The PCP deals and Q&A thread

Discussion

ThunderSpook said:

Following on from a conversation at work, this seems as good a place as any to ask.

Do people really not balk at the idea of paying £3-400 a month or more for a car and not having anything to show for it at the end? I just don't understand it.

I used to think this was madness as well. But in reality I now think it's a bit of a red herring. Do people really not balk at the idea of paying £3-400 a month or more for a car and not having anything to show for it at the end? I just don't understand it.

The way I see it is this:

If you bought the same car new with cash, owned it for 2 years then sold it for cash and lost £7,200 in depreciation. You would also have spent the equivalent of £300 a month, and you also don't have the car any more.

The difference being that you had to have the cash ready to buy in the first place, and that money was tied up in the vehicle over those two years. Both of which are issues you would avoid with PCP.

Can someone confirm I've got that right? I'm another one of the noobs in this thread that have never actually had a PCP or lease deal myself.

Edited by JordanTurbo on Thursday 2nd June 21:25

ThunderSpook said:

Following on from a conversation at work, this seems as good a place as any to ask.

Do people really not balk at the idea of paying £3-400 a month or more for a car and not having anything to show for it at the end? I just don't understand it.

The conversation you are really having is why do people buy new cars. A new car obtained via lease, pcp or cash will lose you money in depreciation.Do people really not balk at the idea of paying £3-400 a month or more for a car and not having anything to show for it at the end? I just don't understand it.

The good point about leasing or pcp is you know exactly how much you are going to lose

chrispmartha said:

ThunderSpook said:

Following on from a conversation at work, this seems as good a place as any to ask.

Do people really not balk at the idea of paying £3-400 a month or more for a car and not having anything to show for it at the end? I just don't understand it.

The conversation you are really having is why do people buy new cars. A new car obtained via lease, pcp or cash will lose you money in depreciation.Do people really not balk at the idea of paying £3-400 a month or more for a car and not having anything to show for it at the end? I just don't understand it.

The good point about leasing or pcp is you know exactly how much you are going to lose

Seems to be around £5k less on a £16k brand new car with 10k miles on it.

Downward said:

chrispmartha said:

ThunderSpook said:

Following on from a conversation at work, this seems as good a place as any to ask.

Do people really not balk at the idea of paying £3-400 a month or more for a car and not having anything to show for it at the end? I just don't understand it.

The conversation you are really having is why do people buy new cars. A new car obtained via lease, pcp or cash will lose you money in depreciation.Do people really not balk at the idea of paying £3-400 a month or more for a car and not having anything to show for it at the end? I just don't understand it.

The good point about leasing or pcp is you know exactly how much you are going to lose

Seems to be around £5k less on a £16k brand new car with 10k miles on it.

But i suppose it all depends on what deals are about.

My lease is up soon and im torn between pcp on a second hand car or a leasing brand new at the mo.

If you bank with Halifax they do good PCP rates!

JordanTurbo said:

ThunderSpook said:

Following on from a conversation at work, this seems as good a place as any to ask.

Do people really not balk at the idea of paying £3-400 a month or more for a car and not having anything to show for it at the end? I just don't understand it.

I used to think this was madness as well. But in reality I now think it's a bit of a red herring. Do people really not balk at the idea of paying £3-400 a month or more for a car and not having anything to show for it at the end? I just don't understand it.

The way I see it is this:

If you bought the same car new with cash, owned it for 2 years then sold it for cash and lost £7,200 in depreciation. You would also have spent the equivalent of £300 a month, and you also don't have the car any more.

The difference being that you had to have the cash ready to buy in the first place, and that money was tied up in the vehicle over those two years. Both of which are issues you would avoid with PCP.

Can someone confirm I've got that right? I'm another one of the noobs in this thread that have never actually had a PCP or lease deal myself.

chrispmartha said:

The conversation you are really having is why do people buy new cars. A new car obtained via lease, pcp or cash will lose you money in depreciation.

The good point about leasing or pcp is you know exactly how much you are going to lose

I suppose my lack of understanding probably comes from this constant desire people have to own a new car. Why do people buy new cars only to sell them 2 or 3 years later and buy another new car? Isn't there also this constant worry that because it's not your car then every little scratch and ding could cost you hundreds when you hand the car back?The good point about leasing or pcp is you know exactly how much you are going to lose

I just like the idea that my car is my car and I'm not paying for it every month, don't have to worry about how much I use it and I can sell it whenever I want. I find it strange seeing all these kids in their 20's driving around in M4's.

ThunderSpook said:

Isn't there also this constant worry that because it's not your car then every little scratch and ding could cost you hundreds when you hand the car back?

With a lease, yes. With a PCP, no. You'll PX the car 99% of the time and so superficial damage like that doesn't really matter. A lease, you must hand it back and some of the lease companies make most of their cash by charging ridiculous repair rates. Some are very reasonable however.ThunderSpook said:

I just like the idea that my car is my car and I'm not paying for it every month, don't have to worry about how much I use it and I can sell it whenever I want. I find it strange seeing all these kids in their 20's driving around in M4's.

If you save £400 cash every month for 3 years and then go out and buy a £14,400 car, it's the exact same as 'buying' the car and paying £400 a month for 3 years for it. You'll never keep the car forever, so the argument of 'not owning it' when it comes to PCP falls flat. If you buy cash or PCP or even HP, you're going to sell the car at some point most likely. With lease, yes, you will never own it. Your partner may be able to buy it though. But with a PCP deal you can trade in the car after 5 minutes of 'owning' it.ThunderSpook said:

Why do people buy new cars only to sell them 2 or 3 years later and buy another new car? Isn't there also this constant worry that because it's not your car then every little scratch and ding could cost you hundreds when you hand the car back?

In addition to the above post, the other thing is that some people think that once a car is out of warranty it'll break down and constantly need repairs. They're worried about cost, but also inconvenience.Even on routine maintenance, a lot of cars these days need a big (expensive) service at 4yrs, and if that also coincides with needing pads & discs and a set of tyres, then the bill will be hefty.

Add in depreciation and you could likely cover a years' payments on a new one. So they see it as a no-brainer to dump the car and replace with a new one.

Since I don't think it's been covered in the info/debating above, the reason I prefer PCP to lease is the flexibility. If you take a lease at £300pcm on a 3+23, you're paying £7800 regardless - if you then lose your job or have any other financial disaster, tough luck. With a PCP if the worst happens you can simply sell it and pay off the loan (admittedly there will probably be a shortfall/negative equity on most deals for the majority of the term, but for most of the period it should be less than the cost of paying off the remaining lease. With a 3-4 year lease this risk only grows.

Also as someone mentioned above, the constant worry about dings etc on a lease car and how much you will get gouged for, even if you get it fixed they can still say it's not to their standard. With PCP again selling the car (or trading in) with a month to go on the loan will generally give you enough to pay off the loan (plus maybe a bit extra) and you won't get gouged for slight damage, just a sensible price reduction for anything noticeable.

Also as someone mentioned above, the constant worry about dings etc on a lease car and how much you will get gouged for, even if you get it fixed they can still say it's not to their standard. With PCP again selling the car (or trading in) with a month to go on the loan will generally give you enough to pay off the loan (plus maybe a bit extra) and you won't get gouged for slight damage, just a sensible price reduction for anything noticeable.

ThunderSpook said:

I suppose my lack of understanding probably comes from this constant desire people have to own a new car. Why do people buy new cars only to sell them 2 or 3 years later and buy another new car? Isn't there also this constant worry that because it's not your car then every little scratch and ding could cost you hundreds when you hand the car back?

I just like the idea that my car is my car and I'm not paying for it every month, don't have to worry about how much I use it and I can sell it whenever I want. I find it strange seeing all these kids in their 20's driving around in M4's.

Its not a constant 'desire' to own a new car , a lot of people if not most prople see a car as a tool to get about and many get car allowances and mikeage paid for by work so leasing can make the most sense.I just like the idea that my car is my car and I'm not paying for it every month, don't have to worry about how much I use it and I can sell it whenever I want. I find it strange seeing all these kids in their 20's driving around in M4's.

Personally cannot see why i would need or want to 'own' a car that i use for work and general travel.

Cars cost money even second hand ones, theres no right or wrong way to get that car just different ways.

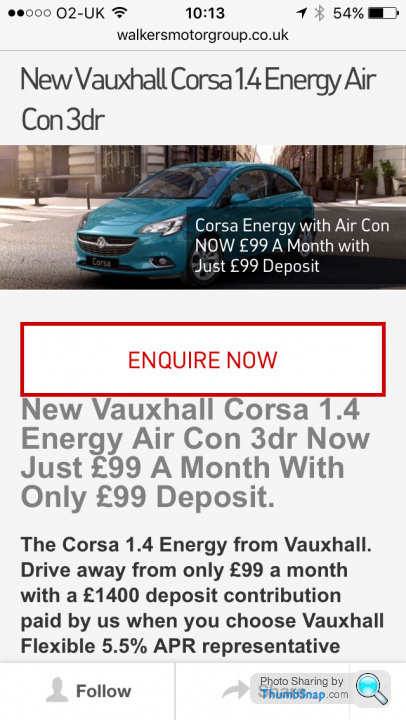

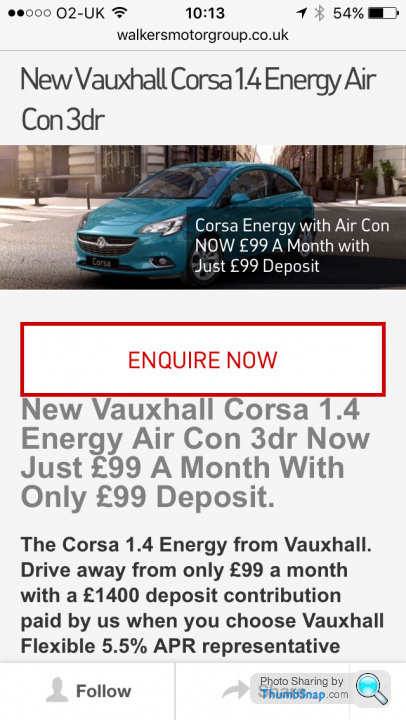

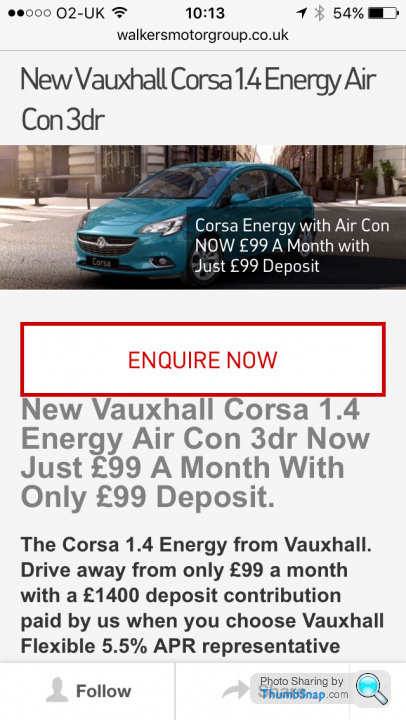

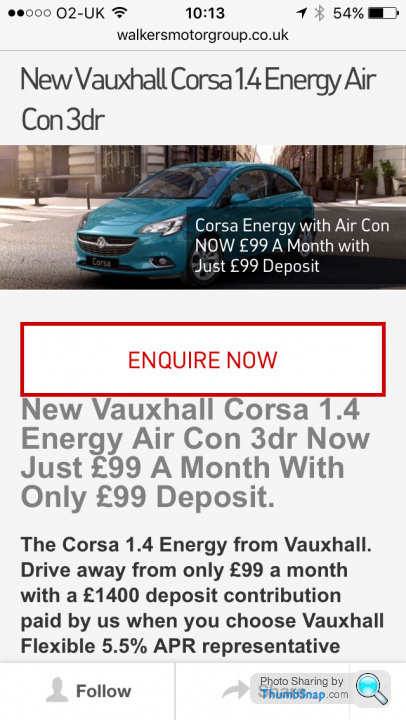

Just to throw a quote in to the discussion of new car leasing/pcp versus buying a used car and keeping it until you hand your licence in.....

Cheaper than a cheap lease, with the flexibility of PCP

http://www.walkersmotorgroup.co.uk/offers/new-car/...

Cheaper than a cheap lease, with the flexibility of PCP

http://www.walkersmotorgroup.co.uk/offers/new-car/...

ThunderSpook said:

Following on from a conversation at work, this seems as good a place as any to ask.

Do people really not balk at the idea of paying £3-400 a month or more for a car and not having anything to show for it at the end? I just don't understand it.

You'd have similar depreciation on a new car anyway?Do people really not balk at the idea of paying £3-400 a month or more for a car and not having anything to show for it at the end? I just don't understand it.

Downward said:

chrispmartha said:

ThunderSpook said:

Following on from a conversation at work, this seems as good a place as any to ask.

Do people really not balk at the idea of paying £3-400 a month or more for a car and not having anything to show for it at the end? I just don't understand it.

The conversation you are really having is why do people buy new cars. A new car obtained via lease, pcp or cash will lose you money in depreciation.Do people really not balk at the idea of paying £3-400 a month or more for a car and not having anything to show for it at the end? I just don't understand it.

The good point about leasing or pcp is you know exactly how much you are going to lose

Seems to be around £5k less on a £16k brand new car with 10k miles on it.

The new car will have a higher residual

There are often subsidised finance rates on new cars

You can get a considerable discount on a new car

There are often manufacturer contributions on new car PCP deals.

Back in 2012 we got a brand new latest model 2.0i Turbo z4 M Sport in black, black leather, comfort pack and 19s (the exact spec we wanted) with a list price of £35K for the same deposit and lower monthly payments than a 6 month old previous engined SE in white with red leather (which we REALLY didnt want) from the same dealer with a forecourt price of £28K.

Sheepshanks said:

ThunderSpook said:

Why do people buy new cars only to sell them 2 or 3 years later and buy another new car? Isn't there also this constant worry that because it's not your car then every little scratch and ding could cost you hundreds when you hand the car back?

In addition to the above post, the other thing is that some people think that once a car is out of warranty it'll break down and constantly need repairs. They're worried about cost, but also inconvenience.Even on routine maintenance, a lot of cars these days need a big (expensive) service at 4yrs, and if that also coincides with needing pads & discs and a set of tyres, then the bill will be hefty.

Add in depreciation and you could likely cover a years' payments on a new one. So they see it as a no-brainer to dump the car and replace with a new one.

Also its more typical now to get a service pack or "free" services wrapped in to your PCP deal, so you dont even have to worry about scheduled costs like servicing.

There is a lot to be said for an "all inclusive" experience.

talksthetorque said:

Just to throw a quote in to the discussion of new car leasing/pcp versus buying a used car and keeping it until you hand your licence in.....

Cheaper than a cheap lease, with the flexibility of PCP

http://www.walkersmotorgroup.co.uk/offers/new-car/...

And thats very appealing to a lot of people.Cheaper than a cheap lease, with the flexibility of PCP

http://www.walkersmotorgroup.co.uk/offers/new-car/...

How many people drive something at > £1000 and then spend a (relative) fortune on MOTs and maintenance and have to change their cars every couple of years because its beyond economical repair anyway?

£99 a month takes all that pain away and probably for similar costs.

rsbmw said:

Since I don't think it's been covered in the info/debating above, the reason I prefer PCP to lease is the flexibility. If you take a lease at £300pcm on a 3+23, you're paying £7800 regardless - if you then lose your job or have any other financial disaster, tough luck. With a PCP if the worst happens you can simply sell it and pay off the loan (admittedly there will probably be a shortfall/negative equity on most deals for the majority of the term, but for most of the period it should be less than the cost of paying off the remaining lease. With a 3-4 year lease this risk only grows.

Also as someone mentioned above, the constant worry about dings etc on a lease car and how much you will get gouged for, even if you get it fixed they can still say it's not to their standard. With PCP again selling the car (or trading in) with a month to go on the loan will generally give you enough to pay off the loan (plus maybe a bit extra) and you won't get gouged for slight damage, just a sensible price reduction for anything noticeable.

The other benefit of PCP deals is that you are covered by the Consumer Credit Act which means once you've paid 50% of the total transaction cost, you can voluntary terminate hand the car back with nothing further to pay.Also as someone mentioned above, the constant worry about dings etc on a lease car and how much you will get gouged for, even if you get it fixed they can still say it's not to their standard. With PCP again selling the car (or trading in) with a month to go on the loan will generally give you enough to pay off the loan (plus maybe a bit extra) and you won't get gouged for slight damage, just a sensible price reduction for anything noticeable.

In fact its even better than that, because you can VT at ANY time and the most they can pursue you for is the difference between what you've paid so far (including deposit) and 50% of the total transaction cost.

daemon said:

The other benefit of PCP deals is that you are covered by the Consumer Credit Act which means once you've paid 50% of the total transaction cost, you can voluntary terminate hand the car back with nothing further to pay.

In fact its even better than that, because you can VT at ANY time and the most they can pursue you for is the difference between what you've paid so far (including deposit) and 50% of the total transaction cost.

But bear in mind that the GMFV is also financed, so it takes longer to get to the 50%.In fact its even better than that, because you can VT at ANY time and the most they can pursue you for is the difference between what you've paid so far (including deposit) and 50% of the total transaction cost.

It's not 50% of the payments excluding the GMFV.

From what I've seen - but I've not studied it or looked for figures - most 3 year GMFVs on mainstream cars for normal mileages are around the 40% mark.

And I think that figure on "premium marques" would be higher.

talksthetorque said:

daemon said:

The other benefit of PCP deals is that you are covered by the Consumer Credit Act which means once you've paid 50% of the total transaction cost, you can voluntary terminate hand the car back with nothing further to pay.

In fact its even better than that, because you can VT at ANY time and the most they can pursue you for is the difference between what you've paid so far (including deposit) and 50% of the total transaction cost.

But bear in mind that the GMFV is also financed, so it takes longer to get to the 50%.In fact its even better than that, because you can VT at ANY time and the most they can pursue you for is the difference between what you've paid so far (including deposit) and 50% of the total transaction cost.

It's not 50% of the payments excluding the GMFV.

From what I've seen - but I've not studied it or looked for figures - most 3 year GMFVs on mainstream cars for normal mileages are around the 40% mark.

And I think that figure on "premium marques" would be higher.

My point was you didnt necessarily - in the context of the scenario whereby you had to "firesale" a PCP'd car - have to worry about paying off the difference between what was owed and what the car was worth, but instead it might be the lesser of two evils to hand the car back depending on where you were relative to 50% paid.

daemon said:

Yes, absolutely. Hence why i said "total transaction cost" and "50% of the payments"

My point was you didnt necessarily - in the context of the scenario whereby you had to "firesale" a PCP'd car - have to worry about paying off the difference between what was owed and what the car was worth, but instead it might be the lesser of two evils to hand the car back depending on where you were relative to 50% paid.

Aah, got you. Hadn't thought of it like that.My point was you didnt necessarily - in the context of the scenario whereby you had to "firesale" a PCP'd car - have to worry about paying off the difference between what was owed and what the car was worth, but instead it might be the lesser of two evils to hand the car back depending on where you were relative to 50% paid.

For comparison, the figure I hear banded about for finishing leases early ( if on target with mileage) is around 50% of remaining payments. What amount they'd chase you for if you defaulted, I don't know.

Gassing Station | General Gassing | Top of Page | What's New | My Stuff