The Next Conservative Budget

Discussion

Funkycoldribena said:

http://metro.co.uk/2015/07/09/were-pretty-much-all...

Interesting 16 second clip halfway down the page.

"We’re pretty much all going to be worse off as a result of the Budget"Interesting 16 second clip halfway down the page.

We aren't.

But then we don't get anything to cut.

rover 623gsi said:

indeed - the Tory plan is

household income =£29,999 live in social housing and pay 60% of market rate rents

household income =£30,001 live in social housing and pay 100% of market rate rents

genius

The KISS principal in action. The problem with doing something more complex and tapering the rates depending on income is it's far more complex and costly to implement. This starts to defeat the object of the changes in the first place which is generate more income for the councils and housing associations.household income =£29,999 live in social housing and pay 60% of market rate rents

household income =£30,001 live in social housing and pay 100% of market rate rents

genius

otolith said:

Funkycoldribena said:

http://metro.co.uk/2015/07/09/were-pretty-much-all...

Interesting 16 second clip halfway down the page.

"We’re pretty much all going to be worse off as a result of the Budget"Interesting 16 second clip halfway down the page.

We aren't.

But then we don't get anything to cut.

I disagree with their analysis.

IroningMan said:

rover 623gsi said:

IroningMan said:

rover 623gsi said:

otolith said:

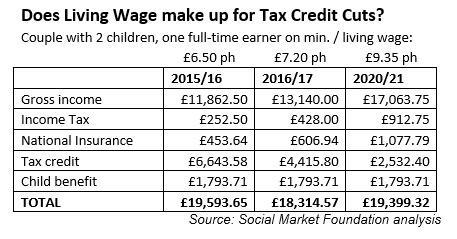

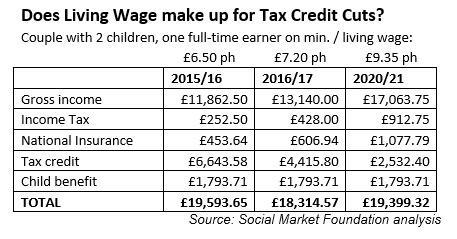

Just seen this - I must admit, I had no idea that tax credits and child benefit were quite so generous, I didn't realise that a minimum wage earner with two kids was on the same take-home as a single person on £24250.

another way of looking at that is that in one example there are four people living on £24,250 and in the other example there is one person living on £24,250

the idea behind tax credits was that it would encourage people in the example given to at least take the full-time minimum wage job rather than do nothing.

I think the tax credit system was/is messy and over-complicated and some reform was needed, but there are a lot of families that are going to really, really struggle without it.

And why are families going to 'really, really struggle' without tax credits when the numbers above show that their incomes will be affected very little? Are the numbers wrong?

What's the idea behind tax credits? Is it simpler to put them in a tax code, or is it because it's for a family and not a single earner?

emicen said:

otolith said:

Funkycoldribena said:

http://metro.co.uk/2015/07/09/were-pretty-much-all...

Interesting 16 second clip halfway down the page.

"We’re pretty much all going to be worse off as a result of the Budget"Interesting 16 second clip halfway down the page.

We aren't.

But then we don't get anything to cut.

I disagree with their analysis.

plasticpig said:

rover 623gsi said:

indeed - the Tory plan is

household income =£29,999 live in social housing and pay 60% of market rate rents

household income =£30,001 live in social housing and pay 100% of market rate rents

genius

The KISS principal in action. The problem with doing something more complex and tapering the rates depending on income is it's far more complex and costly to implement. This starts to defeat the object of the changes in the first place which is generate more income for the councils and housing associations.household income =£29,999 live in social housing and pay 60% of market rate rents

household income =£30,001 live in social housing and pay 100% of market rate rents

genius

plasticpig said:

rover 623gsi said:

the extra money isn't going to councils or housing associations - it's going directly to central govt

Not as I understand it. The Government will cut funding in line with the rent increases. The tenant doesn't pay the extra to the government directly.https://www.gov.uk/government/publications/summer-...

Local Authorities will repay the rent subsidy that they recover from high income tenants to the Exchequer, contributing to deficit reduction. Housing Associations will be able to use the rent subsidy that they recover to reinvest in new housing.

rovermorris999 said:

Back in the fifties and sixties purchase tax was payable at a hefty rate on the base car but not the extras so many manufacturers had things like bumpers and heaters as extras to reduce the tax paid. I expect similar wheezes now if it's on the base price, not bumpers obviously but all the gizmos we expect as given these days. Surely it'll be on the price actually paid? In which case perhaps some things will be 'dealer fit' and could be bought a month down the line so keeping the price under the threshold.

You do that and it impacts BIK tax for company car drivers otolith said:

Funkycoldribena said:

I was pointing out the blatant lies in the clip more than anything.

Note that he said he didn't want to do it, not that he wasn't going to...simoid said:

What's the idea behind tax credits? Is it simpler to put them in a tax code, or is it because it's for a family and not a single earner?

Tax Credits were introduced because once someone isn't paying anything to the state you can't cut taxes to give them more money. The poorest stop benefiting from tax cuts. The words 'bribe' or even 'benefit' were presumably a bit too honest, so they were given a more palatable name. I mean everyone pays tax, so recipients are just getting a little bit back right?

There's nothing simple about Tax Credits from an implementation point of view. If it was just a negative tax rate it would be quite a lot simpler.

plasticpig said:

rover 623gsi said:

indeed - the Tory plan is

household income =£29,999 live in social housing and pay 60% of market rate rents

household income =£30,001 live in social housing and pay 100% of market rate rents

genius

The KISS principal in action. The problem with doing something more complex and tapering the rates depending on income is it's far more complex and costly to implement. This starts to defeat the object of the changes in the first place which is generate more income for the councils and housing associations.household income =£29,999 live in social housing and pay 60% of market rate rents

household income =£30,001 live in social housing and pay 100% of market rate rents

genius

Being paid more money should always result in more expendable income for the payee. I say this as a supporter of highly progressive income tax rates.

Murph7355 said:

wst said:

... I say this as a supporter of highly progressive income tax rates.

Then be quiet and suck it up.This is a discussion forum, if you are offended by discussion occurring on it, shove it up your arse and be quiet.

Edited by wst on Thursday 9th July 20:44

fblm said:

You have zero rate for cars older than 40 years on a rolling calender, 2 flat rates based on engine size if first UK registered after 1975 and before 2001, 13 bands based on co2 with 2 rates each depending on fuel type if registered after then but before 2010 with imported cars first registered after 2006 and over 225g/km rated in band k. From 2010 you pay a different initial duty based on the 13 bands before reverting to the standard rate for your band and fuel type with a 10 pound discount for alternative fuel and for cars registered from 2017 you'll pay a first year rate based on 13 bands associated with completely different co2 emissions to the other 13 bands, followed by a standard charge of either 0 or £140 with a surcharge of £310 for vehicles costing over £40000 for the first 5 years of the standard charge.

Its all perfectly clear and sensible!

or b) fvcking idiotic.

I guess it's also preventing 100% unemployment in Swansea.Its all perfectly clear and sensible!

or b) fvcking idiotic.

FredClogs said:

otolith said:

Funkycoldribena said:

I was pointing out the blatant lies in the clip more than anything.

Note that he said he didn't want to do it, not that he wasn't going to...Gassing Station | News, Politics & Economics | Top of Page | What's New | My Stuff