Crypto Currency Thread (Vol.2)

Discussion

ERIKM400 said:

So a graph showing that if you have a time frame of four years or more and an IQ that exceeds your shoe size it's impossible to lose money by investing in BTC (the percentage returns are triple digits!) is pointless just because you say so and that proves BTC is a bad store of value?

Euhmm...

Well yeah, now you've convinced me that I'm wrong.

Please stop quoting me out of context, that's just proving the weakness of your arguments.

I did NOT say that volatility is a problem for BTC as a store of value. It is CURRENTLY a problem for it's use as a payment method but that will be resolved in the future.

.

I wouldn't go talking about other peoples IQ when you are talking your own book. Its NOT a good store of value as the intra day vol is FAR too high - any shorter dated price chart shows you can be absolutely spanked. You said this:Euhmm...

Well yeah, now you've convinced me that I'm wrong.

Please stop quoting me out of context, that's just proving the weakness of your arguments.

I did NOT say that volatility is a problem for BTC as a store of value. It is CURRENTLY a problem for it's use as a payment method but that will be resolved in the future.

.

ERIKM400 said:

BTC is not a good store of value because of volatility?

That just depends on your timeframe.

Take a look at this chart: try to find the 9 red days were people are not in profit

That store of value - only works if you are long term "hodl'er". The long term growth trajectory masks the peaks and troughs. You could actually loose many hundreds of times over - IF the entry entry / exit points are wrong. It simply is not a granular enough chart (I showed the 3 day BTC chart - the swings are too high for a means of exchange). If you want your money out in a trough to pay a bill, you better hope you were in years ago. That volatility means you can't build a trust system and its decentralised nature means NO one is charged with maintaining price stability. The trust and price stability are linked together, its exactly that which removes excessive price volatility - BTC will never achieve it, unless everyone adopts it (which they won't because its parochial and anarchic).That just depends on your timeframe.

Take a look at this chart: try to find the 9 red days were people are not in profit

It may well be an awesome payment system, its speed, consensus etc all great things that probably exceed SWIFT etc - but only within its only eco system. And that's fine. For the early adapters its great, or those not worried about the erosion / inflation of sentiment value. But it won't work for the masses as speculation erodes labour value.

FIAT money has its issues, but BTC isn't a mass replacement option. Its great people have made a mint on it, but pretending its going to replace $, £UR, £ etc is a fantasy.

Condi said:

Where is that graph from? And what, exactly, does it show? Inflation simply isn't measured by the M2 money supply, inflation is defined as the increase in the cost of goods and services, so maybe you can explain, simply, what relevance that has? Especially as it includes bank deposits, which therefore includes fractional reserves and so as the loans get paid back the money supply decreases, as well as increasing when more loans are made. Measuring money supply does not equal inflation.

The Federal Reserve Bank of St Louis (part of the US Central Bank and a centre for economic research) disagrees with you. The median personal income (adjusted for inflation), has risen from $26,000 in 1974 to $40,500 2022. (https://fred.stlouisfed.org/series/MEPAINUSA672N) while household income has gone from $56k to $75k in just under 40 years. (https://fred.stlouisfed.org/series/MEHOINUSA672N/)

This blog post explains and shows that US earnings are between 3% and 7% higher in real terms than in 2009, depending on what data set you use. Manufacturing wages at the lower end, overall wages at the higher end. (https://fredblog.stlouisfed.org/2018/02/are-wages-increasing-or-decreasing/)

If people are quantitively richer, why does it matter how much $1 buys today vs 100 years ago? A Model T Ford was $700 when it was new. Today a new car is, say, $25,000. This isn't an issue as nobody is buying a car today with dollars from 1910! What matters far more is the value of one currency relative to another, and in this respect the US$ has done very well.

Maybe you could explain why you see it as a problem? You are likely richer than your parents, and almost certainly have a better quality of life and standard of living than your Grandparents. This is itself should show inflation and the decrease in purchasing power of the £ doesn't really matter, if your logic was correct then you'd be worse of than your parents and significantly worse off than your Grandparents.

So what you are saying is that an asset that is not going up in value every second of every minute of every hour of every day of every week of every month of every year is a worthless store of value?The Federal Reserve Bank of St Louis (part of the US Central Bank and a centre for economic research) disagrees with you. The median personal income (adjusted for inflation), has risen from $26,000 in 1974 to $40,500 2022. (https://fred.stlouisfed.org/series/MEPAINUSA672N) while household income has gone from $56k to $75k in just under 40 years. (https://fred.stlouisfed.org/series/MEHOINUSA672N/)

This blog post explains and shows that US earnings are between 3% and 7% higher in real terms than in 2009, depending on what data set you use. Manufacturing wages at the lower end, overall wages at the higher end. (https://fredblog.stlouisfed.org/2018/02/are-wages-increasing-or-decreasing/)

If people are quantitively richer, why does it matter how much $1 buys today vs 100 years ago? A Model T Ford was $700 when it was new. Today a new car is, say, $25,000. This isn't an issue as nobody is buying a car today with dollars from 1910! What matters far more is the value of one currency relative to another, and in this respect the US$ has done very well.

Maybe you could explain why you see it as a problem? You are likely richer than your parents, and almost certainly have a better quality of life and standard of living than your Grandparents. This is itself should show inflation and the decrease in purchasing power of the £ doesn't really matter, if your logic was correct then you'd be worse of than your parents and significantly worse off than your Grandparents.

Edited by Condi on Sunday 14th April 21:06

If so, then please advise me what this magical asset with unabaiting increase in value is that you are investing in so I can join you in a quest for wealth, oh wise one?

People are not getting richer, they really are not.

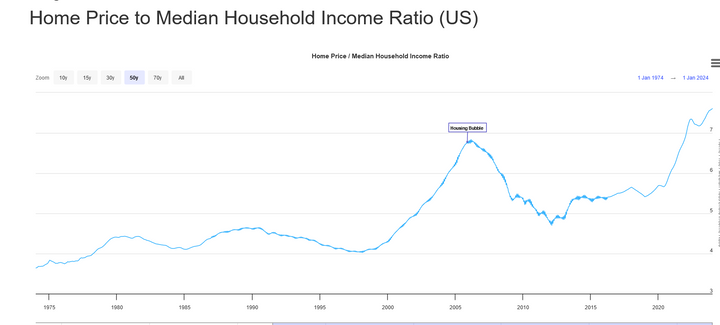

Asset prices are rising faster than income.

So the ability of ordinary people to acquire "wealth" is decreasing.

See house prices versus average income for an example:

And don't get me started on fractional reserve banking.

Please don't

ERIKM400 said:

So what you are saying is that an asset that is not going up in value every second of every minute of every hour of every day of every week of every month of every year is a worthless store of value?

If so, then please advise me what this magical asset with unabaiting increase in value is that you are investing in so I can join you in a quest for wealth, oh wise one?

You are being deliberately obtuse and it does your argument no favours. If so, then please advise me what this magical asset with unabaiting increase in value is that you are investing in so I can join you in a quest for wealth, oh wise one?

A good store of value means that it's price/value is stable, ideally keeping up with overall inflation. Bitcoin is incredibly volatile, and there is a big difference between something which is going up every second of every day and something which crashes by 50% in 6 months and then takes 4 years to return to it's previous price! (Which, of course, by the time you factor in inflation is actually worth less than it was at the same price 4 years ago). A 1% daily change in £/$/€ value is absolutely massive. Bitcoin has lost 10% in a week.

Think of it like this, you get paid £2k in Bitcoin from work, one week later it's only worth £1800. You need to pay rent, buy food, buy petrol, all next week. Try telling your landlord you'll pay him in 4 years time when your Btc recovers it's value.

ERIKM400 said:

People are not getting richer, they really are not.

Asset prices are rising faster than income.

So the ability of ordinary people to acquire "wealth" is decreasing.

See house prices versus average income for an example:

It's far more nuanced than that. House prices (and yes, asset prices in general), have outpaced pay increases, but that is as much a factor of supply and demand as anything to do with inflation. If your population grows by 2m people and you build enough houses for 1m more people then clearly there are more people fighting for the (proportionally) fewer number of houses and the price goes up. If we built double the number of houses we have then house prices would be more in line with overall inflation. Asset prices are rising faster than income.

So the ability of ordinary people to acquire "wealth" is decreasing.

See house prices versus average income for an example:

I agree the state of the UK housing market is a complete mess and it's very hard for anyone to buy a house these days - it takes up more take home pay than it used to and people are taking on more debt to pay off over their lifetimes. However, we are not talking about the ability of people to acquire wealth, we are talking about the ability of people to live day to day. The last few years have seen people get poorer, but that is a break in a longer term trend of them getting richer. What affects the UK more than other countries is the inequality and a single measure does hide a lot of variability.

I fail to see how Bitcoin is the answer to any of this, mind. Bitcoin isn't going to make the average person richer, if anything it is held in the hands of fewer people and is thus far more concentrated than any wealth or money we have at the moment. Switching to Bitcoin isn't going to change asset prices or wages.

ERIKM400 said:

And don't get me started on fractional reserve banking.

Please don't

Please do, I would love to hear it. Please don't

dimots said:

Exchanges are for exchanging. They don’t occupy the same space at all, unless you don’t understand Bitcoin.

The difference with Bitcoin is that it is a way to hold wealth yourself. You hold it, you can take it anywhere. Your own personal Fort Knox.

Dont hold it on an exchange. Keep it on a cold wallet. Most amazing store of value ever invented. Can’t be inflated or confiscated, no chance of being hacked, no way of blocking or closing your account, no third party organisation to f k things up…it’s all on you.

k things up…it’s all on you.

Some people don’t get it or can’t handle it…but that will change.

Tell that to the Canadian truckers during all the protests... they found out the hard way about what is and isn't Sound money.The difference with Bitcoin is that it is a way to hold wealth yourself. You hold it, you can take it anywhere. Your own personal Fort Knox.

Dont hold it on an exchange. Keep it on a cold wallet. Most amazing store of value ever invented. Can’t be inflated or confiscated, no chance of being hacked, no way of blocking or closing your account, no third party organisation to f

k things up…it’s all on you.

k things up…it’s all on you.Some people don’t get it or can’t handle it…but that will change.

Condi said:

Please do, I would love to hear it.

Yep, seconded. He can't differentiate an asset and money, nor why having both exhibit the same behaviour is bad. It's a nonsense argument he's cooked up. Just because it goes up in value doesn't mean it's a decent means of exchange - (heres a hint the value of investments go UP and DOWN). I've been long SPX for years, but I'm not demanding my corner shop takes 500 stocks for a loaf of bread.Why do these BTC maximilists conflate unrelated issues to form an argument, worse call others an idiot when they question it (conviently ignoring evidence like 3 day price vol from BBG....

ERIKM400 said:

People are not getting richer, they really are not.

Asset prices are rising faster than income.

So the ability of ordinary people to acquire "wealth" is decreasing.

It is interesting because that is the main line I usually hear people that are caught into crypto myth. (ignoring the first two sentences above because they basically mean nothing)Asset prices are rising faster than income.

So the ability of ordinary people to acquire "wealth" is decreasing.

I mentioned a few pages before, so there you go, I would like to see any of you crypto millionaires here to buy an actual property in U.K.

I'm yet to meet anyone who has done this. (Either cash or with leverage). Your conveyancer will not touch you, even if its full*cash purchase thats further risk for AML process.

ooid said:

It is interesting because that is the main line I usually hear people that are caught into crypto myth. (ignoring the first two sentences above because they basically mean nothing)

I mentioned a few pages before, so there you go, I would like to see any of you crypto millionaires here to buy an actual property in U.K.

I'm yet to meet anyone who has done this. (Either cash or with leverage). Your conveyancer will not touch you, even if its full*cash purchase thats further risk for AML process.

I have bought two properties with money from selling bitcoin. Total cost both properties low seven figures GBP. Refurb and development of another million or so partly funded through sales of bitcoin. I haven't bought property directly with bitcoin but one of the sellers was up for it and I can't see why it would cause any kind of problem. Do you have any experience in this area or are you just chatting breeze?I mentioned a few pages before, so there you go, I would like to see any of you crypto millionaires here to buy an actual property in U.K.

I'm yet to meet anyone who has done this. (Either cash or with leverage). Your conveyancer will not touch you, even if its full*cash purchase thats further risk for AML process.

OK, let's take a step back because I think we are not talking about the same things.

I do understand the differences between assets and money, thank you very much.

And I have told you that I'm not a BTC nor crypto maximalist and I do hold other assets.

So: what is a good store of value?

For me it's something that's going to be more valuable in the future than it is now and therefore worth investing in.

Time frame preference may be different for each of us but personally I'm happy with a four year or longer time frame for my investments.

From this perspective it's hard or impossible to find another asset that is outperforming BTC. Please prove me wrong and show me something that has appreciated more over the past decade than BTC.

For reference: BTC price in 2014 was about 1000$ at it's then ATH.

I have agreed with you on the fact that price volatility currently is a problem for BTC as a payment method or money if you like to consider it that way.

But try to look at it from this perspective: you say I get paid 2000$ in BTC which drops 20% in value and is now only worth 1600$ so I have a problem paying my rent or whatever.

But I've got the BTC I bought in 2018 at 6000$ which by now has appreciated 1000% to 60k $. So I will just use that, will still be massively in profit and keep the 2000$ of BTC that I just got paid for the next 4 years untill this appreciates by another 1000%. Rince and repeat.

As I have said over and over again: it's all about the time frame you're using.

I don't care about short time price volatility, I welcome 20% price drops because they give me an opportunity to invest more. The long term trend is up by 40% a year, that's what matters for me.

I do not agree that property prices are rising because of increasing demand. Population growth in the Western world has been slowing down in almost all countries and declining in a lot of them. So increased demand makes no sense, or at least not compared to the rate at which property prices are going up.

The real reason is decling purchasing power of fiat money.

I will bite on the fractional reserve banking subject: most commercial banks are leveraged 10 x or more. This means that about 10% of the money on the balance sheats is actually there. The rest is locked up in loans that someday will be paid back, investments that one day will return profits, etc...

It is not available at this moment.

So when 10% of clients want to withdraw their money NOW, the whole thing comes crashing down.

Try walking in to your bank and asking them for 10k £ in cash from your account.

"Sorry sir, can't do that. Regulations and law, you know. And please explain why you want to withdraw this sum of money"

And no, this has nothing to do with money laundering, tax evasion or criminal activities. Banks simply do not have the money they pretend to have.

This is exactly what happened with the banking crisis in 2008 (which ironically gave rise to the birth of BTC). People lost trust in the banking system, tried to retrieve their funds and the banking system went crashing down.

After which central banks decided to print a couple of trillion of $, £, € out of thin air to bail out the commercial banks and prevent their collaps. But hey, that's real money, not magic internet money without intrinsic value...

I'm not thick (university degree doctor, thanks for asking) nor trying to be obtuse. Just looking for some discussion on the pro and contra of crypto. There used to be some very interesting and enriching discussions on this forum from which I have learned a lot and made some serious money. Would like for this to return because currently it just seems to be religiously opposed points of view.

Apologies if this seems to apply to myself.

I do understand the differences between assets and money, thank you very much.

And I have told you that I'm not a BTC nor crypto maximalist and I do hold other assets.

So: what is a good store of value?

For me it's something that's going to be more valuable in the future than it is now and therefore worth investing in.

Time frame preference may be different for each of us but personally I'm happy with a four year or longer time frame for my investments.

From this perspective it's hard or impossible to find another asset that is outperforming BTC. Please prove me wrong and show me something that has appreciated more over the past decade than BTC.

For reference: BTC price in 2014 was about 1000$ at it's then ATH.

I have agreed with you on the fact that price volatility currently is a problem for BTC as a payment method or money if you like to consider it that way.

But try to look at it from this perspective: you say I get paid 2000$ in BTC which drops 20% in value and is now only worth 1600$ so I have a problem paying my rent or whatever.

But I've got the BTC I bought in 2018 at 6000$ which by now has appreciated 1000% to 60k $. So I will just use that, will still be massively in profit and keep the 2000$ of BTC that I just got paid for the next 4 years untill this appreciates by another 1000%. Rince and repeat.

As I have said over and over again: it's all about the time frame you're using.

I don't care about short time price volatility, I welcome 20% price drops because they give me an opportunity to invest more. The long term trend is up by 40% a year, that's what matters for me.

I do not agree that property prices are rising because of increasing demand. Population growth in the Western world has been slowing down in almost all countries and declining in a lot of them. So increased demand makes no sense, or at least not compared to the rate at which property prices are going up.

The real reason is decling purchasing power of fiat money.

I will bite on the fractional reserve banking subject: most commercial banks are leveraged 10 x or more. This means that about 10% of the money on the balance sheats is actually there. The rest is locked up in loans that someday will be paid back, investments that one day will return profits, etc...

It is not available at this moment.

So when 10% of clients want to withdraw their money NOW, the whole thing comes crashing down.

Try walking in to your bank and asking them for 10k £ in cash from your account.

"Sorry sir, can't do that. Regulations and law, you know. And please explain why you want to withdraw this sum of money"

And no, this has nothing to do with money laundering, tax evasion or criminal activities. Banks simply do not have the money they pretend to have.

This is exactly what happened with the banking crisis in 2008 (which ironically gave rise to the birth of BTC). People lost trust in the banking system, tried to retrieve their funds and the banking system went crashing down.

After which central banks decided to print a couple of trillion of $, £, € out of thin air to bail out the commercial banks and prevent their collaps. But hey, that's real money, not magic internet money without intrinsic value...

I'm not thick (university degree doctor, thanks for asking) nor trying to be obtuse. Just looking for some discussion on the pro and contra of crypto. There used to be some very interesting and enriching discussions on this forum from which I have learned a lot and made some serious money. Would like for this to return because currently it just seems to be religiously opposed points of view.

Apologies if this seems to apply to myself.

dimots said:

I have bought two properties with money from selling bitcoin. Total cost both properties low seven figures GBP. Refurb and development of another million or so partly funded through sales of bitcoin. I haven't bought property directly with bitcoin but one of the sellers was up for it and I can't see why it would cause any kind of problem. Do you have any experience in this area or are you just chatting breeze?

So your solicitors completed AML checks with your 7 figures directly coming from crypto investments with non-issue at all?I genuinely would like to know who was your conveyancing/ solicitors and what sort of insurance they got.

ERIKM400 said:

I have agreed with you on the fact that price volatility currently is a problem for BTC as a payment method or money if you like to consider it that way.

But try to look at it from this perspective: you say I get paid 2000$ in BTC which drops 20% in value and is now only worth 1600$ so I have a problem paying my rent or whatever.

But I've got the BTC I bought in 2018 at 6000$ which by now has appreciated 1000% to 60k $. So I will just use that, will still be massively in profit and keep the 2000$ of BTC that I just got paid for the next 4 years untill this appreciates by another 1000%. Rince and repeat.

As I have said over and over again: it's all about the time frame you're using.

I don't care about short time price volatility, I welcome 20% price drops because they give me an opportunity to invest more. The long term trend is up by 40% a year, that's what matters for me.

What did I just read? But try to look at it from this perspective: you say I get paid 2000$ in BTC which drops 20% in value and is now only worth 1600$ so I have a problem paying my rent or whatever.

But I've got the BTC I bought in 2018 at 6000$ which by now has appreciated 1000% to 60k $. So I will just use that, will still be massively in profit and keep the 2000$ of BTC that I just got paid for the next 4 years untill this appreciates by another 1000%. Rince and repeat.

As I have said over and over again: it's all about the time frame you're using.

I don't care about short time price volatility, I welcome 20% price drops because they give me an opportunity to invest more. The long term trend is up by 40% a year, that's what matters for me.

If you are really a doctor, please and please do get some sleep!

ERIKM400 said:

1. I do understand the differences between assets and money, thank you very much.

2. So what's a good store of value...

3. I'm not thick (university degree doctor, thanks for asking) nor trying to be obtuse.

1. That's not apparent. A good store of value is something that is immediately cash convertible, with a deep liquidity pool and ultra low price volatility. Anything else isn't. It doesn't matter how you bend a time frame, it only matters at point of conversion to cash or other assets. You might have a great asset or investment, but its not a money equivalent. Its not a semantics argument its a basic barrier to BTC adoption its simply too volatile to gain trust and its decentralised nature means no central authority. It only has trust within its own sphere, not the wider economy. If you strip out the punters on get rich quick schemes, there are a tiny few that understand it. It's far too parochial, and people equate money as exchange for Labour, with BTC its to the power of market sentiment. It might go up another 200, 500 or 1000%; great investment - still rubbish form of money. It might have many benefits over FIAT - but its anarchic nature is enough to prevent its adoption as a true form of money. And that's before we start on OFAC. 2. So what's a good store of value...

3. I'm not thick (university degree doctor, thanks for asking) nor trying to be obtuse.

One if the most basic rules with our financial and regulatory sphere is suitability. BTC isn't suitable an investment let alone source of money for most. Fill your boots if you know what you are doing, but it fails the suitability test.

2. What's a good store if value, not much. Inflation is the problem. Tether if you offloading BTC for a big purchase (like a house) would be my suggestion. Almost same theory your apply to retirement saving. The closer you are to using / spending, the lower asset vol you want. Are you really going to look at 12 year BTC charts at retirement IF you have low diversification?

3. You were commenting on other people's IQ, not the other way around.

Whilst BTC has many benefits and the decentralised ledger is a great one, I suspect its days are numbered when CBDCs roll out and we see greater use of asset backed tokens.

ooid said:

So your solicitors completed AML checks with your 7 figures directly coming from crypto investments with non-issue at all?

I genuinely would like to know who was your conveyancing/ solicitors and what sort of insurance they got.

I have been taking payment in bitcoin, paying in bitcoin, using bitcoin, accounting for my bitcoin earnings and paying tax to HMRC on the proceeds for over ten years. No issues.I genuinely would like to know who was your conveyancing/ solicitors and what sort of insurance they got.

OoopsVoss said:

Whilst BTC has many benefits and the decentralised ledger is a great one, I suspect its days are numbered when CBDCs roll out and we see greater use of asset backed tokens.

CBDCs are never going to happen. They wouldn't be able to touch bitcoin for security, regulation or immutability. Unless they used an open proof of work protocol...which they couldn't. And even if they could, which they can't, no country on the planet could afford to build the proof of work engine bitcoin has...it is secured by the most powerful computing network on the planet...maybe you can guesstimate how much that would cost to replicate?dimots said:

CBDCs are never going to happen. They wouldn't be able to touch bitcoin for security, regulation or immutability. Unless they used an open proof of work protocol...which they couldn't. And even if they could, which they can't, no country on the planet could afford to build the proof of work engine bitcoin has...it is secured by the most powerful computing network on the planet...maybe you can guesstimate how much that would cost to replicate?

And a CBDC is backed by the financial might of the government. Which for 99.999% of people is perfectly enough.

dimots said:

OoopsVoss said:

Whilst BTC has many benefits and the decentralised ledger is a great one, I suspect its days are numbered when CBDCs roll out and we see greater use of asset backed tokens.

CBDCs are never going to happen. They wouldn't be able to touch bitcoin for security, regulation or immutability. Unless they used an open proof of work protocol...which they couldn't. And even if they could, which they can't, no country on the planet could afford to build the proof of work engine bitcoin has...it is secured by the most powerful computing network on the planet...maybe you can guesstimate how much that would cost to replicate? t Tiffany Cufflinks in that regard, but why when I liquidated it to buy my house the solicitor just told me I'm 45k short as BTC took an intra-day crap?

t Tiffany Cufflinks in that regard, but why when I liquidated it to buy my house the solicitor just told me I'm 45k short as BTC took an intra-day crap?They are not even trying to compete - and once they solve the transmission losses etc, BTC has a serious problem as it can't be trusted. If you want to evade sanctions, load up on BTC.

robscot said:

https://www.lindsays.co.uk/

Quid if you work out who I am from my solicitors.

Only one dumbo on this thread

Quid if you work out who I am from my solicitors.

Only one dumbo on this thread

robscot said:

https://www.lindsays.co.uk/

Quid if you work out who I am from my solicitors.

Only one dumbo on this thread

Actually I'll change this. I'll DM you.Quid if you work out who I am from my solicitors.

Only one dumbo on this thread

EDIT: Not DMing you I believe it reveals my email. But yes I think I know who you are now.

Gassing Station | Finance | Top of Page | What's New | My Stuff