How far will house prices fall [volume 4]

Discussion

Pork said:

princeperch said:

well. I'm not sure whats going to happen to the london market, so i've decided to hedge my bets a bit.

I'm selling in E3 for 440k and buying a house in E11 for 385k. The flat might well go up a smidge more due to its location but when you look at what it will rent for (which was always option B for us if we couldnt sell for a good price) I think its time to take our money out and buy a house we can live in/extend/not get shafted by the managing agents etc.

long term, I remain positive about london property. I think a lot of people are realising that the cost of a season ticket, especially for 2 professional, is a pretty crippling amount of money to spend each month, compared to living centrally when you can cycle to work or get a bus/tube for not that much money each month. ok so the property costs you a bit more than it would if you were living in harlow or luton [insert AN Other dull and souless commuter town) but when you are saving 600 a quid on train travel that can make a massive dent in the mortgage each month.

I'll probably get a loft extension done in the new place (assuming it all goes to plan) which will probably cost me 40 grand, but that asides we should be mortgage free in 5 years I reckon - and that will only be possible because we havent been hemorrhaging money to the train company each month..

Some people chose to move out for more space, quieter living, less sirens/traffic or whatever. For me, I'd rather be 26 mins from Kings Cross and have a massive garden, great schools, rolling countryside 2 mins walk down the road etc....although I do miss the cycling to work.I'm selling in E3 for 440k and buying a house in E11 for 385k. The flat might well go up a smidge more due to its location but when you look at what it will rent for (which was always option B for us if we couldnt sell for a good price) I think its time to take our money out and buy a house we can live in/extend/not get shafted by the managing agents etc.

long term, I remain positive about london property. I think a lot of people are realising that the cost of a season ticket, especially for 2 professional, is a pretty crippling amount of money to spend each month, compared to living centrally when you can cycle to work or get a bus/tube for not that much money each month. ok so the property costs you a bit more than it would if you were living in harlow or luton [insert AN Other dull and souless commuter town) but when you are saving 600 a quid on train travel that can make a massive dent in the mortgage each month.

I'll probably get a loft extension done in the new place (assuming it all goes to plan) which will probably cost me 40 grand, but that asides we should be mortgage free in 5 years I reckon - and that will only be possible because we havent been hemorrhaging money to the train company each month..

okgo said:

NomduJour said:

One of those £750k pretend warehouse flats in not-quite-trendy-enough E-whatever would have me twitching.

Apart from - Fulham isn't going to change, its what it is, and always will be a pleasant area. Peckham can only improve...I agree good stuff sells for top money, but I'd still not be too worried about having my cash in a place in an emerging borough. Clapham, yes I read your posts, they're very interesting, but I do wonder how many people think about the market in the complexity that you do when they're looking to buy...

Anyway, with regards to what I will do, I take your point, however its already happening in the area I live. Dreamland pricing for the open day, people wake up and realise 700k for a 2 bed cottage in the burbs is mental, and then it sits there, until slowly it starts coming down £50k at a time. Its happening with loads of properties, and good ones too in good roads. Very few from what I can tell are getting pounced on at the dreamland figure on the open day...

The property market went soft. The gentrification process stopped a few streets away. His house was surrounded by drug addicts and pox-infested hookers. He hated living there. Then the decades of poor maintenance on a property that had been owned by generations who could not afford to look after it came home to roost. He ended up having to demolish the front of the house and rebuild. It was over a decade before he could get back enough to be able to move.

I sold mine two years later for more than I paid and spent my time chatting up blonde heiresses in the Sloaney Pony.

This time might be different (the huge cost of property elsewhere mean gentrification will happen). But the rule is still "location, location, location".

I had a shoebox flat in Zone 2 Camden/Mornington Crescent which I paid 240k for 10 yrs ago.After 18m I was sick of it,not only the dimensions but the area in general,day and night it felt edgy/unsafe.The guy who bought it off me was new to London literally lived there 2 months and sold on.He hated it.So it's worth about 600k now but I would not have wanted to live there until now for that.I moved to Zone 5,bought a small 2 bed house next to Epping Forest.25 mins into Liv St.The difference in travel time/costs are nothing compared to the restrictions of living in a shoebox in town IMO,and that rationale becomes even more difficult to understand past 40/with kids etc.Im sure prices will keep going North but it's not all about £,quality of life is priceless.

Edited by metrofour on Thursday 21st August 11:41

AstonZagato said:

In 1987, I bought a flat in Parsons Green. A mate bought a house in Crouch End (or North Islington, as he called it) at the same time. He said I was mad - buying in an "up and come" area rather than an "up and coming" area.

The property market went soft. The gentrification process stopped a few streets away. His house was surrounded by drug addicts and pox-infested hookers. He hated living there. Then the decades of poor maintenance on a property that had been owned by generations who could not afford to look after it came home to roost. He ended up having to demolish the front of the house and rebuild. It was over a decade before he could get back enough to be able to move.

I sold mine two years later for more than I paid and spent my time chatting up blonde heiresses in the Sloaney Pony.

This time might be different (the huge cost of property elsewhere mean gentrification will happen). But the rule is still "location, location, location".

I think some of the places mentioned in this thread are a bit further gone than what Crouch End may have been then, though? The property market went soft. The gentrification process stopped a few streets away. His house was surrounded by drug addicts and pox-infested hookers. He hated living there. Then the decades of poor maintenance on a property that had been owned by generations who could not afford to look after it came home to roost. He ended up having to demolish the front of the house and rebuild. It was over a decade before he could get back enough to be able to move.

I sold mine two years later for more than I paid and spent my time chatting up blonde heiresses in the Sloaney Pony.

This time might be different (the huge cost of property elsewhere mean gentrification will happen). But the rule is still "location, location, location".

Frankly I'd rather be surrounded by hookers than talk to any of the utter

s that lurk in that boozer

s that lurk in that boozer

Things ae going a bit barmy in Aberdeen and the surrounding area, new builds by most accounts are selling like hot cakes, Barretts opened a new plot in Inverurie, an Aberdeen commuter town with a good rail link and people were queueing for a chance to put a deposit down the night before they went on general release.

We looked at a new build house in Ellon, another commuter town around 15 miles north of the city - I didn't want it and thankfully we never bought it, but we went to look at the development twice in the space of around three weeks, they had put the price up 30K due to "market forces", I.E, because they think they can - as far as I am concerned they can keep their overpriced, characterless, tiny hutches.

We bought a house in Westhill in 2012 and sold it back in April, it saw a fairly dramatic increase in value in that time and I think if we were just starting out now, we wouldn't have been able to afford a similar property had our 2014 situation been the same as our 2012 one.

We looked at a new build house in Ellon, another commuter town around 15 miles north of the city - I didn't want it and thankfully we never bought it, but we went to look at the development twice in the space of around three weeks, they had put the price up 30K due to "market forces", I.E, because they think they can - as far as I am concerned they can keep their overpriced, characterless, tiny hutches.

We bought a house in Westhill in 2012 and sold it back in April, it saw a fairly dramatic increase in value in that time and I think if we were just starting out now, we wouldn't have been able to afford a similar property had our 2014 situation been the same as our 2012 one.

okgo said:

Frankly I'd rather be surrounded by hookers than talk to any of the utter  s that lurk in that boozer

s that lurk in that boozer

s that lurk in that boozer

s that lurk in that boozer

No word of a lie, I was there one summer having a beer on the green. The police were called to settle a disturbance. A couple of Sloanies had kicked off. As it happens, one of the lads involved got called over by the female officer to right in front of us to have a quiet word. Collars turned up on his polo shirt, he immediately started to hit on her (with very limited success).

I'm not making this up (seriously, I couldnt!) - he then gave up chatting her up, and in a really stroppy tantrum said "but everyone knows that xxx prep schools is so much better than yyy prep school that he went too"

Only on the Sloany.

Edited by Pork on Thursday 21st August 12:58

Fotic said:

Magog said:

Never understood why anyone would use Foxtons to sell their house...

Because they value them MUCH higher than their competitors and sometimes achieve that price. Chap in my office had 4 valuations: 350,355, 345 and 400...sold for 375 in the end and he's happy with them. metrofour said:

The difference in travel time/costs are nothing compared to the restrictions of living in a shoebox in town IMO,and that rationale becomes even more difficult to understand past 40/with kids etc.Im sure prices will keep going North but it's not all about £,quality of life is priceless.

The problem is that previously, those living in shoeboxes in Islington pissing their money away on cupcakes could get away with a move further out when kids came along in spite of their lack of savings.With the high rent reducing saving power further, and foreign money/population influx ripple effect moving wealthier Londoners out of centre, these showbox dwellers are now finding they can't afford anything decent out of town neither and can only pray any further price increases don't outrun their savings.

princeperch said:

Pork said:

princeperch said:

well. I'm not sure whats going to happen to the london market, so i've decided to hedge my bets a bit.

I'm selling in E3 for 440k and buying a house in E11 for 385k. The flat might well go up a smidge more due to its location but when you look at what it will rent for (which was always option B for us if we couldnt sell for a good price) I think its time to take our money out and buy a house we can live in/extend/not get shafted by the managing agents etc.

long term, I remain positive about london property. I think a lot of people are realising that the cost of a season ticket, especially for 2 professional, is a pretty crippling amount of money to spend each month, compared to living centrally when you can cycle to work or get a bus/tube for not that much money each month. ok so the property costs you a bit more than it would if you were living in harlow or luton [insert AN Other dull and souless commuter town) but when you are saving 600 a quid on train travel that can make a massive dent in the mortgage each month.

I'll probably get a loft extension done in the new place (assuming it all goes to plan) which will probably cost me 40 grand, but that asides we should be mortgage free in 5 years I reckon - and that will only be possible because we havent been hemorrhaging money to the train company each month..

Some people chose to move out for more space, quieter living, less sirens/traffic or whatever. For me, I'd rather be 26 mins from Kings Cross and have a massive garden, great schools, rolling countryside 2 mins walk down the road etc....although I do miss the cycling to work.I'm selling in E3 for 440k and buying a house in E11 for 385k. The flat might well go up a smidge more due to its location but when you look at what it will rent for (which was always option B for us if we couldnt sell for a good price) I think its time to take our money out and buy a house we can live in/extend/not get shafted by the managing agents etc.

long term, I remain positive about london property. I think a lot of people are realising that the cost of a season ticket, especially for 2 professional, is a pretty crippling amount of money to spend each month, compared to living centrally when you can cycle to work or get a bus/tube for not that much money each month. ok so the property costs you a bit more than it would if you were living in harlow or luton [insert AN Other dull and souless commuter town) but when you are saving 600 a quid on train travel that can make a massive dent in the mortgage each month.

I'll probably get a loft extension done in the new place (assuming it all goes to plan) which will probably cost me 40 grand, but that asides we should be mortgage free in 5 years I reckon - and that will only be possible because we havent been hemorrhaging money to the train company each month..

gibbon said:

AstonZagato said:

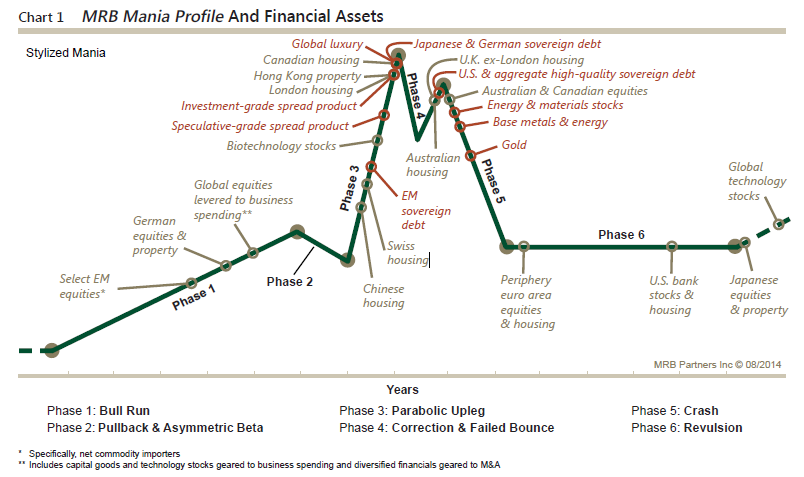

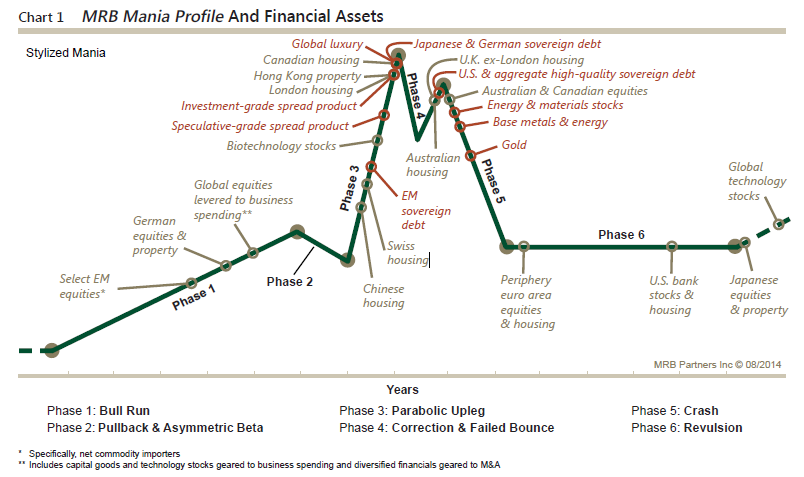

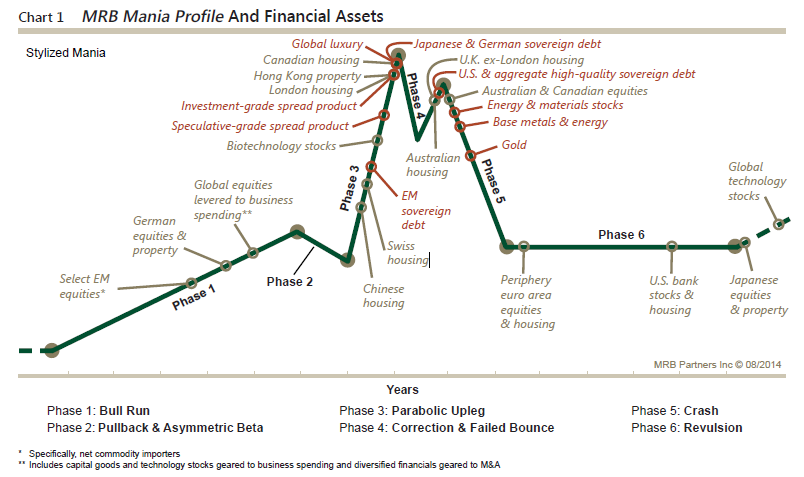

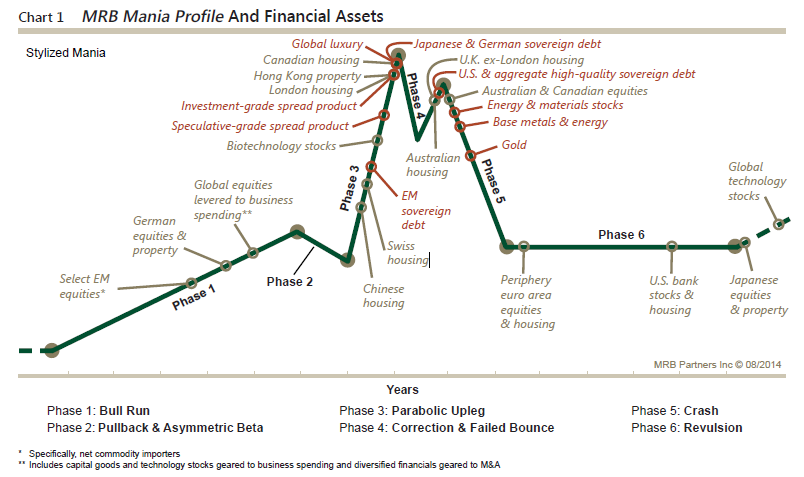

From a recent report I read:

Note the UK property (London and regions).

Not sure I agree.

Apologies, what exactly is this showing us?

Note the UK property (London and regions).

Not sure I agree.

Phase 1: Bull Run

Phase 2: Pullback & Asymmetric Beta

Phase 3: Parabolic Upleg

Phase 4: Correction & Failed Bounce

Phase 5: Crash

Phase 6: Revulsion

That much I'd agree with - most investment manias exhibit those types of trends/emotions. I suppose it is a little like the financial markets version of the "five stages of grief" (denial, anger, bargaining, depression and acceptance) that are often discussed

The scale of the moves is not meant to be accurate but more the trend/emotion/reaction.

They have then mapped on to that where, in their opinion, various asset classes currently are in that cycle. They have put London residential property near the peak and non-London property past the peak.

They are suggesting that Japanese equities (far right) are set for a huge bull run.

Gold has further to fall on their view.

my buyers mortgage valuation came back clean today - its been signed off at 435k.

if I had bigger balls id take the 1/4 mill we'll shortly have in cash and buy a big old pad up in scotland.

instead everyone gets a slice, including the agent and the bloke we are buying from, and the london property merry-go-round continues...

if I had bigger balls id take the 1/4 mill we'll shortly have in cash and buy a big old pad up in scotland.

instead everyone gets a slice, including the agent and the bloke we are buying from, and the london property merry-go-round continues...

AstonZagato said:

gibbon said:

AstonZagato said:

From a recent report I read:

Note the UK property (London and regions).

Not sure I agree.

Apologies, what exactly is this showing us?

Note the UK property (London and regions).

Not sure I agree.

Phase 1: Bull Run

Phase 2: Pullback & Asymmetric Beta

Phase 3: Parabolic Upleg

Phase 4: Correction & Failed Bounce

Phase 5: Crash

Phase 6: Revulsion

That much I'd agree with - most investment manias exhibit those types of trends/emotions. I suppose it is a little like the financial markets version of the "five stages of grief" (denial, anger, bargaining, depression and acceptance) that are often discussed

The scale of the moves is not meant to be accurate but more the trend/emotion/reaction.

They have then mapped on to that where, in their opinion, various asset classes currently are in that cycle. They have put London residential property near the peak and non-London property past the peak.

They are suggesting that Japanese equities (far right) are set for a huge bull run.

Gold has further to fall on their view.

okgo said:

What a lovely place to be at such an early (presumably?) stage of the property ladder. 250k cash gets you into all sorts of places pending how much you are prepared to mortgage!

we have been v v lucky. we are both 29 and its sort of (pending any disasters) fallen into place. even if the chain falls apart I'm still selling the flat, even if I have to pay 5k on ERCs on the mortgage..

Gassing Station | News, Politics & Economics | Top of Page | What's New | My Stuff

(I'm getting old)

(I'm getting old)