The future for the small BTL investor

Discussion

LDN said:

If my partner and I want to buy a new home together (but we own, between us, several BTL's) - will the purchase of our new home cost us an extra 3% in stamp duty from April '16? Do I have that right? The fact we have other properties in our name means we will have to pay that extra 3%?

correct yes.Eric Mc said:

I would never classify buy to let owners as being particularly nasty. I've known hundreds (as a tenant and as clients) over the years and their personalities reflect a cross section of humanity. Some are decent - some are not.

I certainly wouldn't tar them all with the same brush.

However. I do think that over the past few decades taxation policy has, on the whole, been fairly kind to those who chose to "invest" in land and property - and not so kind to those who chose to invest in industry or commerce.

A rebalancing of the tax environment has long been overdue.

Also. culturally, the UK population has become rather fixated with property ownership as a symbol of "capitalist entrepreneurship" - which I actually don't think it always is.

I'm not sure I always agree with Mr Eric but here, yes. I certainly wouldn't tar them all with the same brush.

However. I do think that over the past few decades taxation policy has, on the whole, been fairly kind to those who chose to "invest" in land and property - and not so kind to those who chose to invest in industry or commerce.

A rebalancing of the tax environment has long been overdue.

Also. culturally, the UK population has become rather fixated with property ownership as a symbol of "capitalist entrepreneurship" - which I actually don't think it always is.

Eric Mc said:

I would never classify buy to let owners as being particularly nasty. I've known hundreds (as a tenant and as clients) over the years and their personalities reflect a cross section of humanity. Some are decent - some are not.

I certainly wouldn't tar them all with the same brush.

However. I do think that over the past few decades taxation policy has, on the whole, been fairly kind to those who chose to "invest" in land and property - and not so kind to those who chose to invest in industry or commerce.

A rebalancing of the tax environment has long been overdue.

Also. culturally, the UK population has become rather fixated with property ownership as a symbol of "capitalist entrepreneurship" - which I actually don't think it always is.

Yes, rest property has become the text book 'self employment' business in the last 20 years. I certainly wouldn't tar them all with the same brush.

However. I do think that over the past few decades taxation policy has, on the whole, been fairly kind to those who chose to "invest" in land and property - and not so kind to those who chose to invest in industry or commerce.

A rebalancing of the tax environment has long been overdue.

Also. culturally, the UK population has become rather fixated with property ownership as a symbol of "capitalist entrepreneurship" - which I actually don't think it always is.

One of the big problems being that when a small property comes up for sale in the UK the buyer who wishes to be the owner occupier has everything against them. Typically speaking, they have low income, low savings, will be subject to some sensible lending criteria and often higher interest rates. Conversely, their competition for the asset has become an over 50s cash rich, solid income, easy access to credit amateur investor who is very prone to using their excessive financial firepower to overbid.

There are obviously professional landlords out there but at the same time huge numbers of (not meaning any harm or wanting to be rude) cash rich, incompetent, inefficient investors pouring huge sums into the market and helping inflate it.

If I take my own personal situation as a BTL landlord, I bought two 1 bed flats in St John's Wood. I bought them for my daughters and as such I want two properties next to each other, where the block had a porter and was a well light, public, short walk to the Tube. Because of these illogical criteria I ended up outbidding the professional BTL and young professionals.

It may have been that facing a larger tax bill at the time would have swung me back towards more traditional investments and thus kept someone like myself who is an inefficient and detrimental element of the U.K. Market out.

Another aspect to consider is that how much cheaper will it be for local authorities to liaise with a handful of professional property groups looking after thousands of institutionally held properties in contrast to the current situation of dealing with thousands of amateur landlords?

DonkeyApple said:

Was having a few drinks with a couple of property fund managers today.

On the surface it seems like the intent is to try and halt retail investment into the residential market and to focus it more to funds. The theory is that it will make the rental market more efficient, more competitive and more importantly better able to withstand a market correction.

It was pointed out that the State owned banks and others still have extreme exposure to mortgage debt and that institutional investors would not be forced sellers in a downturn unlike the less well capitalised private investor.

Seems an interesting argument.

Some good points here, especially in the 2nd paragraph. To my understanding there are too many amateur investors up to their necks in debt chasing capital appreciation. A small increase in interest rates & the whole edifice will come tumbling down. Far better in my mind to cool the BTL market through these measures now, than let it continue to expand & then burst big time later. BTL for most is not about making letting a business. Its property speculation. And we all know what happens with speculative bubbles!On the surface it seems like the intent is to try and halt retail investment into the residential market and to focus it more to funds. The theory is that it will make the rental market more efficient, more competitive and more importantly better able to withstand a market correction.

It was pointed out that the State owned banks and others still have extreme exposure to mortgage debt and that institutional investors would not be forced sellers in a downturn unlike the less well capitalised private investor.

Seems an interesting argument.

Out of interest DA - do you happen to know if there are ANY residential real estate funds?

I know you have private offices doing their own bespoke portfolio creation (e.g. Grosvenor) but is anyone pooling serious capital to do this?

Aren't all the REITs commercial only?

Might it be possible with say an HA running the letting side of things?

If it doesn't exist, why not?

I know you have private offices doing their own bespoke portfolio creation (e.g. Grosvenor) but is anyone pooling serious capital to do this?

Aren't all the REITs commercial only?

Might it be possible with say an HA running the letting side of things?

If it doesn't exist, why not?

GT03ROB said:

DonkeyApple said:

Was having a few drinks with a couple of property fund managers today.

On the surface it seems like the intent is to try and halt retail investment into the residential market and to focus it more to funds. The theory is that it will make the rental market more efficient, more competitive and more importantly better able to withstand a market correction.

It was pointed out that the State owned banks and others still have extreme exposure to mortgage debt and that institutional investors would not be forced sellers in a downturn unlike the less well capitalised private investor.

Seems an interesting argument.

Some good points here, especially in the 2nd paragraph. To my understanding there are too many amateur investors up to their necks in debt chasing capital appreciation. A small increase in interest rates & the whole edifice will come tumbling down. Far better in my mind to cool the BTL market through these measures now, than let it continue to expand & then burst big time later. BTL for most is not about making letting a business. Its property speculation. And we all know what happens with speculative bubbles!On the surface it seems like the intent is to try and halt retail investment into the residential market and to focus it more to funds. The theory is that it will make the rental market more efficient, more competitive and more importantly better able to withstand a market correction.

It was pointed out that the State owned banks and others still have extreme exposure to mortgage debt and that institutional investors would not be forced sellers in a downturn unlike the less well capitalised private investor.

Seems an interesting argument.

What would concern me is the recent, 2008, evidence that such institutional wealth is in itself not immune from over leverage and default.

In addition, if we look to the corporate property market we've had for many years the situation that pension funds must invest the cash they receive by strict time and allocation criteria which has resulted in funds being forced to bid commercial property assets up because they have to invest the capital to the detriment of yield etc. There are a lot of good quality commercial property assets sitting in pension fund books that they know they have hugely overpaid for.

So how do you stop this institutional money from excessively bidding up the resi market?

DonkeyApple said:

So how do you stop this institutional money from excessively bidding up the resi market?

Well it sounds like the sort of thing that decent yields elsewhere would solve... or a haircut to capital appreciation assumptions...Did someone say "time to normalise interest rates..."????

walm said:

Out of interest DA - do you happen to know if there are ANY residential real estate funds?

I know you have private offices doing their own bespoke portfolio creation (e.g. Grosvenor) but is anyone pooling serious capital to do this?

Aren't all the REITs commercial only?

Might it be possible with say an HA running the letting side of things?

If it doesn't exist, why not?

Rob is probably the best person to answer this. There was a good thread where this was discussed. I'll see if I can find it. I know you have private offices doing their own bespoke portfolio creation (e.g. Grosvenor) but is anyone pooling serious capital to do this?

Aren't all the REITs commercial only?

Might it be possible with say an HA running the letting side of things?

If it doesn't exist, why not?

Re the serious capital, my understanding is that replicating the more traditional BTL model of units owned over a large area and therefore needing quite expensive maintenance due to this inefficiency isn't what is being solely intended under this change but that institutional funds buy entire developments. In other words, I think this is being seen as part of an intent to privatise new 'council estates' and 'tower blocks' or what is now referred to as 'affordable housing developments'.

DonkeyApple said:

Rob is probably the best person to answer this. There was a good thread where this was discussed. I'll see if I can find it.

Re the serious capital, my understanding is that replicating the more traditional BTL model of units owned over a large area and therefore needing quite expensive maintenance due to this inefficiency isn't what is being solely intended under this change but that institutional funds buy entire developments. In other words, I think this is being seen as part of an intent to privatise new 'council estates' and 'tower blocks' or what is now referred to as 'affordable housing developments'.

You're probably right. A couple of problems spring to mind though.Re the serious capital, my understanding is that replicating the more traditional BTL model of units owned over a large area and therefore needing quite expensive maintenance due to this inefficiency isn't what is being solely intended under this change but that institutional funds buy entire developments. In other words, I think this is being seen as part of an intent to privatise new 'council estates' and 'tower blocks' or what is now referred to as 'affordable housing developments'.

1. If you have large developments populated entirely by renters there can be problems with ghettoisation.

2. The PRS as it stands now won't go away but will come under significant cost pressure. Pressure quite deliberately imposed by the government and also as a result of marching regulation. This will, I think, result in a number of die-hard landlords struggling to make ends meet and as a consequence doing the bare minimum to get by and engaging in sharp practice.

13m said:

You're probably right. A couple of problems spring to mind though.

1. If you have large developments populated entirely by renters there can be problems with ghettoisation.

2. The PRS as it stands now won't go away but will come under significant cost pressure. Pressure quite deliberately imposed by the government and also as a result of marching regulation. This will, I think, result in a number of die-hard landlords struggling to make ends meet and as a consequence doing the bare minimum to get by and engaging in sharp practice.

Couldn't agree more. I'm certainly not a believer in ignoring what we have already learned but it would appear that this is what is being mooted. 1. If you have large developments populated entirely by renters there can be problems with ghettoisation.

2. The PRS as it stands now won't go away but will come under significant cost pressure. Pressure quite deliberately imposed by the government and also as a result of marching regulation. This will, I think, result in a number of die-hard landlords struggling to make ends meet and as a consequence doing the bare minimum to get by and engaging in sharp practice.

coetzeeh said:

LDN said:

If my partner and I want to buy a new home together (but we own, between us, several BTL's) - will the purchase of our new home cost us an extra 3% in stamp duty from April '16? Do I have that right? The fact we have other properties in our name means we will have to pay that extra 3%?

correct yes.I read it as the 3% surcharge is for additional properties bought with a value of more than £40k....therefore this applies to properties bought with the sole intention of being Let out, properties to be used a second home or a UK holiday home.

I haven't seen anything yet that covers the Let to Buy scenario where somebody retains their previous residential property, let that property in order to buy a new home but retains their residential mortgage with 'consent to let'. Could this be seen as a person having 2 residential mortgages if an outsider (Government) was looking at this? Wonder how that will be treated!!!!

The problem is where else do people invest money? It's looking more and more likely that the government are going to leave people high and dry in old age as they've mismanaged the pension pot so people need to find some way to secure their own comfortable retirement.

Unfortunately most people don't understand or are too afraid to invest in the stock market or commodities as they don't understand how it all works or are afraid of the risk. The old adage "safe as houses" is one that is well ingrained in the UK psyche and to be fair it has been proven to be true for decades. The hundreds of property investment programs on TV have also done their bit to make people think investing in property is a sure-fire way to get rich.

On the surface it all seems so simple, if you have bit of cash lying around earning next to no interest, buy a property, rent it out so someone else pays the mortgage, then in 20 years time you have an asset that has been paid for by someone else and house prices always go up right? The fact that so many pensions under-perform or that is the perception doesn't help either. It seems to make BTL the least path of resistance to securing a comfortable future, is it really a wonder that so many people do it? It's a problem and a market, almost unique to the UK that the government, media and we have created for ourselves.

Unfortunately most people don't understand or are too afraid to invest in the stock market or commodities as they don't understand how it all works or are afraid of the risk. The old adage "safe as houses" is one that is well ingrained in the UK psyche and to be fair it has been proven to be true for decades. The hundreds of property investment programs on TV have also done their bit to make people think investing in property is a sure-fire way to get rich.

On the surface it all seems so simple, if you have bit of cash lying around earning next to no interest, buy a property, rent it out so someone else pays the mortgage, then in 20 years time you have an asset that has been paid for by someone else and house prices always go up right? The fact that so many pensions under-perform or that is the perception doesn't help either. It seems to make BTL the least path of resistance to securing a comfortable future, is it really a wonder that so many people do it? It's a problem and a market, almost unique to the UK that the government, media and we have created for ourselves.

Guvernator said:

The problem is where else do people invest money? It's looking more and more likely that the government are going to leave people high and dry in old age as they've mismanaged the pension pot so people need to find some way to secure their own comfortable retirement.

Unfortunately most people don't understand or are too afraid to invest in the stock market or commodities as they don't understand how it all works or are afraid of the risk. The old adage "safe as houses" is one that is well ingrained in the UK psyche and to be fair it has been proven to be true for decades. The hundreds of property investment programs on TV have also done their bit to make people think investing in property is a sure-fire way to get rich.

On the surface it all seems so simple, if you have bit of cash lying around earning next to no interest, buy a property, rent it out so someone else pays the mortgage, then in 20 years time you have an asset that has been paid for by someone else and house prices always go up right? The fact that so many pensions under-perform or that is the perception doesn't help either. It seems to make BTL the least path of resistance to securing a comfortable future, is it really a wonder that so many people do it? It's a problem and a market, almost unique to the UK that the government, media and we have created for ourselves.

A first class post and one that certainly resonates with me. Unfortunately most people don't understand or are too afraid to invest in the stock market or commodities as they don't understand how it all works or are afraid of the risk. The old adage "safe as houses" is one that is well ingrained in the UK psyche and to be fair it has been proven to be true for decades. The hundreds of property investment programs on TV have also done their bit to make people think investing in property is a sure-fire way to get rich.

On the surface it all seems so simple, if you have bit of cash lying around earning next to no interest, buy a property, rent it out so someone else pays the mortgage, then in 20 years time you have an asset that has been paid for by someone else and house prices always go up right? The fact that so many pensions under-perform or that is the perception doesn't help either. It seems to make BTL the least path of resistance to securing a comfortable future, is it really a wonder that so many people do it? It's a problem and a market, almost unique to the UK that the government, media and we have created for ourselves.

I am that person.

Before 2008 I was content to run my business with the majority of my savings earning a reasonable rate of interest on the money market,whilst dabbling in shares and the odd investment property.

This long period of low interest rates has truly fecked that up.

avinalarf said:

A first class post and one that certainly resonates with me.

I am that person.

Before 2008 I was content to run my business with the majority of my savings earning a reasonable rate of interest on the money market,whilst dabbling in shares and the odd investment property.

This long period of low interest rates has truly fecked that up.

Isn't this just a misunderstanding about the difference between nominal growth and real growth?I am that person.

Before 2008 I was content to run my business with the majority of my savings earning a reasonable rate of interest on the money market,whilst dabbling in shares and the odd investment property.

This long period of low interest rates has truly fecked that up.

Sure you might have had "reasonable rate of interest" on the money market pre-08 but you were suffering far higher inflation rate too.

It's the spread that matters.

What the low interest rates have done is just massively inflate ASSETS like houses, classic cars, art etc...and not forgetting equities.

We are seven years into a massive bull market right now.

So my opinion is that money market funds/risk-free savings are as bad value now as they always were but it is simply that the other assets have been super attractive owing to asset price inflation.

That can easily get turned on its head if interest rates go up.

walm said:

So my opinion is that money market funds/risk-free savings are as bad value now as they always were but it is simply that the other assets have been super attractive owing to asset price inflation.

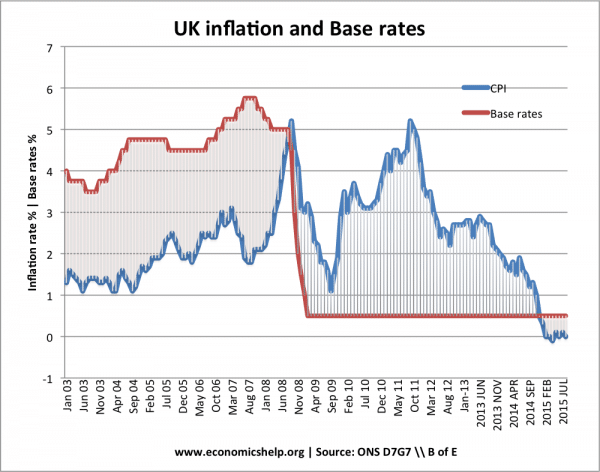

Real returns on cash have been negative for some years - which is unusual. - Inflation at 4% with interest rates at 6%? Yes, I can live with that.

- Inflation at 2% with interest rates at 1%? No thanks!! That's being charged for having cash!

Ozzie Osmond said:

walm said:

So my opinion is that money market funds/risk-free savings are as bad value now as they always were but it is simply that the other assets have been super attractive owing to asset price inflation.

Real returns on cash have been negative for some years - which is unusual. - Inflation at 4% with interest rates at 6%? Yes, I can live with that.

- Inflation at 2% with interest rates at 1%? No thanks!! That's being charged for having cash!

Either way we are talking about a pretty de minimus change.

Leaving money in the bank has never been a great way to get rich.

Gassing Station | Finance | Top of Page | What's New | My Stuff