RE: Silverstone Auctions Porsche sale results

Discussion

The Maritime 968 CS was mine. I bought it two years ago solely on it being one of the best handling porsches of all time and it was/is great. I had hoped for a price rise and ironically if I had invested nothing in the car I would have made more I think but I spent lots!

I had it for sale privately and through a dealer on SOR in the SE but no interest for over a year. The auction was a decent option and I am happy with the result after fees.

I had looked at the yellow Manthey car last year and it was just too expensive IMHO when private sale and when it was at Border Revivers but the hammer price seems reasonable today. I guess its a Scotland car?

What have I learned? 1) Auction values are probably as real as you are going to get for your cars value as Silverstone had a live market with online bidding and the results are the results. 2) I should have bought a 964 coupe manual two years ago instead but they seemed poor value compared to a 968 CS.

I had it for sale privately and through a dealer on SOR in the SE but no interest for over a year. The auction was a decent option and I am happy with the result after fees.

I had looked at the yellow Manthey car last year and it was just too expensive IMHO when private sale and when it was at Border Revivers but the hammer price seems reasonable today. I guess its a Scotland car?

What have I learned? 1) Auction values are probably as real as you are going to get for your cars value as Silverstone had a live market with online bidding and the results are the results. 2) I should have bought a 964 coupe manual two years ago instead but they seemed poor value compared to a 968 CS.

Can someone please decipher the gobblydigook speak the forum members are using for me ?

I only learned English at school - I'm not very conversant in 'asset upgrowth', 'peer market adjustment', 'blue sky thinking', 'pushing of envelopes', 'performance enhancement', 'value added logistics', 'experience enlightenment' et al.

Must be because I drive a manual air cooled Porsche and looked at the report to see how a bespoke Porsche auction had fared.

I bought mine because I want one to drive and enjoy using it. At the time of purchase 6 years ago, it was a car that basically retained its secondhand cost or 'value' after normal depreciation had happened for the previous owners, without them putting extreme mileage on it, as it was a second car for them and myself. I didn't buy it as an investment, I bought it to drive and enjoy something from the time before today's high technology era where it seems you need to be a computer technician to be able to 'configure' the driver aids before you can actually drive it. Rather like the comments and observations on the forthcoming new 5 series BMW previewed on this site - also points made on the McClaren 570S/GT comparison this week.

Don't forget - as the advertisements say "investments can go down as well as up"

If you get a sell off triggered by rising rates then those that have risen the most will more than halve. It's an unregulated market that is now loaded with debt which will mean no support at all from outside forces to underpin any values and forced sales to crystallise bad debts. Any significant sell off wil be a rout the likes of which most under 40s have never witnessed in an asset class.

With no external entities to step in and vision the fall by buying up supply or halting banks delivering stock to the markets the chances for such markets to unwind gently are immensely slim.

The only real question is what the trigger is likely to be and when the event will happen. The fact that it will be a monumental rout is very hard to disagree with.Not sure I entirely agree - the above logic certainly applies where products are bought on borrowed money although in times of high inflation assets also become value stores and hedges against inflation. Things are also affected by how distressed the sale is, that's why there was no great house price crash post 08 as am sure you well know as people didn't need to sell unlike the crash on the early 90s when interest rates were sky high post ERM departure which was the low after the Big Bang high.

The key here will be how high inflation rises and how Carney reacts. Notwithstanding, if you couldn't service your borrowings for say 5 years out of cash in the bank with base rates at 5 percent within 2 years then I would be concernedBut that is the exact point. The only crash most people can refer to is the 2008 property correction. A market where the State intervened to halt it by creating an artificial demand for assets in one hand and by forcibly restricting supply by preventing lenders from foreclosing.

Asset classes such as classic cars have no such entity to step in to prevent market forces from applying. They are true markets and in the case of classic cars it is a highly leveraged market especially at the top end.

Lenders won't be calling people up to chat about how they will be restricting the debt on their home and the BofE won't be slashing interest rates to zero to stem defaults and not will the State be pretending lenders from aggressively dealing with arrears and defaults or offering 'help to buy' schemes. Same with stock markets and currency markets as well as commodity markets. All ultimately underpinned by States and central banks.

Property is a politically under pinned and artificial market. Classic cars are a true market and the two types share almost no similarity in how they react to either a rise in debt funding costs or external trigger events.

So, if people find themselves struggling to meet the finance obligation on their classic car what do you genuinely believe that lender will be doing? For the honest answer you need look no further than the assets of various leveraged collectors who's income and wealth was derived from the price of oil.

The change of sentiment alone will drive values down. If lead assets are being forced into the market by lenders (who are the ultimate owners) then once the sell off commences who is going to sit on the other side of the sale and deliver matching demand? No one. What people will be doing is trying to unwind their own debt or convert their investment into an alternate asset as quickly as possible just adding to the supply while almost all demand falls away overnight.

But this is part of the point, a huge number of people today have never witnessed a true, free market asset value correction only State and central bank artificial market manipulations.

Well explained by DA as always. For a layman such as myself at least

Well explained by DA as always. For a layman such as myself at least  [footnote]Edited by Oakman on Thursday 20th October 01:30

[footnote]Edited by Oakman on Thursday 20th October 01:30

I only learned English at school - I'm not very conversant in 'asset upgrowth', 'peer market adjustment', 'blue sky thinking', 'pushing of envelopes', 'performance enhancement', 'value added logistics', 'experience enlightenment' et al.

Must be because I drive a manual air cooled Porsche and looked at the report to see how a bespoke Porsche auction had fared.

I bought mine because I want one to drive and enjoy using it. At the time of purchase 6 years ago, it was a car that basically retained its secondhand cost or 'value' after normal depreciation had happened for the previous owners, without them putting extreme mileage on it, as it was a second car for them and myself. I didn't buy it as an investment, I bought it to drive and enjoy something from the time before today's high technology era where it seems you need to be a computer technician to be able to 'configure' the driver aids before you can actually drive it. Rather like the comments and observations on the forthcoming new 5 series BMW previewed on this site - also points made on the McClaren 570S/GT comparison this week.

Don't forget - as the advertisements say "investments can go down as well as up"

DegsyE39 said:

DonkeyApple said:

CS Garth said:

DonkeyApple said:

WojaWabbit said:

oli_quick said:

Inflation heading up - interest rates will rise - asset prices will fall...simple economics...

The asset-buying car people will have already shifted these items off their balance sheets and reinvested - leaving the rest of us to cheer for the return to sensibly priced cars over the next 3 years

I doubt there will be much in the way of cheering. Air cooled 911's and GT3's are not going to half in value.The asset-buying car people will have already shifted these items off their balance sheets and reinvested - leaving the rest of us to cheer for the return to sensibly priced cars over the next 3 years

With no external entities to step in and vision the fall by buying up supply or halting banks delivering stock to the markets the chances for such markets to unwind gently are immensely slim.

The only real question is what the trigger is likely to be and when the event will happen. The fact that it will be a monumental rout is very hard to disagree with.

The key here will be how high inflation rises and how Carney reacts. Notwithstanding, if you couldn't service your borrowings for say 5 years out of cash in the bank with base rates at 5 percent within 2 years then I would be concerned

Asset classes such as classic cars have no such entity to step in to prevent market forces from applying. They are true markets and in the case of classic cars it is a highly leveraged market especially at the top end.

Lenders won't be calling people up to chat about how they will be restricting the debt on their home and the BofE won't be slashing interest rates to zero to stem defaults and not will the State be pretending lenders from aggressively dealing with arrears and defaults or offering 'help to buy' schemes. Same with stock markets and currency markets as well as commodity markets. All ultimately underpinned by States and central banks.

Property is a politically under pinned and artificial market. Classic cars are a true market and the two types share almost no similarity in how they react to either a rise in debt funding costs or external trigger events.

So, if people find themselves struggling to meet the finance obligation on their classic car what do you genuinely believe that lender will be doing? For the honest answer you need look no further than the assets of various leveraged collectors who's income and wealth was derived from the price of oil.

The change of sentiment alone will drive values down. If lead assets are being forced into the market by lenders (who are the ultimate owners) then once the sell off commences who is going to sit on the other side of the sale and deliver matching demand? No one. What people will be doing is trying to unwind their own debt or convert their investment into an alternate asset as quickly as possible just adding to the supply while almost all demand falls away overnight.

But this is part of the point, a huge number of people today have never witnessed a true, free market asset value correction only State and central bank artificial market manipulations.

Edited by DonkeyApple on Wednesday 19th October 09:56[/footnote]

+1  Well explained by DA as always. For a layman such as myself at least

Well explained by DA as always. For a layman such as myself at least

Edited by Oakman on Thursday 20th October 09:19

Mark you calendars. If bubble is going pop violently 25-27 November 2016 is the weekend it can happen. Over 400 cars without reserve is a lot for market to handle in one lump.

http://www.rmsothebys.com/tv16/duemila-ruote/lots/

If prices are very low what will happen to all other similar cars on offer by dealers, different websites etc? Will sellers panic and lower prices to get their investment out? How will buyers behave if this happens? Will this cause chain reaction? Many currently available cars have been for sale a long time. Year or two selling time isn't that unusual. If these sellers see prices start to fall will they have nerves to keep price high or will they take -10%, -20% since they are still ahead compared to what they paid two years ago? Interesting times.

http://www.rmsothebys.com/tv16/duemila-ruote/lots/

If prices are very low what will happen to all other similar cars on offer by dealers, different websites etc? Will sellers panic and lower prices to get their investment out? How will buyers behave if this happens? Will this cause chain reaction? Many currently available cars have been for sale a long time. Year or two selling time isn't that unusual. If these sellers see prices start to fall will they have nerves to keep price high or will they take -10%, -20% since they are still ahead compared to what they paid two years ago? Interesting times.

Is the whole lot up without reserve?

BTW, this 131 is fantastic: http://www.rmsothebys.com/tv16/duemila-ruote/lots/...

BTW, this 131 is fantastic: http://www.rmsothebys.com/tv16/duemila-ruote/lots/...

928 GTS said:

Mark you calendars. If bubble is going pop violently 25-27 November 2016 is the weekend it can happen. Over 400 cars without reserve is a lot for market to handle in one lump.

http://www.rmsothebys.com/tv16/duemila-ruote/lots/

If prices are very low what will happen to all other similar cars on offer by dealers, different websites etc? Will sellers panic and lower prices to get their investment out? How will buyers behave if this happens? Will this cause chain reaction? Many currently available cars have been for sale a long time. Year or two selling time isn't that unusual. If these sellers see prices start to fall will they have nerves to keep price high or will they take -10%, -20% since they are still ahead compared to what they paid two years ago? Interesting times.

Some spectacular cars in that sale, and if it was me, I would have drip fed them to the market over 12 months.http://www.rmsothebys.com/tv16/duemila-ruote/lots/

If prices are very low what will happen to all other similar cars on offer by dealers, different websites etc? Will sellers panic and lower prices to get their investment out? How will buyers behave if this happens? Will this cause chain reaction? Many currently available cars have been for sale a long time. Year or two selling time isn't that unusual. If these sellers see prices start to fall will they have nerves to keep price high or will they take -10%, -20% since they are still ahead compared to what they paid two years ago? Interesting times.

I'm hoping to head out to see the classic show and look at the cars, but unfortunately most of them will be way out of my budget...

Wonder what the real story was with the collection?

928 GTS said:

I know nothing about them, but I want these!http://www.rmsothebys.com/tv16/duemila-ruote/lots/...

Leins said:

Is the whole lot up without reserve?

I believe they are. If that's true and there aren't any funny business going on this will tell true market situation quite well.sim16v said:

I would have drip fed them to the market over 12 months.

That would be sensible option and could possibly bring in more £$€. Now there is real possibility of flooding the market.sim16v said:

Wonder what the real story was with the collection?

Story goes that some dude called Umberto who owned company which does valuable goods moves or something like that is owner of the collection. Millions of euros has have been borrowed to build it and seems banks want their money back fast. Either they don't know what they are doing which is unlikely since auction is handled by pros or they think they have good reason to dump everything at once.Edited by 928 GTS on Friday 21st October 00:21

928 GTS said:

sim16v said:

Wonder what the real story was with the collection?

Story goes that some dude called Umberto who owned company which does valuable goods moves or something like that is owner of the collection. Millions of euros has have been borrowed to build it and seems banks want their money back fast. Either they don't know what they are doing which is unlikely since auction is handled by pros or they think they have good reason to dump everything at once.Edited by 928 GTS on Friday 21st October 00:21

It's a few of these happening simultaneously with big ticket items that then fail to find buyers that will lead to a real sentiment change and then investors will start rushing to sell out and finally the litigations will all start over the thousands of frauds that have been being peddled out into the boom market.

928 GTS said:

Mark you calendars. If bubble is going pop violently 25-27 November 2016 is the weekend it can happen. Over 400 cars without reserve is a lot for market to handle in one lump.

http://www.rmsothebys.com/tv16/duemila-ruote/lots/

If prices are very low what will happen to all other similar cars on offer by dealers, different websites etc? Will sellers panic and lower prices to get their investment out? How will buyers behave if this happens? Will this cause chain reaction? Many currently available cars have been for sale a long time. Year or two selling time isn't that unusual. If these sellers see prices start to fall will they have nerves to keep price high or will they take -10%, -20% since they are still ahead compared to what they paid two years ago? Interesting times.

I don't think it will make any difference to the market as a whole. A lot of the cars appear to be no better than 'barn-find' quality, and in the context of the entire market and the many thousands of cars for sale, this is just a small drop in the ocean.http://www.rmsothebys.com/tv16/duemila-ruote/lots/

If prices are very low what will happen to all other similar cars on offer by dealers, different websites etc? Will sellers panic and lower prices to get their investment out? How will buyers behave if this happens? Will this cause chain reaction? Many currently available cars have been for sale a long time. Year or two selling time isn't that unusual. If these sellers see prices start to fall will they have nerves to keep price high or will they take -10%, -20% since they are still ahead compared to what they paid two years ago? Interesting times.

thegreenhell said:

I don't think it will make any difference to the market as a whole. A lot of the cars appear to be no better than 'barn-find' quality, and in the context of the entire market and the many thousands of cars for sale, this is just a small drop in the ocean.

It's all about appearance. People see low numbers and think market is going to fail. Buyers simply will not buy at current market values. Sellers get nervous and lower price a little just to get things going again. This gives buyers indication prices are really going down and they'll wait some more. Sellers get more and more nervous and lower prices some more. Next... Thats all it takes. Maxige said:

No, there was a fraud, assets have been seized by the state, the chap stole around 35m from banks that had cash deposited in his safe (he had one of the biggest firm that were doing cash transportation on behalf of various clients) and around 60m owed to the italian tax man...

That explains quick sale which might not give best possible result.

Oakman said:

Can someone please decipher the gobblydigook speak the forum members are using for me ?

I only learned English at school - I'm not very conversant in 'asset upgrowth', 'peer market adjustment', 'blue sky thinking', 'pushing of envelopes', 'performance enhancement', 'value added logistics', 'experience enlightenment' et al.

Must be because I drive a manual air cooled Porsche and looked at the report to see how a bespoke Porsche auction had fared.

I bought mine because I want one to drive and enjoy using it. At the time of purchase 6 years ago, it was a car that basically retained its secondhand cost or 'value' after normal depreciation had happened for the previous owners, without them putting extreme mileage on it, as it was a second car for them and myself. I didn't buy it as an investment, I bought it to drive and enjoy something from the time before today's high technology era where it seems you need to be a computer technician to be able to 'configure' the driver aids before you can actually drive it. Rather like the comments and observations on the forthcoming new 5 series BMW previewed on this site - also points made on the McClaren 570S/GT comparison this week.

Don't forget - as the advertisements say "investments can go down as well as up"

If you get a sell off triggered by rising rates then those that have risen the most will more than halve. It's an unregulated market that is now loaded with debt which will mean no support at all from outside forces to underpin any values and forced sales to crystallise bad debts. Any significant sell off wil be a rout the likes of which most under 40s have never witnessed in an asset class.

With no external entities to step in and vision the fall by buying up supply or halting banks delivering stock to the markets the chances for such markets to unwind gently are immensely slim.

The only real question is what the trigger is likely to be and when the event will happen. The fact that it will be a monumental rout is very hard to disagree with.Not sure I entirely agree - the above logic certainly applies where products are bought on borrowed money although in times of high inflation assets also become value stores and hedges against inflation. Things are also affected by how distressed the sale is, that's why there was no great house price crash post 08 as am sure you well know as people didn't need to sell unlike the crash on the early 90s when interest rates were sky high post ERM departure which was the low after the Big Bang high.

The key here will be how high inflation rises and how Carney reacts. Notwithstanding, if you couldn't service your borrowings for say 5 years out of cash in the bank with base rates at 5 percent within 2 years then I would be concernedBut that is the exact point. The only crash most people can refer to is the 2008 property correction. A market where the State intervened to halt it by creating an artificial demand for assets in one hand and by forcibly restricting supply by preventing lenders from foreclosing.

Asset classes such as classic cars have no such entity to step in to prevent market forces from applying. They are true markets and in the case of classic cars it is a highly leveraged market especially at the top end.

Lenders won't be calling people up to chat about how they will be restricting the debt on their home and the BofE won't be slashing interest rates to zero to stem defaults and not will the State be pretending lenders from aggressively dealing with arrears and defaults or offering 'help to buy' schemes. Same with stock markets and currency markets as well as commodity markets. All ultimately underpinned by States and central banks.

Property is a politically under pinned and artificial market. Classic cars are a true market and the two types share almost no similarity in how they react to either a rise in debt funding costs or external trigger events.

So, if people find themselves struggling to meet the finance obligation on their classic car what do you genuinely believe that lender will be doing? For the honest answer you need look no further than the assets of various leveraged collectors who's income and wealth was derived from the price of oil.

The change of sentiment alone will drive values down. If lead assets are being forced into the market by lenders (who are the ultimate owners) then once the sell off commences who is going to sit on the other side of the sale and deliver matching demand? No one. What people will be doing is trying to unwind their own debt or convert their investment into an alternate asset as quickly as possible just adding to the supply while almost all demand falls away overnight.

But this is part of the point, a huge number of people today have never witnessed a true, free market asset value correction only State and central bank artificial market manipulations.

Well explained by DA as always. For a layman such as myself at least

Well explained by DA as always. For a layman such as myself at least  [footnote]Edited by Oakman on Thursday 20th October 01:30

[footnote]Edited by Oakman on Thursday 20th October 01:30

DA is totally right.I only learned English at school - I'm not very conversant in 'asset upgrowth', 'peer market adjustment', 'blue sky thinking', 'pushing of envelopes', 'performance enhancement', 'value added logistics', 'experience enlightenment' et al.

Must be because I drive a manual air cooled Porsche and looked at the report to see how a bespoke Porsche auction had fared.

I bought mine because I want one to drive and enjoy using it. At the time of purchase 6 years ago, it was a car that basically retained its secondhand cost or 'value' after normal depreciation had happened for the previous owners, without them putting extreme mileage on it, as it was a second car for them and myself. I didn't buy it as an investment, I bought it to drive and enjoy something from the time before today's high technology era where it seems you need to be a computer technician to be able to 'configure' the driver aids before you can actually drive it. Rather like the comments and observations on the forthcoming new 5 series BMW previewed on this site - also points made on the McClaren 570S/GT comparison this week.

Don't forget - as the advertisements say "investments can go down as well as up"

DegsyE39 said:

DonkeyApple said:

CS Garth said:

DonkeyApple said:

WojaWabbit said:

oli_quick said:

Inflation heading up - interest rates will rise - asset prices will fall...simple economics...

The asset-buying car people will have already shifted these items off their balance sheets and reinvested - leaving the rest of us to cheer for the return to sensibly priced cars over the next 3 years

I doubt there will be much in the way of cheering. Air cooled 911's and GT3's are not going to half in value.The asset-buying car people will have already shifted these items off their balance sheets and reinvested - leaving the rest of us to cheer for the return to sensibly priced cars over the next 3 years

With no external entities to step in and vision the fall by buying up supply or halting banks delivering stock to the markets the chances for such markets to unwind gently are immensely slim.

The only real question is what the trigger is likely to be and when the event will happen. The fact that it will be a monumental rout is very hard to disagree with.

The key here will be how high inflation rises and how Carney reacts. Notwithstanding, if you couldn't service your borrowings for say 5 years out of cash in the bank with base rates at 5 percent within 2 years then I would be concerned

Asset classes such as classic cars have no such entity to step in to prevent market forces from applying. They are true markets and in the case of classic cars it is a highly leveraged market especially at the top end.

Lenders won't be calling people up to chat about how they will be restricting the debt on their home and the BofE won't be slashing interest rates to zero to stem defaults and not will the State be pretending lenders from aggressively dealing with arrears and defaults or offering 'help to buy' schemes. Same with stock markets and currency markets as well as commodity markets. All ultimately underpinned by States and central banks.

Property is a politically under pinned and artificial market. Classic cars are a true market and the two types share almost no similarity in how they react to either a rise in debt funding costs or external trigger events.

So, if people find themselves struggling to meet the finance obligation on their classic car what do you genuinely believe that lender will be doing? For the honest answer you need look no further than the assets of various leveraged collectors who's income and wealth was derived from the price of oil.

The change of sentiment alone will drive values down. If lead assets are being forced into the market by lenders (who are the ultimate owners) then once the sell off commences who is going to sit on the other side of the sale and deliver matching demand? No one. What people will be doing is trying to unwind their own debt or convert their investment into an alternate asset as quickly as possible just adding to the supply while almost all demand falls away overnight.

But this is part of the point, a huge number of people today have never witnessed a true, free market asset value correction only State and central bank artificial market manipulations.

Edited by DonkeyApple on Wednesday 19th October 09:56[/footnote]

+1  Well explained by DA as always. For a layman such as myself at least

Well explained by DA as always. For a layman such as myself at least

Edited by Oakman on Thursday 20th October 09:19

Some people have said that so many P&J classics are bought cash and so won't be susceptible to market moves. Well that's not true and once there's weakness it can spiral very quickly as buyers won't step in if confidence has gone, hence a crash.

Classics crashed 25yrs ago...

The top end property works this way too, and has (again) since the 08 crash. Have a million cash, borrow many more millions more at low rates (doesn't work with mere 6 figure sums). Some big houses halved last time in desperate attempts to cover calls.

Cars are to be enjoyed for what they are!

jeremyc said:

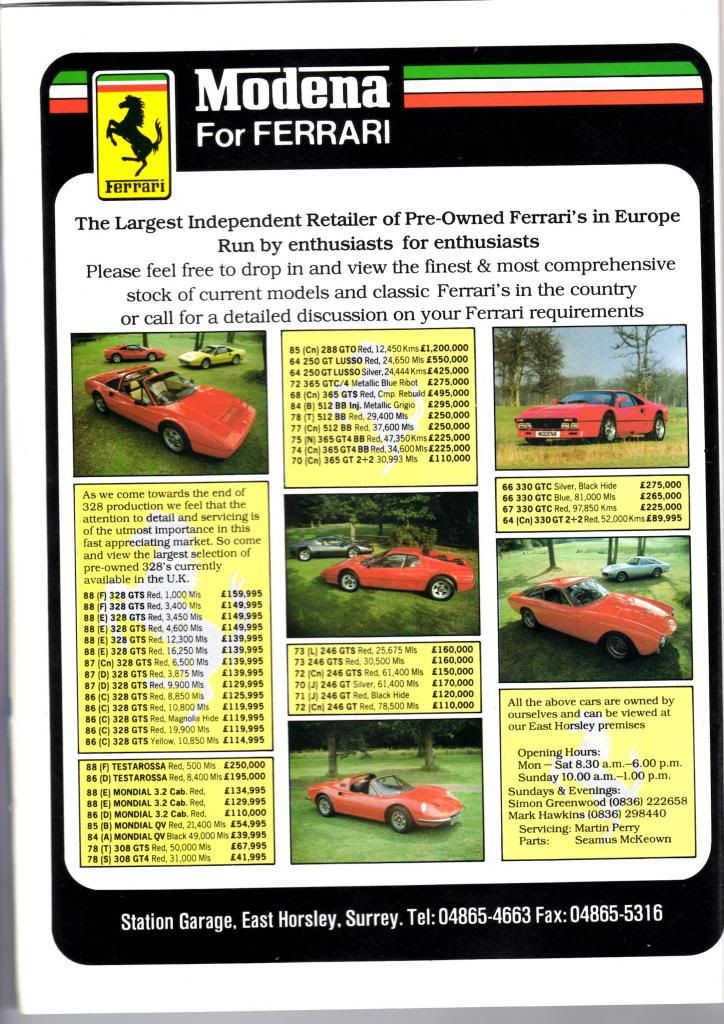

I grew up in East Horsley and remember the dealership well, as a kid I spent loads of time there as they were right in the heart of the village. The showroom closed down long ago but the retirement home that was built in its place is called "Maranello House", which always makes me smile.

Thank you for the reminder

PrancingHorses said:

Why would anybody pay that fat wideboy conman anything? Some suckers will fall for it and get fleeced sadly

thatsprettyshady said:

I grew up in East Horsley and remember the dealership well, as a kid I spent loads of time there as they were right in the heart of the village.

The showroom closed down long ago but the retirement home that was built in its place is called "Maranello House", which always makes me smile.

Thank you for the reminder

30 years ago, amazing. All low miles - Ferraris always are. I wonder what mileage those cars have now - must be a lot more. The showroom closed down long ago but the retirement home that was built in its place is called "Maranello House", which always makes me smile.

Thank you for the reminder

MDMA . said:

the Rubystone 964 RS seems a bargain at 163,240 ! few for sale in Germany at the moment for over 250,000 euros.

http://www.germansportscars.net/GB/cars-for-sale.p...

It's come from Japan and wasn't numbers matching. It wouldn't put me off (if I had the money!) as I'd nwant to drive it. For a collector that knocks the price of ithttp://www.germansportscars.net/GB/cars-for-sale.p...

Gassing Station | General Gassing | Top of Page | What's New | My Stuff