Where does all the money go?

Discussion

Scootersp said:

and +95% of that is down to housing costs? Because wealth is held by a small proportion of people that are in/around London (or other major cities), to the point that high housing costs elsewhere in (nice parts of) the country (Cornwall?) are also high because of this same subsection of society and not because the people in that area have a high proportion of big earners nudging prices up.

For decades now if you had spare money the vast majority has gone into "bricks and mortar", second homes, buy to lets, just moving up the ladder, it's been the go to for, ex footy players to modest late inheritance recipients.

Multiple factors around which we can all argue endlessly but the things you mention are certainly on the list. However, the two core drivers were lending deregulation by government and women being allowed to work by society. House price values are very much defined by dual incomes today and not single incomes. The third largest driver has been excessive pension spending by an abnormally large group of pensioners. That all coincided with the technology revolution which gave younger workers the largest opportunity ever to earn high incomes as well as to stay out in the regions to earn that pay. And the final significant driver was probably the rise of the developing nations from wealth held by just a few families to wealth being held by hundreds of millions and the need to protect it from third world kleptocrats which poured excess investment capital in and pushed local capital further out. For decades now if you had spare money the vast majority has gone into "bricks and mortar", second homes, buy to lets, just moving up the ladder, it's been the go to for, ex footy players to modest late inheritance recipients.

Around those core drivers there are lots of things we can pick to argue over or just download the ones from our owners and shout them across the Wetherspoons as programmed.

The OP does raise an interesting point as to pondering how so many people are appearing to be spending so much money. The simple truth is that many GenX and Millenials with professional salaries are just spending it as quickly as they can to keep up with the joneses.

I notice that Kate Garroway is appearing this week to be explaining that she is now in debt after 3 years of having to deal with the terrible situation of caring for her other half. But this is a person who has earned an enormous salary since the turn of the century and also in an industry that can be quite high risk when being paid to open and close one's mouth all day and was a single income household yet entered their 50s with a huge mortgage and low savings. Now one can easily be repulsed by the endless whinging of an adult capable of still earning huge sums and who can easily just pay off their mortgage and reduce outgoings by simply moving home but who thinks it's ok to bang on endlessly as if it's all other people's fault and that they're really in debt when obviously they aren't but it's also an example of how an awful lot of GenXers who have been earning high levels of income for years have thrown it all away on an illusionary level of lifestyle.

Im seeing a real split appearing among my peers who have all had the same sort of journey and opportunity and similar struggles but the split is quite pronounced between those just carrying on as they always have and those starting to get quite militant about how bad it is that their lifestyle is being attacked by other people who are charging them more for everything. This latter group being the folk who have been spending an awful lot of money living the lifestyle two to three income rungs up and who seemingly now need their parents to die sooner than they had originally already been planning!!!

DonkeyApple said:

…but it's also an example of how an awful lot of GenXers who have been earning high levels of income for years have thrown it all away on an illusionary level of lifestyle.

Let’s be fair though.Many have profited from this in economic and GDP growth.

Look at all the people on here who fit flashy £100,000 kitchens for example.

Necessary? Nope.

Viable if you can truly afford it? Fine.

But how many truly can?

The economy has boomed in part due to this consumerist excess, which has helped allow property prices and stocks and assets to boom too.

Which has ultimately benefited a whole range of society, including pensioners.

So let’s not pretend individuals can be financial islands.

Let’s not pretend some people on here suggesting these people are idiots, have been the very source of business for the people calling them idiots.

DonkeyApple said:

Im seeing a real split appearing among my peers who have all had the same sort of journey and opportunity and similar struggles but the split is quite pronounced between those just carrying on as they always have and those starting to get quite militant about how bad it is that their lifestyle is being attacked by other people who are charging them more for everything. This latter group being the folk who have been spending an awful lot of money living the lifestyle two to three income rungs up and who seemingly now need their parents to die sooner than they had originally already been planning!!!

Your peers are almost certainly not on the same level as mine, but isn't this just a case for both of us that we see varying levels of "cutting your cloth" defined as undertake only what you have the money or ability to do and no more.It's an old saying pre the financial deregulation you mention, it's also a saying that in recent terms won't actually have helped you, frugal hasn't paid? The saying doesn't even mention borrowing, but in the modern sense it would I imagine to equate to taking on reasonable debt?

The student loan situation is almost against this ethos, but the non repayment below a certain level perhaps brings it back in to be acceptable.

I feel those living the rungs above would in the past have received more frequent issues/lessons to temper them a little but the recent financial history has done little to put the brakes on anyone, and economic outcomes have almost encouraged high risk. They will always feel the decline harder than those happy to chug along in their lane (one mans content can be another's rich or poor depending on where they start from) it can be harder to adapt to a change in cashflow/wealth than simply being in a lower category all the time?

My peers kids do I think face a genuine tougher time than me and my peers, from the reasons we've both said, a big one being your two people working point. "When I was a lad" mums almost exclusively didn't have full time jobs and worked just for some extra pocket money, not to fundamentally support the buying and running of the family home. That this is the status quo of nearly all the working population going forward is an indication that we are poorer in many ways?

Scootersp said:

May be, although I see it taking a long time to be given up on in a big way, the "can't lose in the long run" mentality is strong, because in living memory it's been right and there is a generation at least of this being handed down, and what your parents think is a powerful narrative and not one people shift away from easily?

This guy made sense in respect of the asset inflation disparity (and that crucially it's not been measured/tracked/discussed) and explaining the difficulties of fixing the high house prices vs low house affordability equation.

https://www.youtube.com/watch?v=PGZ4ADmQbZE

Ideally we need to make property a less attractive store of wealth. Recent figures are showing that UK housing is over-priced and poor value overall (tell us something we didn't know!). This guy made sense in respect of the asset inflation disparity (and that crucially it's not been measured/tracked/discussed) and explaining the difficulties of fixing the high house prices vs low house affordability equation.

https://www.youtube.com/watch?v=PGZ4ADmQbZE

What we need is some stagnation in property values to deflate the underlying value of them (and mortgages) away.

Three ways to do that that I can see - remove some of the the transaction costs associated with buying property (i.e. SDLT) which just mean people need the value to go up in order just to stand still, apply an element of CGT to property sales (i.e. shift the tax burden from the buyer to the seller) , and lastly, build more houses.

We also need to remove the help to buy scheme that just artificially inflated new build prices (largely to the benefit of developers).

Mr Whippy said:

If you sent kids to work to boost incomes then everything would just go up in price to suit.

Take away the working mum/dad/partner again and prices would fall.

Supply side needs fixing.

Yes but equally we have moved from most employees being productive to a whole wedge doing stuff that adds nothing in terms of productivity. Take away the working mum/dad/partner again and prices would fall.

Supply side needs fixing.

dave123456 said:

Mr Whippy said:

If you sent kids to work to boost incomes then everything would just go up in price to suit.

Take away the working mum/dad/partner again and prices would fall.

Supply side needs fixing.

Yes but equally we have moved from most employees being productive to a whole wedge doing stuff that adds nothing in terms of productivity.Take away the working mum/dad/partner again and prices would fall.

Supply side needs fixing.

It’s all an illusory setup though as over the long term inflation, once realised, will offset all the “gains”

Wombat3 said:

Ideally we need to make property a less attractive store of wealth. Recent figures are showing that UK housing is over-priced and poor value overall (tell us something we didn't know!).

We also need to remove the help to buy scheme that just artificially inflated new build prices (largely to the benefit of developers).

This is the issue, I'd add shared ownership to the list too, but that these 'solutions' came about to tackle the affordability issues suggests there is no interest in making your first sentence a reality? the return of low rates and 40-50 year terms are probably just, if not more, likely?We also need to remove the help to buy scheme that just artificially inflated new build prices (largely to the benefit of developers).

Scootersp said:

Wombat3 said:

Ideally we need to make property a less attractive store of wealth. Recent figures are showing that UK housing is over-priced and poor value overall (tell us something we didn't know!).

We also need to remove the help to buy scheme that just artificially inflated new build prices (largely to the benefit of developers).

This is the issue, I'd add shared ownership to the list too, but that these 'solutions' came about to tackle the affordability issues suggests there is no interest in making your first sentence a reality? the return of low rates and 40-50 year terms are probably just, if not more, likely?We also need to remove the help to buy scheme that just artificially inflated new build prices (largely to the benefit of developers).

The UK property market is such a daft mechanism. The only people it seems to benefit is the finance industry that gets to lend ever increasing sums. In the commercial market its killing retailers and adding huge numbers to the cost base of most businesses. It really does need to be pulled back.

Meanwhile people spend far too much time worrying about the value of their houses instead of just living in them.

But see also " Man who's house has gone up in value by 50 grand thinks he's a financial genius"

Edited by Wombat3 on Tuesday 26th March 22:48

Help to Buy is a difficult one. You can see that it is market manipulation that just adds to the overall issue but it exists because of the importance of equality. Young people don't get to chose where they are born or who they are born to and unless you can legally ban unearned deposits amongst FTBs then we have a social obligation to assist those without access to unearned deposits.

Plus, FTBs aren't the group that drives asset values but they are essential for supporting everyone else's debt piles. They also have no choice but to carry by far the greatest risk of all market participants.

Rather than targeting a niche group that is essential to the market, I'd leave FTBs well alone and do nothing that doesn't support their entry regardless of their childhood background, instead I'd be looking at the true issue which is excess leverage and excess capital.

The U.K. property market can be wholly controlled by its lending regulations. An entire generation was sold down the river so as to ensure their parents voted for the right party by deliberately removing the lending regulations that had kept housing affordable.

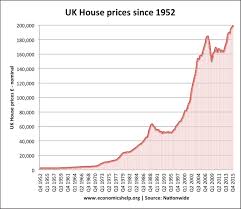

The damage was done between 1997 and 2008 and was synthetically manufactured by allowing excess lending:

There is nothing to be done to rewind that so that young adults who were the victim of one of the largest gerrymandering scams of all time to get in at old prices. Even if values were to fall back anywhere near no lender is going to offer money in such a climate to such a customer. But you can put the genie back in the bottle to unwind things so that future generations don't incur the same fate.

Plus, FTBs aren't the group that drives asset values but they are essential for supporting everyone else's debt piles. They also have no choice but to carry by far the greatest risk of all market participants.

Rather than targeting a niche group that is essential to the market, I'd leave FTBs well alone and do nothing that doesn't support their entry regardless of their childhood background, instead I'd be looking at the true issue which is excess leverage and excess capital.

The U.K. property market can be wholly controlled by its lending regulations. An entire generation was sold down the river so as to ensure their parents voted for the right party by deliberately removing the lending regulations that had kept housing affordable.

The damage was done between 1997 and 2008 and was synthetically manufactured by allowing excess lending:

There is nothing to be done to rewind that so that young adults who were the victim of one of the largest gerrymandering scams of all time to get in at old prices. Even if values were to fall back anywhere near no lender is going to offer money in such a climate to such a customer. But you can put the genie back in the bottle to unwind things so that future generations don't incur the same fate.

Edited by DonkeyApple on Wednesday 27th March 07:52

We have a combined take home pay of 4800 and still have f k all left after paying for our bang average 3 bed semi in kettering, one 16 year old car and one 5 year old car, fuel, food, bills, insurances, dog & baby.

k all left after paying for our bang average 3 bed semi in kettering, one 16 year old car and one 5 year old car, fuel, food, bills, insurances, dog & baby.

Quite a depressing state of affairs really and while I'm grateful we are able to support ourselves, big bills wipe out any meaningful progress we ever make.

I see some of my colleagues in a similar situation, or worse, with furniture and new cars on tick but struggling to make ends meet. The thing is, when you work quite hard you feel you 'deserve' a nice car to spend 2 hours a day in etc... its a slippery slope. Of course, some people just actually do have more than you or have had handouts or inheritance etc.

It's hard to compare, it's never apples with apples, we just try and focus on our own situation as best we can.

k all left after paying for our bang average 3 bed semi in kettering, one 16 year old car and one 5 year old car, fuel, food, bills, insurances, dog & baby.

k all left after paying for our bang average 3 bed semi in kettering, one 16 year old car and one 5 year old car, fuel, food, bills, insurances, dog & baby. Quite a depressing state of affairs really and while I'm grateful we are able to support ourselves, big bills wipe out any meaningful progress we ever make.

I see some of my colleagues in a similar situation, or worse, with furniture and new cars on tick but struggling to make ends meet. The thing is, when you work quite hard you feel you 'deserve' a nice car to spend 2 hours a day in etc... its a slippery slope. Of course, some people just actually do have more than you or have had handouts or inheritance etc.

It's hard to compare, it's never apples with apples, we just try and focus on our own situation as best we can.

Raymond Reddington said:

We have a combined take home pay of 4800 and still have f k all left after paying for our bang average 3 bed semi in kettering, one 16 year old car and one 5 year old car, fuel, food, bills, insurances, dog & baby.

k all left after paying for our bang average 3 bed semi in kettering, one 16 year old car and one 5 year old car, fuel, food, bills, insurances, dog & baby.

Quite a depressing state of affairs really and while I'm grateful we are able to support ourselves, big bills wipe out any meaningful progress we ever make.

I see some of my colleagues in a similar situation, or worse, with furniture and new cars on tick but struggling to make ends meet. The thing is, when you work quite hard you feel you 'deserve' a nice car to spend 2 hours a day in etc... its a slippery slope. Of course, some people just actually do have more than you or have had handouts or inheritance etc.

It's hard to compare, it's never apples with apples, we just try and focus on our own situation as best we can.

And, may I suggest, that it won't be very long before a big vets bill comes over the hill. k all left after paying for our bang average 3 bed semi in kettering, one 16 year old car and one 5 year old car, fuel, food, bills, insurances, dog & baby.

k all left after paying for our bang average 3 bed semi in kettering, one 16 year old car and one 5 year old car, fuel, food, bills, insurances, dog & baby. Quite a depressing state of affairs really and while I'm grateful we are able to support ourselves, big bills wipe out any meaningful progress we ever make.

I see some of my colleagues in a similar situation, or worse, with furniture and new cars on tick but struggling to make ends meet. The thing is, when you work quite hard you feel you 'deserve' a nice car to spend 2 hours a day in etc... its a slippery slope. Of course, some people just actually do have more than you or have had handouts or inheritance etc.

It's hard to compare, it's never apples with apples, we just try and focus on our own situation as best we can.

Edited by Alickadoo on Wednesday 27th March 14:12

DonkeyApple said:

Help to Buy is a difficult one. You can see that it is market manipulation that just adds to the overall issue but it exists because of the importance of equality. Young people don't get to chose where they are born or who they are born to and unless you can legally ban unearned deposits amongst FTBs then we have a social obligation to assist those without access to unearned deposits.

Plus, FTBs aren't the group that drives asset values but they are essential for supporting everyone else's debt piles. They also have no choice but to carry by far the greatest risk of all market participants.

Rather than targeting a niche group that is essential to the market, I'd leave FTBs well alone and do nothing that doesn't support their entry regardless of their childhood background, instead I'd be looking at the true issue which is excess leverage and excess capital.

The U.K. property market can be wholly controlled by its lending regulations. An entire generation was sold down the river so as to ensure their parents voted for the right party by deliberately removing the lending regulations that had kept housing affordable.

The damage was done between 1997 and 2008 and was synthetically manufactured by allowing excess lending:

[Img]https://encrypted-tbn0.gstatic.com/images?q=tbn:ANd9GcSAJcouWbLCM_RI6k9_jic5koWwQEOwWCh1BfiYJuC8tQ&s[/thumb]

There is nothing to be done to rewind that so that young adults who were the victim of one of the largest gerrymandering scams of all time to get in at old prices. Even if values were to fall back anywhere near no lender is going to offer money in such a climate to such a customer. But you can put the genie back in the bottle to unwind things so that future generations don't incur the same fate.

OTOH, if you take the view that (all) house prices continue to rise while FTB's can continue to get in you can see the damage that providing synthetic support to the bottom end of the market does (i.e. HtB). Plus, FTBs aren't the group that drives asset values but they are essential for supporting everyone else's debt piles. They also have no choice but to carry by far the greatest risk of all market participants.

Rather than targeting a niche group that is essential to the market, I'd leave FTBs well alone and do nothing that doesn't support their entry regardless of their childhood background, instead I'd be looking at the true issue which is excess leverage and excess capital.

The U.K. property market can be wholly controlled by its lending regulations. An entire generation was sold down the river so as to ensure their parents voted for the right party by deliberately removing the lending regulations that had kept housing affordable.

The damage was done between 1997 and 2008 and was synthetically manufactured by allowing excess lending:

[Img]https://encrypted-tbn0.gstatic.com/images?q=tbn:ANd9GcSAJcouWbLCM_RI6k9_jic5koWwQEOwWCh1BfiYJuC8tQ&s[/thumb]

There is nothing to be done to rewind that so that young adults who were the victim of one of the largest gerrymandering scams of all time to get in at old prices. Even if values were to fall back anywhere near no lender is going to offer money in such a climate to such a customer. But you can put the genie back in the bottle to unwind things so that future generations don't incur the same fate.

When FTB's can't get in you can start the process of the market at least stalling if not correcting.

First steps are to reduce and then phase out HtB & then start to introduce stricter lending controls.

But its not the work of even one parliament , it will take a long time to do if you want to avoid some sort of crash.

Edited by Wombat3 on Wednesday 27th March 18:41

DonkeyApple said:

Help to Buy is a difficult one. You can see that it is market manipulation that just adds to the overall issue but it exists because of the importance of equality. Young people don't get to chose where they are born or who they are born to and unless you can legally ban unearned deposits amongst FTBs then we have a social obligation to assist those without access to unearned deposits.

May be our social obligation to assist those less well off was to have measures to keep house prices/deposits lower these last few decades, by restricting multiple purchases by wealthier individuals, foreign nationals etc? Then the wealthier individuals could afford larger first houses (a good thing for them) and the less wealthy can afford a simple home (a good thing too), some might even be able to do the old school way of having one working parent!? and it could encourage generational benefit claimants to perhaps buck the family trend? The downsides being what, retirees not sitting on quite such a valuably property (lower inheritances), 'mini not multi' millionaire landlords, there are probably larger economic issues maybe with lower prices but perhaps that highlights that our basic housing needs are too entwined with our GDP?Edited by DonkeyApple on Wednesday 27th March 07:52

The help to buy 'solution' was to provide additional deposit borrowing at a reduced rate, a sort of shared ownership where the government/funder is the silent equity partner?

I'd argue it's a bit late and a bit rich <sic> to suggest this was created because of a realisation of social obligation, rather than just a way to keep the first buyer inflows coming to support the overall market?

The western world seems to have the view that expensive housing is a generally good thing, or at th every least it's where we've ended up, but really as the poster above mentions, it's not really what you earn or what your basic essential assets are worth it's ultimately what you have left over, and what you do with that, that defines your wealth/feeling of wealth?

We can argue some people are rubbish at curtailing their spending but it hard to argue that the day to day essentials increases haven't outpaced the general income increases leaving us all (nearly all) feeling a bit more hard up.

Wombat3 said:

OTOH, if you take the view that (all) house prices continue to rise while FTB's can continue to get in you can see the damage that providing synthetic support to the bottom end of the market does (i.e. HtB).

When FTB's can't get in you can start the process of the market at least stalling if not correcting.

First steps are to reduce and then phase out HtB & then start to introduce stricter lending controls.

But its not the work of even one parliament , it will take a long time to do if you want to avoid some sort of crash.

I really do stringently disagree. I agree that we don't want a market where HtB exists but vehemently against phasing it out ahead of addressing the real issues. HtB isn't the problem and to consider it as such is to overtly discriminate against those who aren't part of the problem. When FTB's can't get in you can start the process of the market at least stalling if not correcting.

First steps are to reduce and then phase out HtB & then start to introduce stricter lending controls.

But its not the work of even one parliament , it will take a long time to do if you want to avoid some sort of crash.

Edited by Wombat3 on Wednesday 27th March 18:41

Why not level the FTB initial deposit market by simply asking the purchaser to show the evidence that they have earned the deposit? It makes no sense to target or blame those being offered deposit assistance to enable competing against those who can extract a deposit from thin air.

What is the actual purpose of that deposit? On the one hand it is so that as the lender you have some collateral to cover the costs of default but that isn't the primary reason because as the lender you ne we want to get to that default point in the first instance nor is a 5 or 10% deposit of any great value.

The real purpose of a deposit is for the borrower to prove to the lender that they have the strength of character to earn and save rather than just being some feckless loser you don't want to lend to unless it's to specifically put in default and milk as per the payday/nothing to pay debt markets. Its purpose is to ensure the client has a functioning adult mind that allows them to not shop like a loser and to then hand over a significant lump of money that further focuses the mind as well as giving them even more to lose. If they haven't earned that deposit then it serves no real value at all. The client hasn't proven they are responsible in any way and nor do they have any skin in the game.

So why even have a deposit requirement for FTBs? Those trying to earn their own can't easily do so even if they try and those who get given or lent it by family haven't learned the lesson the deposit requirement exists to enforce.

Logically, there is no point today in asking FTBs for a deposit. Meanwhile, at the other end of the market we insanely ask older people to meet the same deposit requirements when in reality you want to be demanding far higher deposits so as to curb the inflationary ability of the those who really do drive house prices beyond a natural level of affordability.

So as a lender, how could you operate a zero deposit loan to an FTB? Well it would be really rather easy. First you filter properly based on their current account activity over 3-5 years. You don't need any fancy algo to spot a loser and tell them to go away. A responsible adult that you can lend to without deposit reveals themselves very clearly just through their chosen lifestyle. Extra brownie points for them having a savings track record on top.

Already at that point you are moving away from favouring FTBs just on who their parents happen to be but instead to favouring them based on not being f

king idiots which is terribly logical. In other words, you can have a loan like a grown up when you have shown that you are a grown up. If you can't do that until you're 40 then that's the way it has to be. After that sort of age you don't want to lend to an FTB anyway as they have 20+ years of proof of being a loser and they can join the ranks of those needing to put down a large enough deposit that the lender has no capital risk.

king idiots which is terribly logical. In other words, you can have a loan like a grown up when you have shown that you are a grown up. If you can't do that until you're 40 then that's the way it has to be. After that sort of age you don't want to lend to an FTB anyway as they have 20+ years of proof of being a loser and they can join the ranks of those needing to put down a large enough deposit that the lender has no capital risk. Back to lending to FTBs with no deposit. We've got rid of the feckless by just basing whether we will entertain them as a client by looking at their adult lifestyle to date. Losers have received their 'Go away and grow up' letters and adults have been offered a loan. What you now need to do is get equity into that property asap. Now despite having spotted the most feckless and told them to go away you know that this hasn't removed all risk at all and that the borrower must focus on paying down the loan as quickly as possible to create that equity that derisks them.

Now, you can be a total moron and just get your client to agree and pinky promise that they will, honest like, take some of their income each month and put it to one side. You can even be still as stupid and let them invest it knowing that it will get dumped into childish junk like crypto, NFTs or whatever their lamp stand tells them to buy. Every man and his dog knows that doesn't work. Every single age demographic has a legion of losers who gambled or ahopped it all away and are still paying mortgages or rent or are skint in retirement despite having had career income levels more than sufficient to have sorted everything out.

So in order to get the loan the FTB has to have their salary paid to you direct. I get their whole net salary, I take out my owed interest, my capital repayment and then I send on to the FTBer what is left. I don't really care what they do with that leftover money as I've taken enough to be building a security deposit quickly enough and my downside risk is really that they'll just become a trapped tenant paying rent. What I do care about is them using that money to borrow more money. I don't really want that as that is my real risk, other lenders. So to avoid that risk the FTB needs to ask me for permission to borrow shopping tokens from one of the Wonga type Shylocks.

So, want to borrow money at 13% from VW for a shiny new car? FRO that's not happening.

Want a load of consumer credit to fill your property with shiny grey tat? FRO, pay down your debt to me before doing that.

Want to go on holiday? Buy a tent, I'm not having you going to MacchuPicchu to find yourself. The only thing you'll be finding is my foot up your arse until you paid my money back as agreed.

It sounds aggressive but only to those who are a liability and who cares about those idiots? To the grown up and responsible it would be a wholly frictionless partnership that got them their first home and got them nicely secured in their first home but what it does do for those people is completely remove the unfair and random deposit lottery.

DonkeyApple said:

The real purpose of a deposit is for the borrower to prove to the lender that they have the strength of character to earn and save rather than just being some feckless loser you don't want to lend to unless it's to specifically put in default and milk as per the payday/nothing to pay debt markets.

What?I generally agree with most of what you have to say but this is utter nonsense.

Strength of character?

The entire system has worked fine without qualifying borrowers on ‘strength of character’ assessed via ability to “save up”.

Why not just say save up for the entire house then?

Ah, we still want to lend to people, but we need them to prove just enough that they’ve “got what it takes” to save for a bit, then let them through the doors to become a 25-30yr borrower/debt slave?

It’s a non-sensical juxtaposition of proof.

Prove you’re able to become a debt slave by not being a debt slave

Why not just fix the market supply and demand side, strip out all this b

ks, and let the market figure it out using good old market forces.

ks, and let the market figure it out using good old market forces.If it crashes in the meantime, let the pieces lay where they will.

The home market isn’t the economy.

It’s a utility, an essential. It’s value stability shouldn’t override its need as a utility.

Ie, stop monetising utilities.

Just look at Thames Water as another example.

Utterly borked by crony capitalism.

Scootersp said:

May be our social obligation to assist those less well off was to have measures to keep house prices/deposits lower these last few decades, by restricting multiple purchases by wealthier individuals, foreign nationals etc? Then the wealthier individuals could afford larger first houses (a good thing for them) and the less wealthy can afford a simple home (a good thing too), some might even be able to do the old school way of having one working parent!? and it could encourage generational benefit claimants to perhaps buck the family trend? The downsides being what, retirees not sitting on quite such a valuably property (lower inheritances), 'mini not multi' millionaire landlords, there are probably larger economic issues maybe with lower prices but perhaps that highlights that our basic housing needs are too entwined with our GDP?

The help to buy 'solution' was to provide additional deposit borrowing at a reduced rate, a sort of shared ownership where the government/funder is the silent equity partner?

I'd argue it's a bit late and a bit rich <sic> to suggest this was created because of a realisation of social obligation, rather than just a way to keep the first buyer inflows coming to support the overall market?

The western world seems to have the view that expensive housing is a generally good thing, or at th every least it's where we've ended up, but really as the poster above mentions, it's not really what you earn or what your basic essential assets are worth it's ultimately what you have left over, and what you do with that, that defines your wealth/feeling of wealth?

We can argue some people are rubbish at curtailing their spending but it hard to argue that the day to day essentials increases haven't outpaced the general income increases leaving us all (nearly all) feeling a bit more hard up.

Again, that's blaming people on the grounds of their wealth. The second home thing is just a political thing. It's like murdering the Jews when you've borrowed too much money from them. It's what societies do when they've all borrowed too much and become too greedy, they blame the money lenders, the rich and the foreign and if there is a group that symbolises all three then happy days. The help to buy 'solution' was to provide additional deposit borrowing at a reduced rate, a sort of shared ownership where the government/funder is the silent equity partner?

I'd argue it's a bit late and a bit rich <sic> to suggest this was created because of a realisation of social obligation, rather than just a way to keep the first buyer inflows coming to support the overall market?

The western world seems to have the view that expensive housing is a generally good thing, or at th every least it's where we've ended up, but really as the poster above mentions, it's not really what you earn or what your basic essential assets are worth it's ultimately what you have left over, and what you do with that, that defines your wealth/feeling of wealth?

We can argue some people are rubbish at curtailing their spending but it hard to argue that the day to day essentials increases haven't outpaced the general income increases leaving us all (nearly all) feeling a bit more hard up.

The problem is caused by all the individuals who borrowed too much and drive up the asset values. It's not logical to single out a particular group based on a characteristic that we are either envious or scared of.

Now we know that a society will borrow, spend and consume as much as it is allowed to do. Humans will not self regulate in this regard and so society must always regulate these activities in order to protect itself from itself. The lending of money needs to always be regulated by fear of awful consequence and by a centralised entity that decides how much people can borrow.

Why blame bogiemen when the issue was everyone was allowed to borrow far too much.

It's not Giles going to Cornwall and buying a fisherman's cottage that the locals didn't want until Giles' wife made it look all pretty and KnightFrank went from considering it a s

thole hovel not fit for even a local to being willing to act as agent for its sale that has pushed up the price of homes all across the U.K. and the West.

thole hovel not fit for even a local to being willing to act as agent for its sale that has pushed up the price of homes all across the U.K. and the West. Nor is it Abdul buying a few slums in Leicester to rent out until his kids get married and are given them as their first homes? He's not remotely to blame nor is he doing anything that Steve or Barry couldn't do but Steve and Barry can't be arsed, it's just easier to sit on the sofa watching Tommy Robinson.

The reason why house prices shot up in every corner of the U.K. was purely down to the general public being allowed to borrow as much as they wanted and then being allowed to bid up every home in the U.K. Prices aren't driven up by the smart minority who know the value of something and decide to only pay that value. Prices are driven up by the millions of absolute idiots let loose with a massive credit line and will then just bid up a house to that credit line.

Agree to lend someone £300k and they will just pay £300k for a £200k property. Why? Because people are over emotional and under responsible.

Just go to a property auction to see this in action. The smart people are bidding what it is worth and the idiots with credit lines are bidding way over worth because they're basing value as being defined by how much they can borrow. It's just the completely normal insanity and idiocy of us all, it's in the genetics.

That's what caused the excessive property inflation in the West. The releasing of lenders to just not care how much punters borrowed and how much they paid.

We could have avoided all of this by just leaving the core lending regulation in place and where other nations hadn't we could have just levied a suitable stamp duty levy that was aligned with the general cost of high quality money laundering.

All the other stuff that is less than ideal can be dealt with but it's not to blame. There is only one core cause of where we find ourselves today and that was the removal of lending controls. And worse than it just being a failure of regulation by the govt, it was deliberate to create this very market.

Covid was my reset for my personally (nothing can last forever, and the world is a mad place!!), in terms of my finances and 'where my money goes'.

Gone were the fancy cars, and personal loan and in with the £1k shed, been completely converted to shedding now - cars are such a drain on money especailly A-B daily get to work cars - two ageing daily cars - 16 years old 12 years old both over 150,000 miles on them.

In terms of where the money goes, I suppose people upscale their lifestyle, chasing for that 1 more bedroom they WANT, not necessarily NEED, up their mortgages to counteract the ridiculous asking prices houses now demand, dont get me started on stamp duty and money for old rope fees - I am not surprised FTB's are struggling to get even any kind of property.

I have been content in 'my lane' not wanted to upscale to the bigger house, which we nearly did prior to covid, so glad I didnt and made do! A house means a bigger mortgage, bigger bills, bigger council tax, you get the idea - great if its made money over the years, but we all need somewhere to live full stop.

We have made do, 'cut your cloth' is the oldskool saying - got a small manageable mortgage, which should be paid off in 10 years all being well (3 bed terrace, in a nice town in Cheshire), wife cut down to part-time to look after our child - we get by just fine with much spare for nice family things, the stuff that matters frankly. Our work/life balance is spot on.

But, each to their own completely though.

Gone were the fancy cars, and personal loan and in with the £1k shed, been completely converted to shedding now - cars are such a drain on money especailly A-B daily get to work cars - two ageing daily cars - 16 years old 12 years old both over 150,000 miles on them.

In terms of where the money goes, I suppose people upscale their lifestyle, chasing for that 1 more bedroom they WANT, not necessarily NEED, up their mortgages to counteract the ridiculous asking prices houses now demand, dont get me started on stamp duty and money for old rope fees - I am not surprised FTB's are struggling to get even any kind of property.

I have been content in 'my lane' not wanted to upscale to the bigger house, which we nearly did prior to covid, so glad I didnt and made do! A house means a bigger mortgage, bigger bills, bigger council tax, you get the idea - great if its made money over the years, but we all need somewhere to live full stop.

We have made do, 'cut your cloth' is the oldskool saying - got a small manageable mortgage, which should be paid off in 10 years all being well (3 bed terrace, in a nice town in Cheshire), wife cut down to part-time to look after our child - we get by just fine with much spare for nice family things, the stuff that matters frankly. Our work/life balance is spot on.

But, each to their own completely though.

DonkeyApple said:

That's what caused the excessive property inflation in the West. The releasing of lenders to just not care how much punters borrowed and how much they paid.

Exactly.Moral hazard. And lenders can’t see risk while governments prop up property.

So they go along with lending more and more silly valuations while people are willingly paying more and more.

That’s a self-fulfilling feedback loop.

If lenders would feel the risks they wouldn’t do this, but they’re shielded, so they do.

The ills of the market are borne by governments stepping in to save everyone… but all they do is socialise debts and reward the private risk takers.

Just like a child, over protect them and you get a daft child who can’t operate properly.

Walking for them, talking for them, helping too much on homework.

Society has been turned into a financial retard by a government unwilling to just let people suffer and learn a lesson.

While simultaneously shafting the poor at the advantage of the rich, via the bailout mechanism.

Gassing Station | Finance | Top of Page | What's New | My Stuff