9.9bn Quid, 0% tax. Tell me PH, How is this fair?

Discussion

caelite said:

chow pan toon said:

TheLordJohn said:

caelite said:

If it where up to me it would be taxed more heavily above set amounts, trusts and inheiritence reinforces the aristocratic birthright/'good blood' society that we have been trying to move away from since Victorian times

But we've only got worse as a society since those times...1. The 'Benefit scroungers stealing my hard earned cash!' stereotype

2. Attacking the method of a statements delivery rather than the statement itself, not all of us bother proof reading every single post we make on an internet forum.

3. 'I miss the good old days when I could get trashed on opium and abuse the lower classes!'

Beyond parody not really, beyond irony more often.

caelite said:

If it where up to me it would be taxed more heavily above set amounts, trusts and inheiritence reinforces the aristocratic birthright/'good blood' society that we have been trying to move away from since victorian times, further redistribution of 'old money' puts people, mainly the young where the wealth divide is most felt, on a more even playing field.

It also encourages the spending of wealth, meaning the elderly are encouraged to enjoy more of there retirement whilst simultainiously stimulating the economy.

And yet only three out of the 25 richest people in Britain are from aristocratic families, and the overwhelming majority of them weren't even born here.It also encourages the spending of wealth, meaning the elderly are encouraged to enjoy more of there retirement whilst simultainiously stimulating the economy.

Do you think it's maybe just slightly possible that by creating a tax regime favourable to the ultra-rich, we might collect more tax revenue from the ultra-rich than the vast majority of other developed economies around the world?

Two things strike me:

- the opening question in inaccurate. 0% tax is incorrect, as tax will be paid when funds are spent. Just not IHT. (But it would certaintly look better scrawled on a placard.)

- if socialists are genuinely proposing to break trusts open to distribute the wealth, what do they think will happen next? A world full of milk and honey for ever after? The dawn of some new socialist collective to last 10,000 years? Pfft. Not convinced.

£9.9bn (assuming it could be turned into cash) would give the average wage of £30k to about 330,000 people. For one year. That's about the population of Croydon.

And what would happen next? Would the Trustees continue to provide effective stewardship of the land and businesses within the trust? Of course not. They would have no capital left to do so, or any incentive.

Would the 330,000 beneficeries of the trust be able to perpetuate that wealth in the same way? Doubtful. I suspect hot tub installers in South London would be busy for a while, and various purveyors of sports clothing on the Purley Way would be pleased.

But this idea that a one off raid on "the wealthy" can just magically solve all the problems of an economy that is basically a debt junkie are, frankly, laughable, and a poor cover for what I suspect is largely just envy.

I do think the tax system needs reform though.

The VAT rate would IMO have to be over 100% to replace income tax, NIC, council tax, business rates, corporation tax, capital gains, stamp duty, fuel duty, VED, and all the other myriad of taxes we pay. Getting transactions out of the black / cash economy would need a huge increase in tax inspection too.

Taxes do also have a purpose to influence behaviour of course. With VAT, all the cost falls on the end consumer, so we'd have to do some thinking about exports too.

Taxes have come and gone (e.g. window tax) though I think IHT will be here for a good while longer, especially as the country has to somehow fund a massive spike in health care commitments for it's aging population. I think the anticipated spike in IHT receipts has already been spent about 5 times over.

Ian

- the opening question in inaccurate. 0% tax is incorrect, as tax will be paid when funds are spent. Just not IHT. (But it would certaintly look better scrawled on a placard.)

- if socialists are genuinely proposing to break trusts open to distribute the wealth, what do they think will happen next? A world full of milk and honey for ever after? The dawn of some new socialist collective to last 10,000 years? Pfft. Not convinced.

£9.9bn (assuming it could be turned into cash) would give the average wage of £30k to about 330,000 people. For one year. That's about the population of Croydon.

And what would happen next? Would the Trustees continue to provide effective stewardship of the land and businesses within the trust? Of course not. They would have no capital left to do so, or any incentive.

Would the 330,000 beneficeries of the trust be able to perpetuate that wealth in the same way? Doubtful. I suspect hot tub installers in South London would be busy for a while, and various purveyors of sports clothing on the Purley Way would be pleased.

But this idea that a one off raid on "the wealthy" can just magically solve all the problems of an economy that is basically a debt junkie are, frankly, laughable, and a poor cover for what I suspect is largely just envy.

I do think the tax system needs reform though.

The VAT rate would IMO have to be over 100% to replace income tax, NIC, council tax, business rates, corporation tax, capital gains, stamp duty, fuel duty, VED, and all the other myriad of taxes we pay. Getting transactions out of the black / cash economy would need a huge increase in tax inspection too.

Taxes do also have a purpose to influence behaviour of course. With VAT, all the cost falls on the end consumer, so we'd have to do some thinking about exports too.

Taxes have come and gone (e.g. window tax) though I think IHT will be here for a good while longer, especially as the country has to somehow fund a massive spike in health care commitments for it's aging population. I think the anticipated spike in IHT receipts has already been spent about 5 times over.

Ian

I suspect you're right about the VAT rate going past 100%. Is that a bad thing? It would be a great way of holding the government under the spotlight and showing just exactly what an obscene amount of our money they actually spend!

See if you can figure it out for yourself otherwise. Start with your gross income, then take off income tax (including any BIK) & national insurance, council tax, car tax, all VAT & duty, air travel tax, insurance premium tax, TV licence and all the myriad other ways they have of getting your money.

You're right that there would have to be more inspection to keep stuff out of the black economy, but just think how much money is spent on administering and enforcing all of the dozens of different forms of taxation we currently have. That's a lot of resource that could be diverted, and who knows, we might actually make some savings!

See if you can figure it out for yourself otherwise. Start with your gross income, then take off income tax (including any BIK) & national insurance, council tax, car tax, all VAT & duty, air travel tax, insurance premium tax, TV licence and all the myriad other ways they have of getting your money.

You're right that there would have to be more inspection to keep stuff out of the black economy, but just think how much money is spent on administering and enforcing all of the dozens of different forms of taxation we currently have. That's a lot of resource that could be diverted, and who knows, we might actually make some savings!

johnfm said:

Issue is a bit of an imbalance between taxes on earnings v taxes on capital. Currently, seems overburden on income - as it is 'low hanging fruit; and easy to collect.

But you can be capital rich through chance ie like my grandparents had a house in London they lived in it all their lives, it was worth a lot in the end but they were potless (hand to mouth). If they or anyone like them had to pay tax on assets they would have to sell up leave the area the work their friends and family. Doesn't seem very fair at all. walm said:

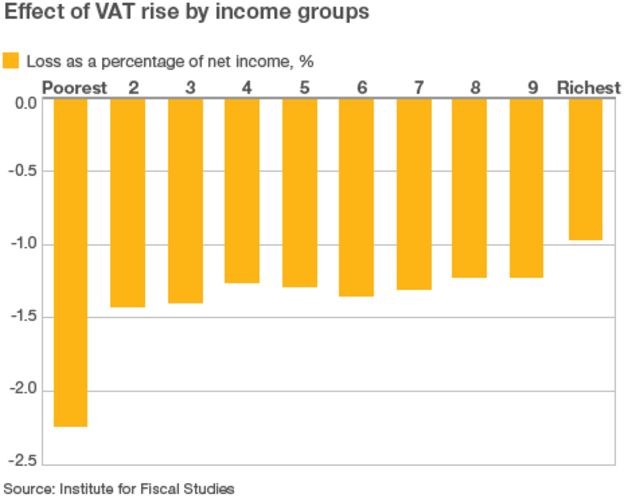

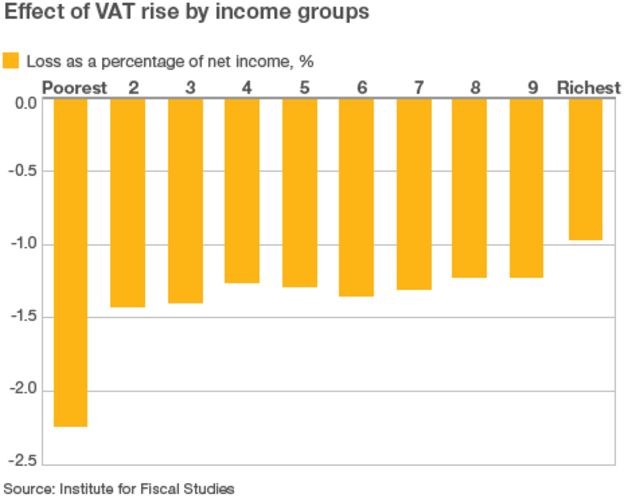

Moving it all to VAT is a ridiculous idea that would cripple the worst off.

It's a well known regressive tax.

Absolute rubbish.It's a well known regressive tax.

Do you really think, in the event that we went through the whole process of getting rid of all other taxes, that we wouldn't be able to introduce variable VAT levels for different product categories?

Start with things like food ingredients and kids' clothes which are currently VAT free, then from there, the more luxurious and inessential the product, the higher the VAT level on it.

Kermit power said:

Absolute rubbish.

Do you really think, in the event that we went through the whole process of getting rid of all other taxes, that we wouldn't be able to introduce variable VAT levels for different product categories?

Start with things like food ingredients and kids' clothes which are currently VAT free, then from there, the more luxurious and inessential the product, the higher the VAT level on it.

So you would add VAT to food and kids clothes?Do you really think, in the event that we went through the whole process of getting rid of all other taxes, that we wouldn't be able to introduce variable VAT levels for different product categories?

Start with things like food ingredients and kids' clothes which are currently VAT free, then from there, the more luxurious and inessential the product, the higher the VAT level on it.

And that is somehow a counter-argument to my point that the less-well off would suffer?

You know, the people who currently pay zero income tax AND zero VAT on food and kids clothes??

They would be WORSE OFF!! That's my point.

Or perhaps you meant you would leave VAT at zero there.

So what next? Perhaps petrol? Would you raise that VAT rate? Again - the worse off suffer most.

In the end, I honestly think to protect the worst off you would be forced to leave VAT where it is for life's essentials and raise it on all the discretionary stuff.

Which would see a huge drop in demand for such things and while the worst off would still be able to feed and clothe themselves, god help them if they want to have a little fun. Because you would end up taxing the crap out of booze, fags, holidays, high CO2 vehicles, etc... etc...

Honestly - it would be miserable for most people.

VAT currently covers just c.10% of all government levies so you need to 10x it. And it is often the ONLY tax the least well off pay. I just don't see how you could avoid making them pay more???

It really isn't "rubbish".

The problem we have currently is that below £11k there is zero income tax and the idea is that this starting point will keep on rising so you end up with having a block of people who contribute zero towards the Uk taxation system (excl purchases and fuel duty) they are in essence disengaged and frankly don't care less.

Problem is as this keep going up and up you then have to tax those paying a higher and higher % to the point that the extra effort to do well is torn away from you and at that point you think f k it instead of teaching at school I'll clean public toilets hardly any different take home zero responsibility all extra hours on Overtime v gratis

k it instead of teaching at school I'll clean public toilets hardly any different take home zero responsibility all extra hours on Overtime v gratis

I think it's a big problem.

What should happen is tax from £0.01 upwards and it should be on a % for all. If you wanted to help the poor you could increase the 0% point but then increase the % to correspond to it.

Additionally we have so many more self employed now but changing dividend taxation will impact pension funds / investment funds etc

Problem is as this keep going up and up you then have to tax those paying a higher and higher % to the point that the extra effort to do well is torn away from you and at that point you think f

k it instead of teaching at school I'll clean public toilets hardly any different take home zero responsibility all extra hours on Overtime v gratis

k it instead of teaching at school I'll clean public toilets hardly any different take home zero responsibility all extra hours on Overtime v gratis I think it's a big problem.

What should happen is tax from £0.01 upwards and it should be on a % for all. If you wanted to help the poor you could increase the 0% point but then increase the % to correspond to it.

Additionally we have so many more self employed now but changing dividend taxation will impact pension funds / investment funds etc

walm said:

So you would add VAT to food and kids clothes?

And that is somehow a counter-argument to my point that the less-well off would suffer?

You know, the people who currently pay zero income tax AND zero VAT on food and kids clothes??

They would be WORSE OFF!! That's my point.

Or perhaps you meant you would leave VAT at zero there.

So what next? Perhaps petrol? Would you raise that VAT rate? Again - the worse off suffer most.

In the end, I honestly think to protect the worst off you would be forced to leave VAT where it is for life's essentials and raise it on all the discretionary stuff.

Which would see a huge drop in demand for such things and while the worst off would still be able to feed and clothe themselves, god help them if they want to have a little fun. Because you would end up taxing the crap out of booze, fags, holidays, high CO2 vehicles, etc... etc...

Honestly - it would be miserable for most people.

VAT currently covers just c.10% of all government levies so you need to 10x it. And it is often the ONLY tax the least well off pay. I just don't see how you could avoid making them pay more???

It really isn't "rubbish".

That is a hugely defeatist attitude that perpetuates the greatest of all socialism's offences; to accept and promote that the poor will always be with us. Without making poverty a grindingly miserable, subsistence existence with only the most basic humanitarian needs met, how will we ever inspire the poor to improve their lot?And that is somehow a counter-argument to my point that the less-well off would suffer?

You know, the people who currently pay zero income tax AND zero VAT on food and kids clothes??

They would be WORSE OFF!! That's my point.

Or perhaps you meant you would leave VAT at zero there.

So what next? Perhaps petrol? Would you raise that VAT rate? Again - the worse off suffer most.

In the end, I honestly think to protect the worst off you would be forced to leave VAT where it is for life's essentials and raise it on all the discretionary stuff.

Which would see a huge drop in demand for such things and while the worst off would still be able to feed and clothe themselves, god help them if they want to have a little fun. Because you would end up taxing the crap out of booze, fags, holidays, high CO2 vehicles, etc... etc...

Honestly - it would be miserable for most people.

VAT currently covers just c.10% of all government levies so you need to 10x it. And it is often the ONLY tax the least well off pay. I just don't see how you could avoid making them pay more???

It really isn't "rubbish".

ClaphamGT3 said:

That is a hugely defeatist attitude that perpetuates the greatest of all socialism's offences; to accept and promote that the poor will always be with us. Without making poverty a grindingly miserable, subsistence existence with only the most basic humanitarian needs met, how will we ever inspire the poor to improve their lot?

Not sure if serious but sadly, the worst off will always be with us, it's kind of a "definition" thing.

walm said:

Welshbeef said:

...they are in essence disengaged and frankly don't care less...

I don't think there is any correlation between the amount of tax you pay and your engagement, is there?(Certainly not in my house!

)

)If you pay nothing in you don't have any pride in contributing (no matter how small)

walm said:

Welshbeef said:

...they are in essence disengaged and frankly don't care less...

I don't think there is any correlation between the amount of tax you pay and your engagement, is there?(Certainly not in my house!

)

)

walm said:

So you would add VAT to food and kids clothes?

And that is somehow a counter-argument to my point that the less-well off would suffer?

You know, the people who currently pay zero income tax AND zero VAT on food and kids clothes??

They would be WORSE OFF!! That's my point.

Or perhaps you meant you would leave VAT at zero there.

So what next? Perhaps petrol? Would you raise that VAT rate? Again - the worse off suffer most.

In the end, I honestly think to protect the worst off you would be forced to leave VAT where it is for life's essentials and raise it on all the discretionary stuff.

Which would see a huge drop in demand for such things and while the worst off would still be able to feed and clothe themselves, god help them if they want to have a little fun. Because you would end up taxing the crap out of booze, fags, holidays, high CO2 vehicles, etc... etc...

Honestly - it would be miserable for most people.

VAT currently covers just c.10% of all government levies so you need to 10x it. And it is often the ONLY tax the least well off pay. I just don't see how you could avoid making them pay more???

It really isn't "rubbish".

From what I can see, VAT is more like 30% of current personal taxation, so hardly requiring a ten fold increase, especially once all the efficiency savings are taken into account.And that is somehow a counter-argument to my point that the less-well off would suffer?

You know, the people who currently pay zero income tax AND zero VAT on food and kids clothes??

They would be WORSE OFF!! That's my point.

Or perhaps you meant you would leave VAT at zero there.

So what next? Perhaps petrol? Would you raise that VAT rate? Again - the worse off suffer most.

In the end, I honestly think to protect the worst off you would be forced to leave VAT where it is for life's essentials and raise it on all the discretionary stuff.

Which would see a huge drop in demand for such things and while the worst off would still be able to feed and clothe themselves, god help them if they want to have a little fun. Because you would end up taxing the crap out of booze, fags, holidays, high CO2 vehicles, etc... etc...

Honestly - it would be miserable for most people.

VAT currently covers just c.10% of all government levies so you need to 10x it. And it is often the ONLY tax the least well off pay. I just don't see how you could avoid making them pay more???

It really isn't "rubbish".

Having said that, though, if people aren't earning enough to contribute even a penny in direct taxation towards the running of the country, why should they be able to buy luxuries?

I don't begrudge paying in more to help cover people who really only have enough for the absolute essentials, but why should I have to forego luxuries so that someone else can afford them?

To my mind, the key benefit to putting all personal taxation into VAT would be the transparency. If everyone gets to see just how much of our money the government really spends, and equally importantly, they see how much that limits their ability to have what they want in life, maybe there might be more pressure from all sides of the electorate to reduce government expenditure.

If you upped VAT we'd all just fly to Europe/US buy suitcases full of clothes and electronics and fly back with them rather than buying them here. Smuggling would become big business again.

Our tax system generally is a bit of a mess but the income tax part of it is mostly fair except for the loss of personal allowance over £100k which gives an effective rate above the 45% additional rate, utterly bizarre.

Our tax system generally is a bit of a mess but the income tax part of it is mostly fair except for the loss of personal allowance over £100k which gives an effective rate above the 45% additional rate, utterly bizarre.

djc206 said:

If you upped VAT we'd all just fly to Europe/US buy suitcases full of clothes and electronics and fly back with them rather than buying them here. Smuggling would become big business again.

Our tax system generally is a bit of a mess but the income tax part of it is mostly fair except for the loss of personal allowance over £100k which gives an effective rate above the 45% additional rate, utterly bizarre.

If you think our current system is fair, you're merely demonstrating the fact that the complexities of the system make it nigh on impossible to see what's happening.Our tax system generally is a bit of a mess but the income tax part of it is mostly fair except for the loss of personal allowance over £100k which gives an effective rate above the 45% additional rate, utterly bizarre.

You wouldn't think it was fair if your supermarket bills suddenly rocketed so that 60% of the people who shopped there could be given their food for free and a cash handout on top, would you?

Why, therefore, do you think it's fair that we have a tax system where over half of all households in this country are net beneficiaries of the state?

Gassing Station | News, Politics & Economics | Top of Page | What's New | My Stuff