Insurance for a 17 year old, just passed his test. £4,000+

Discussion

Apologies if this has been discussed already, I couldn`t find a thread.

Before we start, I KNOW teennage boys are the highest risk group out there, thats why he`s struggling for insurance and why I`m asking for help here

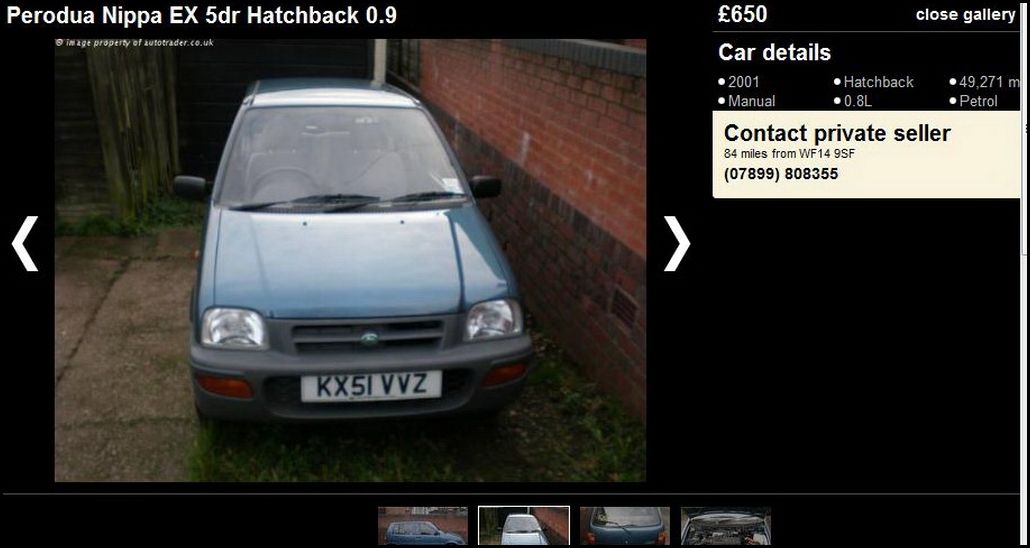

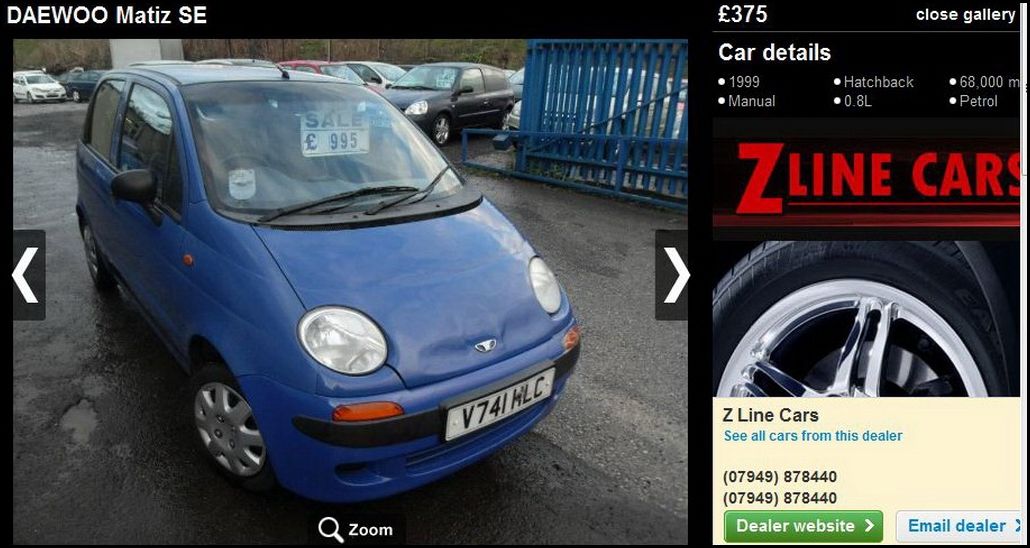

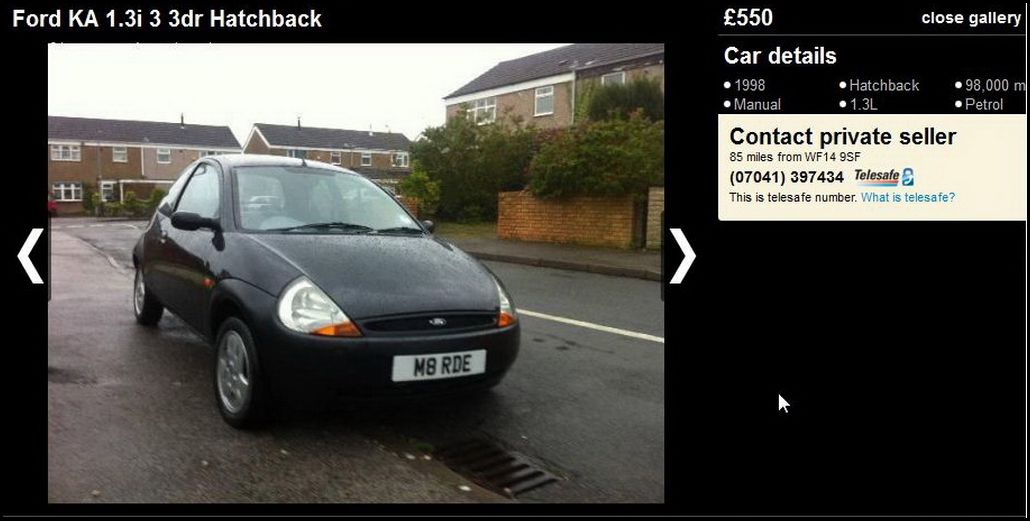

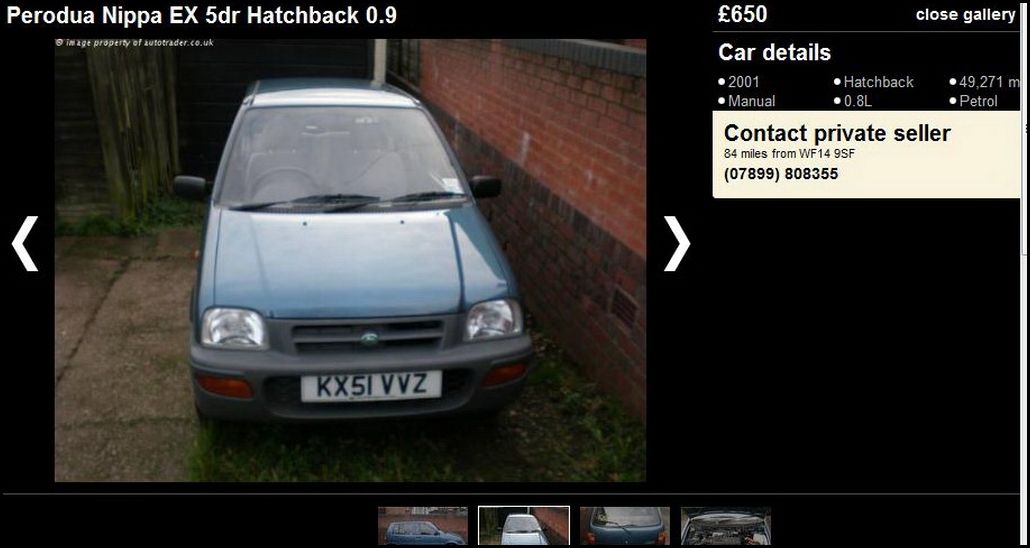

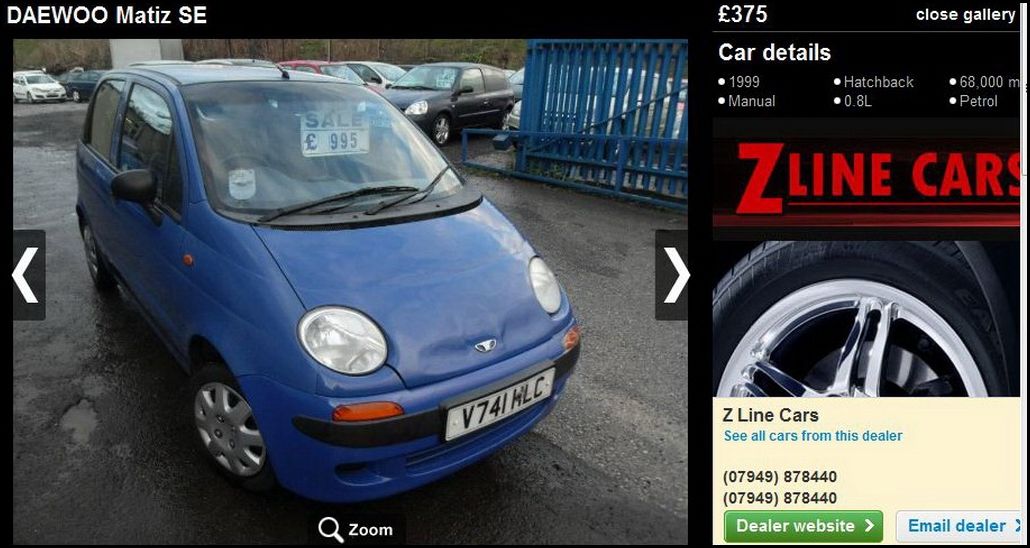

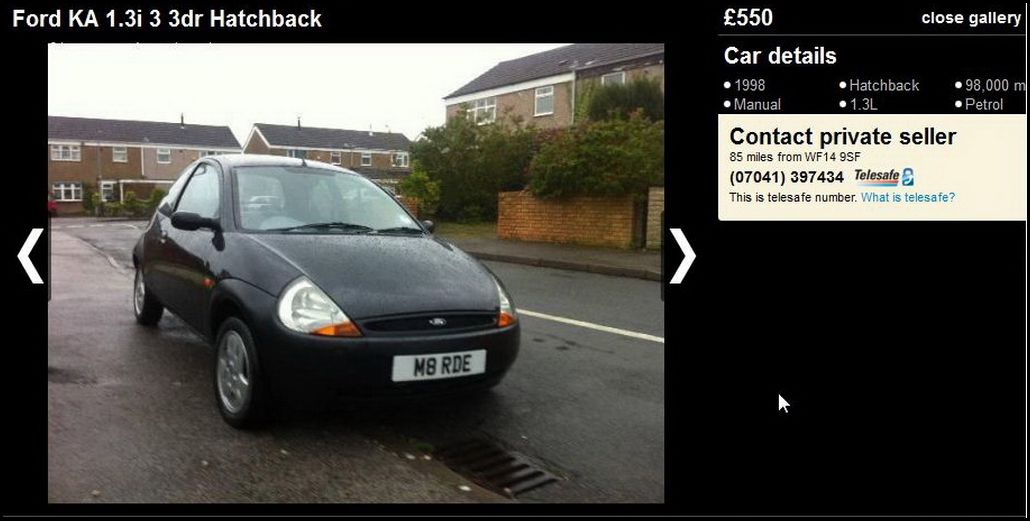

My son recently passed his test and is looking for his first car... we tried the usual `low group` cars first.

Low Miles, Adding me as a driver puts the premium UP. This is using a comparison site.

£4,546

£4,662

£4,314

£4,366

We then tried something a little different..

£6964.

£6,846

Ah, but what about Swinton, they run a young drivers policy. £12,000 for a Group 1 car. Maybe not..

I then rang some Classic insurance Brokers, they only insure drivers over 21.

The only choice seemed to be one of the Black Box GPS systems, as a parent that actually appealed, having something keeping an eye on him didn`t seem like a bad thing. He rang whilst learning and they quoted £1,600 as a provisional driver. He rang the day he passed his test and the cheapest premium was £5,100. The issue (which is NOT clear on their website or in dealing with them) is that your provisional quote doesn`t increase once you have passed your test. This is the crucial part, you MUST be insured with them as a provisional driver, then, once you pass your premium will not increase. If you ring up after passing to try and get insurance, as we did, you`ll find premiums difficulty getting a quote, or if you do, they come in at over £5,000 as we found. Very disappointing and something that was NOT clearly explained in the conversations whilst he was a provisional driver. If it had been, we`d have insured him with them from the start and he would now be enjoying driving for the same premium, instead of being unable to find any affordable insurance, which is where we find ourselves now.

The issue (which is NOT clear on their website or in dealing with them) is that your provisional quote doesn`t increase once you have passed your test. This is the crucial part, you MUST be insured with them as a provisional driver, then, once you pass your premium will not increase. If you ring up after passing to try and get insurance, as we did, you`ll find premiums difficulty getting a quote, or if you do, they come in at over £5,000 as we found. Very disappointing and something that was NOT clearly explained in the conversations whilst he was a provisional driver. If it had been, we`d have insured him with them from the start and he would now be enjoying driving for the same premium, instead of being unable to find any affordable insurance, which is where we find ourselves now.

On the comparison site, I changed his sex from M to F, NOTHING else and the premium dropped from £4,300 to £1,200. As a sex change is something he`d rather not do, that doesn`t help, but it confirmed it isn`t the postcode thats the issue (I thought not as my own premiums are very competitive).

We can`t be the only ones in this situation ! Has anyone found a solution, something to bring insurance down to a `sensible` sub £2k level for new, 17 year old drivers ?

Before we start, I KNOW teennage boys are the highest risk group out there, thats why he`s struggling for insurance and why I`m asking for help here

My son recently passed his test and is looking for his first car... we tried the usual `low group` cars first.

Low Miles, Adding me as a driver puts the premium UP. This is using a comparison site.

£4,546

£4,662

£4,314

£4,366

We then tried something a little different..

£6964.

£6,846

Ah, but what about Swinton, they run a young drivers policy. £12,000 for a Group 1 car. Maybe not..

I then rang some Classic insurance Brokers, they only insure drivers over 21.

The only choice seemed to be one of the Black Box GPS systems, as a parent that actually appealed, having something keeping an eye on him didn`t seem like a bad thing. He rang whilst learning and they quoted £1,600 as a provisional driver. He rang the day he passed his test and the cheapest premium was £5,100.

The issue (which is NOT clear on their website or in dealing with them) is that your provisional quote doesn`t increase once you have passed your test. This is the crucial part, you MUST be insured with them as a provisional driver, then, once you pass your premium will not increase. If you ring up after passing to try and get insurance, as we did, you`ll find premiums difficulty getting a quote, or if you do, they come in at over £5,000 as we found. Very disappointing and something that was NOT clearly explained in the conversations whilst he was a provisional driver. If it had been, we`d have insured him with them from the start and he would now be enjoying driving for the same premium, instead of being unable to find any affordable insurance, which is where we find ourselves now.

The issue (which is NOT clear on their website or in dealing with them) is that your provisional quote doesn`t increase once you have passed your test. This is the crucial part, you MUST be insured with them as a provisional driver, then, once you pass your premium will not increase. If you ring up after passing to try and get insurance, as we did, you`ll find premiums difficulty getting a quote, or if you do, they come in at over £5,000 as we found. Very disappointing and something that was NOT clearly explained in the conversations whilst he was a provisional driver. If it had been, we`d have insured him with them from the start and he would now be enjoying driving for the same premium, instead of being unable to find any affordable insurance, which is where we find ourselves now. On the comparison site, I changed his sex from M to F, NOTHING else and the premium dropped from £4,300 to £1,200. As a sex change is something he`d rather not do, that doesn`t help, but it confirmed it isn`t the postcode thats the issue (I thought not as my own premiums are very competitive).

We can`t be the only ones in this situation ! Has anyone found a solution, something to bring insurance down to a `sensible` sub £2k level for new, 17 year old drivers ?

They are fully comp, 3rd party was usually more. All his mates have been added onto their parents insurance, something I am very reluctant to do. Admiral offer a policy where he can supposedly earn NCD on my policy, but the premium wasn`t competitive enough to even consider it.

I`ve tried every comparison site going, as I mentioned, it isn`t the postcode thats the issue, I tried with an `A` band and it was only a few hundred pounds less.

I know he can wait until next year, but he doesn`t want to. He has been saving for his first car for years and was really looking forward to getting one. Like most on PH, he`s a car enthusiast and watching from the passenger seat isn`t his first choice.

I`ve tried every comparison site going, as I mentioned, it isn`t the postcode thats the issue, I tried with an `A` band and it was only a few hundred pounds less.

I know he can wait until next year, but he doesn`t want to. He has been saving for his first car for years and was really looking forward to getting one. Like most on PH, he`s a car enthusiast and watching from the passenger seat isn`t his first choice.

Mike Oxbig said:

People who have just passed their test, don't deserve cheap insurance.... Statistics back me up on this point of view

Which is why the GPS systems looked appealing. The fact that they are MORE than a `normal` policy from the comparison sites makes absolutely no sense to me. iKube was the company who we`d planned on going with.We did try adding my wife and myself and absolute Max reduction was £300, some policies even increased it the premium !. Elephant and Admiral were over £4600.

A motorbike / scooter is not an option.

98elise said:

Young male drivers need to stop crashing so much. Thats whats driving their premiums up. .

Obviously ! I thought the GPS systems would help that, knowing their every move was being recorded would do slow them down, but the premiums don`t reflect this.I`ll get him to ring LV tonight. Thanks for the heads up.

Lanxx said:

Trial Admiral, Elephant or Bell's online quote system.

I am insured on a Clio 1.2, took it out when I was 18 for £1400 a year TPFT. Female named drivers will bring it down (usually) and males will make it go up (usually).

Postcode makes a massive difference.

I also got some more reasonable quotes on an old 1.0 Polo (circa 1991).

I don't know if Footman James still take under 21's on their classic policies, but I got a quote with them for a 1000cc Austin Mini for £750 a year TPFT when I was 17 (under 2 years ago). I decided not to do this, but it was at least of half any other quote I got at the time.

The ones I tried didn`t I am insured on a Clio 1.2, took it out when I was 18 for £1400 a year TPFT. Female named drivers will bring it down (usually) and males will make it go up (usually).

Postcode makes a massive difference.

I also got some more reasonable quotes on an old 1.0 Polo (circa 1991).

I don't know if Footman James still take under 21's on their classic policies, but I got a quote with them for a 1000cc Austin Mini for £750 a year TPFT when I was 17 (under 2 years ago). I decided not to do this, but it was at least of half any other quote I got at the time.

Wh00sher said:

I then rang some Classic insurance Brokers, they only insure drivers over 21.

For info, my postcode is WF14.We have limited the mileage when getting quotes, increased the Excess (although over £500 it makes ahardly any difference to the policy).

For those who say "get the bus, or don`t drive", yeah, of course he could do that, but aren`t we all petrol heads on here ? It is called PistonHeads after all !! Of course he COULD wait until he was 21 and get a taxi / bus in the meantime, but he doesn`t WANT to, he would LIKE to own his own car. The problem is the £4,000+ quotes make that an unaffordable luxury for him at the moment.

I`ll give the suggestions in the thread a try tonight and post back tomorrow.

Nige.

s3fella said:

My insurance in 1987 for a 1.1 fiesta pop plus was £693, 3rd party fire and theft.

Car was a 1985 and cost me 2100quid.

I worked all holidays at school, (genuinely not one day off on hols) to pay for it all.

Don't know what it translates to now, overall, but motoring as a 17 yr old has never been cheap, that's for sure. I recall not being able to afford petrol to get home from where we'd been on several occasions !

from http://safalra.com/other/historical-uk-inflation-p... it works out at about £1,700....Car was a 1985 and cost me 2100quid.

I worked all holidays at school, (genuinely not one day off on hols) to pay for it all.

Don't know what it translates to now, overall, but motoring as a 17 yr old has never been cheap, that's for sure. I recall not being able to afford petrol to get home from where we'd been on several occasions !

Your insurance would have been £1,700 in 1987 to equal £4,000 now.

By the time he got in last night, it was too late to ring the companies suggested earlier, he`ll be ringing them this evening.

Finally, an update.

He rang `Bell`, they couldn`t even offer a quote.

Next up was LV. I`ve been with them in the past and found them competitive so was hoping for a competitive quote. They came back with a £5,200 as the cheapest quote, he tried various vehicles, the lowest appears to be a 1.0 2000 Corsa but £5,200 was obviously far too high.

Moving on to Adrian Flux. A friendly guy on the phone who understood what the issues were. Adding my wife or myself as named drivers reduced the quote by £300, adding another older member of the family actually increased the premium. Adding both me AND my wife as named drivers made extra difference, only the £300 for either of us.

They said the chillibongo device COULDN`T be incorporated into the policy or quotes for him to reduce premiums, even after asking twice so we were sure, they confirmed it could not be used with the young driver policy, which seems at odds with this post on their site "Saves Young Drivers 15% off their insurance premium with Adrian Flux's Young Driver motor insurance".

However, after several options a quote of £2750 was offered. This could be reduced `by 15% to 25%` if he passed the NVQ Safe Driver course. Obviously, we are looking into that and what it entails now.

He then asked about a Classic MK1 Golf 1.1L 4speed which would be £2,900

Waiting until his 18th Birthday makes NO difference to the quotes, they said as he wouldn`t drive for the next year, he`d gain no experience or NCD so the quote would be the same.

Then we tried a 1979 Classic 1100 Mini and the premium for this was £2,246. Taking the NVQ Safe Driver Course @ £40 would reduce that to £1993 (including the £40).

This is getting into the realm of almost being acceptable !

He rang `Bell`, they couldn`t even offer a quote.

Next up was LV. I`ve been with them in the past and found them competitive so was hoping for a competitive quote. They came back with a £5,200 as the cheapest quote, he tried various vehicles, the lowest appears to be a 1.0 2000 Corsa but £5,200 was obviously far too high.

Moving on to Adrian Flux. A friendly guy on the phone who understood what the issues were. Adding my wife or myself as named drivers reduced the quote by £300, adding another older member of the family actually increased the premium. Adding both me AND my wife as named drivers made extra difference, only the £300 for either of us.

They said the chillibongo device COULDN`T be incorporated into the policy or quotes for him to reduce premiums, even after asking twice so we were sure, they confirmed it could not be used with the young driver policy, which seems at odds with this post on their site "Saves Young Drivers 15% off their insurance premium with Adrian Flux's Young Driver motor insurance".

However, after several options a quote of £2750 was offered. This could be reduced `by 15% to 25%` if he passed the NVQ Safe Driver course. Obviously, we are looking into that and what it entails now.

He then asked about a Classic MK1 Golf 1.1L 4speed which would be £2,900

Waiting until his 18th Birthday makes NO difference to the quotes, they said as he wouldn`t drive for the next year, he`d gain no experience or NCD so the quote would be the same.

Then we tried a 1979 Classic 1100 Mini and the premium for this was £2,246. Taking the NVQ Safe Driver Course @ £40 would reduce that to £1993 (including the £40).

This is getting into the realm of almost being acceptable !

ChilliBongo said:

I've been working really hard over the last few months to get this all in place and the team at Adrian Flux have been really great at not only getting the discount agreed on their Young Driver scheme, but also on about 20+ other schemes which I literally announced only last night, so when I read this I was naturally extremely concerned, and I'm hoping I may be able to help get to the bottom of this for you.

I can only currently think of 2 reasons for the discount not being offered.

1) It's a Brand New discount scheme and isn't actually in the IT system yet (it will be very shortly). As a result, the team are having to apply the discount manually.

All of the team should be aware of it but as they've got around 500 members of staff, it's possible 1 or 2 may not have been told yet if they've just got back from holiday, etc. If that's the case, obviously that needs resolving ASAP, so I'll get in touch with them for you to see if that's what the problem was.

2) The only other explanation I can think of is that I know in a small number of cases where the customer falls into a particular high risk category, they're unable to offer the discount. That's why on the website I've mentioned "There are a few small terms & conditions for the discount, so contact Adrian Flux to check that you're eligable"

Did you happen to catch the name of the customer service team member who helped you with your call? If so, could you please let me know and hopefully we'll be able to get to the bottom of this for you ASAP and try to get you that discount!

Alternatively, please do feel free to email me your contact details and I'll be happy to ask a member of the Adrian Flux team to call you back.

If I can help with anything else, just shout!

Thanks

Kieran

Kieran Thomas

Founder - ChilliBongo

Hi Kieran, many thanks for taking the time to register and post.I can only currently think of 2 reasons for the discount not being offered.

1) It's a Brand New discount scheme and isn't actually in the IT system yet (it will be very shortly). As a result, the team are having to apply the discount manually.

All of the team should be aware of it but as they've got around 500 members of staff, it's possible 1 or 2 may not have been told yet if they've just got back from holiday, etc. If that's the case, obviously that needs resolving ASAP, so I'll get in touch with them for you to see if that's what the problem was.

2) The only other explanation I can think of is that I know in a small number of cases where the customer falls into a particular high risk category, they're unable to offer the discount. That's why on the website I've mentioned "There are a few small terms & conditions for the discount, so contact Adrian Flux to check that you're eligable"

Did you happen to catch the name of the customer service team member who helped you with your call? If so, could you please let me know and hopefully we'll be able to get to the bottom of this for you ASAP and try to get you that discount!

Alternatively, please do feel free to email me your contact details and I'll be happy to ask a member of the Adrian Flux team to call you back.

If I can help with anything else, just shout!

Thanks

Kieran

Kieran Thomas

Founder - ChilliBongo

I`ve just been on the phone to Flux and spoke to a different person. A really friendly 19 year old bloke called Ed who knew EXACTLY what I was struggling with, unfortunately, the NVQ can`t be applied to the premium would be £2246.

Again, I asked about chillibongo but he said the young drivers scheme, which was what they were quoting via didn`t allow addition of discount from using the chillibongo. He said that once they are giving a quote, they have a list of discounts applicable to the policy and that wasn`t an option he could select.

matt is a full time student studying A Levels which they don`t class as particularly high risk. A full time job would be better from a risk point of view, but it didn`t load the policy too much.

He did agree at 18 it would be a little less, but not much. If I went to a company who offered a cheaper premium, but gave no NCD, ie a Classic Policy, I couldn`t then ring and say i`ve got a years driving experience and NCD, they would quote as if I was starting from scratch.

If you are able to offer advice on a broker or way I could use the system and gain a discount, i`d obviously be VERY interested.

Nige.

Gassing Station | General Gassing | Top of Page | What's New | My Stuff