GAP insurance pondering

Discussion

I took my policy with Total Loss Gap for my own car,on a PCP, in July.It was the highest level of protection I could find without being the most expensive option.I was advised of this when I phoned their office.I have just taken a policy for the other half's Contract Hire BMW over two years.All they ask for is the monthly payment and the term.It was only £99 with the down payment of up to £3,000 protected.

Any decent car insurance policy will provide you with a new car in the first year.

Gap covers the difference between what your insurance pays and what you owe. I. Pretty sure after a year it won't be anything.

Also, I shop around for my new cars. Recently finding £6000 off the price of a new Golf R. The dealer still insisted I needed GAP, even though he had 2 year old ones on his forecourt for similar to me buying new.

There are instances it's worthwhile but 95 ℅ of the time it's selling you something you don't need

Gap covers the difference between what your insurance pays and what you owe. I. Pretty sure after a year it won't be anything.

Also, I shop around for my new cars. Recently finding £6000 off the price of a new Golf R. The dealer still insisted I needed GAP, even though he had 2 year old ones on his forecourt for similar to me buying new.

There are instances it's worthwhile but 95 ℅ of the time it's selling you something you don't need

slk 32 said:

Parents bought a brand new fully loaded mazda 3 for 23k in 2014

Spool on to 2016 and they are t boned at a junction by a woman in a 15 year old 307.

Third party insurer paid out market value (15k) and GAP paid out just under 9k allowing them to replace with new car

How did your parents owe £2000 more than 2 years previous when they bought it?Spool on to 2016 and they are t boned at a junction by a woman in a 15 year old 307.

Third party insurer paid out market value (15k) and GAP paid out just under 9k allowing them to replace with new car

Mazda 3 are known to depreciation so you were lucky with £15k, because on auto trader you won't pay more than £9k for a 2014 model.

What's the 3rd party insurance? Your entitled to everything back in a non fault claim. It's irrelevant if the person who hits you is only 3rd party insurance, it means your covered.

A case that sticks in my mind is a customer who bought a car from me through sub-prime finance (around 19% flat if memory serves) and 18 months in to it he was t-boned. Insurance company valued the car at £6000 and he still owed the finance company £8500. GAP paid off his outstanding finance straight away so he didn't have to find £2500 to pay off a smashed up car! As someone in the trade GAP is something I always recommend on cars up to 2yrs old

nottyash said:

There are instances it's worthwhile but 95 ? of the time it's selling you something you don't need

well that's pretty much any insurance, it's only "of value" when things go wrong and you make a claimi believe dealers are obligated to offer GAP on new cars by the government, and they earn on it of course

nottyash said:

How did your parents owe £2000 more than 2 years previous when they bought it?

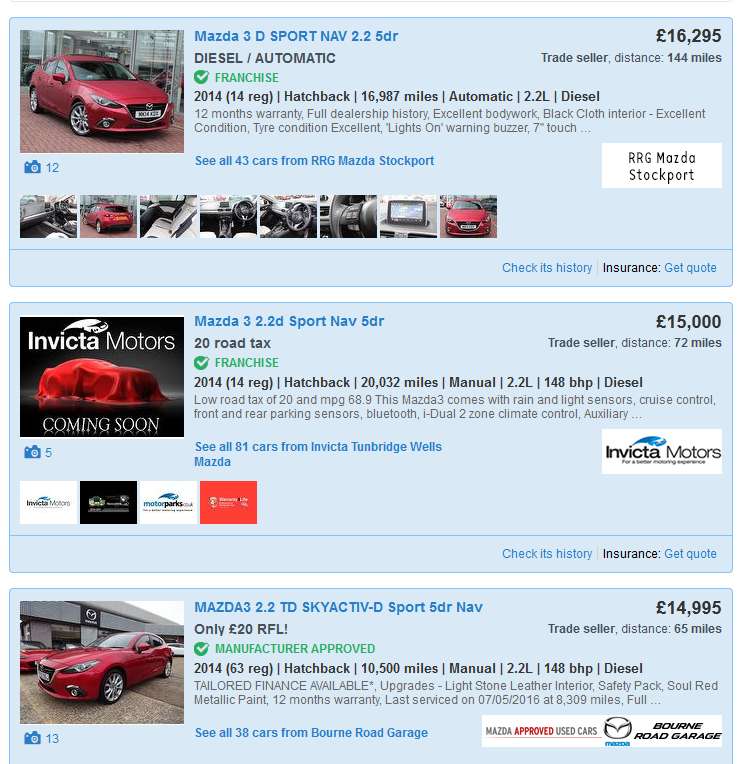

Mazda 3 are known to depreciation so you were lucky with £15k, because on auto trader you won't pay more than £9k for a 2014 model.

What's the 3rd party insurance? Your entitled to everything back in a non fault claim. It's irrelevant if the person who hits you is only 3rd party insurance, it means your covered.

You're confused about Gap insurance. There are many different kinds. Mazda 3 are known to depreciation so you were lucky with £15k, because on auto trader you won't pay more than £9k for a 2014 model.

What's the 3rd party insurance? Your entitled to everything back in a non fault claim. It's irrelevant if the person who hits you is only 3rd party insurance, it means your covered.

Finance Gap (just covers finance shortfall)

Return To Invoice Gap (Would have paid £23K - £15K in this case)

Vehicle Replacement Gap (which poster above obviously had)

nottyash said:

Mazda 3 are known to depreciation so you were lucky with £15k, because on auto trader you won't pay more than £9k for a 2014 model.

I'd guess this happened earlier in the year and 2014 car prices will have dropped since, but even so you're completely wrong. http://www.autotrader.co.uk/car-search?sort=price-...

If you go via a 3rd party (ALA as has been mentioned), it's peanuts for a return to invoice policy and in my mind worth it for peace of mind.

Removes any wrangling over a payout from an insurer, yours or a 3rd party, they'll take care of it till they are both happy and you'll get a new car/purchase price back.

Removes any wrangling over a payout from an insurer, yours or a 3rd party, they'll take care of it till they are both happy and you'll get a new car/purchase price back.

JQ said:

That's only if you claim off your own insurance policy. If your car being written off is the fault of a third party their insurer will only pay you market value.

Uninsured loss recovery?Also I always use an accident management company who fight for every out of pocket expense.

silentbrown said:

nottyash said:

How did your parents owe £2000 more than 2 years previous when they bought it?

Mazda 3 are known to depreciation so you were lucky with £15k, because on auto trader you won't pay more than £9k for a 2014 model.

What's the 3rd party insurance? Your entitled to everything back in a non fault claim. It's irrelevant if the person who hits you is only 3rd party insurance, it means your covered.

You're confused about Gap insurance. There are many different kinds. Mazda 3 are known to depreciation so you were lucky with £15k, because on auto trader you won't pay more than £9k for a 2014 model.

What's the 3rd party insurance? Your entitled to everything back in a non fault claim. It's irrelevant if the person who hits you is only 3rd party insurance, it means your covered.

Finance Gap (just covers finance shortfall)

Return To Invoice Gap (Would have paid £23K - £15K in this case)

Vehicle Replacement Gap (which poster above obviously had)

silentbrown said:

I'd guess this happened earlier in the year and 2014 car prices will have dropped since, but even so you're completely wrong.

http://www.autotrader.co.uk/car-search?sort=price-...

The link is for a Mazda 6http://www.autotrader.co.uk/car-search?sort=price-...

I don't see your point

JQ said:

That's only if you claim off your own insurance policy. If your car being written off is the fault of a third party their insurer will only pay you market value.

Even if it's the tp's fault you can still claim off your own policy and get the new for old option. Then your insurer can argue with the tp about recovering their outlay. If you have comp cover, you can claim directly off tp or not, whatever suits you best. Emeye said:

The more I read about GAP on here, the more it blows my mind as to whether it is worth it on a lease deal.

No one seems to have been able to give a definitive answer - well, they might have, but then someone has come along to challenge it!

There is no definitive answer. It depends on various factors. Like any insurance policy, it's worth it for some people, and not so much for others. No one seems to have been able to give a definitive answer - well, they might have, but then someone has come along to challenge it!

TwigtheWonderkid said:

There is no definitive answer. It depends on various factors. Like any insurance policy, it's worth it for some people, and not so much for others.

Indeed. Just insure against what you consider unacceptable risks. If the risk of having to find the money to pay off the difference between market value and outstanding finance is unacceptable to you, you can insure against it.Any new-for-old insurance (e.g return-to-invoice or Vehicle Replacement gap) is really gambling. Spending the money on lottery tickets would be an equally valid. I'd guess chances of a new car being written off in any one year are about 1 in 100.

Gassing Station | General Gassing | Top of Page | What's New | My Stuff