All Employee Share Ownership Scheme

Discussion

Morning all.

The company I work(ed) for has recently been acquired by another, and as such our new employer has offered us access to their AESOP.

Now, I'm a complete newbie to any kind of shares / stock / investment, but I do think it's time I start doing something with my money so this does interest me.

To be honest I don't feel that we've been given enough information about this by the employer, but the keys facts are:

So before going any further I just need some independent advice / information. Some info I probably need to get from my employer, I realise.

CGT - form what I can gather from HMRC, this only applies to £50k+ which obviously won't be applicable here, right?

Share prices - How are shares priced? A quick Google says '1,432' - Is that £14.32? So eg. £50/month would buy 3.5 shares/month at the current rate?

I understand the part about holding them for 5 years before selling tax-free, but another query is the part about leaving the employer. As this is an AESOP, if I leave I'll no longer be an employee - is this likely to mean that I'll still be able to hold / sell my shares, but won't be able to buy any pre-tax / get the 2:1 Matching Shares?

Also, we're in a sector where company acquisitions aren't too rare, and contract changes mean we can change employer through TUPE every 4-5 years. Any idea whether an acquisition or TUPE transfer would count as 'leaving the employer' and thus allow us to sell the Matching Shares before the 3 year period?

Any advice or information that you guys can offer would be great, as I say I've never bought into anything like this before but without any real savings elsewhere, I think for a 5-year investment period it may be worth a shot.

Cheers.

The company I work(ed) for has recently been acquired by another, and as such our new employer has offered us access to their AESOP.

Now, I'm a complete newbie to any kind of shares / stock / investment, but I do think it's time I start doing something with my money so this does interest me.

To be honest I don't feel that we've been given enough information about this by the employer, but the keys facts are:

- We pay monthly out of pre-tax salary.

- Up to 10% of our monthly - min. £10/m, max. £125/m.

- For every 2 Partnership Shares we buy, they will give us 1 Matching Share.

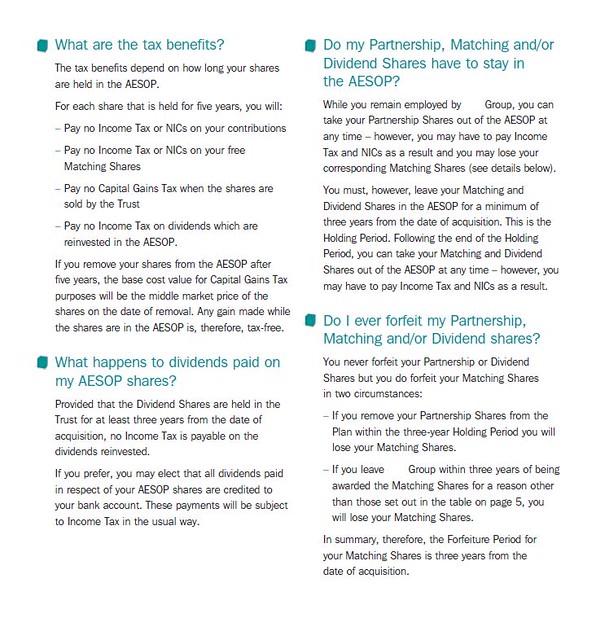

- "You will pay no income tax or NICs when you remove the shares from the Trust provided they have been in the AESOP for at least five years."

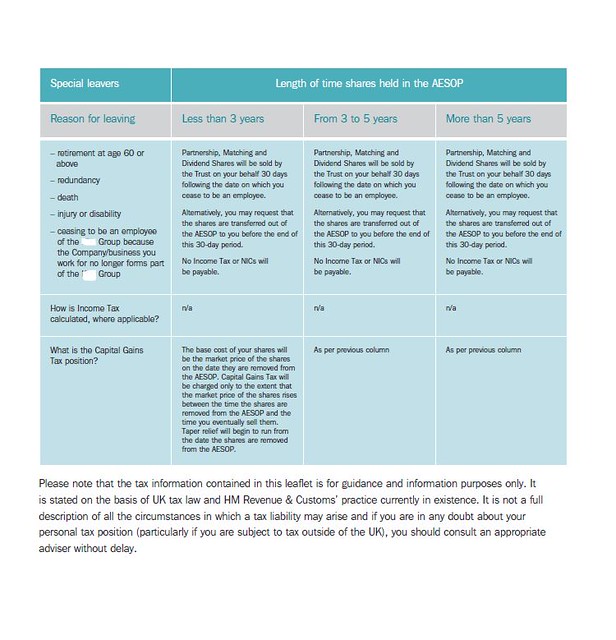

- "Unless you leave (the employer), you must hold your Matching Shares for 3 years before they can be sold. Matching Shares must be held for 5 years before they can be sold directly from the plan without being subject to to income tax and National Insurance. If you have a query regarding Capital Gains Tax you should seek independent financial advice."

So before going any further I just need some independent advice / information. Some info I probably need to get from my employer, I realise.

CGT - form what I can gather from HMRC, this only applies to £50k+ which obviously won't be applicable here, right?

Share prices - How are shares priced? A quick Google says '1,432' - Is that £14.32? So eg. £50/month would buy 3.5 shares/month at the current rate?

I understand the part about holding them for 5 years before selling tax-free, but another query is the part about leaving the employer. As this is an AESOP, if I leave I'll no longer be an employee - is this likely to mean that I'll still be able to hold / sell my shares, but won't be able to buy any pre-tax / get the 2:1 Matching Shares?

Also, we're in a sector where company acquisitions aren't too rare, and contract changes mean we can change employer through TUPE every 4-5 years. Any idea whether an acquisition or TUPE transfer would count as 'leaving the employer' and thus allow us to sell the Matching Shares before the 3 year period?

Any advice or information that you guys can offer would be great, as I say I've never bought into anything like this before but without any real savings elsewhere, I think for a 5-year investment period it may be worth a shot.

Cheers.

Edited by smithyithy on Monday 3rd August 08:58

Ozzie Osmond said:

It would be a better idea to read it first, and then ask specific questions. It should be pretty straightforward for you to understand.

I have and it is  still some uncertainties.. I just need to consider any pit falls really, like I said I'm totally new to this so there may be things I'm not considering that aren't detailed in the information provided.

still some uncertainties.. I just need to consider any pit falls really, like I said I'm totally new to this so there may be things I'm not considering that aren't detailed in the information provided.

DavidJJ said:

Some of the posters above are getting their All Employee Share Schemes mixed up. The "savings contract/you can't lose/price set at the start/post-tax deductions" gubbins is referring to SAYE - Sharesave.

Which this is not - like you say, its a AESOP (more usually known these days as a SIP (Share Incentive Plan). There are three primary differences with your AESOP;

1) deductions are PRE-tax/nic deductions

2) Those deductions are being used to purchase actual shares (rather than an option to buy shares which is what a Sharesave is) called "partnership shares," monthly usually.

3) the partnership shares are matched at a set ratio with Matching shares that can be forfeit under certain conditions (most obviously, leaving by resignation)

(there are far more differences but these are the key things)

So, taking that together you have;

a) depending on your tax rate you are making an immediate tax saving on your deductions because the deductions come out before tax is taken - just like a pension contribution. Hurrah!

b) your employer is given you extra shares for free (hurrah!) albeit with some strings attached

c) you are investing in shares. THE PRICE OF SHARES CAN FALL AS WELL AS RISE!

What I love about SIP and points 1 & 2 is that, when you think about it, the share price would have to fall massively before you actually take a hit. In fact, if the share price never even changes (up or down) and you stayed in the plan, once the shares had been in there long enough you are already ahead because your deduction has not only been very tax efficient, it has also been matched with additional shares.

You need to decide of course based on your own appetite to risk, how much you can afford to save, and of course how long you plan to stay there, but it's potentially pretty appealing.

If you sell your shares from within the plan, i.e. at some point you instruct the administrator/trustee to sell for you, there is no CGT. If you left the SIP and held the shares in your own name (i.e. in a share certificate) and subsequently sold then, you could have CGT liability but there is an annual exemption (use Google to find out more).

That's really helpful David, thanks.Which this is not - like you say, its a AESOP (more usually known these days as a SIP (Share Incentive Plan). There are three primary differences with your AESOP;

1) deductions are PRE-tax/nic deductions

2) Those deductions are being used to purchase actual shares (rather than an option to buy shares which is what a Sharesave is) called "partnership shares," monthly usually.

3) the partnership shares are matched at a set ratio with Matching shares that can be forfeit under certain conditions (most obviously, leaving by resignation)

(there are far more differences but these are the key things)

So, taking that together you have;

a) depending on your tax rate you are making an immediate tax saving on your deductions because the deductions come out before tax is taken - just like a pension contribution. Hurrah!

b) your employer is given you extra shares for free (hurrah!) albeit with some strings attached

c) you are investing in shares. THE PRICE OF SHARES CAN FALL AS WELL AS RISE!

What I love about SIP and points 1 & 2 is that, when you think about it, the share price would have to fall massively before you actually take a hit. In fact, if the share price never even changes (up or down) and you stayed in the plan, once the shares had been in there long enough you are already ahead because your deduction has not only been very tax efficient, it has also been matched with additional shares.

You need to decide of course based on your own appetite to risk, how much you can afford to save, and of course how long you plan to stay there, but it's potentially pretty appealing.

If you sell your shares from within the plan, i.e. at some point you instruct the administrator/trustee to sell for you, there is no CGT. If you left the SIP and held the shares in your own name (i.e. in a share certificate) and subsequently sold then, you could have CGT liability but there is an annual exemption (use Google to find out more).

Edited by DavidJJ on Monday 3rd August 21:31

I think I'll go for it then, it does seem a very good investment opportunity and I think as long as I stick with the employer I can't really lose out.

For sure. Although I think we carry less risk than something in the financial market. Heck, there's no point keeping it 'secret' - it's Kier Group.

https://en.wikipedia.org/wiki/Kier_Group

We originally worked for Amey, who then lost the commission, so we all TUPE'd to EM Highways (a company owned by Mouchel) just over a year ago.

Recently, Kier has completely bought out Mouchel and its companies, so we now work for Kier Group who seem to be doing very well in this sector.

https://en.wikipedia.org/wiki/Kier_Group

We originally worked for Amey, who then lost the commission, so we all TUPE'd to EM Highways (a company owned by Mouchel) just over a year ago.

Recently, Kier has completely bought out Mouchel and its companies, so we now work for Kier Group who seem to be doing very well in this sector.

JungleJim said:

Just to add to what has already been said, I'd be all in on this scheme (and I am, in my own companies one).

Depending on whether you are a a 20% or 40% tax payer you will lose either £100 or £75 from your monthly take home, and in return you will receive £375 worth of shares.

You can sell your bought shares, 'partnership' shares anytime you like, you just need to pay the income tax.

Keep in the system and they're tax free. Oh, and you'll get dividend on them too from day one.

The shares would have to fall an awful long way before you lose money on it.

Do it. Or kick yourself.

Sounds pretty damn good! How do the dividends work exactly? That's something I've seen mentioned but not explained in the brochure..Depending on whether you are a a 20% or 40% tax payer you will lose either £100 or £75 from your monthly take home, and in return you will receive £375 worth of shares.

You can sell your bought shares, 'partnership' shares anytime you like, you just need to pay the income tax.

Keep in the system and they're tax free. Oh, and you'll get dividend on them too from day one.

The shares would have to fall an awful long way before you lose money on it.

Do it. Or kick yourself.

Gassing Station | Finance | Top of Page | What's New | My Stuff