My house hasn't appreciated in value in 12 years

Discussion

I find this sort of thing fascinating. My wifes uncle was a docker in Hartlepool. I think he used to earm pretty good money and the last property he purchased 2 or 3 years ago was 100k! I guess the flip side of being able to buy cheap houses is they stay cheap (generally). Cheap housing does allow you to buy other stuff tho, the said uncle has a 8k rolex and changes his car every 2 or 3 years.

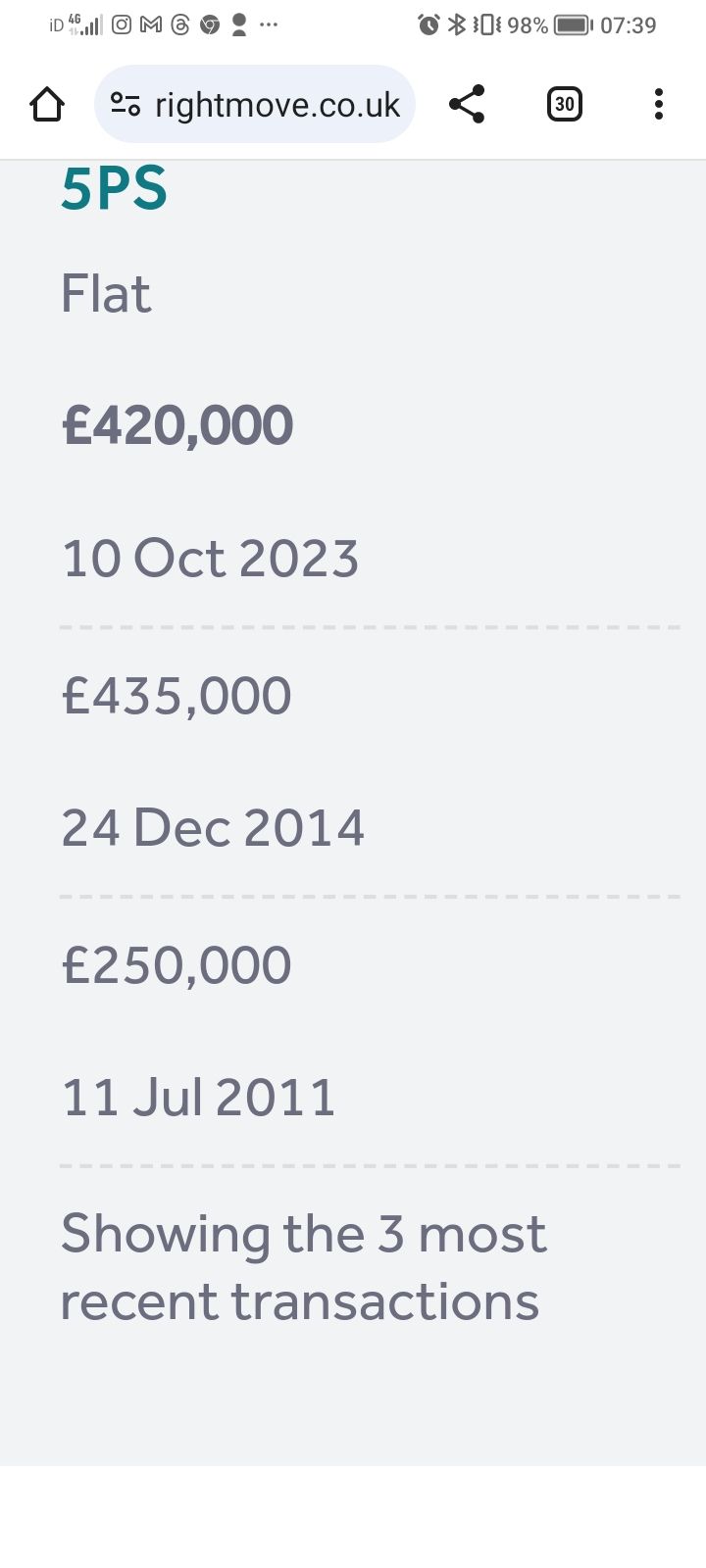

In the meanwhile here is what has happened to me on the last 2 properties I've owned. I sold the flat 2014 and purchased the house which I sold 2022. I actually undersold the house by 5 to 10k or so but what's done is done.

The flat I didnt spend anything on, the house I spent about 60k on.

In the meanwhile here is what has happened to me on the last 2 properties I've owned. I sold the flat 2014 and purchased the house which I sold 2022. I actually undersold the house by 5 to 10k or so but what's done is done.

The flat I didnt spend anything on, the house I spent about 60k on.

Raised an interesting thought for me. Have we spent enough over the years to maintain the house?

Our house is reasonably maintained (currently a leaking flat roof) and we have been in for 17 years.

We have spent

8k new roof

12k new kitchen

2k new shower room

3k new front door

4k new conservatory (replacing an old wooden one)

8k new windows

3k new boiler

Plus all the little bits of decoration and painting and garden maintenance. (New lawn) But all sub £1k. Prices may seem cheap due to inflation, so the new roof was done when we first moved in, for example. New windows were done last year.

I suppose it is contextual too. The house is a four bed semi dating from 1848.

Wife nagging about the main bathroom and shower room (again), which I think looks alright.

Our house is reasonably maintained (currently a leaking flat roof) and we have been in for 17 years.

We have spent

8k new roof

12k new kitchen

2k new shower room

3k new front door

4k new conservatory (replacing an old wooden one)

8k new windows

3k new boiler

Plus all the little bits of decoration and painting and garden maintenance. (New lawn) But all sub £1k. Prices may seem cheap due to inflation, so the new roof was done when we first moved in, for example. New windows were done last year.

I suppose it is contextual too. The house is a four bed semi dating from 1848.

Wife nagging about the main bathroom and shower room (again), which I think looks alright.

Chamon_Lee said:

you've summed up the biggest con of this century. a few made big bucks the rest just signed up to the debt imprisonment without knowing it.

I am being a bit harsh as we essentially pay for the roof on our head but its not this life changing asset people harp on about especially if you ride it out to a full term of 25-35 years

Seriously???I am being a bit harsh as we essentially pay for the roof on our head but its not this life changing asset people harp on about especially if you ride it out to a full term of 25-35 years

You can pay a mortgage for 25-35 years and then have an asset worth several hundred thousand pounds that you can live in for the rest of your life, only paying for maintenance or you can pay somebody else's mortgage for the rest of your life and die with no assets to show for it and you think the purchase route is the con?

blueg33 said:

Thats mad

Mind you, we once built some apartments in Cheltenham, very high end. Sold the penthouse for over £1m (20 years ago). We had put in a super fancy top of the range kitchen that cost us £20k (thats a huge amount for a developer, especially back then). The day after the owners completed the purchase, I went past and found the kitchen in a skip - apparently it wasn't good enough!

After selling my flat in London my old neighbour mentioned that the new owners had ripped out the nearly new Pogg that I'd spent close to 50 on and replaced it with a new Pogg from the same shop. When I sold the cottage out here the new owner ripped out the new bathroom and my ex neighbour lifted the original Victorian bath from the skip as he knew it was an original. Mind you, we once built some apartments in Cheltenham, very high end. Sold the penthouse for over £1m (20 years ago). We had put in a super fancy top of the range kitchen that cost us £20k (thats a huge amount for a developer, especially back then). The day after the owners completed the purchase, I went past and found the kitchen in a skip - apparently it wasn't good enough!

A friend of mine managed the fit out for 1 Hyde Park and everyone in his team ended up with near £200k kitchens because each time Candy got a unit sold the investor instructed them to rip and skip the kitchens along with other fittings.

1997-2022 was a mad quarter century of debt fuelled, endless consumption that's for sure.

That said, if fitting a nice new kitchen didn't normally add value then equity release firms wouldn't be pitching it as one of the things the vendors should be buying them for the house they now own with the money they just lent the inhabitants!!!!!

That's a great business. Buying someone's home on the cheap and then getting them to spend the money you paid on increasing the value of your investment!!

We bought a High Street flat for £105k , lived in it for 10 years and sold it for £120k.

And that’s after sinking at least £30k into it, new kitchen, bathroom, rewired, windows overhauled, new boiler, the list goes on.

However we paid too much for it but we were desperate and there was nothing else on the market. It was also over a pub with no ground and we tried 4 times to sell it without a sniff of interest. The other owners wouldn’t put a penny into common repairs.

So on the end we were just glad to get shot of it and the fact we didn’t make much on it was secondary to just getting rid.

Shnozz said:

Who the f k takes into account mortgage interest in considering whether their property has increased in value? Never heard anyone do that before.

k takes into account mortgage interest in considering whether their property has increased in value? Never heard anyone do that before.

I dare not look at the figures for a house I bought in 2019 and sold in 2023, the man maths which showed that I t was financially viable to own a house in the location near to where I'd done most of my contract work.  k takes into account mortgage interest in considering whether their property has increased in value? Never heard anyone do that before.

k takes into account mortgage interest in considering whether their property has increased in value? Never heard anyone do that before. The actual interest was "only" £220 a month, but it was the new roof, that really hurt.

I think I did a thread about getting the Alcoholic lodger to leave so I could put it on the market

If you ignore the interest, consider that the costs of running the house, were what I would have spent on "digs" or b&bs then we don't have a capital gains tax liability.

Drawweight said:

We bought a High Street flat for £105k , lived in it for 10 years and sold it for £120k.

And that’s after sinking at least £30k into it, new kitchen, bathroom, rewired, windows overhauled, new boiler, the list goes on.

However we paid too much for it but we were desperate and there was nothing else on the market. It was also over a pub with no ground and we tried 4 times to sell it without a sniff of interest. The other owners wouldn’t put a penny into common repairs.

So on the end we were just glad to get shot of it and the fact we didn’t make much on it was secondary to just getting rid.

The problem with things like first homes is that we tend to get good advice such as 'you make your money on the purchase price not the sale price', 'buy the worst property on the nicest street', 'stretch to get the next size up to negate the huge costs of needing to move on too soon', 'buy what you are most likely to need tomorrow not what you need today' etc and that's all solid advance from wise people and those who learned from earlier mistakes but we have to weigh that up with the fact that to follow that advice often means renting for longer and all too often you just need to bite the bullet and cross your fingers you don't get too badly bummed when it's time to trade up. And that’s after sinking at least £30k into it, new kitchen, bathroom, rewired, windows overhauled, new boiler, the list goes on.

However we paid too much for it but we were desperate and there was nothing else on the market. It was also over a pub with no ground and we tried 4 times to sell it without a sniff of interest. The other owners wouldn’t put a penny into common repairs.

So on the end we were just glad to get shot of it and the fact we didn’t make much on it was secondary to just getting rid.

In a normal market it can make more sense to just keep renting flats until one's life dictates that it's time to buy a house and just live in that house until you keep over but in a market where prices were ripping away and a mortgage looked cheaper than rent along with peers all rushing to buy it wasn't exactly easy to do that.

Interesting exercise. I bought my current house for £275k in 2016, neighbour has recently sold theirs (same design as mine albeit a little bit smaller) for 500k. In that time I've paid £26k interest, and according to notes, £32400 since the beginning of 2020 on maint and upkeep. That covers about half of the time I've been here, so can effectively double it, so call it 90 grand for a notional £225k uplift seems a reasonable return.

Drawweight said:

We bought a High Street flat for £105k , lived in it for 10 years and sold it for £120k.

And that’s after sinking at least £30k into it, new kitchen, bathroom, rewired, windows overhauled, new boiler, the list goes on.

However we paid too much for it but we were desperate and there was nothing else on the market. It was also over a pub with no ground and we tried 4 times to sell it without a sniff of interest. The other owners wouldn’t put a penny into common repairs.

So on the end we were just glad to get shot of it and the fact we didn’t make much on it was secondary to just getting rid.

Many flats are known for being stagnant relative to the rest of the market, to be fair. Obviously that’s not an absolute. Our first property ( a flat) went from our purchase price of £49k to a sale of £130k over six years. Since we sold that in about 2003, they have only increased by about £30k to date.And that’s after sinking at least £30k into it, new kitchen, bathroom, rewired, windows overhauled, new boiler, the list goes on.

However we paid too much for it but we were desperate and there was nothing else on the market. It was also over a pub with no ground and we tried 4 times to sell it without a sniff of interest. The other owners wouldn’t put a penny into common repairs.

So on the end we were just glad to get shot of it and the fact we didn’t make much on it was secondary to just getting rid.

Wombat3 said:

I've spent quite a lot on mine over 10 years & it definitly hasn't really appreciated as much as it looks like it has on paper.

Arguably I'd be much better off if I'd stuck that money in a Global Tracker fund .

....but I've had a much better house to live in instead. I'm not sure how you value that but I'd do it again.

Very true - properties that make money are of a certain type or in crazy markets like the SE. Arguably I'd be much better off if I'd stuck that money in a Global Tracker fund .

....but I've had a much better house to live in instead. I'm not sure how you value that but I'd do it again.

Our main house has little over doubled in the last 21 years - it’s basically worth what it was when we bought it allowing for inflation. Lancashire. Beautiful old stone property but it’s maxed out as to what people will pay.

On the other hand we also have a flat in Chorlton-cum-Hardy. That’s worth about 15 times what it was in 1996.

Gassing Station | Homes, Gardens and DIY | Top of Page | What's New | My Stuff