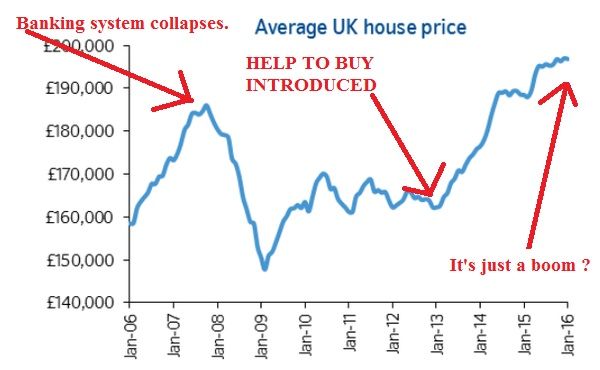

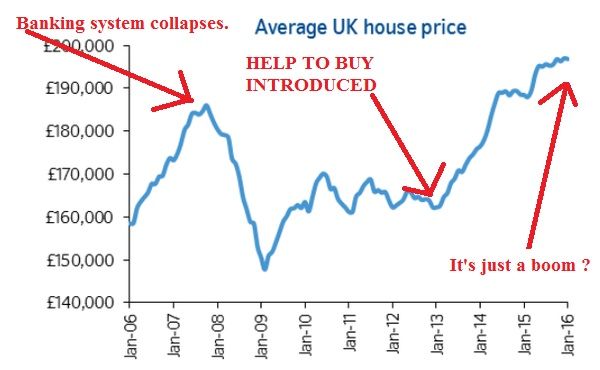

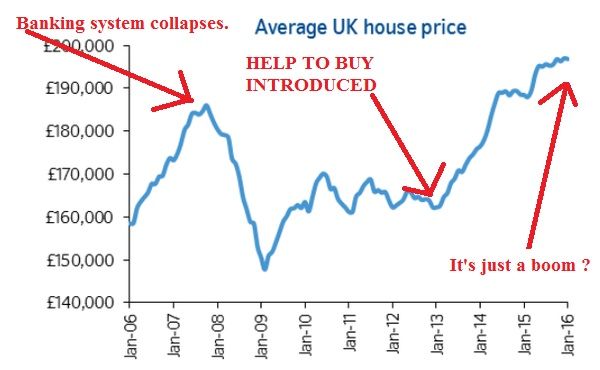

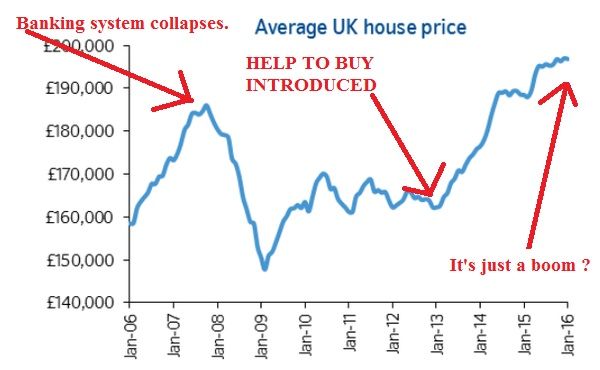

House prices at an all time high.... Bad time to buy?

Discussion

Jakey123 said:

http://moneyweek.com/merryns-blog/signs-that-the-l...

Mmmmmm.....

Kensington and Chelsea prices down 14% over last year.

http://moneyweek.com/merryns-blog/buying-in-london...

The average sale price of all apartments in the SW8 postcode has fallen by about 16% to £818,000 in the last year.

But yeah, buy and ride it out. They have further to fall though....?

London is cooling because we're in the third year of the rebasing of the commodity market and also much of the tax evasion and money laundering or Europeans via the London market has come to an end.Mmmmmm.....

Kensington and Chelsea prices down 14% over last year.

http://moneyweek.com/merryns-blog/buying-in-london...

The average sale price of all apartments in the SW8 postcode has fallen by about 16% to £818,000 in the last year.

But yeah, buy and ride it out. They have further to fall though....?

With the fall in commodity prices it means your Russians, Arabs, Khazachs etc are out of the market at present. Some are even having to cash in.

The slowing of Chinese growth has meant that Asians are not rushing to buy in London at the moment.

The EU has settled down and the number of PIG tax evaders has dwindled as they've all laundered heir money by now.

And the English don't earn enough to compete in any great number against the global buyers so they aren't filling the void.

At the same time the market had obviously got carried away and has had two big reality checks. The first one being that they've not sold any of the resi space in the Shard. It has priced to only be affordable to the super wealthy who grew up in crap holes and the investors have realised that that type of person isn't going to spend a few million on a London residence where the front door opens into the middle of a cultural and financial wasteland of South London. And the second one is phase two of the Battersea power station. £1.2m for a one bed flat in South London? Reality check, no one with serious money wants to be south of the river where their staff live.

So I think the pressure is off while the market adjusts and catches a bit of reality. But the South East is still over populated and under housed and the banks' balance sheets in the UK are so pegged to the book values of resi property and our Govt is totally underpinned by this artificial value that as we've seen with the home starter or whatever it's called, they will do anything to stop a fall.

So will the UK property market collapse? No. Because the Govt has proven that it is a false market that they will underwrite come hell or high water.

Just buy what you can afford to keep paying for in a worst case scenario. Ie don't over leverage.

DonkeyApple said:

And the English don't earn enough to compete in any great number against the global buyers so they aren't filling the void.

That is IMO the truly scary aspect of London and SE.Anyway, who are these "English" of whom you speak? Don't hear much of that spoken in London these days....

DonkeyApple said:

So will the UK property market collapse? No. Because the Govt has proven that it is a false market that they will underwrite come hell or high water.

Just buy what you can afford to keep paying for in a worst case scenario. Ie don't over leverage.

Values will collapse, prices will stay high.Just buy what you can afford to keep paying for in a worst case scenario. Ie don't over leverage.

Depreciate the debt is how the government started, and will continue to underwrite the false market.

The best time to buy would be at the start of the rise in salaries after the next correction of values (either prices drop, or values drop)

Imo.

Lord knows but housepricecrashers haven't done all that well, have they?

I remember reading a thread on there from a guy who'd been offered a three bed house in Hackney for some piffling amount wondering whether he should take the plunge. Cue five pages of 'forget it, son. This ponzi is over.' I assume he took the advice and is now living in a caravan somewhere.

I remember reading a thread on there from a guy who'd been offered a three bed house in Hackney for some piffling amount wondering whether he should take the plunge. Cue five pages of 'forget it, son. This ponzi is over.' I assume he took the advice and is now living in a caravan somewhere.

DonkeyApple said:

London is cooling because we're in the third year of the rebasing of the commodity market and also much of the tax evasion and money laundering or Europeans via the London market has come to an end.

With the fall in commodity prices it means your Russians, Arabs, Khazachs etc are out of the market at present. Some are even having to cash in.

The slowing of Chinese growth has meant that Asians are not rushing to buy in London at the moment.

The EU has settled down and the number of PIG tax evaders has dwindled as they've all laundered heir money by now.

And the English don't earn enough to compete in any great number against the global buyers so they aren't filling the void.

At the same time the market had obviously got carried away and has had two big reality checks. The first one being that they've not sold any of the resi space in the Shard. It has priced to only be affordable to the super wealthy who grew up in crap holes and the investors have realised that that type of person isn't going to spend a few million on a London residence where the front door opens into the middle of a cultural and financial wasteland of South London. And the second one is phase two of the Battersea power station. £1.2m for a one bed flat in South London? Reality check, no one with serious money wants to be south of the river where their staff live.

So I think the pressure is off while the market adjusts and catches a bit of reality. But the South East is still over populated and under housed and the banks' balance sheets in the UK are so pegged to the book values of resi property and our Govt is totally underpinned by this artificial value that as we've seen with the home starter or whatever it's called, they will do anything to stop a fall.

So will the UK property market collapse? No. Because the Govt has proven that it is a false market that they will underwrite come hell or high water.

Just buy what you can afford to keep paying for in a worst case scenario. Ie don't over leverage.

the shard isn't for sale BTW. it's retained for the owners useWith the fall in commodity prices it means your Russians, Arabs, Khazachs etc are out of the market at present. Some are even having to cash in.

The slowing of Chinese growth has meant that Asians are not rushing to buy in London at the moment.

The EU has settled down and the number of PIG tax evaders has dwindled as they've all laundered heir money by now.

And the English don't earn enough to compete in any great number against the global buyers so they aren't filling the void.

At the same time the market had obviously got carried away and has had two big reality checks. The first one being that they've not sold any of the resi space in the Shard. It has priced to only be affordable to the super wealthy who grew up in crap holes and the investors have realised that that type of person isn't going to spend a few million on a London residence where the front door opens into the middle of a cultural and financial wasteland of South London. And the second one is phase two of the Battersea power station. £1.2m for a one bed flat in South London? Reality check, no one with serious money wants to be south of the river where their staff live.

So I think the pressure is off while the market adjusts and catches a bit of reality. But the South East is still over populated and under housed and the banks' balance sheets in the UK are so pegged to the book values of resi property and our Govt is totally underpinned by this artificial value that as we've seen with the home starter or whatever it's called, they will do anything to stop a fall.

So will the UK property market collapse? No. Because the Govt has proven that it is a false market that they will underwrite come hell or high water.

Just buy what you can afford to keep paying for in a worst case scenario. Ie don't over leverage.

gibbon said:

Depends who you ask. Nationwide paints a very different picture.Jakey123 said:

Hoofy said:

Unless something changes significantly (law? war? 1 child policy?) you might get a falter but the supply is only going to get bigger. Sure, there are initiatives to encourage house building but do you really think the likes of Bovis are going to suddenly dump thousands of houses onto the market and then have to sell them for a lower price?

Even s t areas are going to start to cost a lot and this will continue to spread from the south east to other areas.

t areas are going to start to cost a lot and this will continue to spread from the south east to other areas.

Help to buy is helping everyone commit to huge debt, hence pushing prices up and allowing people to over commit. Even s

t areas are going to start to cost a lot and this will continue to spread from the south east to other areas.

t areas are going to start to cost a lot and this will continue to spread from the south east to other areas.

People simply don't earn enough for the rise to continue, but this helps prop them up.

Regarding the rise spreading, areas outside commuting distance from London eg 60miles+ north aren't rising and some places around Smaller Bedford villages are sitting static (if same price as they sold for 5yrs ago, that is a rather large loss in money due to inflation, interest payments and maintenance on the property) and have dropped. It seems very much London overflow related.

The whole prices are going up hype just scares people into a panic buy. And like sheep we all follow the crowd because someone we know made 20k in a year, but paid 5k stamp duty, 5k maintenance costs and 20k interest in that time..... People using dumb maths (I do realise some people have however made huge amounts in and nearer London than areas I am looking)

Regarding changes in law - the government going after BTL investors who already have very low yields, which are typically crap anyway in the south east. Pushing landlords to pull out that market, and raises in stamp duty to put people off the idea. Also stricter lending rules with a 4.5x limits further push home ownership away from the average earners...

I can see both sides of the coin, simply discussing.

It has been extrapolated to make a point for propaganda not fact... to someone with even the basics of stats / economics it shows how prices are under 20 per cent higher than they were 10 years ago.

Hardly unaffordable, the increase in 10 years is the same as the average annual income for an individual, wow... if anything for me it shows further growth possible.

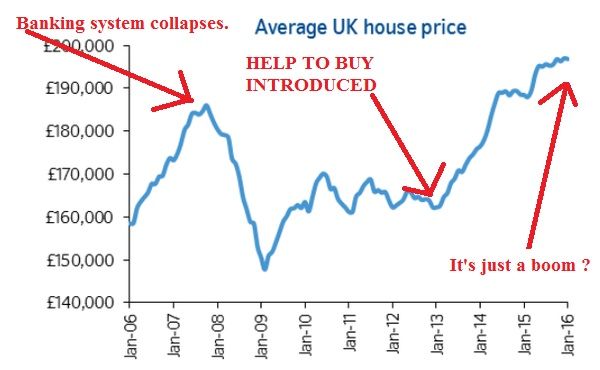

The only reason theres been any significant house price inflation in the last 8 years is due to massive amounts of state intervention... HTB, QE, ZIRP all inflating property prices to what are surely unsustainable levels when compared to wages.

The one question you need to ask yourself is how much longer can and will the government be prepared to prop up the housing market?

The one question you need to ask yourself is how much longer can and will the government be prepared to prop up the housing market?

Not true despite gov intervention house prices have also risen due to

Influx of hard working aspirational migrants who pay rent and buy houses

Massive massive world wide investment into UK property market

Growth of hmo market place

Disillusioned pension investors

Internet has opened market awareness

Social barriers changing, it's not so stigmatised to be working class self employed for middle classes ie property development gained greater gravitas - btl is now aspersional middle class

Enlargement of universities and development of former colleges have created massive student rental market so its yield has driven up prices. You need to go to uni just do a traditional school leaver job of the 90s and that's not entirely due to the government.

The housing market is now seen as a market for investment just like any other market.

Endless TV property programs now passed off as prime time viewing - people are market aware

Disparity in affordability creating a significant rental demand for the long term and a generation of renters with investors aware and willing to fulfil this

There are more reasons I'm sure

Influx of hard working aspirational migrants who pay rent and buy houses

Massive massive world wide investment into UK property market

Growth of hmo market place

Disillusioned pension investors

Internet has opened market awareness

Social barriers changing, it's not so stigmatised to be working class self employed for middle classes ie property development gained greater gravitas - btl is now aspersional middle class

Enlargement of universities and development of former colleges have created massive student rental market so its yield has driven up prices. You need to go to uni just do a traditional school leaver job of the 90s and that's not entirely due to the government.

The housing market is now seen as a market for investment just like any other market.

Endless TV property programs now passed off as prime time viewing - people are market aware

Disparity in affordability creating a significant rental demand for the long term and a generation of renters with investors aware and willing to fulfil this

There are more reasons I'm sure

mike74 said:

So you're saying if interest rates rose 5% in the next 12 months and the money printing machines weren't fired up it wouldn't have any effect at all on property prices due to the reasons you've given?

I doubt UK interest rates will get past 3.75 per cent in the next ten years, maybe 15 years. Government bailed out banks and nationalised BTL debt, so created a rod for its own back... conflict of interests. A government is supposed to be autonomous ie acts for the best interests of entire economy not just one sector of it (there's a joke), but by effectively buying a massive percentage of UK BTL debt and so housing stock it has to keep rates low and cannot afford to let house prices fall on mass – at least for the housing stock it holds.

Economy is in unchartered economic position and may be due another recession within the next two years, most likely due to a combination of public mood and impending interest rate rises... we do like a good recession to moan about. But this will not necessarily see massive house price falls in certain areas. Even in the 2008 house price crash in certain parts of UK prices unaffected and just failed to grow at any rate.

Homeowners have not remortgaged and realised equity like they did in the 2000s and houses are selling not because they have been refurbished but because of a lack of supply and an upwards shift in the demand curve for houses (reasons given above). This means on average most home owners will have their mortgages locked into pre 2008 values and so house price falls will not affect them and interest rate rises will have a deminished effect as their mortgages reflect much lower than market values. Combine this with low interest rates and there are generations of people in their 30s and 40s who bought in 2006 and can have their mortgages paid off by 2020.

A massive regulation of new mortgage lending will lessen the effect of interest rate rises as need massive deposit on BTL and many home owner deals are only available with 20 per cent deposit not the 5 per cent deals offered in 2007. So the debt on the house is less so lessening the effect of interest rate rises.

nct001 said:

Jakey123 said:

Hoofy said:

Unless something changes significantly (law? war? 1 child policy?) you might get a falter but the supply is only going to get bigger. Sure, there are initiatives to encourage house building but do you really think the likes of Bovis are going to suddenly dump thousands of houses onto the market and then have to sell them for a lower price?

Even s t areas are going to start to cost a lot and this will continue to spread from the south east to other areas.

t areas are going to start to cost a lot and this will continue to spread from the south east to other areas.

Help to buy is helping everyone commit to huge debt, hence pushing prices up and allowing people to over commit. Even s

t areas are going to start to cost a lot and this will continue to spread from the south east to other areas.

t areas are going to start to cost a lot and this will continue to spread from the south east to other areas.

People simply don't earn enough for the rise to continue, but this helps prop them up.

Regarding the rise spreading, areas outside commuting distance from London eg 60miles+ north aren't rising and some places around Smaller Bedford villages are sitting static (if same price as they sold for 5yrs ago, that is a rather large loss in money due to inflation, interest payments and maintenance on the property) and have dropped. It seems very much London overflow related.

The whole prices are going up hype just scares people into a panic buy. And like sheep we all follow the crowd because someone we know made 20k in a year, but paid 5k stamp duty, 5k maintenance costs and 20k interest in that time..... People using dumb maths (I do realise some people have however made huge amounts in and nearer London than areas I am looking)

Regarding changes in law - the government going after BTL investors who already have very low yields, which are typically crap anyway in the south east. Pushing landlords to pull out that market, and raises in stamp duty to put people off the idea. Also stricter lending rules with a 4.5x limits further push home ownership away from the average earners...

I can see both sides of the coin, simply discussing.

It has been extrapolated to make a point for propaganda not fact... to someone with even the basics of stats / economics it shows how prices are under 20 per cent higher than they were 10 years ago.

Hardly unaffordable, the increase in 10 years is the same as the average annual income for an individual, wow... if anything for me it shows further growth possible.

Just because they've not gone up much in the last 10 years, doesn't mean they're not still high, or not in a bubble, or they thus have more room to rise.

Nothing makes house prices go up except affordability and market demand. Cheap credit drove affordability and thus demand heavily in the late 90s and up to the mid 00s, and after a dip in the mid 00s and a way to lend yet more money even more cheaply, the trend of more demand continued.

I don't really give two hoots what happens to prices. The higher they go the better off I will be. The lower they go the better off I will be. I just hope they crash and there is much financial pain and suffering who have over-leveraged or over-speculated. It'll ultimately be better for the majority which is no bad thing.

Mr Whippy said:

nct001 said:

Jakey123 said:

Hoofy said:

Unless something changes significantly (law? war? 1 child policy?) you might get a falter but the supply is only going to get bigger. Sure, there are initiatives to encourage house building but do you really think the likes of Bovis are going to suddenly dump thousands of houses onto the market and then have to sell them for a lower price?

Even s t areas are going to start to cost a lot and this will continue to spread from the south east to other areas.

t areas are going to start to cost a lot and this will continue to spread from the south east to other areas.

Help to buy is helping everyone commit to huge debt, hence pushing prices up and allowing people to over commit. Even s

t areas are going to start to cost a lot and this will continue to spread from the south east to other areas.

t areas are going to start to cost a lot and this will continue to spread from the south east to other areas.

People simply don't earn enough for the rise to continue, but this helps prop them up.

Regarding the rise spreading, areas outside commuting distance from London eg 60miles+ north aren't rising and some places around Smaller Bedford villages are sitting static (if same price as they sold for 5yrs ago, that is a rather large loss in money due to inflation, interest payments and maintenance on the property) and have dropped. It seems very much London overflow related.

The whole prices are going up hype just scares people into a panic buy. And like sheep we all follow the crowd because someone we know made 20k in a year, but paid 5k stamp duty, 5k maintenance costs and 20k interest in that time..... People using dumb maths (I do realise some people have however made huge amounts in and nearer London than areas I am looking)

Regarding changes in law - the government going after BTL investors who already have very low yields, which are typically crap anyway in the south east. Pushing landlords to pull out that market, and raises in stamp duty to put people off the idea. Also stricter lending rules with a 4.5x limits further push home ownership away from the average earners...

I can see both sides of the coin, simply discussing.

It has been extrapolated to make a point for propaganda not fact... to someone with even the basics of stats / economics it shows how prices are under 20 per cent higher than they were 10 years ago.

Hardly unaffordable, the increase in 10 years is the same as the average annual income for an individual, wow... if anything for me it shows further growth possible.

Just because they've not gone up much in the last 10 years, doesn't mean they're not still high, or not in a bubble, or they thus have more room to rise.

Nothing makes house prices go up except affordability and market demand. Cheap credit drove affordability and thus demand heavily in the late 90s and up to the mid 00s, and after a dip in the mid 00s and a way to lend yet more money even more cheaply, the trend of more demand continued.

I don't really give two hoots what happens to prices. The higher they go the better off I will be. The lower they go the better off I will be. I just hope they crash and there is much financial pain and suffering who have over-leveraged or over-speculated. It'll ultimately be better for the majority which is no bad thing.

Ability is clearly, cash funds or mortgage ability.

And willingness is derived from many reasons such as

Derived demand -

Influx of hard working aspirational migrants who pay rent and buy houses

Massive massive world wide investment into UK property market

Growth of hmo market place

Disillusioned pension investors

Internet has opened market awareness

Social barriers changing, it's not so stigmatised to be working class self employed for middle classes ie property development gained greater gravitas - btl is now aspersional middle class

Enlargement of universities and development of former colleges have created massive student rental market so its yield has driven up prices. You need to go to uni just do a traditional school leaver job of the 90s and that's not entirely due to the government.

The housing market is now seen as a market for investment just like any other market.

Endless TV property programs now passed off as prime time viewing - people are market aware

Disparity in affordability creating a significant rental demand for the long term and a generation of renters with investors aware and willing to fulfil this.

Also it is much harder to actually over leverage in the current climate, deposits on BTL are huge, I had to put down over £100k on a BTL worth £285k due to multiple changes in lending... in 2007 £35k would have been all I would have needed. And there was no other way around the deal, pay a big deposit or don't buy it. Also second charge lending is so much stricter than it used to be, in 2007 I could borrow with a high street bank 110 per cent of the equity in the BTL as an overdraft, nowadays would be lucky to get a third of equity ( I know that's not the correct was of calculating it but it proves the point).

A desire for financial pain and a market crash is never a good thing to ask for as it rarely just affects those that instigated it and will drag down the masses.

Cheap credit did not drive up prices - cheap credit applied to credit cards and loans and not mortgages - mortgage rates in 90s and 00s were not low, especially compared to today. For example a good fixed rate deal in the mid 2000s was 5.95 fixed for five years as everyone thought rates would rocket in 2008. It was more a case of changes in lending practise that allowed private individuals to become BTL landlords and market awareness of financial products.

There is still some good value housing stock out there but you have to get out there and seek it out an make your own decision not that of an estate agent or anyone with an interest in selling it to you.

Plenty of affordable places within 60 miles of London with increasing house prices - Bracknell, Reading, Newmarket, Aylesbury, High Wycombe, Maidenhead... Newmarket is tipped for massive growth with London overspill and massive new house building projects etc etc

Agreed places like Bedford and Peterborough where supply outstrips demand with massive housing projects and builds. But if you want a cheap four bed detached house and get into Kings Cross then Peterborough is your friend with prices starting from £250k for very sensible detached houses and four bed semis from £150k - just how cheap do you want it and still commute to London in 40 minutes?

nct001 said:

Mr Whippy said:

nct001 said:

Jakey123 said:

Hoofy said:

Unless something changes significantly (law? war? 1 child policy?) you might get a falter but the supply is only going to get bigger. Sure, there are initiatives to encourage house building but do you really think the likes of Bovis are going to suddenly dump thousands of houses onto the market and then have to sell them for a lower price?

Even s t areas are going to start to cost a lot and this will continue to spread from the south east to other areas.

t areas are going to start to cost a lot and this will continue to spread from the south east to other areas.

Help to buy is helping everyone commit to huge debt, hence pushing prices up and allowing people to over commit. Even s

t areas are going to start to cost a lot and this will continue to spread from the south east to other areas.

t areas are going to start to cost a lot and this will continue to spread from the south east to other areas.

People simply don't earn enough for the rise to continue, but this helps prop them up.

Regarding the rise spreading, areas outside commuting distance from London eg 60miles+ north aren't rising and some places around Smaller Bedford villages are sitting static (if same price as they sold for 5yrs ago, that is a rather large loss in money due to inflation, interest payments and maintenance on the property) and have dropped. It seems very much London overflow related.

The whole prices are going up hype just scares people into a panic buy. And like sheep we all follow the crowd because someone we know made 20k in a year, but paid 5k stamp duty, 5k maintenance costs and 20k interest in that time..... People using dumb maths (I do realise some people have however made huge amounts in and nearer London than areas I am looking)

Regarding changes in law - the government going after BTL investors who already have very low yields, which are typically crap anyway in the south east. Pushing landlords to pull out that market, and raises in stamp duty to put people off the idea. Also stricter lending rules with a 4.5x limits further push home ownership away from the average earners...

I can see both sides of the coin, simply discussing.

It has been extrapolated to make a point for propaganda not fact... to someone with even the basics of stats / economics it shows how prices are under 20 per cent higher than they were 10 years ago.

Hardly unaffordable, the increase in 10 years is the same as the average annual income for an individual, wow... if anything for me it shows further growth possible.

Just because they've not gone up much in the last 10 years, doesn't mean they're not still high, or not in a bubble, or they thus have more room to rise.

Nothing makes house prices go up except affordability and market demand. Cheap credit drove affordability and thus demand heavily in the late 90s and up to the mid 00s, and after a dip in the mid 00s and a way to lend yet more money even more cheaply, the trend of more demand continued.

I don't really give two hoots what happens to prices. The higher they go the better off I will be. The lower they go the better off I will be. I just hope they crash and there is much financial pain and suffering who have over-leveraged or over-speculated. It'll ultimately be better for the majority which is no bad thing.

Ability is clearly, cash funds or mortgage ability.

And willingness is derived from many reasons such as

Derived demand -

Influx of hard working aspirational migrants who pay rent and buy houses

Massive massive world wide investment into UK property market

Growth of hmo market place

Disillusioned pension investors

Internet has opened market awareness

Social barriers changing, it's not so stigmatised to be working class self employed for middle classes ie property development gained greater gravitas - btl is now aspersional middle class

Enlargement of universities and development of former colleges have created massive student rental market so its yield has driven up prices. You need to go to uni just do a traditional school leaver job of the 90s and that's not entirely due to the government.

The housing market is now seen as a market for investment just like any other market.

Endless TV property programs now passed off as prime time viewing - people are market aware

Disparity in affordability creating a significant rental demand for the long term and a generation of renters with investors aware and willing to fulfil this.

Also it is much harder to actually over leverage in the current climate, deposits on BTL are huge, I had to put down over £100k on a BTL worth £285k due to multiple changes in lending... in 2007 £35k would have been all I would have needed. And there was no other way around the deal, pay a big deposit or don't buy it. Also second charge lending is so much stricter than it used to be, in 2007 I could borrow with a high street bank 110 per cent of the equity in the BTL as an overdraft, nowadays would be lucky to get a third of equity ( I know that's not the correct was of calculating it but it proves the point).

A desire for financial pain and a market crash is never a good thing to ask for as it rarely just affects those that instigated it and will drag down the masses.

Cheap credit did not drive up prices - cheap credit applied to credit cards and loans and not mortgages - mortgage rates in 90s and 00s were not low, especially compared to today. For example a good fixed rate deal in the mid 2000s was 5.95 fixed for five years as everyone thought rates would rocket in 2008. It was more a case of changes in lending practise that allowed private individuals to become BTL landlords and market awareness of financial products.

There is still some good value housing stock out there but you have to get out there and seek it out an make your own decision not that of an estate agent or anyone with an interest in selling it to you.

Plenty of affordable places within 60 miles of London with increasing house prices - Bracknell, Reading, Newmarket, Aylesbury, High Wycombe, Maidenhead... Newmarket is tipped for massive growth with London overspill and massive new house building projects etc etc

Agreed places like Bedford and Peterborough where supply outstrips demand with massive housing projects and builds. But if you want a cheap four bed detached house and get into Kings Cross then Peterborough is your friend with prices starting from £250k for very sensible detached houses and four bed semis from £150k - just how cheap do you want it and still commute to London in 40 minutes?

You're right though that more and more people see homes as investments now. But that isn't a good indicator.

Unless we're at "New Paradigm!!!" and this time really is different.

I don't blame you for thinking it is, afterall this is what the herd mentality in most humans drives us to do.

Dave

Jakey123 said:

I'm not saying they will all drop, just cant see the rises will continue. Two beds in average areas of luton are up over £230k now, Which isn't the most affluent or desirable of areas.

St albans has gone crazy with people moving out of london and pouring the money into that market pushing it out of reach of most people.

St.Albans is always going to be a bit of outlier though. St albans has gone crazy with people moving out of london and pouring the money into that market pushing it out of reach of most people.

A mixture of a lot of greenbelt land, so supply is not increasing as there's nowhere to build.

45% of the population is AB social grade (Higher & intermediate managerial, administrative, professional occupations). Compared to 22% national average. So there's a lot more money flying about to buy property.

Country feel with the ability to be in London in 18 mins

London people like to move out here to breed.

The prices out here are getting silly though. A newbuild 2 bed flat on the Oaklands development (8 min walk from the station) that was built in 2010 and purchased for £250k just sold for £410k last month.

Jakey123 said:

Hoofy said:

Unless something changes significantly (law? war? 1 child policy?) you might get a falter but the supply is only going to get bigger. Sure, there are initiatives to encourage house building but do you really think the likes of Bovis are going to suddenly dump thousands of houses onto the market and then have to sell them for a lower price?

Even s t areas are going to start to cost a lot and this will continue to spread from the south east to other areas.

t areas are going to start to cost a lot and this will continue to spread from the south east to other areas.

Help to buy is helping everyone commit to huge debt, hence pushing prices up and allowing people to over commit. Even s

t areas are going to start to cost a lot and this will continue to spread from the south east to other areas.

t areas are going to start to cost a lot and this will continue to spread from the south east to other areas.

People simply don't earn enough for the rise to continue, but this helps prop them up.

Regarding the rise spreading, areas outside commuting distance from London eg 60miles+ north aren't rising and some places around Smaller Bedford villages are sitting static (if same price as they sold for 5yrs ago, that is a rather large loss in money due to inflation, interest payments and maintenance on the property) and have dropped. It seems very much London overflow related.

The whole prices are going up hype just scares people into a panic buy. And like sheep we all follow the crowd because someone we know made 20k in a year, but paid 5k stamp duty, 5k maintenance costs and 20k interest in that time..... People using dumb maths (I do realise some people have however made huge amounts in and nearer London than areas I am looking)

Regarding changes in law - the government going after BTL investors who already have very low yields, which are typically crap anyway in the south east. Pushing landlords to pull out that market, and raises in stamp duty to put people off the idea. Also stricter lending rules with a 4.5x limits further push home ownership away from the average earners...

I can see both sides of the coin, simply discussing.

Very much sums up my views as well.

I'm not really qualified to suggest what may happen to house prices. I do know that I wasted a few years of my life reading HPC forum. Convinced the world was about to collapse in on itself. I was convinced house prices simply could not go up anymore, yet they still did, higher and higher and higher. I did use that time to save a deposit, but in the end life was passing by. All my friends had houses and we wanted to settle down into something of my own.

Since buying I view home ownership on a completely different manner. I really enjoy, and I do mean enjoy owning my own home and paying off my mortgage. I feel like I'm aiming for something (no mortgage) and really enjoy the freedom of working on the house and making it work for my family. When I bought, I was still sure there was a a HPC coming. There was a slight blip in the market in 2012 and can't really remember why, but I bought then. Because I was nervous we did not over stretch, the mortgage was exactly half what the rent we were paying was, although the area not as pleasant. But I have HPC forum to thank at least for stopping me maxing out on lending.

I must say I'm positive about house prices, but as said I'm not qualified to suggest I'm right. But I've since gone into BTL as a long term investment which seems to be working well.

My advice regarding wether to buy or not is to buy cautiously. Buy something your comfortable owning for a long time, 10yrs plus. Buy a home. Get on with life. Pay down your mortgage. Ask yourself whats the worst that could happen if prices fall? Even if you did have to sell, the next house would also have fallen in price. Low prices work better when moving up the ladder. It's not a massive deal. What is a problem is still having a mortgage when your 70. I really want to retire early with no mortgage, if I'd waited another five years in hope for a HPC I would have been stuffed. I waited 3 and that really did set me back a few years.

I don't want to bad mouth anyone on the HPC forum. But the founder left and bought a house, some of the big names on there openly left and admitted they had been wrong about their views and advice. Yet some are still there from 5-10 years ago. Moaning about how houses just keep going up. One poster had been waiting to buy, viewing big discounted property in 2008 but kind of missed the boat and watched prices rise and rise above all time high in astonishment. I went back on last night and he's still doing the same. He's about my age (mid 30's) and I just felt a bit sorry for him. He believed everything that forum preaches. But there's always various views that are worth opening up to. But hey, he could yet be right!!

Since buying I view home ownership on a completely different manner. I really enjoy, and I do mean enjoy owning my own home and paying off my mortgage. I feel like I'm aiming for something (no mortgage) and really enjoy the freedom of working on the house and making it work for my family. When I bought, I was still sure there was a a HPC coming. There was a slight blip in the market in 2012 and can't really remember why, but I bought then. Because I was nervous we did not over stretch, the mortgage was exactly half what the rent we were paying was, although the area not as pleasant. But I have HPC forum to thank at least for stopping me maxing out on lending.

I must say I'm positive about house prices, but as said I'm not qualified to suggest I'm right. But I've since gone into BTL as a long term investment which seems to be working well.

My advice regarding wether to buy or not is to buy cautiously. Buy something your comfortable owning for a long time, 10yrs plus. Buy a home. Get on with life. Pay down your mortgage. Ask yourself whats the worst that could happen if prices fall? Even if you did have to sell, the next house would also have fallen in price. Low prices work better when moving up the ladder. It's not a massive deal. What is a problem is still having a mortgage when your 70. I really want to retire early with no mortgage, if I'd waited another five years in hope for a HPC I would have been stuffed. I waited 3 and that really did set me back a few years.

I don't want to bad mouth anyone on the HPC forum. But the founder left and bought a house, some of the big names on there openly left and admitted they had been wrong about their views and advice. Yet some are still there from 5-10 years ago. Moaning about how houses just keep going up. One poster had been waiting to buy, viewing big discounted property in 2008 but kind of missed the boat and watched prices rise and rise above all time high in astonishment. I went back on last night and he's still doing the same. He's about my age (mid 30's) and I just felt a bit sorry for him. He believed everything that forum preaches. But there's always various views that are worth opening up to. But hey, he could yet be right!!

Gassing Station | Finance | Top of Page | What's New | My Stuff