House prices at an all time high.... Bad time to buy?

Discussion

I am located in the south east (Unfortunately for myself).

I have been considering buying for the last 6 months (have a deposit, and mortgage in principal in place). I have viewed, and offered on about three properties full asking prices with proof of 15% deposits and the agreement. But nearly everything is selling for substantially over the asking prices.

Is this BTL investors rushing to complete before the stamp duty hike? A bit of a january rush? Or just a crazy market full of stupid people financed to the max and hoping to 'make loads out of property, innit'?

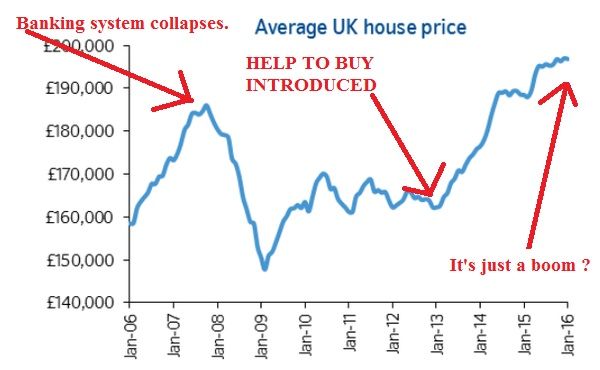

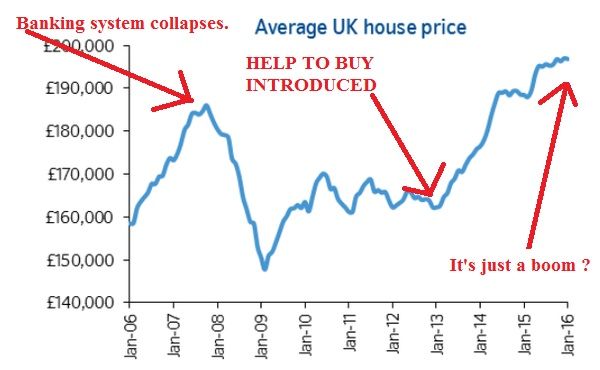

The rises even over the last six months, which can be circa 20k on average 2 beds just seem completely unsustainable with people on the limit of borrowing, being propped up by help to buy, 5% deposits and equity loans. It surely cannot carry on?

As more people are put off BTL and they come onto the market making more available for buyers also this should maybe calm it down. I'm not saying they will all drop, just cant see the rises will continue. Two beds in average areas of luton are up over £230k now, Which isn't the most affluent or desirable of areas.

St albans has gone crazy with people moving out of london and pouring the money into that market pushing it out of reach of most people.

Anyone have any thoughts? It seems like they are hitting a ceiling when you compare average income ( 27k ish?) to average house prices (£240k in the south east last year) they are wayyyy out of correlation. You will be maxing out on your mortgage at no more than 130k. Needing at least 50k up front to get you into a one bed flat in a questionable area.

My thoughts are swaying towards renting a small flat for a while and then saving more, throw my savings into some sensible investments for a couple of years (Hence less on mortgage when time comes) and seeing how it pans out, or are we all set that its an ever rising market and I'm wasting my time waiting for this bubble to burst?

As currently its near impossible to save at the rate the property is rising around here. its just bonkers.

Thoughts anyone?

I have been considering buying for the last 6 months (have a deposit, and mortgage in principal in place). I have viewed, and offered on about three properties full asking prices with proof of 15% deposits and the agreement. But nearly everything is selling for substantially over the asking prices.

Is this BTL investors rushing to complete before the stamp duty hike? A bit of a january rush? Or just a crazy market full of stupid people financed to the max and hoping to 'make loads out of property, innit'?

The rises even over the last six months, which can be circa 20k on average 2 beds just seem completely unsustainable with people on the limit of borrowing, being propped up by help to buy, 5% deposits and equity loans. It surely cannot carry on?

As more people are put off BTL and they come onto the market making more available for buyers also this should maybe calm it down. I'm not saying they will all drop, just cant see the rises will continue. Two beds in average areas of luton are up over £230k now, Which isn't the most affluent or desirable of areas.

St albans has gone crazy with people moving out of london and pouring the money into that market pushing it out of reach of most people.

Anyone have any thoughts? It seems like they are hitting a ceiling when you compare average income ( 27k ish?) to average house prices (£240k in the south east last year) they are wayyyy out of correlation. You will be maxing out on your mortgage at no more than 130k. Needing at least 50k up front to get you into a one bed flat in a questionable area.

My thoughts are swaying towards renting a small flat for a while and then saving more, throw my savings into some sensible investments for a couple of years (Hence less on mortgage when time comes) and seeing how it pans out, or are we all set that its an ever rising market and I'm wasting my time waiting for this bubble to burst?

As currently its near impossible to save at the rate the property is rising around here. its just bonkers.

Thoughts anyone?

In the long term it only ever goes up. If you can buy in one of the troughs then you're lucky but from personal experience I wish I'd never dithered about property purchasing and if I had bought sooner I'd be much better off as a result of it now.

Edited by C0ffin D0dger on Thursday 28th January 16:29

rotarymazda said:

Time to visit www.housepricecrash.co.uk , the only site I like more than PH.

check the graph on the front page of that site, house prices versus inflation. 2015 is still in a dipbuy below the line, sell above the line if you are just doing it for the money and dont need it to live in

otherwise just buy and get paying it off ASAP

rotarymazda said:

Time to visit www.housepricecrash.co.uk , the only site I like more than PH.

Haha, I have wasted many hours reading through opinions on that site!With regards to just buy as soon as possible, I'm not desperate to buy. I can quite happily rent and save more thus a smaller mortgage (pay 60p on every £1 borrowed, so 10k saved makes for a 6k saving on interest assuming 35yr staying at 3% which will go up)....

I doubt prices in places like Putney (or other blue chip postcodes in London) are going to fall anytime soon. Market may cool off a bit but nice places will always sell as demand will more than likely outstrip supply (I would probably steer clear of the new build stuff there where they want circa £1m for a 2 bed apartment). If you view as long term investment I would just buy now and get on the ladder. The £600k asset you buy now in a blue chip London postcode will probably be worth circa twice that in ten years. Trying to "time the market" is more relevant for those who are speculating over short time horizons.

Unless something changes significantly (law? war? 1 child policy?) you might get a falter but the supply is only going to get bigger. Sure, there are initiatives to encourage house building but do you really think the likes of Bovis are going to suddenly dump thousands of houses onto the market and then have to sell them for a lower price?

Even s t areas are going to start to cost a lot and this will continue to spread from the south east to other areas.

t areas are going to start to cost a lot and this will continue to spread from the south east to other areas.

Even s

t areas are going to start to cost a lot and this will continue to spread from the south east to other areas.

t areas are going to start to cost a lot and this will continue to spread from the south east to other areas.Have you asked your agents whether your competitors are investors or home buyers? If they are the former, hang on until after the stamp duty change. If the latter, seriously consider buying if you find a house you get excited about. If it's an even mixture of both, then you're non the wiser

Price change fluctuations vary a great deal across the country. In some parts right now it's flat or creeping downward.

Price change fluctuations vary a great deal across the country. In some parts right now it's flat or creeping downward.

Hoofy said:

Unless something changes significantly (law? war? 1 child policy?) you might get a falter but the supply is only going to get bigger. Sure, there are initiatives to encourage house building but do you really think the likes of Bovis are going to suddenly dump thousands of houses onto the market and then have to sell them for a lower price?

Even s t areas are going to start to cost a lot and this will continue to spread from the south east to other areas.

t areas are going to start to cost a lot and this will continue to spread from the south east to other areas.

Help to buy is helping everyone commit to huge debt, hence pushing prices up and allowing people to over commit. Even s

t areas are going to start to cost a lot and this will continue to spread from the south east to other areas.

t areas are going to start to cost a lot and this will continue to spread from the south east to other areas.

People simply don't earn enough for the rise to continue, but this helps prop them up.

Regarding the rise spreading, areas outside commuting distance from London eg 60miles+ north aren't rising and some places around Smaller Bedford villages are sitting static (if same price as they sold for 5yrs ago, that is a rather large loss in money due to inflation, interest payments and maintenance on the property) and have dropped. It seems very much London overflow related.

The whole prices are going up hype just scares people into a panic buy. And like sheep we all follow the crowd because someone we know made 20k in a year, but paid 5k stamp duty, 5k maintenance costs and 20k interest in that time..... People using dumb maths (I do realise some people have however made huge amounts in and nearer London than areas I am looking)

Regarding changes in law - the government going after BTL investors who already have very low yields, which are typically crap anyway in the south east. Pushing landlords to pull out that market, and raises in stamp duty to put people off the idea. Also stricter lending rules with a 4.5x limits further push home ownership away from the average earners...

I can see both sides of the coin, simply discussing.

Jakey123 said:

Hoofy said:

Unless something changes significantly (law? war? 1 child policy?) you might get a falter but the supply is only going to get bigger. Sure, there are initiatives to encourage house building but do you really think the likes of Bovis are going to suddenly dump thousands of houses onto the market and then have to sell them for a lower price?

Even s t areas are going to start to cost a lot and this will continue to spread from the south east to other areas.

t areas are going to start to cost a lot and this will continue to spread from the south east to other areas.

Help to buy is helping everyone commit to huge debt, hence pushing prices up and allowing people to over commit. Even s

t areas are going to start to cost a lot and this will continue to spread from the south east to other areas.

t areas are going to start to cost a lot and this will continue to spread from the south east to other areas.

People simply don't earn enough for the rise to continue, but this helps prop them up.

Regarding the rise spreading, areas outside commuting distance from London eg 60miles+ north aren't rising and some places around Smaller Bedford villages are sitting static (if same price as they sold for 5yrs ago, that is a rather large loss in money due to inflation, interest payments and maintenance on the property) and have dropped. It seems very much London overflow related.

The whole prices are going up hype just scares people into a panic buy. And like sheep we all follow the crowd because someone we know made 20k in a year, but paid 5k stamp duty, 5k maintenance costs and 20k interest in that time..... People using dumb maths (I do realise some people have however made huge amounts in and nearer London than areas I am looking)

Regarding changes in law - the government going after BTL investors who already have very low yields, which are typically crap anyway in the south east. Pushing landlords to pull out that market, and raises in stamp duty to put people off the idea. Also stricter lending rules with a 4.5x limits further push home ownership away from the average earners...

I can see both sides of the coin, simply discussing.

Those villages you mentioned - "falter", as I wrote.

Jakey123 said:

the government going after BTL investors who already have very low yields, which are typically crap anyway in the south east. Pushing landlords to pull out that market, and raises in stamp duty to put people off the idea.

Govt is just pushing out private landlords in favour of corporate landlords who are now ramping up in the private rental sector. Rental yields in London are comparable to all rich capital cities worldwide.If you put the govt's tax meddling at the margins aside (it's a short term blip imo), the key factor longer term is lack of supply. I don't see that changing, especially in London. Why is HK so expensive? Nowhere to build. Why is London so expensive? Next to nothing being built.

TheInternet said:

Jakey123 said:

With regards to just buy as soon as possible, I'm not desperate to buy. I can quite happily rent and save more thus a smaller mortgage

Sure?Jakey123 said:

The rises even over the last six months, which can be circa 20k

Do we truly think house prices will carry on rising at such extreme rates though?

40k in a year, two more years and everyone buying 320k 2 bed terraced houses. It seems completely unsustainable surely?

Wise old estate agent once said to me that house prices generally rise till people at the bottom can't afford to get in. Help to buy is just extending where that point is IMO but it won't change the basic maxim.

Sooner or later the thing is going to check though - at which point it may flatten out for a year or two but I also doubt it will come back by much. Paying rent is dead money unless the market is already falling - and it isn't & I would think its unlikely to start doing so within the next 6-12 months either. On balance I'd get in now.

Sooner or later the thing is going to check though - at which point it may flatten out for a year or two but I also doubt it will come back by much. Paying rent is dead money unless the market is already falling - and it isn't & I would think its unlikely to start doing so within the next 6-12 months either. On balance I'd get in now.

I'd have said prices were about at the top at least 3 or 4 times and I've been wrong each time.

The trouble with the current price range is that you don't need a huge percentage increase to see prices going up by £20-40k a year.

Maybe the BTL changes will cool things off a bit, but I'm not that hopeful.

The trouble with the current price range is that you don't need a huge percentage increase to see prices going up by £20-40k a year.

Maybe the BTL changes will cool things off a bit, but I'm not that hopeful.

Wombat3 said:

Wise old estate agent once said to me that house prices generally rise till people at the bottom can't afford to get in. Help to buy is just extending where that point is IMO but it won't change the basic maxim.

Sooner or later the thing is going to check though - at which point it may flatten out for a year or two but I also doubt it will come back by much. Paying rent is dead money unless the market is already falling - and it isn't & I would think its unlikely to start doing so within the next 6-12 months either. On balance I'd get in now.

I disagree.Sooner or later the thing is going to check though - at which point it may flatten out for a year or two but I also doubt it will come back by much. Paying rent is dead money unless the market is already falling - and it isn't & I would think its unlikely to start doing so within the next 6-12 months either. On balance I'd get in now.

Rent isn't dead money, any more than interest is on a mortgage....? You are just paying the bank 'rent' on the money they have lent you.

Just one way exposes you to House price fluctuations, makes you liable for maintenance/upkeep and a large debt/tie while consuming your savings as a deposit....

I remember talking with a friend of mine back in 2001, we were both asking how on earth the price rises could continue, with property already becoming unaffordable for many. This was near the beginning of the boom...

If you find somewhere you want to live (rather than "invest") and can afford it, buy it. Factor in moves in the economy into your own affordability calculations - when/if house prices fall it's generally due to other macro factors - an economic downturn possibly, which may mean that employment is at risk. A mortgage taken at a stretch (if that's still possible) is harder to fund through savings, family help, and a pay cut.

If you find somewhere you want to live (rather than "invest") and can afford it, buy it. Factor in moves in the economy into your own affordability calculations - when/if house prices fall it's generally due to other macro factors - an economic downturn possibly, which may mean that employment is at risk. A mortgage taken at a stretch (if that's still possible) is harder to fund through savings, family help, and a pay cut.

Jakey123 said:

I disagree.

Rent isn't dead money, any more than interest is on a mortgage....? You are just paying the bank 'rent' on the money they have lent you.

Just one way exposes you to House price fluctuations, makes you liable for maintenance/upkeep and a large debt/tie while consuming your savings as a deposit....

The interest you pay on your mortgage tends to be cancelled out by the house prices rising, so your effectively paying into a savings account you can live inRent isn't dead money, any more than interest is on a mortgage....? You are just paying the bank 'rent' on the money they have lent you.

Just one way exposes you to House price fluctuations, makes you liable for maintenance/upkeep and a large debt/tie while consuming your savings as a deposit....

AMST09 said:

The interest you pay on your mortgage tends to be cancelled out by the house prices rising, so your effectively paying into a savings account you can live in

This isn't happening everywhere. And if it doesn't happen, it's an expensive way of living in one. Unless you just really like the house and ignore the fact you could have rented In same period for less and still have your deposit sitting in a better investment. Not every house is rising, many are sitting at the same price as 5+ Yrs ago (a large loss considering inflation and interest payments over that period) , and some have dropped back down. Arguably we are getting out of this silly obsession of ever rising house prices and said houses will not suddenly shoot up either?

Or I'm completely wrong and we will all be buying two beds for 400k in five years time....

Jakey123 said:

Wombat3 said:

Wise old estate agent once said to me that house prices generally rise till people at the bottom can't afford to get in. Help to buy is just extending where that point is IMO but it won't change the basic maxim.

Sooner or later the thing is going to check though - at which point it may flatten out for a year or two but I also doubt it will come back by much. Paying rent is dead money unless the market is already falling - and it isn't & I would think its unlikely to start doing so within the next 6-12 months either. On balance I'd get in now.

I disagree.Sooner or later the thing is going to check though - at which point it may flatten out for a year or two but I also doubt it will come back by much. Paying rent is dead money unless the market is already falling - and it isn't & I would think its unlikely to start doing so within the next 6-12 months either. On balance I'd get in now.

Rent isn't dead money, any more than interest is on a mortgage....? You are just paying the bank 'rent' on the money they have lent you.

Just one way exposes you to House price fluctuations, makes you liable for maintenance/upkeep and a large debt/tie while consuming your savings as a deposit....

But they aren't flat are they?

Renting is dead money - always has been. Low risk, (clearly) but dead money. I know people who have rented for years (decades) when they could have bought. Spent tens of thousands on rent and have nothing to show for it - it also (usually) consumes far more cash (income) than a mortgage - especially in the South East.

Gassing Station | Finance | Top of Page | What's New | My Stuff