RE: Silverstone Auctions Porsche sale results

Discussion

Leins said:

Is the whole lot up without reserve?

BTW, this 131 is fantastic: http://www.rmsothebys.com/tv16/duemila-ruote/lots/...

That's exactly what stood out for me BTW, this 131 is fantastic: http://www.rmsothebys.com/tv16/duemila-ruote/lots/...

must be same age group

must be same age group

That's some sale, 21 E types, 9 Lancia Fulvias, 22 classic Maseratis, I didn't bother counting the Porsches. ....

jeremyc said:

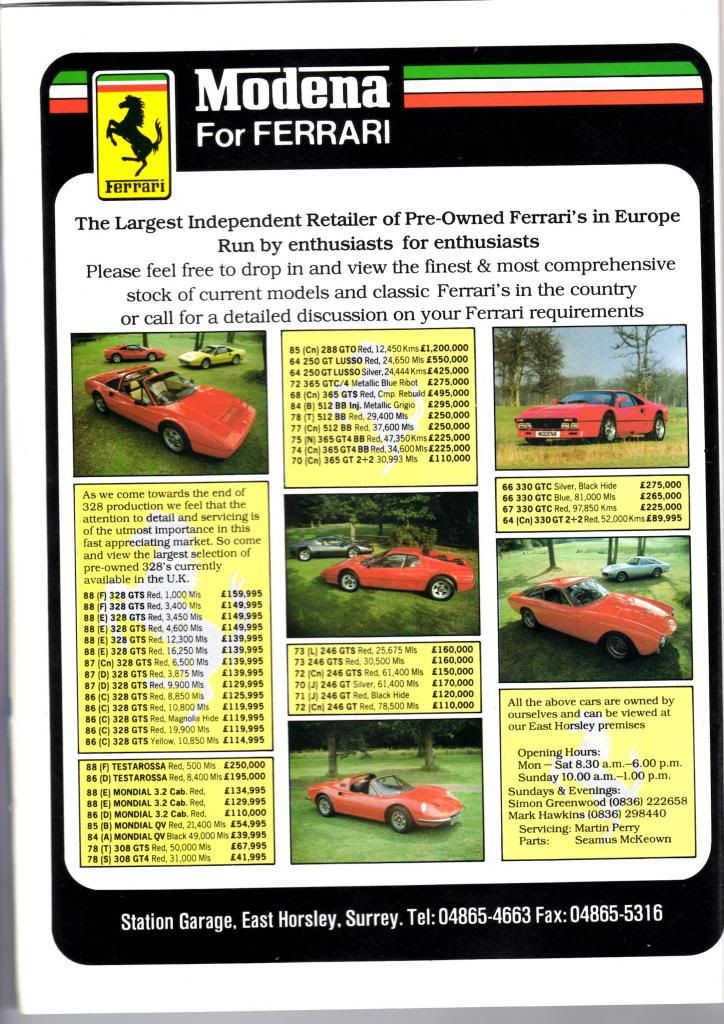

Tremendous. For comparison, in 1989 the average house price was about £60,000 (today it's a shade under £220k). So a 'new' 328 in the overs market was circa 2.5 times an average house price (interest rates then were circa 13 percent). How these guys would have wept if they had known that 20 years later one could be picked up for 35k.

jeremyc said:

Talking of bubbles, one of my favourite reminders from 1989.

Nothing special average one year old Ferrari is 2x more expensive than its list price was when it was new. 100% sure definition of the bubble. We haven't seen this yet on normal base models but back in late eighties Ferrari, Porsche etc. didn't do as many special models so base stuff was in larger demand. It can be said we are in almost identical situation now. Only differences are if interest rate stays low for several years and current fleet isn't build on loaned money.

Those results make me feel it's a great time to sell my fully restored 1965 Porsche 912

Not sure I agree about the whole 'bubble' thing. Yes there are fluctuations, but over many years most models will be worth more and more.

Everyone is laughing at that 'bubble' advert from 1989, but I wish you could still get a Dino for £150k. It's £300k now for a decent one.

There aren't any more of these models being made, and worldwide there are now more people who can afford them.

Even junk, cheap classics, or hot hatches that you couldn't give away a few years ago are now rising rapidly in value.

Not sure I agree about the whole 'bubble' thing. Yes there are fluctuations, but over many years most models will be worth more and more.

Everyone is laughing at that 'bubble' advert from 1989, but I wish you could still get a Dino for £150k. It's £300k now for a decent one.

There aren't any more of these models being made, and worldwide there are now more people who can afford them.

Even junk, cheap classics, or hot hatches that you couldn't give away a few years ago are now rising rapidly in value.

NinjaPower said:

Those results make me feel it's a great time to sell my fully restored 1965 Porsche 912

Not sure I agree about the whole 'bubble' thing. Yes there are fluctuations, but over many years most models will be worth more and more.

Everyone is laughing at that 'bubble' advert from 1989, but I wish you could still get a Dino for £150k. It's £300k now for a decent one.

That is roughly only beating inflation [1], so not a good investment since keeping the car in a good condition is not free. Makes a lot more sense if one enjoys the car (think this is something PH can agree on

Not sure I agree about the whole 'bubble' thing. Yes there are fluctuations, but over many years most models will be worth more and more.

Everyone is laughing at that 'bubble' advert from 1989, but I wish you could still get a Dino for £150k. It's £300k now for a decent one.

).

).[1] http://www.bankofengland.co.uk/education/Pages/res...

NinjaPower said:

Everyone is laughing at that 'bubble' advert from 1989, but I wish you could still get a Dino for £150k. It's £300k now for a decent one.

Indeed but they were circa 100k about 6 years ago - so if you invested 150k in 1989 you would have lost 50k over the period 89-'09. And that 50k in 89 is worth about 100k in today's money. I'm not sure if I bought a Fezza today, lost 100k over 20 years and had to pay running/storage costs I'd think it was a decent investment. That said, if I was driving the thing and saw that 4K per annum as the cost of having a fantastic car to drive I'd see it as cheap. So it somewhat depends on your viewpoint. The grasss is always greener. On an aside, I see the Silverstone Porsche buyer who paid stratospheric prices was the bloke who owns a large chunk of Whatsapp. Aside from the fact this explains where the money came from, I can't help feel like someone knew he wanted those cars and pushed the price up. Given he is somewhat of a unicorn I don't buy there being 2 unicorns in the room

NinjaPower said:

Those results make me feel it's a great time to sell my fully restored 1965 Porsche 912

Not sure I agree about the whole 'bubble' thing. Yes there are fluctuations, but over many years most models will be worth more and more.

Everyone is laughing at that 'bubble' advert from 1989, but I wish you could still get a Dino for £150k. It's £300k now for a decent one.

There aren't any more of these models being made, and worldwide there are now more people who can afford them.

Even junk, cheap classics, or hot hatches that you couldn't give away a few years ago are now rising rapidly in value.

And arguably that £150k 27 years ago was probably a larger sum that £300 of today's considerably devalued GBP.

Not sure I agree about the whole 'bubble' thing. Yes there are fluctuations, but over many years most models will be worth more and more.

Everyone is laughing at that 'bubble' advert from 1989, but I wish you could still get a Dino for £150k. It's £300k now for a decent one.

There aren't any more of these models being made, and worldwide there are now more people who can afford them.

Even junk, cheap classics, or hot hatches that you couldn't give away a few years ago are now rising rapidly in value.

And, as you say, there are far more wealthy investors and enthusiasts than 27 years ago when the market was probably defined by US, UK, JP and ME buyers most of whom could have fit on one Rolladex.

But all of the buyers today are considerably more leveraged in all aspects of their financial activity so the market is quite a lot riskier and if past performance was a true indicator of future performance then most chartists, technical analysts and economists would be walking around in ten year old underpants trying to convince people they can see the future.

But what we have is a debt fuelled market while at the same time the potential for rising debt costs and rising inflation plus the likelihood of global corporate profits plateauing so all the traditional ingredients required for a crash are slowly coming together. And traditionally as this happens there is an unexpected global event that just shifts sentiment enough to start the ball rolling.

My wild stab in the dark is that Brexit has to be one of those possible triggers over the next couple of years as does how China handles its burgeoning debt crisis.

DonkeyApple said:

But what we have is a debt fuelled market while at the same time the potential for rising debt costs and rising inflation plus the likelihood of global corporate profits plateauing so all the traditional ingredients required for a crash are slowly coming together.

I'm not convinced about that debt. My suspicion is that much of the money pouring into classic cars and other silly assets (watches, wine, etc and even gold) is money that has been made elsewhere.In all of these markets I see the biggest risk as being a collapse in demand for that particular type of asset. Such a crash usually affects owners of the "also rans" much more than it affects owners of "the real thing".

So if you're going to attempt investment in a classic car, make sure it's genuinely rare and desirable. The last place I would "invest" money is into the mass of "last air-cooled 911s" which are likely to collapse in value as that generation of owners reach old age. If they were excited youngsters who'd like to have had a 911 in the 1990s they're probably 50 years old already.

Ozzie Osmond said:

DonkeyApple said:

But what we have is a debt fuelled market while at the same time the potential for rising debt costs and rising inflation plus the likelihood of global corporate profits plateauing so all the traditional ingredients required for a crash are slowly coming together.

I'm not convinced about that debt. My suspicion is that much of the money pouring into classic cars and other silly assets (watches, wine, etc and even gold) is money that has been made elsewhere.In all of these markets I see the biggest risk as being a collapse in demand for that particular type of asset. Such a crash usually affects owners of the "also rans" much more than it affects owners of "the real thing".

So if you're going to attempt investment in a classic car, make sure it's genuinely rare and desirable. The last place I would "invest" money is into the mass of "last air-cooled 911s" which are likely to collapse in value as that generation of owners reach old age. If they were excited youngsters who'd like to have had a 911 in the 1990s they're probably 50 years old already.

In simple terms, a guy whose business has personal guarantees and starts to look like his revenue cannot cover the debt obligations will be awoken by the noise of his personal investments and toys being taken. A few hours before the noise of the front door closing behind the wife for the last time.

I agree that it will take a collapse in demand but that requires a change in sentiment or a change in law. To change sentiment of a market you need quite a powerful tool such as an increase in forced sellers due to debt default and the change in law route would need to be something like all major governments agreeing to tax classic cars as assets.

Agree with the 911 thing. That market is setting up to be the poster boy like the EType was.

^^^ OK yes, on that basis I agree with you. I was buying various categories of cheap "asset" back in 2008 when the financial crisis turned various people into "forced sellers".

It will be fascinating to see what happens over the next few years while global interest rates rise at the same time as UK is fuelling its own inflation with a weak currency and reduction of plentiful cheap labour.

It will be fascinating to see what happens over the next few years while global interest rates rise at the same time as UK is fuelling its own inflation with a weak currency and reduction of plentiful cheap labour.

DegsyE39 said:

PrancingHorses said:

Why would anybody pay that fat wideboy conman anything? Some suckers will fall for it and get fleeced sadly

Gassing Station | General Gassing | Top of Page | What's New | My Stuff