What % of NET monthly salary do you spend on your car

Discussion

Artey said:

a) in the grand scheme of things your parents are an exception and should be applauded for being prudent and having savings

b) you selectively read my first post and chose what was needed to come back waving your willy showing off how well off your parents are - which again is a genuinely great thing

c) the issue is not that everyone is like your parents, quite otherwise and this is what my post was about. You might want to reread it and perhaps understand that what I'm saying is that if everyone was like your parents leasing, borrowing, debt wouldn't be an issue. What's happening now is opposite to that. On a scale that is going to f k everyone over including people like your parents.

k everyone over including people like your parents.

This precisely. b) you selectively read my first post and chose what was needed to come back waving your willy showing off how well off your parents are - which again is a genuinely great thing

c) the issue is not that everyone is like your parents, quite otherwise and this is what my post was about. You might want to reread it and perhaps understand that what I'm saying is that if everyone was like your parents leasing, borrowing, debt wouldn't be an issue. What's happening now is opposite to that. On a scale that is going to f

k everyone over including people like your parents.

k everyone over including people like your parents.Well said Artey.

Its not about what is right for the individual its about the dangers to the economy (both UK and global) of the "have now pay later but don't have anything put away" mentality that is very common in modern society.

To see how quickly it can go wrong I suggest people watch the movie "The Big Short". A great story about how a simple idea became a global recession. The scary thing is its still happening.

As for what people buy and whether they are buying for status or not I couldn't give a rats RS. These days I'm comfortable enough with myself to not care what others have and not care what others think I have.

If anyone reading this has enough financial prudence to not be like that kudos to them as I believe they are in the minority.

lostkiwi said:

This precisely.

Well said Artey.

Its not about what is right for the individual its about the dangers to the economy (both UK and global) of the "have now pay later but don't have anything put away" mentality that is very common in modern society.

To see how quickly it can go wrong I suggest people watch the movie "The Big Short". A great story about how a simple idea became a global recession. The scary thing is its still happening.

As for what people buy and whether they are buying for status or not I couldn't give a rats RS. These days I'm comfortable enough with myself to not care what others have and not care what others think I have.

If anyone reading this has enough financial prudence to not be like that kudos to them as I believe they are in the minority.

I could accept all this as a viewpoint if you hadnt previously told us you currently have a car on PCP?Well said Artey.

Its not about what is right for the individual its about the dangers to the economy (both UK and global) of the "have now pay later but don't have anything put away" mentality that is very common in modern society.

To see how quickly it can go wrong I suggest people watch the movie "The Big Short". A great story about how a simple idea became a global recession. The scary thing is its still happening.

As for what people buy and whether they are buying for status or not I couldn't give a rats RS. These days I'm comfortable enough with myself to not care what others have and not care what others think I have.

If anyone reading this has enough financial prudence to not be like that kudos to them as I believe they are in the minority.

Its ok for you then, but everyone else is living beyond their means doing it?

otolith said:

MrBarry123 said:

Anyone who purchases a £40k+ car on a lease is paying a considerable monthly figure and therefore a) need a good credit history to secure the finance and b) need to be paid a good well to afford the repayments.

And (c) would end up driving something broadly similar if they were in the habit of saving up for cars.A 48 month PCP on a BMW M4 is around £650 (with a 10%) deposit. In order to buy a similar car, you'd need to save the best part of £60k which would take approximately 8 years to save if you were saving the £650 per month.

Let's clear some things up shall we:

1) Leasing is not the root of all evil. But it can be problematic.

2) What happens within the capital markets goes thus:

-Consumers borrow money to buy stuff. Houses, cars, TVs, holidays whatever they want to spend/waste their money on.

-Often these debts sit within the consumer finance arms of the car manufacturers if it is car finance, often the debts are packaged up (either as secured or unsecured debt) and sold on, commonly via what are known as Special Purpose Vehicles (SPVs). These debt is then bought by someone who wants an income stream: pension funds, the broader financial community, whoever.

-These debts are often packaged accordingly to level of security - ie all of the hairy chested company directors together, all of the lower income groups together. Financial alchemy was believed to be blending all types together so that even if a few of the risker types defaulted it would not have a material impact on the income stream if each parcel of debt had a diverse social economic make up

-Accordingly, people make money selling debt and packing and reselling. Thus they are incentivised to feed the machine by lending more and more.

-In theory, people should be able to borrow what they feel is right. However, people are imperfect economic decision makers and often borrow too much.

-This is what happened with the sub prime crisis - lots of debtors borrow to much and fail to repay, the value of the secured asset plummets and the debt income stream is slashed and thus the value must be written down on a mark-to-market basis.

The risk today is that currently most car finance is not yet currently packaged and sold and this sits within the manufacturers finance divisions.

Ergo, should there be another short term economic shock (lets say, erm, like Brexit) and people suddenly find themselves with less money as the basic cost of living going up, they suddenly want to hand back their leased vehicles. Thus the car manufacturers find themselves with loads of cars and no one to buy them.

At this point leasing starts to look unwise but not before then whilst it continues to serve as a useful economic tool to grease the wheels of the manufacturing economy

1) Leasing is not the root of all evil. But it can be problematic.

2) What happens within the capital markets goes thus:

-Consumers borrow money to buy stuff. Houses, cars, TVs, holidays whatever they want to spend/waste their money on.

-Often these debts sit within the consumer finance arms of the car manufacturers if it is car finance, often the debts are packaged up (either as secured or unsecured debt) and sold on, commonly via what are known as Special Purpose Vehicles (SPVs). These debt is then bought by someone who wants an income stream: pension funds, the broader financial community, whoever.

-These debts are often packaged accordingly to level of security - ie all of the hairy chested company directors together, all of the lower income groups together. Financial alchemy was believed to be blending all types together so that even if a few of the risker types defaulted it would not have a material impact on the income stream if each parcel of debt had a diverse social economic make up

-Accordingly, people make money selling debt and packing and reselling. Thus they are incentivised to feed the machine by lending more and more.

-In theory, people should be able to borrow what they feel is right. However, people are imperfect economic decision makers and often borrow too much.

-This is what happened with the sub prime crisis - lots of debtors borrow to much and fail to repay, the value of the secured asset plummets and the debt income stream is slashed and thus the value must be written down on a mark-to-market basis.

The risk today is that currently most car finance is not yet currently packaged and sold and this sits within the manufacturers finance divisions.

Ergo, should there be another short term economic shock (lets say, erm, like Brexit) and people suddenly find themselves with less money as the basic cost of living going up, they suddenly want to hand back their leased vehicles. Thus the car manufacturers find themselves with loads of cars and no one to buy them.

At this point leasing starts to look unwise but not before then whilst it continues to serve as a useful economic tool to grease the wheels of the manufacturing economy

CS Garth said:

Let's clear some things up shall we:

1) Leasing is not the root of all evil. But it can be problematic.

2) What happens within the capital markets goes thus:

-Consumers borrow money to buy stuff. Houses, cars, TVs, holidays whatever they want to spend/waste their money on.

-Often these debts sit within the consumer finance arms of the car manufacturers if it is car finance, often the debts are packaged up (either as secured or unsecured debt) and sold on, commonly via what are known as Special Purpose Vehicles (SPVs). These debt is then bought by someone who wants an income stream: pension funds, the broader financial community, whoever.

-These debts are often packaged accordingly to level of security - ie all of the hairy chested company directors together, all of the lower income groups together. Financial alchemy was believed to be blending all types together so that even if a few of the risker types defaulted it would not have a material impact on the income stream if each parcel of debt had a diverse social economic make up

-Accordingly, people make money selling debt and packing and reselling. Thus they are incentivised to feed the machine by lending more and more.

-In theory, people should be able to borrow what they feel is right. However, people are imperfect economic decision makers and often borrow too much.

-This is what happened with the sub prime crisis - lots of debtors borrow to much and fail to repay, the value of the secured asset plummets and the debt income stream is slashed and thus the value must be written down on a mark-to-market basis.

The risk today is that currently most car finance is not yet currently packaged and sold and this sits within the manufacturers finance divisions.

Ergo, should there be another short term economic shock (lets say, erm, like Brexit) and people suddenly find themselves with less money as the basic cost of living going up, they suddenly want to hand back their leased vehicles. Thus the car manufacturers find themselves with loads of cars and no one to buy them.

At this point leasing starts to look unwise but not before then whilst it continues to serve as a useful economic tool to grease the wheels of the manufacturing economy

So basically if exit the European Union we are f1) Leasing is not the root of all evil. But it can be problematic.

2) What happens within the capital markets goes thus:

-Consumers borrow money to buy stuff. Houses, cars, TVs, holidays whatever they want to spend/waste their money on.

-Often these debts sit within the consumer finance arms of the car manufacturers if it is car finance, often the debts are packaged up (either as secured or unsecured debt) and sold on, commonly via what are known as Special Purpose Vehicles (SPVs). These debt is then bought by someone who wants an income stream: pension funds, the broader financial community, whoever.

-These debts are often packaged accordingly to level of security - ie all of the hairy chested company directors together, all of the lower income groups together. Financial alchemy was believed to be blending all types together so that even if a few of the risker types defaulted it would not have a material impact on the income stream if each parcel of debt had a diverse social economic make up

-Accordingly, people make money selling debt and packing and reselling. Thus they are incentivised to feed the machine by lending more and more.

-In theory, people should be able to borrow what they feel is right. However, people are imperfect economic decision makers and often borrow too much.

-This is what happened with the sub prime crisis - lots of debtors borrow to much and fail to repay, the value of the secured asset plummets and the debt income stream is slashed and thus the value must be written down on a mark-to-market basis.

The risk today is that currently most car finance is not yet currently packaged and sold and this sits within the manufacturers finance divisions.

Ergo, should there be another short term economic shock (lets say, erm, like Brexit) and people suddenly find themselves with less money as the basic cost of living going up, they suddenly want to hand back their leased vehicles. Thus the car manufacturers find themselves with loads of cars and no one to buy them.

At this point leasing starts to look unwise but not before then whilst it continues to serve as a useful economic tool to grease the wheels of the manufacturing economy

ked.

ked.MrBarry123 said:

I wonder if a large proportion of those who bash leasing are jealous because they couldn't afford the monthly repayments on a nice car?

Anyone who purchases a £40k+ car on a lease is paying a considerable monthly figure and therefore a) need a good credit history to secure the finance and b) need to be paid a good well to afford the repayments.

I don't even think that's always the major issue. Buy i understand your point and i see what you're getting at completely.Anyone who purchases a £40k+ car on a lease is paying a considerable monthly figure and therefore a) need a good credit history to secure the finance and b) need to be paid a good well to afford the repayments.

For me, people that take a dig at others for leasing come out with the usual "yeah but you don't own the car". Obviously, these are people that know nothing about cars. As if they don't already know that? I'm sure if a swift response of "Why do i need to own a car?" would happen then they would literally stand there in their tracks with nothing to say.

None-car people are the issue for me. Most probably would lease/finace if they would just climb out of their cave for 5 mins and see it's not all about buying s

tty old snotters for a very small amount of cash and then winge every 5 mins when it breaks and costs a fortune. Just to make a point that they own their car.

tty old snotters for a very small amount of cash and then winge every 5 mins when it breaks and costs a fortune. Just to make a point that they own their car.Buy whatever car you want however you want. There's pros and cons to each. Do whatever's best for you. Simple.

daemon said:

lostkiwi said:

This precisely.

Well said Artey.

Its not about what is right for the individual its about the dangers to the economy (both UK and global) of the "have now pay later but don't have anything put away" mentality that is very common in modern society.

To see how quickly it can go wrong I suggest people watch the movie "The Big Short". A great story about how a simple idea became a global recession. The scary thing is its still happening.

As for what people buy and whether they are buying for status or not I couldn't give a rats RS. These days I'm comfortable enough with myself to not care what others have and not care what others think I have.

If anyone reading this has enough financial prudence to not be like that kudos to them as I believe they are in the minority.

I could accept all this as a viewpoint if you hadnt previously told us you currently have a car on PCP?Well said Artey.

Its not about what is right for the individual its about the dangers to the economy (both UK and global) of the "have now pay later but don't have anything put away" mentality that is very common in modern society.

To see how quickly it can go wrong I suggest people watch the movie "The Big Short". A great story about how a simple idea became a global recession. The scary thing is its still happening.

As for what people buy and whether they are buying for status or not I couldn't give a rats RS. These days I'm comfortable enough with myself to not care what others have and not care what others think I have.

If anyone reading this has enough financial prudence to not be like that kudos to them as I believe they are in the minority.

Its ok for you then, but everyone else is living beyond their means doing it?

We are fortunate enough to have sufficient put away that we could live for 4-5 years with no other income if we had to without missing a payment on either the car (which would be at the end of term next year) or the mortgage or household bills. Next year we will have an investment mature extending that by another year and the year after another maturing for a further year extension.

Sadly that is not the case with much of the population. Those are the ones who have PCPs and leases that could be defaulted on in the event of a major recession. A significant proportion of the UK population live from payday to payday and those in that group with leases are a danger should a recession come.

Artey said:

Likewise but let me be a good boy that I am, I do like to help a misguided brother in need. Any ideas what happened in 2008?

I'm not sure I agree with the point you're trying to make.

Whilst still growing, China's economic growth has slowed as it struggles with a transition from an economy based almost solely on industry/production to an economy that needs consumers to spend their money (mainly because the population are prolific savers). Fortunately it still has vast production capability, hence the significant economic growth figures still being seen.

To suggest that a good idea would be for people to stop spending their disposal income and instead save it is ill-advised.

lostkiwi said:

Sadly that is not the case with much of the population. Those are the ones who have PCPs and leases that could be defaulted on in the event of a major recession. A significant proportion of the UK population live from payday to payday and those in that group with leases are a danger should a recession come.

You've taken a group who you believe live payday to payday AND then concluded a significant percentage of those people lease or PCP?And whats the risk if they've already got a job? That they're going to be made redundant?

Lets add all those ANDS together then

Percentage of people who live one pay packet to next AND who have leased a car AND who still in that position when the next recession comes around AND are in a company that decides to make cutbacks AND who are made redundant AND who cant make cutbacks anywhere else AND who dont get a redundancy amount enough to see them through AND who havent got family who could help with a couple of payments AND who cant find another job AND who have to return the car??

Seems you're fretting about a very precise set of circumstances for what would be in percentage terms a small amount of people?

And your biggest assumption is that people who lease are people who other live hand to mouth each month? Thats the BIGGEST weakness in your argument.

As said I have no problem with people renting. It adds great stock to the used market.

However it is interesting to see the monthly rental costs justified by stating how much you would need to save to buy a new one outright. Yet no one NEEDS to buy brand new. Most of the cars I've bought have been totally mint and close to driving a new example. Yet all have cost an absolute fraction of the price. My current example had low teen miles, full warranty, under half price. Yet as a cash buyer made some sense. I could sell for close to what I paid. With a private plate no one is wiser, even those obsessed by such things as image. Yes this is a new v barely used example. So shoot me.

I'm just saying there are options. But I am so glad people rent!

However it is interesting to see the monthly rental costs justified by stating how much you would need to save to buy a new one outright. Yet no one NEEDS to buy brand new. Most of the cars I've bought have been totally mint and close to driving a new example. Yet all have cost an absolute fraction of the price. My current example had low teen miles, full warranty, under half price. Yet as a cash buyer made some sense. I could sell for close to what I paid. With a private plate no one is wiser, even those obsessed by such things as image. Yes this is a new v barely used example. So shoot me.

I'm just saying there are options. But I am so glad people rent!

MrBarry123 said:

otolith said:

MrBarry123 said:

Anyone who purchases a £40k+ car on a lease is paying a considerable monthly figure and therefore a) need a good credit history to secure the finance and b) need to be paid a good well to afford the repayments.

And (c) would end up driving something broadly similar if they were in the habit of saving up for cars.A 48 month PCP on a BMW M4 is around £650 (with a 10%) deposit. In order to buy a similar car, you'd need to save the best part of £60k which would take approximately 8 years to save if you were saving the £650 per month.

k-ink said:

As said I have no problem with people renting. It adds great stock to the used market.

Agreed.k-ink said:

However it is interesting to see the monthly rental costs justified by stating how much you would need to save to buy a new one outright.

By ONE person so far??k-ink said:

Yet no one NEEDS to buy brand new. Most of the cars I've bought have been totally mint and close to driving a new example. Yet all have cost an absolute fraction of the price. My current example had low teen miles, full warranty, under half price. Yet as a cash buyer made some sense. I could sell for close to what I paid. With a private plate no one is wiser, even those obsessed by such things as image. Yes this is a new v barely used example. So shoot me.

I'm just saying there are options. But I am so glad people rent!

Yes. Absolutely. However some people prefer a simple monthly payment to cover their depreciation, maintenance, repairs, interest and in the case of leasing Tax. If someone can lease a new VW Up! for £99 a month, that may well make more sense to them than running some old banger thats previously been costing them a fortune in unexpected bills, mot, days off work, etc, etc.I'm just saying there are options. But I am so glad people rent!

It may well work out more expensive for them - in monthly payment terms - to make a commitment to buy one through an HP agreement compared to leasing one

Whilst subjectively your particular purchase may well work for you, objectively, it may not work for others.

Edited by daemon on Thursday 5th May 13:39

daemon said:

Artey said:

iphonedyou said:

About the level of response I was expecting, to be honest.

Likewise but let me be a good boy that I am, I do like to help a misguided brother in need. Any ideas what happened in 2008?

Any form of household debt past a certain level poses a risk to the economy. If people don't have debt (from buying stuff on any form of credit be it leases/PCPs/credit cards/loans etc) then they usually end up saving more.

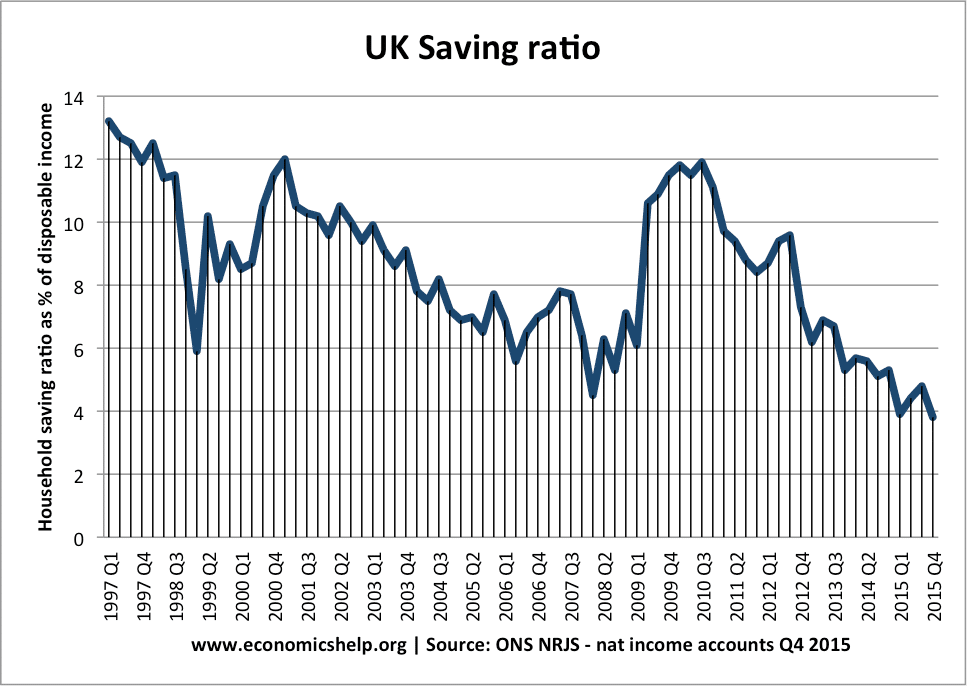

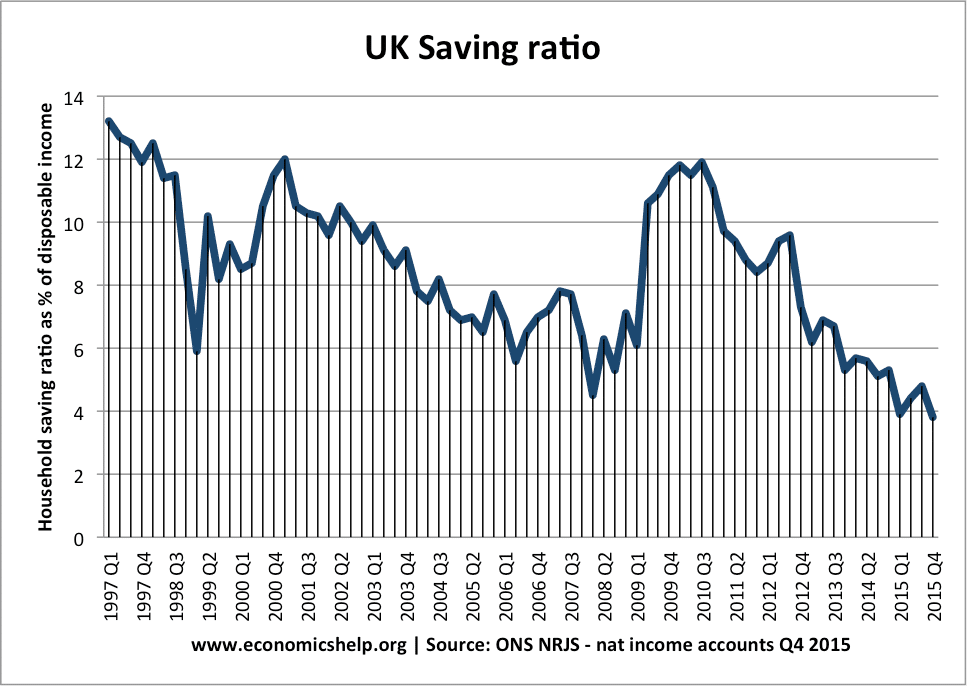

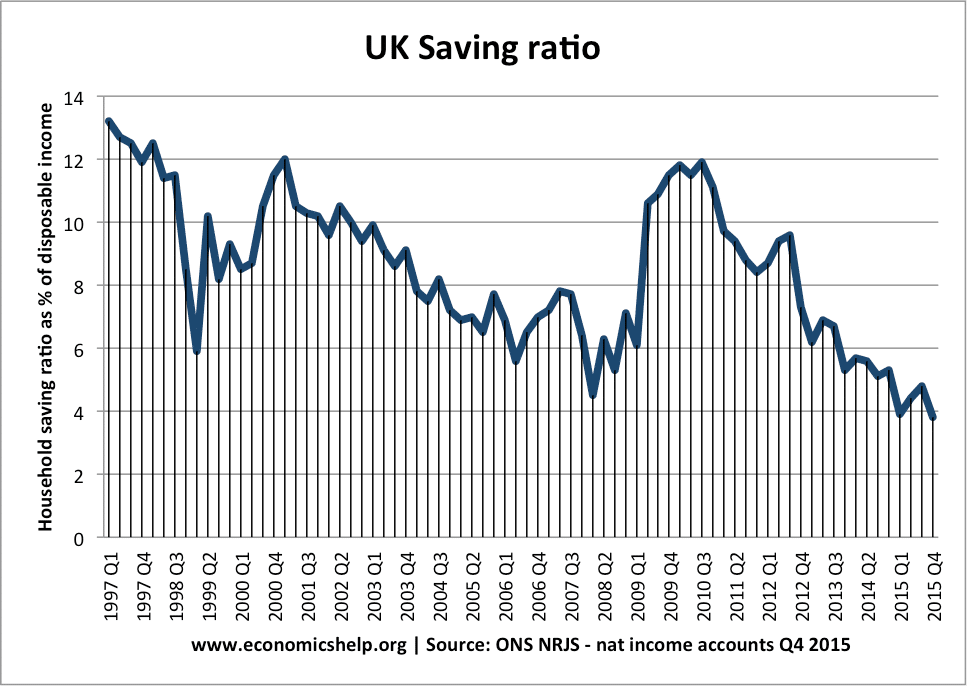

Seeing the household savings ratio dropping like that graph is a fairly good indicator that private household debt is increasing. The biggest single debts for many households are mortgages and cars. If a serious recession were to limit household income which do you think most people would default on if money were that tight?

Its really not difficult to understand if you try hard enough.

Gassing Station | General Gassing | Top of Page | What's New | My Stuff