Sold bike, new owner crashes it, old owners responsible??

Discussion

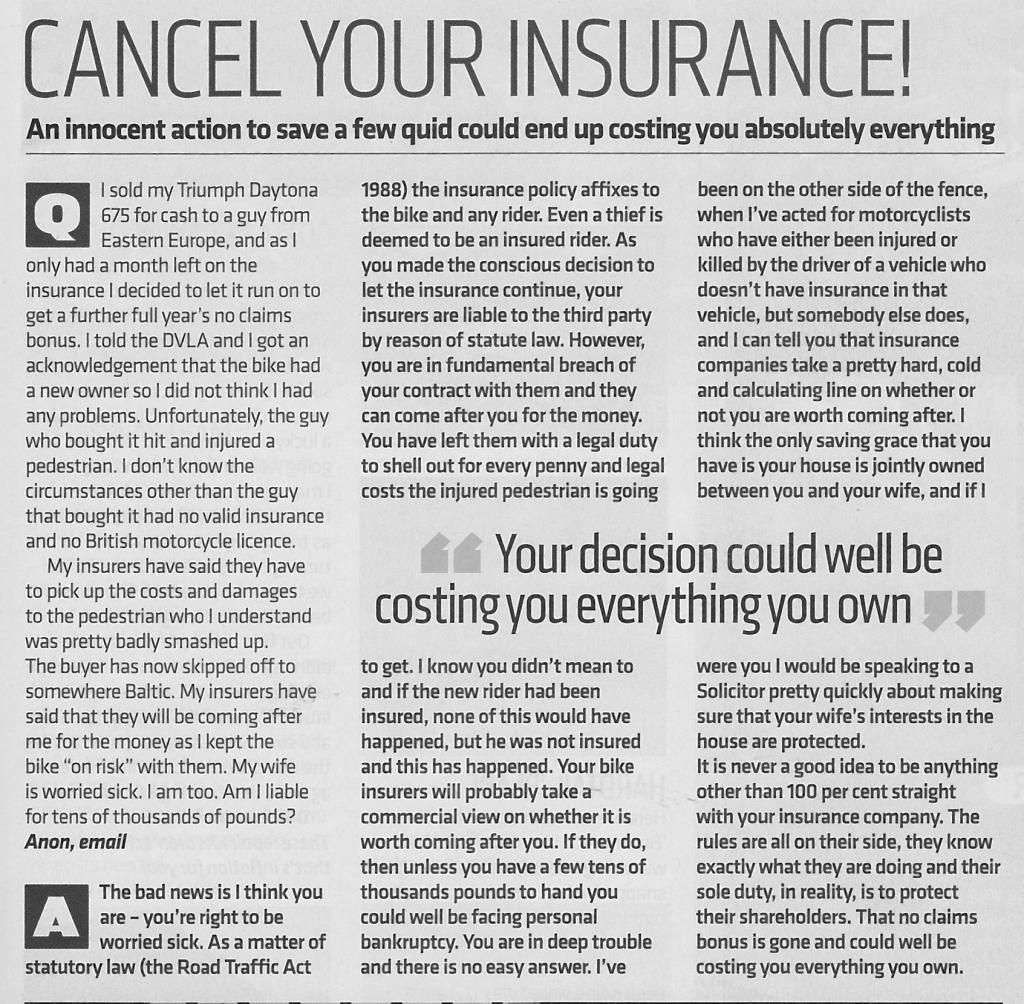

http://britishbikersassociation.org/blog/entry/sco...

Would any resident Legal experts care to talk me through this one please?

Makes no sense to me at all.

Would any resident Legal experts care to talk me through this one please?

Makes no sense to me at all.

Will cede any and all points to Loon and Zollar, but...

Did he forget to cancel the policy because it was nearly up, and NCB doesn't do part years?

This is absolutely nothing new, and the very reason I have, in the past unwillingly cancelled a policy at 10 months, because I wasn't going to replace the bike before that year end, and it's simply too much risk.

Did he forget to cancel the policy because it was nearly up, and NCB doesn't do part years?

This is absolutely nothing new, and the very reason I have, in the past unwillingly cancelled a policy at 10 months, because I wasn't going to replace the bike before that year end, and it's simply too much risk.

I don't even know how MCE knew the vehicle they insured for someone else was crashed. Then knowing they don't unsure the rider they've volunteered themselves to pay out on a policy when surely they wouldn't have to, even if someone else was eventually footing the bill for them.

Feel sorry for bloke, he's probably feeling terrible that someone died on his old bike then he's made to feel like it was his fault.

Feel sorry for bloke, he's probably feeling terrible that someone died on his old bike then he's made to feel like it was his fault.

NB Scots law probably applies in this case, but under English law it is hard to see how the vendor of the bike would have any liability to the insurance company. EDIT: I have had a rethink, and there may be a way to hold the poor bloke liable. See my post further down

I suggest that the biker needs to obtain better legal advice than he has at present. It does not appear that any court has ruled on this as yet. EDIT: I still say this.

Some basic concepts: a insurance policy indemnifies the policy holder in respect of (as well as risks to himself) liability that HE owes to a third party. There has to be a primary liability in order for the insurance to be engaged. In this case, the vendor has no primary liability for the fatal crash. Thus neither he nor a third party can claim against his insurance policy. The purchaser of the bike was not riding it with the vendor's permission. He was riding it as owner of the bike. EDIT; Yes, but section 151 RTA 1988 may change things. See below.

I suggest that the biker needs to obtain better legal advice than he has at present. It does not appear that any court has ruled on this as yet. EDIT: I still say this.

Some basic concepts: a insurance policy indemnifies the policy holder in respect of (as well as risks to himself) liability that HE owes to a third party. There has to be a primary liability in order for the insurance to be engaged. In this case, the vendor has no primary liability for the fatal crash. Thus neither he nor a third party can claim against his insurance policy. The purchaser of the bike was not riding it with the vendor's permission. He was riding it as owner of the bike. EDIT; Yes, but section 151 RTA 1988 may change things. See below.

Edited by anonymous-user on Tuesday 2nd September 10:51

'Bryson was jailed for six months for driving a friend’s car through Arbroath while being chased by three police vehicles and while nearly three times the drink-drive limit in January.'

not a great loss then.

but the law really is an ass if the old insurance company has to pay out, i have left policies to run in the past until i buy another car, will make me think next time.

not a great loss then.

but the law really is an ass if the old insurance company has to pay out, i have left policies to run in the past until i buy another car, will make me think next time.

If anyone is a contributor on a bike site or comments on bike journals, they should urge the biker to take proper legal advice as at present I think he is possibly getting a bum steer (EDIT : but nb section 151 RTA 1988 - see below). As an ex biker I would offer him advice myself for free but I am not qualified in Scots law.

Edited by anonymous-user on Tuesday 2nd September 10:51

I believe it is the 3rd party liability that MCE are obliged to pay out on as there's is the only insurance policy in force on the bike at the time of the crash. It is galling for the previous owner - but I have heard of this before and he really should have cancelled the policy once the bike was sold.

There is some dodgy reporting for sure.

MCE are a broker, not an insurer, and aren't based in Merseyside for a start.

I am a bit out of touch these days, but it wouldn't be that unusual for the "closest" insurer to pick up the tab then seek to recover their losses. In the days of paper insurance certificates insurers were very pernickety about their return, precisely because a stray cancelled certificate in a glovebox could see them liable for an accident which they weren't on cover for.

MCE are a broker, not an insurer, and aren't based in Merseyside for a start.

I am a bit out of touch these days, but it wouldn't be that unusual for the "closest" insurer to pick up the tab then seek to recover their losses. In the days of paper insurance certificates insurers were very pernickety about their return, precisely because a stray cancelled certificate in a glovebox could see them liable for an accident which they weren't on cover for.

edeath said:

.... he really should have cancelled the policy once the bike was sold.

I do agree, however it is easy to see why someone wouldn't bother from a money POV as once the admin and cancellation fees are added up it's usually fairly pointless for cancel a policy with only 3 or less months to run.Not saying that you shouldn't, just that I can see why people don't bother enduring the joy of trying to cancel a policy.

My vague recollection of RTA Insurance cover suggests that, in the absence of proper insurance for the new owner, the old insurer may have to pay out for TP injury/damage if the Policy was in in force at the time of the incident. Something to do with the requirements under the road traffic act insurance section as it is a compulsory cover and not being able to decline claims made against the cover.

Changed this to say; they can contractually persue the Policyholder for the costs but it is rare to do it as commercially it is shooting yourself in the foot.

Changed this to say; they can contractually persue the Policyholder for the costs but it is rare to do it as commercially it is shooting yourself in the foot.

Edited by Jimmyarm on Tuesday 2nd September 10:46

Breadvan72 said:

Here's the possible wrinkle: If a judgment is obtained against the rider of the bike, then section 151 RTA 1988 may compel the insurer to satisfy that judgment. The contract between insured and insured might require the insured to indemnify the insurer against that liability.

Out of interest would the insurer need to prove negligence or is the liability "strict"?(let's not have the row about what strict liability is again!)

It's my understanding that your insurance will pay out to third parties if they suffer damage from your car at the hands of a joyrider.

This link claims, however, that this is at the discretion of the insurer.

http://www.thompsons.law.co.uk/road-traffic-accide...

This link claims, however, that this is at the discretion of the insurer.

http://www.thompsons.law.co.uk/road-traffic-accide...

Gassing Station | Speed, Plod & the Law | Top of Page | What's New | My Stuff