Your questions answered Vol 2 - IM Private Clients

Discussion

Steve H said:

Ftse is holding above 8000, Dow up 200, smci up 7% and Nvidia up almost 4%.

All good news so I assume some sort of crash is to be expected

Should be ok for a week or 2 now I think.All good news so I assume some sort of crash is to be expected

I caused the previous dip by topping up an ISA and pension to catch the end of the tax year.

It won't drop again until I decide to go in with this year's full ISA allowance in one lump.

I'll let you know when/if I do it so you can 'buy the dip'.

PorkInsider said:

I caused the previous dip by topping up an ISA and pension to catch the end of the tax year.

It won't drop again until I decide to go in with this year's full ISA allowance in one lump.

The effect that PHers have on the markets is indeed remarkable. I thought I was the only one trading hundreds of millions each time but it seems we all are!It won't drop again until I decide to go in with this year's full ISA allowance in one lump.

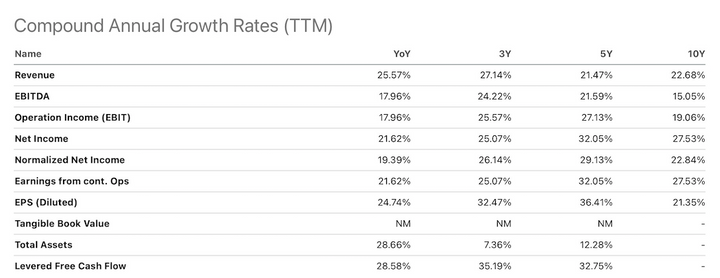

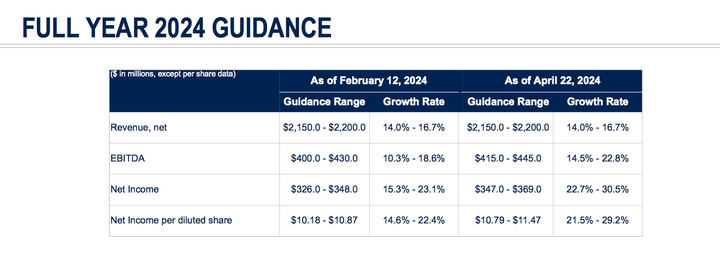

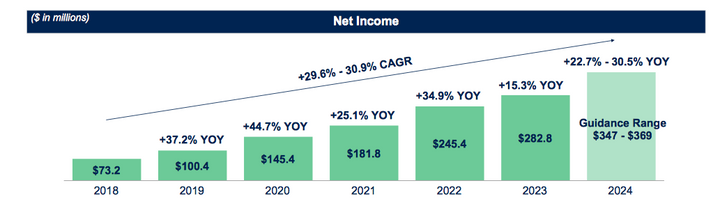

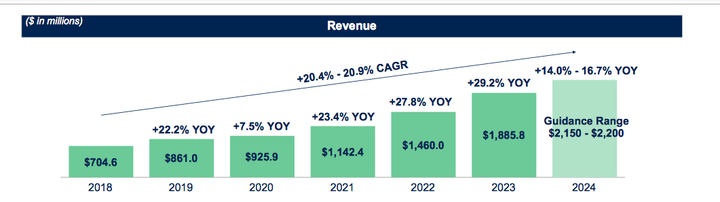

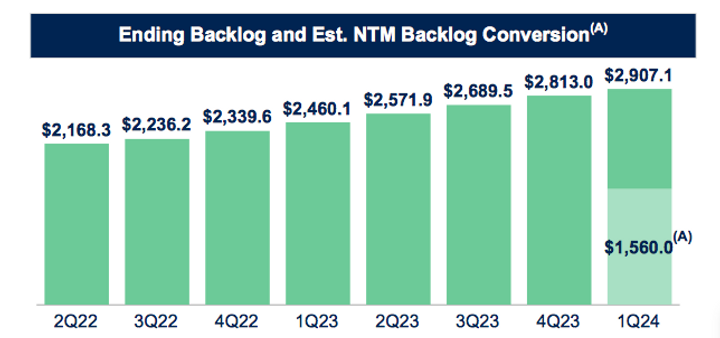

Medpace reported solid numbers on Monday with in line revenue and a welcome beat on EPS. Strangely it was weak after hours but was bid up $30 during the normal session. The big takeaway from Management is that biotech research funding is showing new strength after a post covid lull. The company now has a very large backlog(circa 1 year), strong margins and continued growth. The first table below says it all. These are compounded growth rates over various time periods. This is why we hold Medpace and it's a very good reminder that short term blips should be taken into context. That being Medpace is a very high quality business, run by outstanding management. The portfolio acquired MEDP in April 22 @ $165 and today the stock is trading at $407.

The company received a price target upgrade today of $450 which seems reasonable given their guide and consistency of execution over the past decade.

The company received a price target upgrade today of $450 which seems reasonable given their guide and consistency of execution over the past decade.

2Btoo said:

Well the ar5e dropped out of Meta today. Wobbles about AI apparently. I don't think that IM has Meta in any of it's portfolios but wonder why this can be the case when SMCI and Nvidia are both going great guns.

Meta’s forward guidance was slightly below what analysts expected and they also said they’d be increasing capex on AI infrastructure which hurt them but helped Nvidia, Super Micro and others.Meta suffered from the narrow minded investors who clearly don't like them accelerating AI spending-they are wrong, again. Zuckerburg has a long history of success. The company reported very good results and the guide had a typical wide range of 36-39B so taking a midpoint and suggesting its .00001% less than we thought is not what we'd call logical but that's the current climate. Miss by a penny and look out below!

Not only did Meta raise capex to the $40B range for 2024, Zuckerburg stated that whilst we don't provide 2025 guidance for 2025 this early it's safe to say we will spend even more money in 2025. The market realises where most of this cash is going. And just think about the numbers. This is one company-$40B on capital expenditure in 12 months. What will AWS(AMZN)/ORCL/GOOG/MSFT be spending? A colossal sum

On Alphabet, as well as very strong search ads, Youtube monetisation was a record and i'm not surprised. Google reported record earnings, a $70B buy back program and its first ever dividend. The stock is at an all time high if it opens where it closed in After Hours.

KLA Corporation proved yet again why it is the King of yield management equipment and services. Beating the guide and raising forward guidance again. A cash making machine that is in the perfect segment to capitalise on cutting edge technologies, being the sub 7nm nodes. They are the only company in the world who has a solution to manage yields at 2nm, a node which TSMC are moving to later this year. To put into context how important their products and services are, when a chip can cost $40K and 1 wafer can yield 80 chips that's a very valuable asset which warrants the spending to ensure it's not scrapped due to defects. Moreso when demand exceeds ability to supply so every extra yield counts!

MSFT had a great quarter, reporting records for Azure and further monetisation of Co-pilot and associated ChatGPT offerings. MSFT are planning a huge investment in new Data Centres around ChatGPT called project Stargate where $100B will be invested by 2028. We hear that the power needs are so great that the company is planning to install a Nuclear reactor to meet those needs!

Not only did Meta raise capex to the $40B range for 2024, Zuckerburg stated that whilst we don't provide 2025 guidance for 2025 this early it's safe to say we will spend even more money in 2025. The market realises where most of this cash is going. And just think about the numbers. This is one company-$40B on capital expenditure in 12 months. What will AWS(AMZN)/ORCL/GOOG/MSFT be spending? A colossal sum

On Alphabet, as well as very strong search ads, Youtube monetisation was a record and i'm not surprised. Google reported record earnings, a $70B buy back program and its first ever dividend. The stock is at an all time high if it opens where it closed in After Hours.

KLA Corporation proved yet again why it is the King of yield management equipment and services. Beating the guide and raising forward guidance again. A cash making machine that is in the perfect segment to capitalise on cutting edge technologies, being the sub 7nm nodes. They are the only company in the world who has a solution to manage yields at 2nm, a node which TSMC are moving to later this year. To put into context how important their products and services are, when a chip can cost $40K and 1 wafer can yield 80 chips that's a very valuable asset which warrants the spending to ensure it's not scrapped due to defects. Moreso when demand exceeds ability to supply so every extra yield counts!

MSFT had a great quarter, reporting records for Azure and further monetisation of Co-pilot and associated ChatGPT offerings. MSFT are planning a huge investment in new Data Centres around ChatGPT called project Stargate where $100B will be invested by 2028. We hear that the power needs are so great that the company is planning to install a Nuclear reactor to meet those needs!

Edited by AdamIM on Friday 26th April 08:08

dingg said:

Dpz, yum yum :-)

Yes, Domino's Pizza popped 5% on Earnings of $3.58, a beat of 18 cents and in-line sales due to same store sales being ahead of last year. Overall a 19.4% increase in operating income as it laps a difficult 23 comp. The company said it is benefiting from its tie up with UberGassing Station | Finance | Top of Page | What's New | My Stuff