BoE Base Rate, What if...

Discussion

What would happen if the Bank of England base rate would go up?

We have had a 0.5% rate for the past 10 years now. There is a huge swathe of the country that bought their house on this low rate, and have never seen the likes of a 6% or 10% rate.

If the rate would increase up to 5% I would see massive problems for the UK.

Firstly, people wouldn't be able to pay off their mortgages. a £500 a month mortgage would go to £825.

Then rental prices would go up to meet the landlords mortgages

people would no longer be able to get mortgages, so surely the bottom would fall out of the housing market.

Would there be a way out of this, is there actually a possibility that the BoE could raise it's rates more than a few percent?

We have had a 0.5% rate for the past 10 years now. There is a huge swathe of the country that bought their house on this low rate, and have never seen the likes of a 6% or 10% rate.

If the rate would increase up to 5% I would see massive problems for the UK.

Firstly, people wouldn't be able to pay off their mortgages. a £500 a month mortgage would go to £825.

Then rental prices would go up to meet the landlords mortgages

people would no longer be able to get mortgages, so surely the bottom would fall out of the housing market.

Would there be a way out of this, is there actually a possibility that the BoE could raise it's rates more than a few percent?

With Government debt in the UK (and rest of world) running so high, I'm starting to wonder if they will ever actually go up. Once rates go up this effects the interest on government debt as well so you can see why they have a keen interest in this not happening. If we had paid it off to some extent (seemingly impossible) they would go up some small degree.

Unless something huge happens such as a huge debt write off, which wont be for the proleteriat like us, I cant see it ever going back up in the next 10+ years.

Happily proved wrong

Unless something huge happens such as a huge debt write off, which wont be for the proleteriat like us, I cant see it ever going back up in the next 10+ years.

Happily proved wrong

Typically though rises in the base rate of interest are linked to high inflation. If inflation is high then those in work will be getting large cost of living wage rises every year hence more cash to pay the mortgage (sticking point here is that high inflation can also relate to high unemployment).

Efbe said:

What would happen if the Bank of England base rate would go up?

We have had a 0.5% rate for the past 10 years now. There is a huge swathe of the country that bought their house on this low rate, and have never seen the likes of a 6% or 10% rate.

If the rate would increase up to 5% I would see massive problems for the UK.

Firstly, people wouldn't be able to pay off their mortgages. a £500 a month mortgage would go to £825.

Then rental prices would go up to meet the landlords mortgages

people would no longer be able to get mortgages, so surely the bottom would fall out of the housing market.

Would there be a way out of this, is there actually a possibility that the BoE could raise it's rates more than a few percent?

We have had a 0.5% rate for the past 10 years now. There is a huge swathe of the country that bought their house on this low rate, and have never seen the likes of a 6% or 10% rate.

If the rate would increase up to 5% I would see massive problems for the UK.

Firstly, people wouldn't be able to pay off their mortgages. a £500 a month mortgage would go to £825.

Then rental prices would go up to meet the landlords mortgages

people would no longer be able to get mortgages, so surely the bottom would fall out of the housing market.

Would there be a way out of this, is there actually a possibility that the BoE could raise it's rates more than a few percent?

I could afford (mortgage) for the base rate to go back to 5/6%+ (or whatever would double the mortgage), I would have to live relatively poorly though.

I figure that by the time I'm struggling, half of houses with a mortgage on them would have been repossessed. If this happened I assume that house prices would have tanked, which wouldn't do the banks doing the repossessing any favours, so I really can't see it happening.

It's like the saying (who said it?) that if you owe the bank a little money it's your problem, if you owe them a lot it's their problem. Well collectively the UK public owe them a lot.

I figure that by the time I'm struggling, half of houses with a mortgage on them would have been repossessed. If this happened I assume that house prices would have tanked, which wouldn't do the banks doing the repossessing any favours, so I really can't see it happening.

It's like the saying (who said it?) that if you owe the bank a little money it's your problem, if you owe them a lot it's their problem. Well collectively the UK public owe them a lot.

Edited by Esseesse on Friday 22 April 11:47

Efbe said:

We have had a 0.5% rate for the past 10 years now. There is a huge swathe of the country that bought their house on this low rate, and have never seen the likes of a 6% or 10% rate.

Hi you've just described me. I took the view that interest rates are bound to go up again at some point so I've ensured I have enough spare to cover any increase. The result is I could quite happily cover a doubling and maybe more of my mortgage payments and I know this because that's how much I'm paying currently as it's a great time to whittle down the size of the mortgage.

Hi you've just described me. I took the view that interest rates are bound to go up again at some point so I've ensured I have enough spare to cover any increase. The result is I could quite happily cover a doubling and maybe more of my mortgage payments and I know this because that's how much I'm paying currently as it's a great time to whittle down the size of the mortgage. If my payments double due to interest rate rises then that's fine though I'd be a bit miffed that I'm not able to make the same overpayments anymore. I also appreciate that not everyone is as boring and sensible as me.

Efbe said:

There is a huge swathe of the country that bought their house on this low rate, and have never seen the likes of a 6% or 10% rate.

There are also a huge swathe that have fixed deals that are more like 4%-5%. Personally I'm on a 4% offset. IIRC it was 4% when BoE rates were much higher, ie, the base rate cuts were not passed on. I guess like petrol though the slightest rise in base rate WILL be passed on. Some of the stress testing now is supposed to account for that, I'd wager the majority would be well & truly up s t creek should that happen.

t creek should that happen.Moonhawk said:

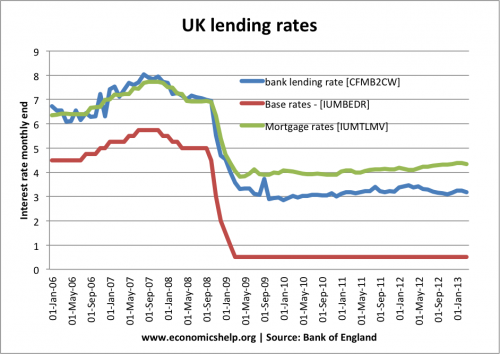

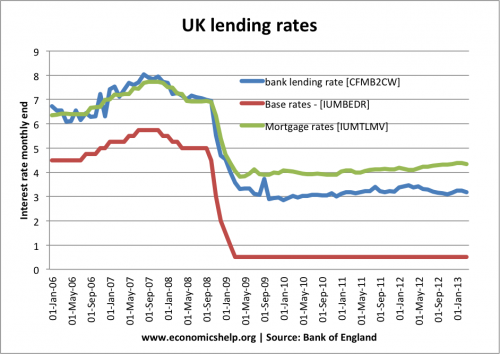

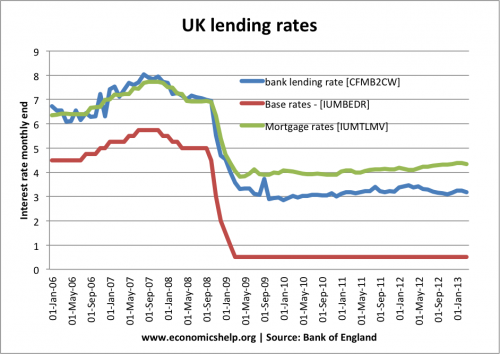

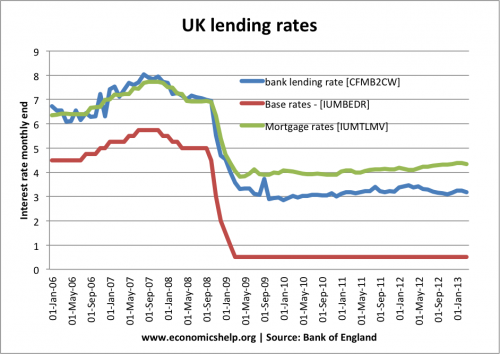

Mortgage rates shouldn't go up as fast as the base rate - afterall they didn't come down as quickly.

Between 2008 and 2009 the base rate dropped by a little under 5%, whereas the mortgage interest rates only dropped by around 3% over the same period.

That graph only goes up to January 2013 - it's now April 2016, so not much use.Between 2008 and 2009 the base rate dropped by a little under 5%, whereas the mortgage interest rates only dropped by around 3% over the same period.

Secondly can you clarify whether the figure for mortgage rates relates to average or best-buy? Because if it's average then it will be highly skewed by the increased uptake of fixed rates after the GFC or 2007-2009.

Moonhawk said:

Mortgage rates shouldn't go up as fast as the base rate - afterall they didn't come down as quickly.

Between 2008 and 2009 the base rate dropped by a little under 5%, whereas the mortgage interest rates only dropped by around 3% over the same period.

Indeed, mortgage rates stopped tracking BR when it went below a certain point. Lenders need a margin to make it worthwhile.Between 2008 and 2009 the base rate dropped by a little under 5%, whereas the mortgage interest rates only dropped by around 3% over the same period.

They will not hesitate to raise rates as soon the BoE signals its intent.

We are actually living through a very interesting economic experiment.

The 2007 crash had the potential to be as bad as the great depression for many countries, and, closer to today's time, it also had similarities with the Japanese crash.

As a response central bankers slashed interest rates close to zero and embarked on QE. whether this was the correct policy response is looking more and more dubious. Structural imbalances that existed in 2007 have, if anything, got worse since.

If you stripped out the significant rise in the working population in the UK, and the effects of a reinflated asset and debt bubble, we would be doing barely better than Italy which has stagnated since the crash.

QE has poured money into asset markets and done little to stimulate economic activity. Ultra low interest rates have left those with money hunting for yield and many have become BTL landlords as a result.

I doubt the BOE will raise base rates any time soon, but we are hardly a poster child for the success of the post crash economic policies.

In retrospect the British economy did better during the great depression as the combination of policies stumbled into, from abandoning the gold standard to widespread building (pre 1947 planning act), actually stimulated productive economic activity.

The 2007 crash had the potential to be as bad as the great depression for many countries, and, closer to today's time, it also had similarities with the Japanese crash.

As a response central bankers slashed interest rates close to zero and embarked on QE. whether this was the correct policy response is looking more and more dubious. Structural imbalances that existed in 2007 have, if anything, got worse since.

If you stripped out the significant rise in the working population in the UK, and the effects of a reinflated asset and debt bubble, we would be doing barely better than Italy which has stagnated since the crash.

QE has poured money into asset markets and done little to stimulate economic activity. Ultra low interest rates have left those with money hunting for yield and many have become BTL landlords as a result.

I doubt the BOE will raise base rates any time soon, but we are hardly a poster child for the success of the post crash economic policies.

In retrospect the British economy did better during the great depression as the combination of policies stumbled into, from abandoning the gold standard to widespread building (pre 1947 planning act), actually stimulated productive economic activity.

Four Litre said:

With Government debt in the UK (and rest of world) running so high, I'm starting to wonder if they will ever actually go up. Once rates go up this effects the interest on government debt as well so you can see why they have a keen interest in this not happening. If we had paid it off to some extent (seemingly impossible) they would go up some small degree.

Not strictly true.Gilts are issued at a fixed rate which remains the same over the diuration of the gilt (often 20+ years), so the gov has been refinancing all its maturing debt on a much lower interest rate. If interest rates went up it wouldn't make the slightest difference to gilts already in issue.

There are some exceptions, for exmaple index-linked gilts, but you get the general idea.

CaptainSensib1e said:

Not strictly true.

Gilts are issued at a fixed rate which remains the same over the diuration of the gilt (often 20+ years), so the gov has been refinancing all its maturing debt on a much lower interest rate. If interest rates went up it wouldn't make the slightest difference to gilts already in issue.

There are some exceptions, for exmaple index-linked gilts, but you get the general idea.

I assume he's referring to the significant amount of new gilts that we are going to have to issue to fund the ongoing deficit and other gilt maturities.Gilts are issued at a fixed rate which remains the same over the diuration of the gilt (often 20+ years), so the gov has been refinancing all its maturing debt on a much lower interest rate. If interest rates went up it wouldn't make the slightest difference to gilts already in issue.

There are some exceptions, for exmaple index-linked gilts, but you get the general idea.

Jockman said:

Indeed, mortgage rates stopped tracking BR when it went below a certain point. Lenders need a margin to make it worthwhile.

They will not hesitate to raise rates as soon the BoE signals its intent.

No and yes.They will not hesitate to raise rates as soon the BoE signals its intent.

They take a spread (absolute delta between rate charged to customers and rate they pay to borrow).

It isn't a percentage of the base rate but an absolute percentage.

So all else equal it does exactly track the base rate.

walm said:

Jockman said:

Indeed, mortgage rates stopped tracking BR when it went below a certain point. Lenders need a margin to make it worthwhile.

They will not hesitate to raise rates as soon the BoE signals its intent.

No and yes.They will not hesitate to raise rates as soon the BoE signals its intent.

They take a spread (absolute delta between rate charged to customers and rate they pay to borrow).

It isn't a percentage of the base rate but an absolute percentage.

So all else equal it does exactly track the base rate.

Gassing Station | News, Politics & Economics | Top of Page | What's New | My Stuff