the debt is no different to 1.75x income for a mortgage multiplier. Given we've had 3x for decades and now up to 6x and can easily afford a 25yr then 1.75x is perfectly fine for what 8-10year mortgage.

Dead simple.

Too many get drawn into the while ohh its too big nonsense. Compare it to an individual and frankly if you'd say anyone with a 1.75x mortgage in the UK was insolvent is boneless.

Jesus Christ, you're a finance director? What of, Northern Rock? GDP is not income, it's a measure of economic activity. If you must liken it to an individual's finances it would be more like lending a supermarket checkout girl $17.5m because $10m goes through her till each year.Dead simple.

Too many get drawn into the while ohh its too big nonsense. Compare it to an individual and frankly if you'd say anyone with a 1.75x mortgage in the UK was insolvent is boneless.

Welshbeef said:

Gargamel said:

Still some big number problems

50% of all people under 24 don't have an income

Country has debt to GDP of 175%

population is circa 10,000,000

Debt is around 330,000,000,000

I just don't think any of the list of policies can change the really big numbers.

Given its just in surplus now the debt is no different to 1.75x income for a mortgage multiplier. Given we've had 3x for decades and now up to 6x and can easily afford a 25yr then 1.75x is perfectly fine for what 8-10year mortgage. 50% of all people under 24 don't have an income

Country has debt to GDP of 175%

population is circa 10,000,000

Debt is around 330,000,000,000

I just don't think any of the list of policies can change the really big numbers.

Dead simple.

Too many get drawn into the while ohh its too big nonsense. Compare it to an individual and frankly if you'd say anyone with a 1.75x mortgage in the UK was insolvent is boneless.

The other issue they have is 50% youth unemployment.

So really should they be trying to increase the working lives of the older population or make them retire so that these jobs go to the young instead and rather than a life of total in engagement with society they begin that process. Then and only then start to increase retirement age.

Does Wealfare really post that much different to early retirement costs? Probably the same ball park really. Given that this is the better move to make. Unusual view maybe but they have to try something.

Re the mortgage post clearly I'm being a bit tongue in cheek. An individual can at most get a 35 year mortgage most being. 25 years. A govt and get any duration it is not restricted so play the long game move the debts onto extremely long maturities - even perpetual which future generations can elect to repay once the country is back in good health.

No hair cuts just 100year-150 year + debt maturity dates. Given state income is low but will improve at some point then extend the debt out until it is an affordable % of the annual income. Allow them the option to overpay whenever they like job done.

For the chap who was eating cornflakes at 3am and had a choking fit. GDP is a strong indicator of actual (or potential) tax take. Vat, income tax corporation tax fuel duty / any additional duties, property council tax stamp duty investment tax employers NI the fact that people earn money then spend that money in shops instant vat and future corporation tax. Leading to death tax.

You know very well as has been discussed previously that it is eye watering how much actual % eventually of all money the govt ends up with.

So really should they be trying to increase the working lives of the older population or make them retire so that these jobs go to the young instead and rather than a life of total in engagement with society they begin that process. Then and only then start to increase retirement age.

Does Wealfare really post that much different to early retirement costs? Probably the same ball park really. Given that this is the better move to make. Unusual view maybe but they have to try something.

Re the mortgage post clearly I'm being a bit tongue in cheek. An individual can at most get a 35 year mortgage most being. 25 years. A govt and get any duration it is not restricted so play the long game move the debts onto extremely long maturities - even perpetual which future generations can elect to repay once the country is back in good health.

No hair cuts just 100year-150 year + debt maturity dates. Given state income is low but will improve at some point then extend the debt out until it is an affordable % of the annual income. Allow them the option to overpay whenever they like job done.

For the chap who was eating cornflakes at 3am and had a choking fit. GDP is a strong indicator of actual (or potential) tax take. Vat, income tax corporation tax fuel duty / any additional duties, property council tax stamp duty investment tax employers NI the fact that people earn money then spend that money in shops instant vat and future corporation tax. Leading to death tax.

You know very well as has been discussed previously that it is eye watering how much actual % eventually of all money the govt ends up with.

I admire your optimism WB

The fact is off a population of around 10m only 3m are economically active. About 40% of those are state employees.

I take your point re moving to a much longer term of debt. I think the Greek Government could for example sell long term bonds to its own people at say a 2% - 4% coupon rate - or as a Tax free investment.

These could help repay the external debt. Japan, which also has a huge debt problem, has been more straightforward since it is largely internal debt, so the money at least on interest is staying in the same pool.

Your other points re the Tax take I am afraid are just wishful thinking, The Greek Government is fundamentally unable to collect taxation under the current system, it almost appears voluntary to pay tax over there.

The fact is off a population of around 10m only 3m are economically active. About 40% of those are state employees.

I take your point re moving to a much longer term of debt. I think the Greek Government could for example sell long term bonds to its own people at say a 2% - 4% coupon rate - or as a Tax free investment.

These could help repay the external debt. Japan, which also has a huge debt problem, has been more straightforward since it is largely internal debt, so the money at least on interest is staying in the same pool.

Your other points re the Tax take I am afraid are just wishful thinking, The Greek Government is fundamentally unable to collect taxation under the current system, it almost appears voluntary to pay tax over there.

fblm said:

Welshbeef said:

Given its just in surplus now the debt is no different to 1.75x income for a mortgage multiplier. Given we've had 3x for decades and now up to 6x and can easily afford a 25yr then 1.75x is perfectly fine for what 8-10year mortgage.

Dead simple.

Too many get drawn into the while ohh its too big nonsense. Compare it to an individual and frankly if you'd say anyone with a 1.75x mortgage in the UK was insolvent is boneless.

Jesus Christ, you're a finance director? What of, Northern Rock? GDP is not income, it's a measure of economic activity. If you must liken it to an individual's finances it would be more like lending a supermarket checkout girl $17.5m because $10m goes through her till each year.Dead simple.

Too many get drawn into the while ohh its too big nonsense. Compare it to an individual and frankly if you'd say anyone with a 1.75x mortgage in the UK was insolvent is boneless.

Thanks for the graph Gargamel; interesting reading. Poor old Greece has got an 'Everest' of a mountain to climb to get income into line with expenditure. How Syriza thought they could reverse the austerity program beggar's belief. Their new policies regarding tax collection and anti smuggling/corruption will take German levels of efficiency to achieve - we haven't seen that quality in any Greek Government ever, so the chances of even a modest improvement seems highly dubious. I stand in awe that this pantomime horse continues to stagger on.

Gassing Station | News, Politics & Economics | Top of Page | What's New | My Stuff