BTL as a pension fund - why not?

Discussion

Yazar said:

But we are not talking about an 'over priced house' in term of a home, this a BTL discussion. If you bought a single home to live in, fine.

But if you are an investor, risk goes with the territory?

I agree (home owner only, no btl) but since you can't hurt one without hurting the other...But if you are an investor, risk goes with the territory?

Btl isn't causing high house prices - its too small a share of the market for that. Property is affordable to anyone that wants to get on the ladder, but it is a ladder not an elevator nor an escalator, so what problem are people trying to fix by walloping it with taxes?

Yazar said:

But we are not talking about an 'over priced house' in term of a home, this a BTL discussion. If you bought a single home to live in, fine.

But if you are an investor, risk goes with the territory?

It is a BTL discussion, but what is also being suggested is punitive CGT tax on the primary residence every time you move house along with tax regimes to discourage ownership of more than one house. But if you are an investor, risk goes with the territory?

Apparantly, this is so any equity anyone has built up through either luck or hard work, to used for their old age should be taken off them to fund thousands of council houses to be built.

Also, you are right, there is a risk in BTL, rents may fall, house prices may fall, you are at the mercy of the market. Some people make on houses some lose, it's life.

It seems some are basically saying it should be illegal for anyone other than local councils to own more than one house.

Eric Mc said:

I agree also.

Property fueled economic booms aided by reckless lending and colateralised debt being passed around like a live time bomb has no bearing whatsoever on any discussion on the relevance of property to national economies.

You're agreeing with yourself? Excellent.Property fueled economic booms aided by reckless lending and colateralised debt being passed around like a live time bomb has no bearing whatsoever on any discussion on the relevance of property to national economies.

I refer you to my previous analogy of musical chairs. If you don't get the parallel I can't help you.

I am suggesting no such thing.

However, what I am pointing out is that there are alternative ways governments can chose to tackle problems - some more politically acceptable or practical than others.

The OP initially queried whether buying property was a good way of working out their funds for later in life. The point I was making is that the political and economic landscape in which one makes a long term financial decision now can radically alter before the economic consequences of that decision have come to fruition.

However, what I am pointing out is that there are alternative ways governments can chose to tackle problems - some more politically acceptable or practical than others.

The OP initially queried whether buying property was a good way of working out their funds for later in life. The point I was making is that the political and economic landscape in which one makes a long term financial decision now can radically alter before the economic consequences of that decision have come to fruition.

ITP said:

through either luck or hard work

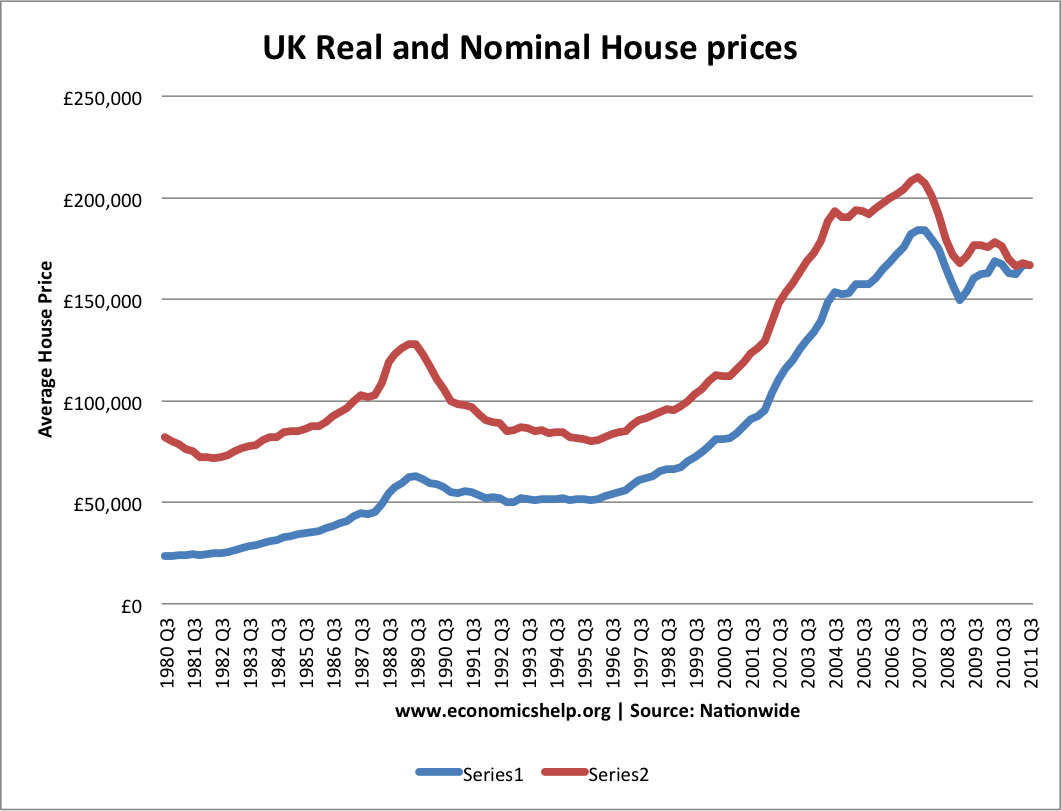

Wasn't luck though. Population increase and housing shortages meant BTL's have had odds firmly on their side throughout. Even post 2008 the government has continued to intervene with 20% rises not uncommon in the madness of the 'help to buy 2' last year. In light of this:

-how about capping rental rates to x+ inflation/mortgage rates, So Investors can make a decent profit related to actual risk.

- and set a maximum percentage yearly price gain of btl properties. So investors can again make a decent profit when they sell, but any explosive gains due to other conditions are shared with the public purse.

When did house prices really take off?

Has population really got that much to do with it?

Isnt it just this:

Pre-c.2004 people could only have mortgages up to about 3.5x with higher rates.

Post 2004 people have has access to much looser lending and so could be convinced by Phil and Kirsty to pay ever higher prices or miss the boat.

?

Also, what is a housing ladder? Isn't it just wage (rather than cost) inflation that occured back historically?

I.e. Buying a s tty flat isn't a magic path to affording a 3 bed house. In a rising market the house just gets further out of your reach.

tty flat isn't a magic path to affording a 3 bed house. In a rising market the house just gets further out of your reach.

Has population really got that much to do with it?

Isnt it just this:

Pre-c.2004 people could only have mortgages up to about 3.5x with higher rates.

Post 2004 people have has access to much looser lending and so could be convinced by Phil and Kirsty to pay ever higher prices or miss the boat.

?

Also, what is a housing ladder? Isn't it just wage (rather than cost) inflation that occured back historically?

I.e. Buying a s

tty flat isn't a magic path to affording a 3 bed house. In a rising market the house just gets further out of your reach.

tty flat isn't a magic path to affording a 3 bed house. In a rising market the house just gets further out of your reach.Yazar said:

Wasn't luck though. Population increase and housing shortages meant BTL's have had odds firmly on their side throughout. Even post 2008 the government has continued to intervene with 20% rises not uncommon in the madness of the 'help to buy 2' last year.

In light of this:

-how about capping rental rates to x+ inflation/mortgage rates, So Investors can make a decent profit related to actual risk.

- and set a maximum percentage yearly price gain of btl properties. So investors can again make a decent profit when they sell, but any explosive gains due to other conditions are shared with the public purse.

Population increase isn't slowing down, nor will it doe the useful life of this discussion. Place your bets accordingly.In light of this:

-how about capping rental rates to x+ inflation/mortgage rates, So Investors can make a decent profit related to actual risk.

- and set a maximum percentage yearly price gain of btl properties. So investors can again make a decent profit when they sell, but any explosive gains due to other conditions are shared with the public purse.

If you cap tents all you'll get is property meeting minimum spec within maximum timescales. There'll be no competition to earn higher rents with better property or standards. The x in your equation would have to flex to account for Mayfair being a bit nicer than Brentwood. It'd also have to allow for the higher capital cist in a 3 bed over a bedsit. Too many variables, in fact, for a centralised system. For that you'd need the market, and the market is what you already have. If you don't like your rent, move somewhere cheaper.

The state already gets a share of btl house price gains via CGT.

fblm said:

Yazar said:

- and set a maximum percentage yearly price gain of btl properties. So investors can again make a decent profit when they sell, but any explosive gains due to other conditions are shared with the public purse.

have you heard of capital gains tax?jdw1234 said:

Also, what is a housing ladder? Isn't it just wage (rather than cost) inflation that occured back historically?

I.e. Buying a s tty flat isn't a magic path to affording a 3 bed house. In a rising market the house just gets further out of your reach

tty flat isn't a magic path to affording a 3 bed house. In a rising market the house just gets further out of your reach

Everything after the first place is a marginal purchase (and rising prices reduce LTV) so there's certainly a step up.I.e. Buying a s

tty flat isn't a magic path to affording a 3 bed house. In a rising market the house just gets further out of your reach

tty flat isn't a magic path to affording a 3 bed house. In a rising market the house just gets further out of your reachLucreLout said:

Why should Gen X have to buy horrendously over priced houses from the baby boomers, and now have to give half the value away to Gen Y/MeMeMe?

You can't build your way out of several million people arriving every decade. What we can do is get rid of child benefits and transition HB onto rooms in shared houses. That'd free up a lot of social housing.

Any loss of value inflicted on my house by the state due to tax changes or excessive house building is coming right off my IT bill. Its not optional, and I won't be swayed by the cut backs to public services required if others join me. I bought into a market with a set of rules. If the government want to tear up the rule book, that's fine, but they can eat the losses.

You can't build your way out of several million people arriving every decade. What we can do is get rid of child benefits and transition HB onto rooms in shared houses. That'd free up a lot of social housing.

Any loss of value inflicted on my house by the state due to tax changes or excessive house building is coming right off my IT bill. Its not optional, and I won't be swayed by the cut backs to public services required if others join me. I bought into a market with a set of rules. If the government want to tear up the rule book, that's fine, but they can eat the losses.

You talk disparigingly about Generation mememe and then threaten to throw your toys out of the pram if "too many" houses are built and it affects the value of yours? What a selfish baby you are, "I'm alright Jack and f everyone else"

You talk disparigingly about Generation mememe and then threaten to throw your toys out of the pram if "too many" houses are built and it affects the value of yours? What a selfish baby you are, "I'm alright Jack and f everyone else"Yazar said:

ITP said:

through either luck or hard work

Wasn't luck though. Population increase and housing shortages meant BTL's have had odds firmly on their side throughout. Even post 2008 the government has continued to intervene with 20% rises not uncommon in the madness of the 'help to buy 2' last year. In light of this:

-how about capping rental rates to x+ inflation/mortgage rates, So Investors can make a decent profit related to actual risk.

- and set a maximum percentage yearly price gain of btl properties. So investors can again make a decent profit when they sell, but any explosive gains due to other conditions are shared with the public purse.

I digress, how do you propose capping rents? What if I do up my rental with a new kitchen/bathroom, it will command a higher rent, some streets are nicer than others. There are so many variables. You wouldn't want to have rents liked to mortgage rates at the moment either as the only way is up, as they say in the song.

NomduJour said:

jdw1234 said:

Also, what is a housing ladder? Isn't it just wage (rather than cost) inflation that occured back historically?

I.e. Buying a s tty flat isn't a magic path to affording a 3 bed house. In a rising market the house just gets further out of your reach

tty flat isn't a magic path to affording a 3 bed house. In a rising market the house just gets further out of your reach

Everything after the first place is a marginal purchase (and rising prices reduce LTV) so there's certainly a step up.I.e. Buying a s

tty flat isn't a magic path to affording a 3 bed house. In a rising market the house just gets further out of your reach

tty flat isn't a magic path to affording a 3 bed house. In a rising market the house just gets further out of your reachI buy a flat for £500k

My deposit is £100k

My mortgage is £400k

At the time a 3 bed house is £1m.

House prices increase by 50%.

My flat is £750k.

My mortage is now £350k.

My equity is £400k.

A 3 bed house is now £1.5m.

Before I had a deposit of £100k and a £900k gap to buy a family sized home.

Now I have £400k and a £1.1m gap to buy a family sized home.

Living in the flat has also cost me lots in fees, stamp duty and maintenance.

How is that a ladder?

LucreLout said:

If you cap tents all you'll get is property meeting minimum spec within maximum timescales.

When new labour raised the housing benefit rates, landlords bought the cheapest properties to get the max rates. Rentals are always to a minimum spec for the price point (the cost-benefit ratio), higher spec tends to result when it was previously the owners house. LucreLout said:

There'll be no competition to earn higher rents with better property or standards.

Competition is always going to be low if supply is lower than demand.LucreLout said:

The x in your equation would have to flex to account for Mayfair being a bit nicer than Brentwood. It'd also have to allow for the higher capital cist in a 3 bed over a bedsit.

Account for areas using current rental rates as a benchmark, x is a percentage. Mayfair and Brentwood both have a sensible yearly increases in rent.LucreLout said:

Too many variables, in fact, for a centralised system.

Appreciate any system won't please everyone The alternative however is to keep it as is, so those on low incomes but doing essential jobs either buy and commute 2 hours each way or rent.LucreLout said:

For that you'd need the market, and the market is what you already have. If you don't like your rent, move somewhere cheaper

What if they stay and pay? Our consumerist economy relies on disposable income.NomduJour said:

jdw1234 said:

How is that a ladder?

You had 1/9 of the money you needed to begin with, now you have just over a third of it. Which situation is more likely to get you into that house?

Your situation hasn't been improved by owning the flat or house prices increasing (mythical ladder).

Gassing Station | News, Politics & Economics | Top of Page | What's New | My Stuff