BTL - is it worth it?

Discussion

ATG said:

98elise said:

Its fair to assume that if you are investing for the long term then house prices will go up. There are not enough houses to go around as it is.

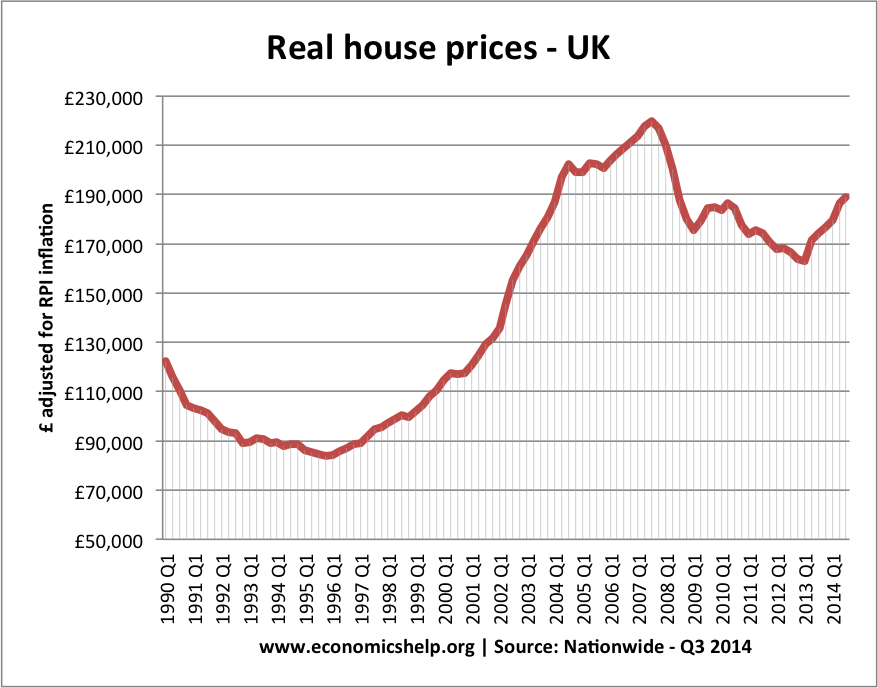

It's this kind of complacency that has driven house price inflation. There is no good reason to think the rates of inflation we have seen are sustainable over the long term. Tenants are not in a position to pay higher rent and rates can't go any lower. There is very limited upside for property over the medium term. Longer term are we really sure there will even be a sustained housing shortage? If someone has borrowed 3:1 against a property, how is the lender going to react if the relevant bit of the property market dips by 25%? Is a 25% dip in a small investor's undiversified property portfolio completely unthinkable?

Landlords who are geared are wide open to an increase in mortgage rates. Even if we assume that general rates are going to stay pretty low by historical standards, we have to consider that mortgage rates can move independently of general interest rates. If the PRA or the BOE think individual financial institutions, the sector, or the economy as a whole is dangerously exposed to the housing market, then they can increase the amount of capital that lenders need to hold against their mortgage portfolio. That increases the lenders' cost of capital for that lending activity and they will pass that through to their customers. People should consider that this could be targeted specifically at BTL lending, not at general mortgage lending. With the current levels of debt being so high, growth returning but not being long established, and inflation not being evenly distributed across the economy, the Bank is already making unconventional monetary interventions. We can't rule out that that will become the new norm. And in these circumstances it is not likely that geared landlords will be able to pass their increased costs through to their tenants.

It is in most speculator's nature to "talk their own book" ... i.e. once they have made an investment they tend to focus on the reasons why it will work in their favour and discount the reasons that it might fail; they lose their objectivity and can't look at the market dispassionately.

Is this all pessimistic? Yes. Is it outside the realms of possibility? No. If you're running a business it may well be appropriate to take a fair bit of risk. If you are saving for your retirement, then you should be pretty risk averse.

I see an awful lot of people saying they are running a BTL business, but in fact taking speculative positions in the property market because their current and expected earnings don't provide a reasonable return on the capital employed in the business. They say they are running a business, but actually they're saving for their retirement. They have limited capital invested and have taken out big loans. They have all their "assets" in one market; no diversification. By any normal standards of risk management, to put it politely they are being incredibly naive.

If you had to place a bet on property being more or less expensive in 10/20/30 years, where would your money go?

It fair to assume that inflation will continue, and it will erode cash deposits. BTL provides a cash return, AND capital growth. As its normally a leveraged investment then capital growth is actually magnified.

I agree current rates of inflation are not sustainable though. They were not sustainable during the last boom (and the one before that which I've also been through). I'm only interested in long term trends.

What we do know is that no-one knows for sure what will happen over the next 10/20 years or so.

It is fairly safe to assume however that interest rates won't be as low, or maybe they will!

Like many forms of retirement planning though, sometimes just have to do what you think is best, for you, at the time of making the decision.

So many things can change, wasn't too long ago that you could get 12,000 per 100,000 for an annuity, what is it now , about 3-4000?

Who's to say that some crackpot government gets in just as you want to sell (or your kids inherit) your BTL's who change the capital gains to 90% for anything other than your main home?

Personally i wouldn't be too happy having more than 50-60% loan on a BTL at the moment and if its for retirment planning, i'd want to be putting money aside in some other form of saving too (whilst interest rates are low), to potentially pay off any interest only loans either at retirment, or if the rates shot up.

As people have said though, having all your retirement eggs in a BTL basket may not be the best idea, but that rule applies to any other form of retirement planning too. Suppose it depends on how many baskets you can afford to put money into to spead your risk.

It is fairly safe to assume however that interest rates won't be as low, or maybe they will!

Like many forms of retirement planning though, sometimes just have to do what you think is best, for you, at the time of making the decision.

So many things can change, wasn't too long ago that you could get 12,000 per 100,000 for an annuity, what is it now , about 3-4000?

Who's to say that some crackpot government gets in just as you want to sell (or your kids inherit) your BTL's who change the capital gains to 90% for anything other than your main home?

Personally i wouldn't be too happy having more than 50-60% loan on a BTL at the moment and if its for retirment planning, i'd want to be putting money aside in some other form of saving too (whilst interest rates are low), to potentially pay off any interest only loans either at retirment, or if the rates shot up.

As people have said though, having all your retirement eggs in a BTL basket may not be the best idea, but that rule applies to any other form of retirement planning too. Suppose it depends on how many baskets you can afford to put money into to spead your risk.

ITP said:

What we do know is that no-one knows for sure what will happen over the next 10/20 years or so.

It is fairly safe to assume however that interest rates won't be as low, or maybe they will!

Like many forms of retirement planning though, sometimes just have to do what you think is best, for you, at the time of making the decision.

So many things can change, wasn't too long ago that you could get 12,000 per 100,000 for an annuity, what is it now , about 3-4000?

Who's to say that some crackpot government gets in just as you want to sell (or your kids inherit) your BTL's who change the capital gains to 90% for anything other than your main home?

Personally i wouldn't be too happy having more than 50-60% loan on a BTL at the moment and if its for retirment planning, i'd want to be putting money aside in some other form of saving too (whilst interest rates are low), to potentially pay off any interest only loans either at retirment, or if the rates shot up.

As people have said though, having all your retirement eggs in a BTL basket may not be the best idea, but that rule applies to any other form of retirement planning too. Suppose it depends on how many baskets you can afford to put money into to spead your risk.

I agree. I have enough in cash to reduce the LTV's significantly if needs be (currently offsetting my residential mortgage). If the landscape for BTL's changes then I will exit and invest somewhere else. BTL margins are reasonable, but it wouldn't take much to make it a poor investment.It is fairly safe to assume however that interest rates won't be as low, or maybe they will!

Like many forms of retirement planning though, sometimes just have to do what you think is best, for you, at the time of making the decision.

So many things can change, wasn't too long ago that you could get 12,000 per 100,000 for an annuity, what is it now , about 3-4000?

Who's to say that some crackpot government gets in just as you want to sell (or your kids inherit) your BTL's who change the capital gains to 90% for anything other than your main home?

Personally i wouldn't be too happy having more than 50-60% loan on a BTL at the moment and if its for retirment planning, i'd want to be putting money aside in some other form of saving too (whilst interest rates are low), to potentially pay off any interest only loans either at retirment, or if the rates shot up.

As people have said though, having all your retirement eggs in a BTL basket may not be the best idea, but that rule applies to any other form of retirement planning too. Suppose it depends on how many baskets you can afford to put money into to spead your risk.

red_slr said:

Calling BTL land lords!

What is your view on the value of doing BTL? I.e once you paid your mortgage, insurance, repairs etc and any admin is it genuinely worth it?

What kind of other costs do you regularly see?

Any other major issues?

Total newbie here so go softly!

As a small time btl investor, the answer really depends upon YOU!

If you are capable of actually thinking for yourself and making informed decisions based upon the information of estate agents, letting agents and the market itself then yes.

Do not simply rely upon what local agents say, they may not have your best interests in mind.

Analyse your local market and come to conclusions on historic prices and letting prices.. get out there listen to tenants and what they want and what they receive.

In 2005/6/7 I bought four BTL properties, it has been an adventure, had to cease trading as self employed and get a job instead as cash flow was essential. But these properties are 3 bed modern 90s properties purchased for £195k, £212k, £215k and are now worth in excess of £300k and a hmo for £290k which needed in excess of £60k of work which is worth £450k.

Low interest rates combined with solid yields, meant the £2800 monthly payments across the three modern properties dropped to £265 or £85 ish a month each... Mortgage Express were doing a base rate minus deal at the time (it was base plus 3 minus 2.5 or something)!

So I changed the mortgages to 15 year repayment, I had to add about £200 a property on top of the rent and treated them as a pension. The mortgage balance for the three has gone from just under £570k to £390k and they are worth £900k today. I have taken the income from the hmo, basically because I have had to spend so much money on it and I knew I had added significant value.

As for maintenance, the hmo has been a nightmare with massive wear and tear and I have got too involved in maintenance etc, but it's an ageing property ie new roof, new lintel in windows etc etc, frontal slip on bay windows, fixing bodges from the 80s etc etc

The modern btl properties have been a total doddle, I went too far in the words of the letting agent, stating they were too good for the rental market, good to start with but with around £8k on refurb on top just doing everything and making them right. Smeg / siemens appliances appliances as I know they look good and will not go wrong for 10 years. Professional re decoration, new internal doors etc etc basically put it right so you dont have to do it again for at least 15 years.

And this has been the case, as I literally have not set foot in three of the houses in the last three years. One I never visited for five years and it was in better condition when I viewed to when I let it!!! Tenant fitted made to measure curtain and landscaped the garden!!! I literally spent no money on maintenance of those properties for a three year period. I played the rental game well and even got the agent to do a rent only scheme, that is, I pay them the first months rent, tenant pays me and deals with me directly... I just told them get me the best tenants in terms of credit profile and those looking for long term let. And when tenant renews next year the admin fee from the agent is approx £250. Small time landlords, in my opinion do the rent only scheme as the agent is useless and if you have a problem you need to know asap and by dealing with the tenant directly this is how you will know.

My tenants get a great deal, they are living an economically productive part of the world where they can earn a good living in a comfortable three bedroom house for £1000 a month which to buy would be £300k in the current climate, I get a great deal as rates are low, but even if rates rise as they inevitably will the mortgage balances on the properties are £130k each I would like to get them down to around £120k for when rates rise, meaning the increase will be minimised. Also there is room for increased rent as similar properties can rent for upto £1400 but for me it is better the devil you know and it's hard to say goodbye to a great tenant.

Location is key, properties have done well due to SE not really being affected by the housing recession, and the fact a new housing estate was planned around the corner of this 90s development at significantly inflated prices, then an emerging student market in the area has boosted rental values and market values and then the council build a nature reserve opposite the housing estate and then the lovely lifting of the £250k stamp duty threshold and the general uplift across the entire local market.

As for those who say btl is in a dire state and the costs associated are too high. I have been approached by a local housing association who already own a third of the estate to take over the modern properties at a guaranteed rent albeit discounted rent for a minimum period of 10 years directly to council tenants, I am looking to gear up the properties and sell the hmo buy three more and then rent directly to a housing association for 10 years and totally walk away from them, and review in 10 years time.

This time (in ten years time) we could be millionaires Rodney!

Calling BTL land lords!

What is your view on the value of doing BTL? I.e once you paid your mortgage, insurance, repairs etc and any admin is it genuinely worth it?

What kind of other costs do you regularly see?

Any other major issues?

Total newbie here so go softly!

As a small time btl investor, the answer really depends upon YOU!

If you are capable of actually thinking for yourself and making informed decisions based upon the information of estate agents, letting agents and the market itself then yes.

Do not simply rely upon what local agents say, they may not have your best interests in mind.

Analyse your local market and come to conclusions on historic prices and letting prices.. get out there listen to tenants and what they want and what they receive.

In 2005/6/7 I bought four BTL properties, it has been an adventure, had to cease trading as self employed and get a job instead as cash flow was essential. But these properties are 3 bed modern 90s properties purchased for £195k, £212k, £215k and are now worth in excess of £300k and a hmo for £290k which needed in excess of £60k of work which is worth £450k.

Low interest rates combined with solid yields, meant the £2800 monthly payments across the three modern properties dropped to £265 or £85 ish a month each... Mortgage Express were doing a base rate minus deal at the time (it was base plus 3 minus 2.5 or something)!

So I changed the mortgages to 15 year repayment, I had to add about £200 a property on top of the rent and treated them as a pension. The mortgage balance for the three has gone from just under £570k to £390k and they are worth £900k today. I have taken the income from the hmo, basically because I have had to spend so much money on it and I knew I had added significant value.

As for maintenance, the hmo has been a nightmare with massive wear and tear and I have got too involved in maintenance etc, but it's an ageing property ie new roof, new lintel in windows etc etc, frontal slip on bay windows, fixing bodges from the 80s etc etc

The modern btl properties have been a total doddle, I went too far in the words of the letting agent, stating they were too good for the rental market, good to start with but with around £8k on refurb on top just doing everything and making them right. Smeg / siemens appliances appliances as I know they look good and will not go wrong for 10 years. Professional re decoration, new internal doors etc etc basically put it right so you dont have to do it again for at least 15 years.

And this has been the case, as I literally have not set foot in three of the houses in the last three years. One I never visited for five years and it was in better condition when I viewed to when I let it!!! Tenant fitted made to measure curtain and landscaped the garden!!! I literally spent no money on maintenance of those properties for a three year period. I played the rental game well and even got the agent to do a rent only scheme, that is, I pay them the first months rent, tenant pays me and deals with me directly... I just told them get me the best tenants in terms of credit profile and those looking for long term let. And when tenant renews next year the admin fee from the agent is approx £250. Small time landlords, in my opinion do the rent only scheme as the agent is useless and if you have a problem you need to know asap and by dealing with the tenant directly this is how you will know.

My tenants get a great deal, they are living an economically productive part of the world where they can earn a good living in a comfortable three bedroom house for £1000 a month which to buy would be £300k in the current climate, I get a great deal as rates are low, but even if rates rise as they inevitably will the mortgage balances on the properties are £130k each I would like to get them down to around £120k for when rates rise, meaning the increase will be minimised. Also there is room for increased rent as similar properties can rent for upto £1400 but for me it is better the devil you know and it's hard to say goodbye to a great tenant.

Location is key, properties have done well due to SE not really being affected by the housing recession, and the fact a new housing estate was planned around the corner of this 90s development at significantly inflated prices, then an emerging student market in the area has boosted rental values and market values and then the council build a nature reserve opposite the housing estate and then the lovely lifting of the £250k stamp duty threshold and the general uplift across the entire local market.

As for those who say btl is in a dire state and the costs associated are too high. I have been approached by a local housing association who already own a third of the estate to take over the modern properties at a guaranteed rent albeit discounted rent for a minimum period of 10 years directly to council tenants, I am looking to gear up the properties and sell the hmo buy three more and then rent directly to a housing association for 10 years and totally walk away from them, and review in 10 years time.

This time (in ten years time) we could be millionaires Rodney!

98elise said:

Indeed, if house prices drop to zero then we will have far more to worry about than owing the bank money.

Well, there are various reasons why an individual property could drop significantly in value.98elise said:

Its fair to assume that if you are investing for the long term then house prices will go up. There are not enough houses to go around as it is.

What's long term? It rather depends on your start point.I was invited to "join the rest of the family" in chipping in to buy an elderly relative a house and was told by a family member who is an accountant by trade and has done well for himself in business, that house prices double every 8 years. So the £275K house we were buying (did buy) in the NorthWest in 2006 would be worth £550K in 2014.

I seemed to be the only one who thought that was an absolute impossibility. As it's panned out, even today it's most unlikely the house could be sold for over £250K.

Of course, this being PH it suits me that the value has stayed down as I'd like to grab the place when the old dear pops her clogs. At 2/3 of £250K ish I can do that - whereas I couldn't at £500K+.

Sheepshanks said:

What's long term? It rather depends on your start point.

I was invited to "join the rest of the family" in chipping in to buy an elderly relative a house and was told by a family member who is an accountant by trade and has done well for himself in business, that house prices double every 8 years. So the £275K house we were buying (did buy) in the NorthWest in 2006 would be worth £550K in 2014.

I seemed to be the only one who thought that was an absolute impossibility. As it's panned out, even today it's most unlikely the house could be sold for over £250K.

Of course, this being PH it suits me that the value has stayed down as I'd like to grab the place when the old dear pops her clogs. At 2/3 of £250K ish I can do that - whereas I couldn't at £500K+.

I think what your relative meant was that hisyorically over the past 100 years UK house prices have doubled on average every 8-10 years. Of course there are highs and lows along the way, the last few years being one of the lows.I was invited to "join the rest of the family" in chipping in to buy an elderly relative a house and was told by a family member who is an accountant by trade and has done well for himself in business, that house prices double every 8 years. So the £275K house we were buying (did buy) in the NorthWest in 2006 would be worth £550K in 2014.

I seemed to be the only one who thought that was an absolute impossibility. As it's panned out, even today it's most unlikely the house could be sold for over £250K.

Of course, this being PH it suits me that the value has stayed down as I'd like to grab the place when the old dear pops her clogs. At 2/3 of £250K ish I can do that - whereas I couldn't at £500K+.

Sheepshanks said:

98elise said:

Indeed, if house prices drop to zero then we will have far more to worry about than owing the bank money.

Well, there are various reasons why an individual property could drop significantly in value.98elise said:

Its fair to assume that if you are investing for the long term then house prices will go up. There are not enough houses to go around as it is.

What's long term? It rather depends on your start point.I was invited to "join the rest of the family" in chipping in to buy an elderly relative a house and was told by a family member who is an accountant by trade and has done well for himself in business, that house prices double every 8 years. So the £275K house we were buying (did buy) in the NorthWest in 2006 would be worth £550K in 2014.

I seemed to be the only one who thought that was an absolute impossibility. As it's panned out, even today it's most unlikely the house could be sold for over £250K.

Of course, this being PH it suits me that the value has stayed down as I'd like to grab the place when the old dear pops her clogs. At 2/3 of £250K ish I can do that - whereas I couldn't at £500K+.

Buying in 2006 was at the peak of a boom, and I would not (and didn't) get into property as an investment back then. I bought when I felt the prices were right which was around 2011/2012. I bought 3 bed 60's/70's built homes in the Southeast for no more than 130k. That to me felt like a good investment.

Today those houses would be 160-180k and I will not buy any more at those prices.

house prices versus inflation. Buy when houseprices are below the real value in a slump and sell when theres a boom and house prices exceed inflation

otherwise dont kid yourself you are making capital gains in real terms, its just an illusion.....of course property "developing" i.e. doing up old and selling them after adding value is a way you can make money on property

Most people I know invest money in property for income, and any capital appreciation that outstrips inflation when you want to sell is a bonus.....

unfortunately I never get it right, the last time I bought and sold in the early 90's got a cheap deal, sold late 90's, made about 15%....if only Id waited to the next up cycle post 2000 ....doh !

Edited by bogie on Tuesday 14th April 08:29

We're just about to move house and keep hold of our 2bed and rent it out so are also going in as newbie landlords. It is a little daunting when I look at the total figures but not so much that I feel uncomfortable.

We've been here for 8yrs having bought for 250k. House now worth between 310-340 (difficult to pinpoint as we have PP for a very large4bed on the site)

New BTL is interest only at around £550pm. Rental income around 1150pm.

We've chosen this route as we're near Reading so Crossrail and lots of other infrastructure improvements and the fact we want a fallback if we ever need to downsize.

Just applied for the mortgage so now working through the other bits we need to get sorted like insurance/checking the electrics/boiler serviced etc.

Does anyone have a good checklist for a newbie like me to make sure we're all above board?

We've been here for 8yrs having bought for 250k. House now worth between 310-340 (difficult to pinpoint as we have PP for a very large4bed on the site)

New BTL is interest only at around £550pm. Rental income around 1150pm.

We've chosen this route as we're near Reading so Crossrail and lots of other infrastructure improvements and the fact we want a fallback if we ever need to downsize.

Just applied for the mortgage so now working through the other bits we need to get sorted like insurance/checking the electrics/boiler serviced etc.

Does anyone have a good checklist for a newbie like me to make sure we're all above board?

MrChips said:

We're just about to move house and keep hold of our 2bed and rent it out so are also going in as newbie landlords. It is a little daunting when I look at the total figures but not so much that I feel uncomfortable.

We've been here for 8yrs having bought for 250k. House now worth between 310-340 (difficult to pinpoint as we have PP for a very large4bed on the site)

New BTL is interest only at around £550pm. Rental income around 1150pm.

We've chosen this route as we're near Reading so Crossrail and lots of other infrastructure improvements and the fact we want a fallback if we ever need to downsize.

Just applied for the mortgage so now working through the other bits we need to get sorted like insurance/checking the electrics/boiler serviced etc.

Does anyone have a good checklist for a newbie like me to make sure we're all above board?

If you rent it for say a further 8 years, I think 50% of your £90k gain becomes liable to CGT (i.e. 8/16 x the gain). That might be a consideration in your calculations. (Plus 50% of any further gain in the ensuing period)We've been here for 8yrs having bought for 250k. House now worth between 310-340 (difficult to pinpoint as we have PP for a very large4bed on the site)

New BTL is interest only at around £550pm. Rental income around 1150pm.

We've chosen this route as we're near Reading so Crossrail and lots of other infrastructure improvements and the fact we want a fallback if we ever need to downsize.

Just applied for the mortgage so now working through the other bits we need to get sorted like insurance/checking the electrics/boiler serviced etc.

Does anyone have a good checklist for a newbie like me to make sure we're all above board?

That could make quite a dent in your returns? (Somebody who actually knows about this stuff will be along shortly to tell me I'm talking bollicks

. But, I guess all I'm saying is check out the CGT position before you get too far in)

. But, I guess all I'm saying is check out the CGT position before you get too far in)MrChips said:

We're just about to move house and keep hold of our 2bed and rent it out so are also going in as newbie landlords. It is a little daunting when I look at the total figures but not so much that I feel uncomfortable.

We've been here for 8yrs having bought for 250k. House now worth between 310-340 (difficult to pinpoint as we have PP for a very large4bed on the site)

New BTL is interest only at around £550pm. Rental income around 1150pm.

We've chosen this route as we're near Reading so Crossrail and lots of other infrastructure improvements and the fact we want a fallback if we ever need to downsize.

Just applied for the mortgage so now working through the other bits we need to get sorted like insurance/checking the electrics/boiler serviced etc.

Does anyone have a good checklist for a newbie like me to make sure we're all above board?

Major ones are:We've been here for 8yrs having bought for 250k. House now worth between 310-340 (difficult to pinpoint as we have PP for a very large4bed on the site)

New BTL is interest only at around £550pm. Rental income around 1150pm.

We've chosen this route as we're near Reading so Crossrail and lots of other infrastructure improvements and the fact we want a fallback if we ever need to downsize.

Just applied for the mortgage so now working through the other bits we need to get sorted like insurance/checking the electrics/boiler serviced etc.

Does anyone have a good checklist for a newbie like me to make sure we're all above board?

EPC

Gas cert

Electrical cert

Suitable insurance

If it is a house you should carry out a fire assessment, making sure there are escape routes from first floor windows, look into mains powered smoke alarms and making sure any furniture included in the let is fire resistant.

You also have a duty of care with your tenants so make sure there are no hazards, because there are some very stupid people out there in the world. I recently had a problem where a paving slab used as a step to the front door came lose and each time it was stood on it would move a MM or so outwards, eventually it tipped out over the edge of the step and tenant went over on her ankle. Any normal person would see the movement of the slab and push it back in or report it but i was ultimately responsible.

Any sharp edges should be sorted, trip hazards addressed etc. You will know better yourself after living there for some time.

If you are self managing your property you will need to research fully the ins and outs of renting, deposit protection, eviction notices etc as the law heavily favours the tenant you cant afford to get anything wrong. there is a lot to learn so might well be useful joining the likes of the RLA.

Edited by dazwalsh on Monday 4th May 09:05

Gassing Station | Finance | Top of Page | What's New | My Stuff