Simple ways for the govt to save money.

Discussion

Gecko1978 said:

Charge £10 to see GP with 50% refund if you turn up - easy to do - make it free for people who are exempt from prescription charges

Council Tax lol lol FFS how is the value of your house relevant to the services you use etc (most likley inverse in fact) so let's just make it a flat rate for everyone in the area who is over the age of 18 and working...might find its actually less for many people.

I have already paid to see my GP. That's what a chunk of national insurance is. Implement your charge for the GP if you like but drop my taxes accordingly. Oh hang on, that would be private healthcare then.Council Tax lol lol FFS how is the value of your house relevant to the services you use etc (most likley inverse in fact) so let's just make it a flat rate for everyone in the area who is over the age of 18 and working...might find its actually less for many people.

They tried the flat rate tax. Community charge remember? Oh Noes it was a pole tax, lets have a riot.

Digga said:

Timmy40 said:

Digga said:

Timmy40 said:

Shoot everybody over 60. They cost loads in upkeep ( NHS, pensions etc ) and drive too slowly creating traffic jams.

but then who would buy nasty little s tbox cars from Arnold Clark's?

tbox cars from Arnold Clark's?Actually I'll add them to the list, shoot them as well.

vehicle procession on last night's commute home.

.. all greenies and Guardian readers.... which would hughely reduce the pulic sector wage bill, and the C02 emissions of said Guardian reading vegans.

Axionknight said:

Liokault said:

errrr Yes, VAT is a man-made concept, hence we as people can construct laws to put VAT on anything we like. Why is my high street populated with subsidised shops selling free merchandise then not paying tax on these sales.

Because you live in a s t hole.

t hole.I know they had the flat rate and it would appear simple to administer and thus cheaper. Frankly if you use local services (you use the police or benefit from them whether or not you call them) then pay for them dont ask others to pay more because they live in a bigger house.

You have paid to see your GP yes but not paid to take the P an stop others getting vital appointment slot. If you can afford perscription you can afford to pay nominal amount to see GP thoes exempt continue to be and you could add the fee to the NHS cards people have who need many perscriptions. Again nothing complex less admin means lower costs.

You have paid to see your GP yes but not paid to take the P an stop others getting vital appointment slot. If you can afford perscription you can afford to pay nominal amount to see GP thoes exempt continue to be and you could add the fee to the NHS cards people have who need many perscriptions. Again nothing complex less admin means lower costs.

Gecko1978 said:

Council Tax lol lol FFS how is the value of your house relevant to the services you use etc (most likley inverse in fact) so let's just make it a flat rate for everyone in the area who is over the age of 18 and working...might find its actually less for many people.

Hmmm, we could call it Poll Tax?Liokault said:

errrr Yes, VAT is a man-made concept, hence we as people can construct laws to put VAT on anything we like. Why is my high street populated with subsidised shops selling free merchandise then not paying tax on these sales.

Because city centre footfall was reduced with the advent of insanely high parking charges brought in by councils.. Your trying to address an issue from the wrong end. If shops could afford them locations they would take them, its not the charity shops fault, if you start to charge the charity shops more then they will leave and town city centres will be empty shop fronts.Their is a reason the multiples moved out of town closely followed by the more specialist chain retailers and it boils down to easier access and control of parking and the associated charges.

Some towns have a joined up and logic plan to encourage city centre sales growth and are sympathetic to the needs of small business's some alas are more communist in their approach.

Its all cyclical anyway, town centres will have a resurgence (its already happening in a small way), out of town shopping will fall by the way side.

Edited by Foliage on Thursday 11th February 13:35

Hooli said:

Gecko1978 said:

Council Tax lol lol FFS how is the value of your house relevant to the services you use etc (most likely inverse in fact) so let's just make it a flat rate for everyone in the area who is over the age of 18 and working...might find its actually less for many people.

Hmmm, we could call it Poll Tax?I never saw the issue with this is you were out of work no need to pay it if you are in work its right you pay for services you use. Course if you are getting lots in handouts you might disagree an blame the person down the road in the large house etc who is asking for nothing from the government in form of benefits.

The twist sense of entitlement of some people will never cease to amaze me

Timmy40 said:

.

Further to that I would impose a flat rat 15% income tax paid by everyone and scrap the universe of allowances, credits and tiers that give us the most confusing tax system in the world.

15% wouldn't even scratch the surface of the amount of tax raised by the current system.Further to that I would impose a flat rat 15% income tax paid by everyone and scrap the universe of allowances, credits and tiers that give us the most confusing tax system in the world.

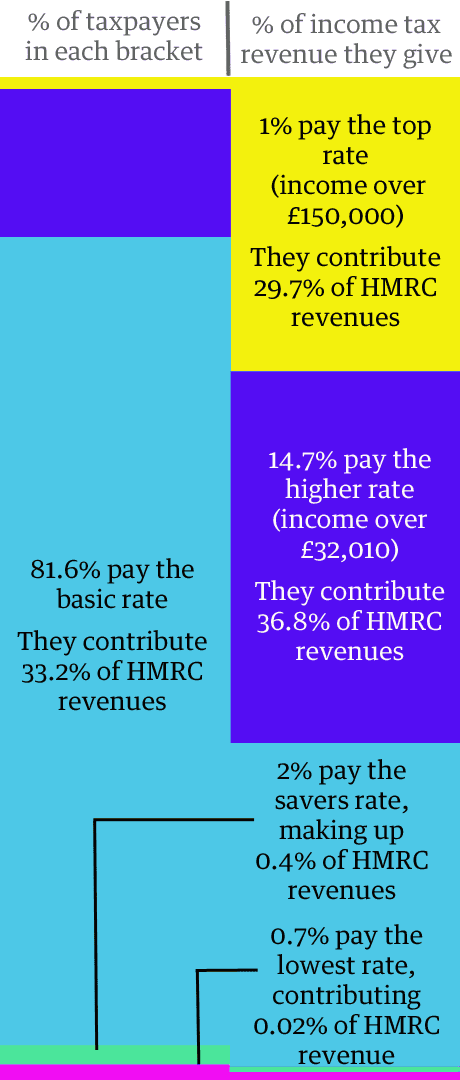

The top 3,000 earners (whose effective rates must be over 40%) pay more into the pot than the bottom 9 million earners combined.

Add on National Insurance contributions and a flat rate income tax rate would have to be north of 30%, possibly even north of 40%.

This explains why we have such a complicated tax system - it keeps people from understanding just how much income tax we, and especially the highest earners, pay.

Its somewhere in the region of 70%-80% if your in full time employment on average wage. I worked it out ages ago. This does include a rough corporation tax and a figure for business rates that you pay indirectly when you buy goods.

This was calculated of my outgoings for the year (my mileage is also rather low so fuel duty was low), I did this a few years ago now and it was likely wrong as its rather complicated but you get the idea.

This was calculated of my outgoings for the year (my mileage is also rather low so fuel duty was low), I did this a few years ago now and it was likely wrong as its rather complicated but you get the idea.

youngsyr said:

A complete load of b ks

ks

The bottom 9m pay feck all tax because you only pay anything at all once you go over £10k p.a. The top 3,000 earners pay relatively feck all because there are so few of them.  ks

ksThe VAST bulk of tax paid in the UK is paid by the middle income earners between £30-40k who pay IIRC 70% of the total tax take.

By shaving £80bn off the social protection budget ( did you bother reading my original post?) and applying a flat 15% rate to ALL earners you would easily raise the £70bn required to have an income effect of a 15% rate ( current total income tax raised each year being @£150bn ).

But go on believing the bulls

t you're fed if you like.

t you're fed if you like. Timmy40 said:

youngsyr said:

A complete load of b ks

ks

The bottom 9m pay feck all tax because you only pay anything at all once you go over £10k p.a. The top 3,000 earners pay relatively feck all because there are so few of them.  ks

ksThe VAST bulk of tax paid in the UK is paid by the middle income earners between £30-40k who pay IIRC 70% of the total tax take.

By shaving £80bn off the social protection budget ( did you bother reading my original post?) and applying a flat 15% rate to ALL earners you would easily raise the £70bn required to have an income effect of a 15% rate ( current total income tax raised each year being @£150bn ).

But go on believing the bulls

t you're fed if you like.

t you're fed if you like.  cks too and say you carrying on believing whatever you complete bullsh

cks too and say you carrying on believing whatever you complete bullsh t you like.

t you like.If they stopped making a complete pigs ear out of every major IT project they would save billions.

I also bet there is 10+ billion worth of efficiency savings in the NHS alone. a couple more billion from various other public services and the MOD.

I would also order the councils to sell off any un-used assets. they have some weird and wonderful s t in their porfolios.

t in their porfolios.

I also bet there is 10+ billion worth of efficiency savings in the NHS alone. a couple more billion from various other public services and the MOD.

I would also order the councils to sell off any un-used assets. they have some weird and wonderful s

t in their porfolios.

t in their porfolios.Gecko1978 said:

Council Tax lol lol FFS how is the value of your house relevant to the services you use etc (most likley inverse in fact) so let's just make it a flat rate for everyone in the area who is over the age of 18 and working...might find its actually less for many people.

How is a flat rate for everybody over the age of 18 fair? People don't use the same eamount of services. I rarely if ever use the Health Service/Police/Fire Brigade/Schools. I don't want to spend £50 gazillion on Trident. Why am i being forced to pay for stuff that I personally will never use? We should scrap the Public Sector and privatise everything so people can pay for exactly what they use.Countdown said:

How is a flat rate for everybody over the age of 18 fair? People don't use the same eamount of services. I rarely if ever use the Health Service/Police/Fire Brigade/Schools. I don't want to spend £50 gazillion on Trident. Why am i being forced to pay for stuff that I personally will never use? We should scrap the Public Sector and privatise everything so people can pay for exactly what they use.

I'll just assume that this is sarcasm, rather than risking the parrot by correcting you.That was sarcasm wasn't it?

Countdown said:

Gecko1978 said:

Council Tax lol lol FFS how is the value of your house relevant to the services you use etc (most likley inverse in fact) so let's just make it a flat rate for everyone in the area who is over the age of 18 and working...might find its actually less for many people.

How is a flat rate for everybody over the age of 18 fair? People don't use the same eamount of services. I rarely if ever use the Health Service/Police/Fire Brigade/Schools. I don't want to spend £50 gazillion on Trident. Why am i being forced to pay for stuff that I personally will never use? We should scrap the Public Sector and privatise everything so people can pay for exactly what they use.The armed forces protect our nation whether they set up a barricade an a tank outside your house or not. Fire service will always come to your house you just hope they won't have to.

Now take a world where you have to research an buy all your own drugs there is no state defense so you need your own private army and there is no fire service so if your neighbors house is torched (they did not have there own private army and were to weak an sick to fight of the arsonist), you are on your own stopping the blaze spreading an sadly because you have spend all your money on drugs to stay healthy an an army you cant afford a fire engine so your house that would have been protected now burns down and you die....

We all use and benefit from services provided even if we do not directly consume them....thus its right we pay for them.

Gassing Station | News, Politics & Economics | Top of Page | What's New | My Stuff