The Next Conservative Budget

Discussion

FredClogs said:

Prefer the idea of a standard rate after the first year - government get all the extra VED up front and it doesn't punish people for continuing to keep higher CO2 cars, which like it or not have already been manufactured, on the road.0000 said:

FredClogs said:

Prefer the idea of a standard rate after the first year - government get all the extra VED up front and it doesn't punish people for continuing to keep higher CO2 cars, which like it or not have already been manufactured, on the road.It's as if they want to deliberately obfuscate things sometimes.

FredClogs said:

It looks to me like the extra on a petrol range rover (or such like) will be about £3500k at purchase time if you did it like that. This way it's £2k upfront and then £300 a year for the first 5, not many will keep it 5 years so the cost is spread. I can't see how this will help new car sales. Surely (in balance) they would have been better trying to get old cars off the road not adding new charges for new cars to get on it?

It's as if they want to deliberately obfuscate things sometimes.

It's partly based on the realisation that you don't reduce the number of high CO2 vehicles on the road by penalising people who buy them second hand - they've already been put on the road by that point, and won't leave it for some time. You might slightly alter the point at which it becomes uneconomical to keep on the road, but not until it's done many, many miles. So by shifting the balance of pain towards the person who specified the car in the first place you can have a greater influence on their purchasing decisions and maybe ensure that the high CO2 vehicle is not built in the first place. It's as if they want to deliberately obfuscate things sometimes.

There was talk fairly recently of completely abolishing VED and front loading the whole thing onto the first owner.

IroningMan said:

rover 623gsi said:

otolith said:

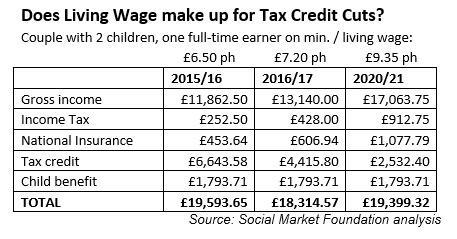

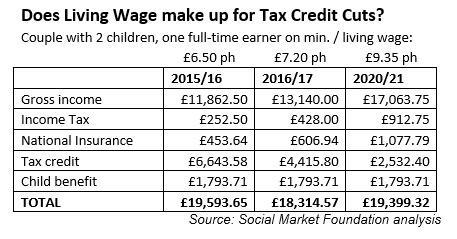

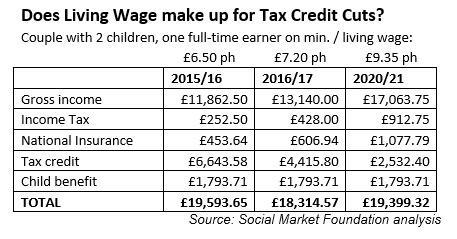

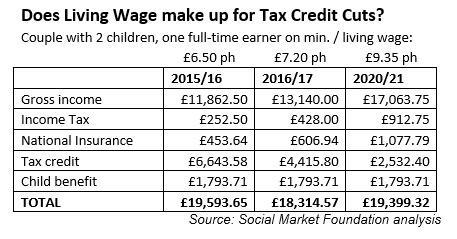

Just seen this - I must admit, I had no idea that tax credits and child benefit were quite so generous, I didn't realise that a minimum wage earner with two kids was on the same take-home as a single person on £24250.

another way of looking at that is that in one example there are four people living on £24,250 and in the other example there is one person living on £24,250

the idea behind tax credits was that it would encourage people in the example given to at least take the full-time minimum wage job rather than do nothing.

I think the tax credit system was/is messy and over-complicated and some reform was needed, but there are a lot of families that are going to really, really struggle without it.

And why are families going to 'really, really struggle' without tax credits when the numbers above show that their incomes will be affected very little? Are the numbers wrong?

FredClogs said:

0000 said:

FredClogs said:

Prefer the idea of a standard rate after the first year - government get all the extra VED up front and it doesn't punish people for continuing to keep higher CO2 cars, which like it or not have already been manufactured, on the road.It's as if they want to deliberately obfuscate things sometimes.

t Sherlock?

t Sherlock?FredClogs said:

It's as if they want to deliberately obfuscate things sometimes.

You have zero rate for cars older than 40 years on a rolling calender, 2 flat rates based on engine size if first UK registered after 1975 and before 2001, 13 bands based on co2 with 2 rates each depending on fuel type if registered after then but before 2010 with imported cars first registered after 2006 and over 225g/km rated in band k. From 2010 you pay a different initial duty based on the 13 bands before reverting to the standard rate for your band and fuel type with a 10 pound discount for alternative fuel and for cars registered from 2017 you'll pay a first year rate based on 13 bands associated with completely different co2 emissions to the other 13 bands, followed by a standard charge of either 0 or £140 with a surcharge of £310 for vehicles costing over £40000 for the first 5 years of the standard charge.Its all perfectly clear and sensible!

or b) fvcking idiotic.

Edited by anonymous-user on Thursday 9th July 15:17

rover 623gsi said:

IroningMan said:

rover 623gsi said:

otolith said:

Just seen this - I must admit, I had no idea that tax credits and child benefit were quite so generous, I didn't realise that a minimum wage earner with two kids was on the same take-home as a single person on £24250.

another way of looking at that is that in one example there are four people living on £24,250 and in the other example there is one person living on £24,250

the idea behind tax credits was that it would encourage people in the example given to at least take the full-time minimum wage job rather than do nothing.

I think the tax credit system was/is messy and over-complicated and some reform was needed, but there are a lot of families that are going to really, really struggle without it.

And why are families going to 'really, really struggle' without tax credits when the numbers above show that their incomes will be affected very little? Are the numbers wrong?

Can't believe the amount of people on 30k+ outraged they will actually have to pay full rent for their council house. I for one am rather glad that my taxes will no longer be paying for the rent of people who earn double my salary (although not sure if the 30k is going to be net or gross)

fblm said:

You have zero rate for cars older than 40 years on a rolling calender, 2 flat rates based on engine size if first UK registered after 1975 and before 2001, 13 bands based on co2 with 2 rates each depending on fuel type if registered after then but before 2010 with imported cars first registered after 2006 and over 225g/km rated in band k. From 2010 you pay a different initial duty based on the 13 bands before reverting to the standard rate for your band and fuel type with a 10 pound discount for alternative fuel and for cars registered from 2017 you'll pay a first year rate based on 13 bands associated with completely different co2 emissions to the other 13 bands, followed by a standard charge of either 0 or £140 with a surcharge of £310 for vehicles costing over £40000 for the first 5 years of the standard charge.

Its all perfectly clear and sensible!

or b) fvcking idiotic.

Even more simple than engine mapping.Its all perfectly clear and sensible!

or b) fvcking idiotic.

Edited by fblm on Thursday 9th July 15:17

Negative Creep said:

Can't believe the amount of people on 30k+ outraged they will actually have to pay full rent for their council house. I for one am rather glad that my taxes will no longer be paying for the rent of people who earn double my salary (although not sure if the 30k is going to be net or gross)

Net or gross, it's still obscene that people get their rent paid then earning this much! Live in the real world please!Negative Creep said:

Can't believe the amount of people on 30k+ outraged they will actually have to pay full rent for their council house. I for one am rather glad that my taxes will no longer be paying for the rent of people who earn double my salary (although not sure if the 30k is going to be net or gross)

Isn't the outrage that you could be working for £30k and paying more than your next door neighbour 'earning' not much less whilst not working and paying less in rent also?I thought that was the gist of it - there seems to be a zone close to the £30k where you're effectively disadvantaged compared to a neighbour for working, no?

iphonedyou said:

Negative Creep said:

Can't believe the amount of people on 30k+ outraged they will actually have to pay full rent for their council house. I for one am rather glad that my taxes will no longer be paying for the rent of people who earn double my salary (although not sure if the 30k is going to be net or gross)

Isn't the outrage that you could be working for £30k and paying more than your next door neighbour 'earning' not much less whilst not working and paying less in rent also?I thought that was the gist of it - there seems to be a zone close to the £30k where you're effectively disadvantaged compared to a neighbour for working, no?

To misquote Churchill totally.

Roma101 said:

Does the £40,000 rule apply to a car before or after options? If after, then I am surprised to hear that in two years time, only 5% of new cars will cost more than £40k list. A kitted out C250 diesel and 330d touring are over £40k list.

Back in the fifties and sixties purchase tax was payable at a hefty rate on the base car but not the extras so many manufacturers had things like bumpers and heaters as extras to reduce the tax paid. I expect similar wheezes now if it's on the base price, not bumpers obviously but all the gizmos we expect as given these days. Surely it'll be on the price actually paid? In which case perhaps some things will be 'dealer fit' and could be bought a month down the line so keeping the price under the threshold.We all know that 'improving the roads we drive on' means putting up more scamera's stupid signs, speed bumps and traffic calming not actually fixing our deteriorating road surfaces and pricing SUV's and crossover's off the road that are accelerating surface damage.

I think the idea of taxing the vehicle with the retail value in mind though is a very good idea. From what i've heard it's similar to the German system (don't trust me on that).

I think the idea of taxing the vehicle with the retail value in mind though is a very good idea. From what i've heard it's similar to the German system (don't trust me on that).

Welshbeef said:

Why punish people who have worked hard and saved and made da rides throughout their lives v say someone who has lived a lavish lifestyle but has nothing to pass on.

The profligate person will have paid more tax on their spending over their lifetime.Also they are not punished they are dead. Death is an excellent time to take money off people. Where would you rather be taxed to replace revenue lost from lowering inheritance tax?

iphonedyou said:

Negative Creep said:

Can't believe the amount of people on 30k+ outraged they will actually have to pay full rent for their council house. I for one am rather glad that my taxes will no longer be paying for the rent of people who earn double my salary (although not sure if the 30k is going to be net or gross)

Isn't the outrage that you could be working for £30k and paying more than your next door neighbour 'earning' not much less whilst not working and paying less in rent also?I thought that was the gist of it - there seems to be a zone close to the £30k where you're effectively disadvantaged compared to a neighbour for working, no?

household income =£29,999 live in social housing and pay 60% of market rate rents

household income =£30,001 live in social housing and pay 100% of market rate rents

genius

rover 623gsi said:

indeed - the Tory plan is

household income =£29,999 live in social housing and pay 60% of market rate rents

household income =£30,001 live in social housing and pay 100% of market rate rents

genius

Apparently the tax system is therefor insufficiently complex!household income =£29,999 live in social housing and pay 60% of market rate rents

household income =£30,001 live in social housing and pay 100% of market rate rents

genius

% of market rates paid needs therefor to be proportionate to household income - within certain bounds - of course.

Perhaps a logarithmic scale should be used?

http://metro.co.uk/2015/07/09/were-pretty-much-all...

Interesting 16 second clip halfway down the page.

Interesting 16 second clip halfway down the page.

Talksteer said:

Welshbeef said:

Why punish people who have worked hard and saved and made da rides throughout their lives v say someone who has lived a lavish lifestyle but has nothing to pass on.

The profligate person will have paid more tax on their spending over their lifetime.Also they are not punished they are dead. Death is an excellent time to take money off people. Where would you rather be taxed to replace revenue lost from lowering inheritance tax?

I feel responsible that I brought them into this World and I wish to provide them with a reasonable start in life.

They have been brought up with a strong work ethic and are trying their best to provide for themselves however living in London it has become extremely difficult for all young singles to afford a place to buy.

I believe the Budget has struck a reasonable stance in helping those like myself that hold that philosophy .

Gassing Station | News, Politics & Economics | Top of Page | What's New | My Stuff