B.O.E. gets tougher on bankers

Discussion

DeltonaS said:

fblm said:

You are claiming off balance sheet spv's arn't allowed in the US. This is ridiculous. The use of spv/spe's through 'offshore' centres like delaware for all kinds of off balance sheet financing is very common in the US. It is the basis of the entire securitization industry that brought you such fine products as MBS and CDO's. If your 'source' is even a tiny bit knowledgeble then you have misunderstood. Have you heard of Enron?

Great example Enron....not........You might want to consult your source of why that isn't such a great example in this very case....

Edited by anonymous-user on Thursday 31st July 18:51

Zod said:

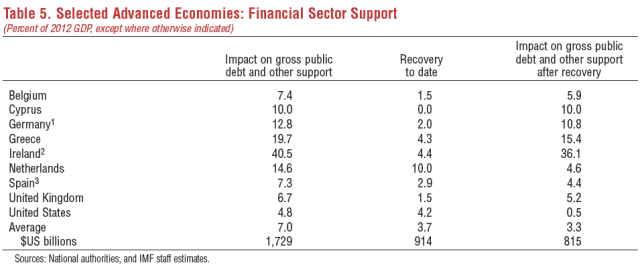

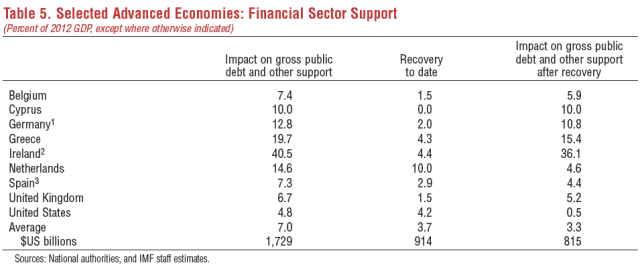

Oh dear, let's start by looking at your own country, the Netherlands, that paragon of financial prudence:

Now go and practice your English like a good little boy (or girl). (Really quite disappointing for a Dutchie)

(The HTTP name of your source starts with "flipchartfairytales" ;-)

Now go and practice your English like a good little boy (or girl). (Really quite disappointing for a Dutchie)

Where have I stated that the Netherlands is such a paragon of financial prudence.....

And by the way you seem to have "missed" some information regarding the chart you've posted:

"Given the size of the UK’s banking sector, our bailout wasn’t as big, relative to our economy, as those of some other countries. Germany, Belgium and the Netherlands were hit by bank failures too and Germany is still sitting on larger potential liabilities than the UK."

So your chart is about the size and relative size of bail-outs vs. GDP, not about the size of the financial sector itself....

And the size of the bail-out doesn't say anything about the necessity, reason or quality of the bail-out. Nor does it say anything about the nature of events (or perpetrator) which let (caused) to the bail-out :-)

Edited by DeltonaS on Thursday 31st July 18:51

fblm said:

My source? I'm can discuss this without help. I gave you Enron as an example because you clearly know nothing about the subject but figured you may have heard of Enron at least. If you had, you might know that they took the common and legal use of SPV's to absurd and illegal levels. Now go ask whoever is telling you this nonsense to substantiate your claim that spv's are illegal in the US. They won't. What do you think an MBS is, who originated most of them and where? (hint - at its heart it is an SPV, originated mostly by US investment banks, in the US, for the purpose of US mortgage originators moving assets off balance sheet). Funnily enough the only guy I knew who actively traded this stuff did so for Rabo in Utrecht...

I didn't claim that SPV's were illegal in the US.DeltonaS said:

I didn't claim that SPV's were illegal in the US.

DeltonaS said:

Funnily enough it's London that pays these huge bonuses, and it's London where the investment banks of this world were allowed by law and under a laughable regulatory regime to create their off balance SPV's (which wasn't even allowed in capitalist USA), which subsequently led to London's rise as a financial center and the biggest financial crisis to date.

And I've done defaulted debt work-out....

SPV's are perfectly legal and make up a huge proportion of corporate loans/mortgages. Any deal is done on the underlying factors, personal/corporate g'tee's should never be rele upon when lending, each deal should stand up on its own merits, which any SPV must do. The only difference is the promoters can walk away and write off initial equity if it goes tits up, that's the whole point!

Nothing illegal, immoral or anything else wrong with an SPV, even of only for tax/busiess efficiency, it's only risk litigation for the borrower after all, for which the bank must be comfortable.

SPV's are perfectly legal and make up a huge proportion of corporate loans/mortgages. Any deal is done on the underlying factors, personal/corporate g'tee's should never be rele upon when lending, each deal should stand up on its own merits, which any SPV must do. The only difference is the promoters can walk away and write off initial equity if it goes tits up, that's the whole point!

Nothing illegal, immoral or anything else wrong with an SPV, even of only for tax/busiess efficiency, it's only risk litigation for the borrower after all, for which the bank must be comfortable.

DeltonaS said:

(The HTTP name of your source starts with "flipchartfairytales" ;-)

Where have I stated that the Netherlands is such a paragon of financial prudence.....

And by the way you seem to have "missed" some information regarding the chart you've posted:

"Given the size of the UK’s banking sector, our bailout wasn’t as big, relative to our economy, as those of some other countries. Germany, Belgium and the Netherlands were hit by bank failures too and Germany is still sitting on larger potential liabilities than the UK."

So your chart is about the size and relative size of bail-outs vs. GDP, not about the size of the financial sector itself....

And the size of the bail-out doesn't say anything about the necessity, reason or quality of the bail-out. Nor does it say anything about the nature of events (or perpetrator) which let (caused) to the bail-out :-)

That, is the whole point: we have a much larger banking sector proportionately, but it did not get itself into anywhere near as much trouble, despite all its supposed iniquities, as those of countries like your own.Where have I stated that the Netherlands is such a paragon of financial prudence.....

And by the way you seem to have "missed" some information regarding the chart you've posted:

"Given the size of the UK’s banking sector, our bailout wasn’t as big, relative to our economy, as those of some other countries. Germany, Belgium and the Netherlands were hit by bank failures too and Germany is still sitting on larger potential liabilities than the UK."

So your chart is about the size and relative size of bail-outs vs. GDP, not about the size of the financial sector itself....

And the size of the bail-out doesn't say anything about the necessity, reason or quality of the bail-out. Nor does it say anything about the nature of events (or perpetrator) which let (caused) to the bail-out :-)

Edited by DeltonaS on Thursday 31st July 18:51

kiethton said:

And I've done defaulted debt work-out....

SPV's are perfectly legal and make up a huge proportion of corporate loans/mortgages. Any deal is done on the underlying factors, personal/corporate g'tee's should never be rele upon when lending, each deal should stand up on its own merits, which any SPV must do. The only difference is the promoters can walk away and write off initial equity if it goes tits up, that's the whole point!

Nothing illegal, immoral or anything else wrong with an SPV, even of only for tax/busiess efficiency, it's only risk litigation for the borrower after all, for which the bank must be comfortable.

Also amusing to note that the most popular jurisdiction of incorporation for SPVs in Europe is the Netherlands.SPV's are perfectly legal and make up a huge proportion of corporate loans/mortgages. Any deal is done on the underlying factors, personal/corporate g'tee's should never be rele upon when lending, each deal should stand up on its own merits, which any SPV must do. The only difference is the promoters can walk away and write off initial equity if it goes tits up, that's the whole point!

Nothing illegal, immoral or anything else wrong with an SPV, even of only for tax/busiess efficiency, it's only risk litigation for the borrower after all, for which the bank must be comfortable.

Randy Winkman said:

OMG!!! They will all go somewhere else!!!

They were all set to leave when Labour put the top rate of tax up and again when the coalition introduced their 'bonus tax' measures. I guess the fact the are still here just shows that these guys are not really interested in money but have stayed around in order to serve the nation and public. This demonisation and witchhunt really must stop.

otolith said:

The same people who would be delighted if this kind of measure did drive the banking industry overseas would be the first to moan when the shortfall in tax revenues leads to cuts in benefits and services.

Quite.You have two job offers. One in New York, where your bonus cannot be clawed back, and one in London where it can.

Guess where the best people will go!?

Soov535 said:

Quite.

You have two job offers. One in New York, where your bonus cannot be clawed back, and one in London where it can.

Guess where the best people will go!?

I think people who don't have careers in 'portable' professions (or otherwise friends or relatives with the same) really don't get quite how seamless and easy it is to make that sort of move. Granted, it's not done on a whim or the bat of an eyelid, or without some regrets, but looking at the bigger picture it's often a very clear choice.You have two job offers. One in New York, where your bonus cannot be clawed back, and one in London where it can.

Guess where the best people will go!?

fblm said:

DeltonaS said:

I didn't claim that SPV's were illegal in the US.

DeltonaS said:

Funnily enough it's London that pays these huge bonuses, and it's London where the investment banks of this world were allowed by law and under a laughable regulatory regime to create their off balance SPV's (which wasn't even allowed in capitalist USA), which subsequently led to London's rise as a financial center and the biggest financial crisis to date.

Zod said:

That, is the whole point: we have a much larger banking sector proportionately, but it did not get itself into anywhere near as much trouble, despite all its supposed iniquities, as those of countries like your own.

Apples and Oranges and Bulls t, in case of the oranges you should know the reason why they got into "trouble"....

t, in case of the oranges you should know the reason why they got into "trouble"....One of which was a rader stupid take over by RBS/Santander/Fortis of ABN AMRO on the brink of the crisis. And RBS alone needed more financial support then all the Dutch banks combined.....

Secondly; a lot of the London based banks got into trouble on there home soil.....

etc.etc.

DeltonaS said:

Apples and Oranges and Bulls t, in case of the oranges you should know the reason why they got into "trouble"....

t, in case of the oranges you should know the reason why they got into "trouble"....

One of which was a rader stupid take over by RBS/Santander/Fortis of ABN AMRO on the brink of the crisis. And RBS alone needed more financial support then all the Dutch banks combined.....

Secondly; a lot of the London based banks got into trouble on there home soil.....

etc.etc.

I think people stopped taking you seriously when you pretended to know about SPV's, it seems to me. You blew it. No one is going to listen now.  t, in case of the oranges you should know the reason why they got into "trouble"....

t, in case of the oranges you should know the reason why they got into "trouble"....One of which was a rader stupid take over by RBS/Santander/Fortis of ABN AMRO on the brink of the crisis. And RBS alone needed more financial support then all the Dutch banks combined.....

Secondly; a lot of the London based banks got into trouble on there home soil.....

etc.etc.

Soov535 said:

otolith said:

The same people who would be delighted if this kind of measure did drive the banking industry overseas would be the first to moan when the shortfall in tax revenues leads to cuts in benefits and services.

Quite.You have two job offers. One in New York, where your bonus cannot be clawed back, and one in London where it can.

Guess where the best people will go!?

I wouldn't take the risk of working for a bank under those circumstances.

98elise said:

Soov535 said:

otolith said:

The same people who would be delighted if this kind of measure did drive the banking industry overseas would be the first to moan when the shortfall in tax revenues leads to cuts in benefits and services.

Quite.You have two job offers. One in New York, where your bonus cannot be clawed back, and one in London where it can.

Guess where the best people will go!?

I wouldn't take the risk of working for a bank under those circumstances.

Government is busy encouraging the pharmaceuticals, sciences, engineering and a return to manufacturing. Whilst they are busy with that they are also keen to clamp down on the errant ways that some banks have done business. Much less reliance on the banking sector is the aim, and that is a good thing imo.

Gassing Station | News, Politics & Economics | Top of Page | What's New | My Stuff