Why is insurance so expensive?

Discussion

Mr Daytona said:

Fight these claims, how ? Insurers are presented with a medical report from an eminent Consultant Orthopaedic Surgeon which confirms a 6/12/18 month whiplash (take your pick).

The Civil Procedure Rules - which govern such PI claims - dictates you cannot instruct an Expert of your own choosing so you're essentially left to defend yourself against a Litigant with (supposedly) independent medical evidence which if presented at Trial, would see the Claimant home and dry. The fact that said Surgeon churns out 10 reports a day at £400 a pop is irrelevant in the Courts eyes, as is the fact that cars have never been safer and that other countries within the EU even refuse to recognise that the medical condition called whiplash can actually exist at the relatively low speeds such injuries actually occur.

So I ask you again, how do you fight something where the rules are so stacked against you ?

Sadly, in the past 10 to 15 years we have become a Society where it is not only expected that you will claim if your car is hit, but that it's "fair game" to exaggerate your symptoms so that a 2 to 3 day dull ache suddenly morphs into a debilitating injury requiring 24 hour round the clock care in a specially adapted £500,000 house.

Well for a start the insurance companies could start by stopping selling their customer records to "accident management" companies, which would a be step towards discouraging the compo culture. They could also fight a test case on the procedure rules, seek a judicial review, marketing campaigns on the impact of the compo culture on their customers wallets. But these things aren't happening are they, and we've already seen in this thread that they're making profit from investment of premiums so is it really in the insurance companies interests to drive premiums down???The Civil Procedure Rules - which govern such PI claims - dictates you cannot instruct an Expert of your own choosing so you're essentially left to defend yourself against a Litigant with (supposedly) independent medical evidence which if presented at Trial, would see the Claimant home and dry. The fact that said Surgeon churns out 10 reports a day at £400 a pop is irrelevant in the Courts eyes, as is the fact that cars have never been safer and that other countries within the EU even refuse to recognise that the medical condition called whiplash can actually exist at the relatively low speeds such injuries actually occur.

So I ask you again, how do you fight something where the rules are so stacked against you ?

Sadly, in the past 10 to 15 years we have become a Society where it is not only expected that you will claim if your car is hit, but that it's "fair game" to exaggerate your symptoms so that a 2 to 3 day dull ache suddenly morphs into a debilitating injury requiring 24 hour round the clock care in a specially adapted £500,000 house.

You also haven't answered my original question, why have the premiums for young drivers risen so disproportionally to those for the rest of us. Compo culture affects all our premiums so what has changed for that group?

adam4472 said:

Urban Sports said:

adam4472 said:

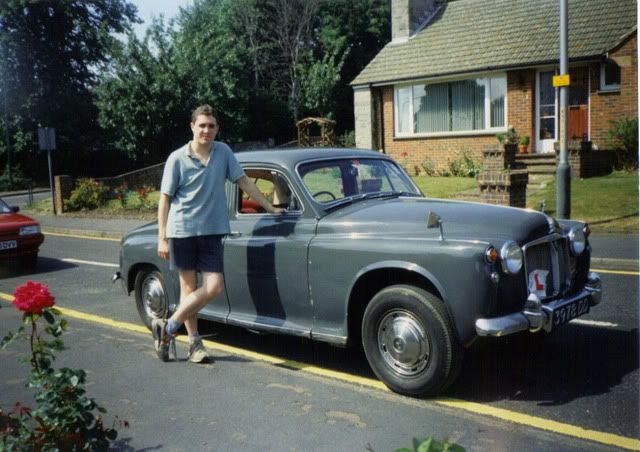

I have an overall budget for car and insurance around about £3500.

The car will be used to mainly get me to uni and to the odd museum

I'm 18 and have got my father on my insurance policy.

Say that in my good ear The car will be used to mainly get me to uni and to the odd museum

I'm 18 and have got my father on my insurance policy.

(And yes I know those are 110 wheel trims. Makes it faster, you see..

Nicky86 said:

Mr Daytona, yes. I've been driving since I was 18 now I'm 29, I've never had or caused a accident so I would like to see where the insurance companies have made a loss from me. My first car was a 1.2 Fiat Punto, cost to insure that was £1600 only recently I've gotten my insurance down to a reasonable £400.

Car insurance I feel is a legal protection racket, government say i must have insurance so the insurance companies now have a free hand to charge what they like and do then act as a cartel not to undercut each other. Why can this be legal? Because the government can take their 6-20% insurance premium tax.

Remember theirs a difference between insurance broker and underwriters!

If you are actually 29 then you should be old enough to understand business. If car insurance is such a big cash cow then point me to one that's making loads of money so I can pick up some big dividends.Car insurance I feel is a legal protection racket, government say i must have insurance so the insurance companies now have a free hand to charge what they like and do then act as a cartel not to undercut each other. Why can this be legal? Because the government can take their 6-20% insurance premium tax.

Remember theirs a difference between insurance broker and underwriters!

Alternative!y set out a business plan for providing cheap insurance for everyone. There are a lot of successful people on here who would probably invest in your new company if it could undercut everyone.

Someone providing cheap insurance for all would corner the market in 12 months.

Insurance is so expensive because the companies have no record of us, so they don't know how we drive, starting driving 2 years ago when I was 18, I got buttf ked for insurance. I got a Ford Ka as it was a lot cheaper to insure than any other Corsa Clio equivalent. (I think the fact it only has 4 seats helps too, plus it's seen as a girls choice, not a lads) but these things (possibly) meant that I could insure it for 1500 quid. Once I had a years no claims the premium dropped £900 to 600, so I swapped the car in for something a little more sporty (Fiat Grande Punto T-Jet) which come renewal will cost me £650. To a point, you almost have to grin and bear it for a year whilst you get that all important NCB, once you have it, you can then look at more interesting cars.

ked for insurance. I got a Ford Ka as it was a lot cheaper to insure than any other Corsa Clio equivalent. (I think the fact it only has 4 seats helps too, plus it's seen as a girls choice, not a lads) but these things (possibly) meant that I could insure it for 1500 quid. Once I had a years no claims the premium dropped £900 to 600, so I swapped the car in for something a little more sporty (Fiat Grande Punto T-Jet) which come renewal will cost me £650. To a point, you almost have to grin and bear it for a year whilst you get that all important NCB, once you have it, you can then look at more interesting cars.

ked for insurance. I got a Ford Ka as it was a lot cheaper to insure than any other Corsa Clio equivalent. (I think the fact it only has 4 seats helps too, plus it's seen as a girls choice, not a lads) but these things (possibly) meant that I could insure it for 1500 quid. Once I had a years no claims the premium dropped £900 to 600, so I swapped the car in for something a little more sporty (Fiat Grande Punto T-Jet) which come renewal will cost me £650. To a point, you almost have to grin and bear it for a year whilst you get that all important NCB, once you have it, you can then look at more interesting cars.

ked for insurance. I got a Ford Ka as it was a lot cheaper to insure than any other Corsa Clio equivalent. (I think the fact it only has 4 seats helps too, plus it's seen as a girls choice, not a lads) but these things (possibly) meant that I could insure it for 1500 quid. Once I had a years no claims the premium dropped £900 to 600, so I swapped the car in for something a little more sporty (Fiat Grande Punto T-Jet) which come renewal will cost me £650. To a point, you almost have to grin and bear it for a year whilst you get that all important NCB, once you have it, you can then look at more interesting cars.Mr Daytona said:

Fight these claims, how ? Insurers are presented with a medical report from an eminent Consultant Orthopaedic Surgeon which confirms a 6/12/18 month whiplash (take your pick).

The Civil Procedure Rules - which govern such PI claims - dictates you cannot instruct an Expert of your own choosing so you're essentially left to defend yourself against a Litigant with (supposedly) independent medical evidence which if presented at Trial, would see the Claimant home and dry. The fact that said Surgeon churns out 10 reports a day at £400 a pop is irrelevant in the Courts eyes, as is the fact that cars have never been safer and that other countries within the EU even refuse to recognise that the medical condition called whiplash can actually exist at the relatively low speeds such injuries actually occur.

So I ask you again, how do you fight something where the rules are so stacked against you ?

Sadly, in the past 10 to 15 years we have become a Society where it is not only expected that you will claim if your car is hit, but that it's "fair game" to exaggerate your symptoms so that a 2 to 3 day dull ache suddenly morphs into a debilitating injury requiring 24 hour round the clock care in a specially adapted £500,000 house.

Get new lawyers if you think that's the effect of the CPR. Complete bThe Civil Procedure Rules - which govern such PI claims - dictates you cannot instruct an Expert of your own choosing so you're essentially left to defend yourself against a Litigant with (supposedly) independent medical evidence which if presented at Trial, would see the Claimant home and dry. The fact that said Surgeon churns out 10 reports a day at £400 a pop is irrelevant in the Courts eyes, as is the fact that cars have never been safer and that other countries within the EU even refuse to recognise that the medical condition called whiplash can actually exist at the relatively low speeds such injuries actually occur.

So I ask you again, how do you fight something where the rules are so stacked against you ?

Sadly, in the past 10 to 15 years we have become a Society where it is not only expected that you will claim if your car is hit, but that it's "fair game" to exaggerate your symptoms so that a 2 to 3 day dull ache suddenly morphs into a debilitating injury requiring 24 hour round the clock care in a specially adapted £500,000 house.

ks. You don't fight the claims because it is easier to just increase premiums and there is a cosy understanding to that effect between insurers.

ks. You don't fight the claims because it is easier to just increase premiums and there is a cosy understanding to that effect between insurers.Their really are some people out their who have no concept of simple business practices.

Get new Lawyers ? And how exactly will that help since they too have to work within the existing framework of the CPR. Or are you suggesting that new Lawyers equates to new laws ? Sadly it doesn't work like that and whilst the Legal/Insurance industry will seek to explore ways of reducing their financial exposure by way of exploring weaknesses in the CPR, our hands are to a degree tied by legislation.

In addition, do you have any evidence that their is some sort of "cosy relationship" between Insurers, or is the fact that you think it exists sufficient proof of such a cartel ? The fact that Insurance premiums - in real terms - are decreasing (particularly for males following the implementation of the EUs reforms on gender discrimination) is evidence that at long last the tide is turning and the Industry is finally overcoming the cancer that is the Compensation Culture.

As for the earlier question regarding increases for young drivers, I would have thought the answer was obvious. For the avoidance of future doubt, they proportionally make more claims than older drivers and accordingly their premiums are higher. Just as certain professions have higher premiums and if you live in a particular postcode (Bradford, Oldham anyone ?) then you too will have increased premiums. Again this is simple business - you charge more for those who cost you more.

I do though accept that in the past some ( though not all) Insurers have been guilty of selling data to Accident Management Companies, but thankfully the Government has now responded to this and has banned referral fees so this practice will die out, though not quickly enough. However, that only applies to Motor claims and does not affect the field of insurance I work in, namely EL/PL.

Google fibromyalgia, complex regional syndrome and such like - then tell me how a syndrome where their are no organic reasons as to the alleged trauma the Claimant is suffering from (and where the medical fraternity agree no such trauma should exist) is the latest cash cow for the feckless of Society. Utter madness.

Think I now know why LoonR1 refuses to become embroiled in this topic anymore, people's understanding - whilst no doubt genuinely felt - doesn't really stand up to simple sctutiny. Hey hum.

Get new Lawyers ? And how exactly will that help since they too have to work within the existing framework of the CPR. Or are you suggesting that new Lawyers equates to new laws ? Sadly it doesn't work like that and whilst the Legal/Insurance industry will seek to explore ways of reducing their financial exposure by way of exploring weaknesses in the CPR, our hands are to a degree tied by legislation.

In addition, do you have any evidence that their is some sort of "cosy relationship" between Insurers, or is the fact that you think it exists sufficient proof of such a cartel ? The fact that Insurance premiums - in real terms - are decreasing (particularly for males following the implementation of the EUs reforms on gender discrimination) is evidence that at long last the tide is turning and the Industry is finally overcoming the cancer that is the Compensation Culture.

As for the earlier question regarding increases for young drivers, I would have thought the answer was obvious. For the avoidance of future doubt, they proportionally make more claims than older drivers and accordingly their premiums are higher. Just as certain professions have higher premiums and if you live in a particular postcode (Bradford, Oldham anyone ?) then you too will have increased premiums. Again this is simple business - you charge more for those who cost you more.

I do though accept that in the past some ( though not all) Insurers have been guilty of selling data to Accident Management Companies, but thankfully the Government has now responded to this and has banned referral fees so this practice will die out, though not quickly enough. However, that only applies to Motor claims and does not affect the field of insurance I work in, namely EL/PL.

Google fibromyalgia, complex regional syndrome and such like - then tell me how a syndrome where their are no organic reasons as to the alleged trauma the Claimant is suffering from (and where the medical fraternity agree no such trauma should exist) is the latest cash cow for the feckless of Society. Utter madness.

Think I now know why LoonR1 refuses to become embroiled in this topic anymore, people's understanding - whilst no doubt genuinely felt - doesn't really stand up to simple sctutiny. Hey hum.

flibbage0 said:

I just don't follow the premise, regarding buying a diesel barge or any barge at all.

I've tried this so called trick and it just gave me silly quotes of £2k+ whilst fiestas and corsas were under £1k.

I think if you can get the right car it works but you have to get just the right car, I just tried it with some made up detailsI've tried this so called trick and it just gave me silly quotes of £2k+ whilst fiestas and corsas were under £1k.

2014 Ford Fiesta Centura, 1242CC - £1774

2014 Ford Mondeo Edge (120), 1596CC - £2333

Trying older

1998 Ford Mondeo Ghia X 16V, 1989CC Petrol, Estate - £4932 (black box), £5304 without.

Then out of curiosity tried my car, £5532 with a black box, £6531 without!

Afromonk said:

Looking around for insurance for mates and family i've always found that hatchbacks tend to be more expensive to insure that it would seem.

I've often found that cars such as old mondeos, saabs or volvos tend to have much lower premiums.

Adding to this and the other comments about barges - I had a Pug 405 1.6 as (basically) my second car and that was cheap to insure in comparison to working my way up the normal hatch hierarchy from the previous Fiesta. Admittedly this was 18-19 years ago (I've often found that cars such as old mondeos, saabs or volvos tend to have much lower premiums.

)

)The downside that I found was that I ended up ferrying everyone everywhere by defauly of having the biggest and most comfy car ...

Collectingbrass said:

You really do have to wonder what has changed. 25 years ago I bought my first car, a 2.0 Capri. It cost me 4 weeks wages as a student engineer, and TPFT insurance also cost 4 weeks wages.

As a slight counterpoint to this I insured my first car (a Nova saloon!) when I was 18 which was 21 years ago. Fully comp with Direct Line and it cost me almost £1000 for a years premium. (Which turned out to be worth it when I wrote it off a few months later and they paid me £1200 for it!

)

) Mr Daytona said:

As for the earlier question regarding increases for young drivers, I would have thought the answer was obvious. For the avoidance of future doubt, they proportionally make more claims than older drivers and accordingly their premiums are higher. Just as certain professions have higher premiums and if you live in a particular postcode (Bradford, Oldham anyone ?) then you too will have increased premiums. Again this is simple business - you charge more for those who cost you more.

I completely understand why certain groups of drivers face higher, or lower, premiums than others based on claims history of the general population and where the risk factors for that group fit on that curve. What I still fail to understand, and what you have not answered, is what has changed in 20 years that means the equivalent premiums for the same young driver group, who present the same / not vastly different risks and claims incidence as they did 20 years ago are now facing premiums 50 to a 100 times greater in comparison to the norm than they did 20 years ago. This cannot be due to the greater number of vehicles around, a change in the PI claims culture, the rise in vehicle crime or other society wide changes as this has lifted premiums for all, so what is it due to?Collectingbrass said:

Mr Daytona said:

Nicky86, really ? Do you really believe that, or is it something else that you've heard down the pub ? Any evidence to back up your wild observations ?

You may not accept this, but most Insurers actually make a loss on the Motor Policies they underwrite - it's only what they do with those premiums by way of investments that actually earns them a profit - though profit in the Motor market has been hard to come by for the past 10 to 15 years.

I don't buy that argument at all. Their investments would have to be outperforming the market so much to provide a return on investment ahead of the loss leaders that you have to question why would they continue to loose money for FIFTEEN years on a loss leader when they could just sit back and reap the additional cash off the investments no longer funding losses. I know no other business that would accept consistent losses like that.You may not accept this, but most Insurers actually make a loss on the Motor Policies they underwrite - it's only what they do with those premiums by way of investments that actually earns them a profit - though profit in the Motor market has been hard to come by for the past 10 to 15 years.

Re: earlier questions on the subject matter :

A) Insurance premiums for young drivers haven't increased 50 to a 100 times more in the past 20 years. If we assume an average years premium of £2000 today, that would equate to only a premium of £20 to £40 a year back in 1994. Whilst my memory might be failing me in my dotage, I seem to remember paying that for a Pug 205 every month on direct debit. The simple fact of the matter is that if young drivers didn't cause so many accidents - particularly with 4 "promising young footballers" as passengers, their premiums wouldn't be so high.

B) As for Motor Insurers making a loss on premiums in v payments out, I didn't say all Insurers routinely make a loss. Some will identity a niche in the market, take advantage of that for a year or two and then when their exposure deteriorates, they either pull out of that niche or raise premiums to cover their projected liabilities. Don't also rule out the potential for cross selling different Insurance policies to their Clients, be it property, life, business cover etc etc.

At first blush it does appear that young drivers pay too much, but the alternative would be safer drivers, ie those who are older, pay more themselves to cover the additional costs that the young inevitably cause. Would you be prepared to do that ? For my part, I don't consider it a God given right to own and drive a car and if any particular section of Society can't afford the costs, be it Insurance, petrol or routine servicing, then the answer is you don't drive.

A) Insurance premiums for young drivers haven't increased 50 to a 100 times more in the past 20 years. If we assume an average years premium of £2000 today, that would equate to only a premium of £20 to £40 a year back in 1994. Whilst my memory might be failing me in my dotage, I seem to remember paying that for a Pug 205 every month on direct debit. The simple fact of the matter is that if young drivers didn't cause so many accidents - particularly with 4 "promising young footballers" as passengers, their premiums wouldn't be so high.

B) As for Motor Insurers making a loss on premiums in v payments out, I didn't say all Insurers routinely make a loss. Some will identity a niche in the market, take advantage of that for a year or two and then when their exposure deteriorates, they either pull out of that niche or raise premiums to cover their projected liabilities. Don't also rule out the potential for cross selling different Insurance policies to their Clients, be it property, life, business cover etc etc.

At first blush it does appear that young drivers pay too much, but the alternative would be safer drivers, ie those who are older, pay more themselves to cover the additional costs that the young inevitably cause. Would you be prepared to do that ? For my part, I don't consider it a God given right to own and drive a car and if any particular section of Society can't afford the costs, be it Insurance, petrol or routine servicing, then the answer is you don't drive.

To reply to the OP you probably are not doing anything wrong but as others have said the cost is not really related to the value of the car you want to insure.

If you want to avoid telematics try to find a good local insurance broker - I did just that earlier this year when my website/call centre only intermediary proved to be absolutely useless.

To Mr Daytona I sympathise in relation to the grief you are receiving - I spent over 30 years handling insurance claims until a few years ago when I was able to take early retirement and escape! Saying that I managed to get away from Motor claims about 20 years ago.

I would have to agree that premiums are not 20+ times what they were in the past. My first car was a 9 year old 1500cc Cortina Mk2 and it cost me 3 to 4 weeks pay to insure it. 3 to 4 weeks of the minimum wage is £800 to £900 (3 to 4 weeks of the national average is about £2,000) and I doubt there is a car made in the last decade with worse dynamics and performance than my old Cortina.

I would also be amazed if the average level of compensation had not increased at a greater rate than the average premium.

The other thing most people don't appreciate is that motor insurers have to fund claims from those injured by uninsured/untraced motorists through the Motor Insurers Bureau and I expect that burden is only heading upwards - that is why we should probably adopt the system used in other places in the EU and display insurance discs instead of the soon to be redundant tax disc. If I get run over I want to know who insures the car, I don't give a flying f k whether it is taxed!

k whether it is taxed!

I'll probably get some grief as well now but I thought maybe some support would help.

If you want to avoid telematics try to find a good local insurance broker - I did just that earlier this year when my website/call centre only intermediary proved to be absolutely useless.

To Mr Daytona I sympathise in relation to the grief you are receiving - I spent over 30 years handling insurance claims until a few years ago when I was able to take early retirement and escape! Saying that I managed to get away from Motor claims about 20 years ago.

I would have to agree that premiums are not 20+ times what they were in the past. My first car was a 9 year old 1500cc Cortina Mk2 and it cost me 3 to 4 weeks pay to insure it. 3 to 4 weeks of the minimum wage is £800 to £900 (3 to 4 weeks of the national average is about £2,000) and I doubt there is a car made in the last decade with worse dynamics and performance than my old Cortina.

I would also be amazed if the average level of compensation had not increased at a greater rate than the average premium.

The other thing most people don't appreciate is that motor insurers have to fund claims from those injured by uninsured/untraced motorists through the Motor Insurers Bureau and I expect that burden is only heading upwards - that is why we should probably adopt the system used in other places in the EU and display insurance discs instead of the soon to be redundant tax disc. If I get run over I want to know who insures the car, I don't give a flying f

k whether it is taxed!

k whether it is taxed!I'll probably get some grief as well now but I thought maybe some support would help.

Mr Tidy, thanks for the support - very much appreciated. Have to say that whenever I'm out and about and someone asks what I do for a living, I invariably reply I'm either a Banker or an Estate Agent - even they aren't as universally disliked as someone who works in Insurance. Lol. You do get thick skinned though, comes with the territory.

Or perhaps I can easily get away with pretending to be an Estate Agent/Banker as Im such a shallow, pretentious git !! If only I earned what they earn.

Highly envious of you retiring as well, have at least 20 years + to go before that. Till then, I'll try and continue to fight the good fight and will never, ever go back to the Claimant side of the fence. Lol

Or perhaps I can easily get away with pretending to be an Estate Agent/Banker as Im such a shallow, pretentious git !! If only I earned what they earn.

Highly envious of you retiring as well, have at least 20 years + to go before that. Till then, I'll try and continue to fight the good fight and will never, ever go back to the Claimant side of the fence. Lol

Mr Tidy said:

The other thing most people don't appreciate is that motor insurers have to fund claims from those injured by uninsured/untraced motorists through the Motor Insurers Bureau

...

If I get run over I want to know who insures the car, I don't give a flying f k whether it is taxed!

k whether it is taxed!

If its going to get paid out anyway, it hardly matters who done it does it?...

If I get run over I want to know who insures the car, I don't give a flying f

k whether it is taxed!

k whether it is taxed!coppice said:

One of the few compensations for being the same age as Nelson Piquet is that I get change out of £500 for insuring an R400 Seven and the daily driver Yeti. Eat your heart out young people...(but I'd still trade some years back even if the insurance went up )

The way it works never ceases to surprise me. I just sold a classic insured for 1,000 miles p.a £30k value with a policy that cost £250-. I transferred the policy to another car, same model but modified, older, 3,000 miles and £50k value. They gave me £50- back.

SS7

Mr Tidy said:

The other thing most people don't appreciate is that motor insurers have to fund claims from those injured by uninsured/untraced motorists through the Motor Insurers Bureau and I expect that burden is only heading upwards

This years levy call by MIB is £247m. It's actually reduced in recent years but is likely to go up next year.As to why insurance is so expensive... It takes an awful lot of £500s to cover the cost of a claim where all 4 members of a family need care for the rest of their lives, which can be 8 figures.

Gassing Station | General Gassing | Top of Page | What's New | My Stuff